Bhavish Aggarwal-led Ola Electric reported a sharp decline in its revenue and a two-fold increase in losses during the fourth quarter of financial year 2025. Its operating revenue fell down nearly 61% (YoY) to Rs 611 crore in January-March quarter from Rs 1,598 crore in the same period last year.

The EV maker’s net loss for the same quarter increased to Rs 870 crore, compared to Rs 416 crore in Q4FY24. The company's EBITDA margin deteriorated sharply to -101.4% in Q4 FY25, compared to -16.4% in the same quarter last year. However, Ola expects it consolidated EBITDA margin to improve significantly to -25% in Q1FY26.

Vehicle deliveries also dropped by nearly half, falling to 51,375 units. It expects Ola scooter deliveries to reach 65,000 units by the end of the ongoing first quarter of FY26.

Ola's Market Share

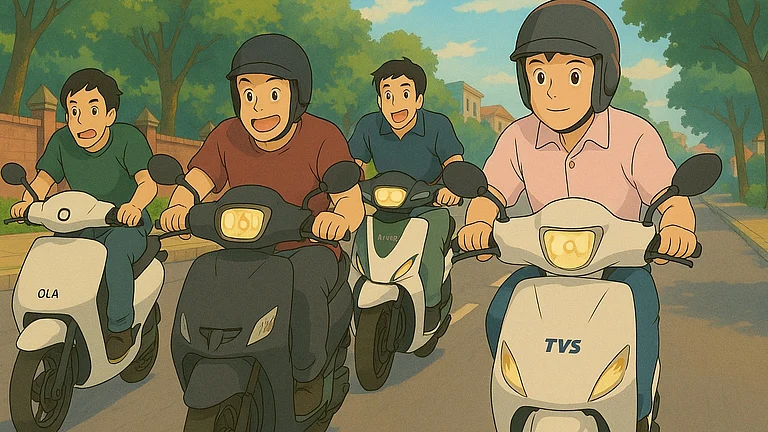

The EV maker also slipped to third spot in India's electric two-wheeler segment, while legacy players TVS Motor and Bajaj Auto claimed the top two positions. These companies grew their market shares to 25% and 22.6% respectively in May, despite experiencing marginal declines in sales volume.

But Ola Electric, which had been the market leader just over a year ago, saw its share shrink dramatically to 20% in the first 26 days of May down from 22.1% in April, according to data from the government-run Vahan portal.

The company registered 15,221 vehicles during the period, a steep 60% drop from 37,388 units in May 2023.

Ola's Fresh Fundraise Post IPO

Ola Electric has received board approval for a new fundraising round, just nine months after its initial public offering (IPO). The EV maker will raise up to ₹1,700 crore through the issuance of non-convertible debentures (NCDs) and other debt securities, as per a filing made on Thursday.

The funds will be raised in one or more tranches, though the company which continues to face regulatory scrutiny, operational challenges, and softening investor sentiment has not disclosed details regarding the intended use of proceeds.

The capital raise forms part of Ola Electric’s broader effort to shore up its financial position and sustain operations amid intensifying competition, a declining market capitalisation, and eroding market share.