Funding for India’s electric vehicle (EV) start-ups surged past $2bn for the first time in financial year 2025, more than doubling from the previous year, according to Tracxn data. Across 109 funding rounds, EV start-ups collectively raised around $2.1bn in financial year 2025, up sharply from $1bn in financial year 2024.

The rebound came after a sharp decline in funding from $1.9bn in financial year 2023 to $1bn in financial year 2024.

According to industry experts, a healthy jump in the inflow of money indicates that the investors are expanding beyond vehicle manufacturing and are now willing to bet across the value chain of the EV ecosystem. However, they expect more money to flow into the sector to match the speed at which it is growing.

“They [investors] are now willing to place bolder bets across the value chain, not just in vehicle manufacturing but also in component tech, battery innovation and logistics electrification. The broader thesis around decarbonisation and domestic innovation is what is fuelling this capital influx,” says Roma Priya, founder of Burgeon Law, a Delhi-based law firm providing advisory to start-ups and entrepreneurs on fundraising.

With the price of batteries falling from about $150 per kilowatt-hour to $100 in the last two years and the government supporting creation of charging infrastructure, the funding in the sector may further improve, experts say.

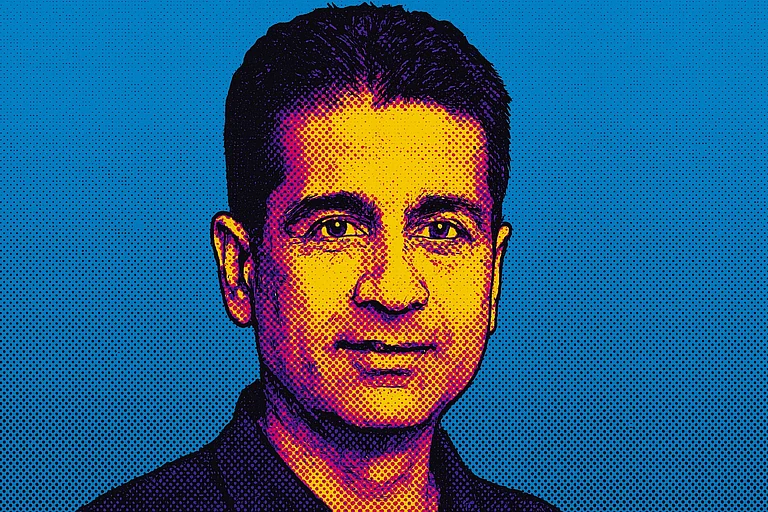

“If we look at Electric cars, they are now available at varied price points, ranging from ₹7 lakh to ₹1.5 crore. We are observing an increase in new launches as well. If you see now half of the launches each month consist of EVs,” says Kunal Khattar, founding partner at venture capital (VC) firm AdvantEdge Founders, a VC fund that supports entrepreneurs and companies with a strong growth potential.

According to the International Energy Agency’s Global EV Outlook 2025 report, the average price gap between battery electric and internal combustion engine (ICE) cars in India fell below 15% for small cars and 25% for SUVs in 2024.

Also, during the last financial year, the industry saw two of the leading two-wheeler start-ups (Ola Electric and Ather Energy) go public which may have boosted investor confidence in the newcomers.

“These IPOs [initial public offering] also serve as a benchmark, helping institutional investors better understand valuation frameworks, consumer demand and margin dynamics in the EV segment,” says Priya of Burgeon Law. “More importantly, they create downstream optimism, investors begin looking for the next wave of EV innovators who might follow a similar trajectory in the next three to five years,” she adds.

However, Kunal cautions against the declining funding rounds in the sector indicating money is getting skewed towards a few big deals. The number of funding rounds in the EV start-up ecosystem, Tracxn data shows, has consistently declined from 157 in financial year 2022 to 109 in financial year 2025.

Moreover, out of total $2.1bn, about $1.1 bn were raised in the fourth quarter of financial year 2025 through 25 funding rounds.

According to Kunal Mundra, founder and chief executive of Astranova Mobility, a full-stack EV asset management and leasing provider, the sector not only needs significantly more capital but also requires it to be well distributed from seed funding to the pre-IPO stage.

Akshay Shekhar, founder and CEO of the energy-tech start-up Kazam, which recently raised $6.2mn in Series B funding led by the International Finance Corporation, echoes Mundra’s view. Shekhar points out that the market has shifted from many smaller funding rounds to fewer, larger ones. This change has resulted in a sharp increase in the overall quantum of capital being raised by the industry.

With rising consolidation in the market, it has become difficult for newcomers to enter the market, specifically in the manufacturing segment, he adds.

While Ola Electric, Ather, TVS Motors and Bajaj control over 80% of the electric two-wheeler market, legacy original equipment manufacturers like Tata Motors, Mahindra and MG Motor have a stronghold in the electric passenger vehicle (PV) space.

Shekhar expects a steady rise in funding in the coming quarters as venture capitalists have optimised their expectations on return on investment. This has helped investors plan exits after achieving an appropriate range of return.

Earlier, VCs would expect RoI in the range of 10-30 times after seven to eight years of their investment cycle, which has come down to three to five times looking at the recent exits in some start-ups, Shekhar explains.

“There are a couple of companies and start-ups where exits have happened. Most of the exits have come from Ather’s side where investors saw return in the range of four to five times,” he says.

However, the money being invested in the EV start-ups may not be enough to ensure quick growth of the industry, Shekhar says. “Private equity funding has been limited on the infrastructure side. If this changes then the industry can grow much faster.”

Weak EV-related infrastructure, such as public charging points, battery swapping stations and electricity grids, has been one of the major reasons for slow uptake of EVs, especially in the four wheeler segment.

According to Mundra, although climate-focused funds are currently driving investments in the EV space, the real inflection point will come when large, generalist VC funds also begin to participate actively. He believes that the EV sector should attract capital on the same scale as emerging sectors like artificial intelligence and quick commerce.