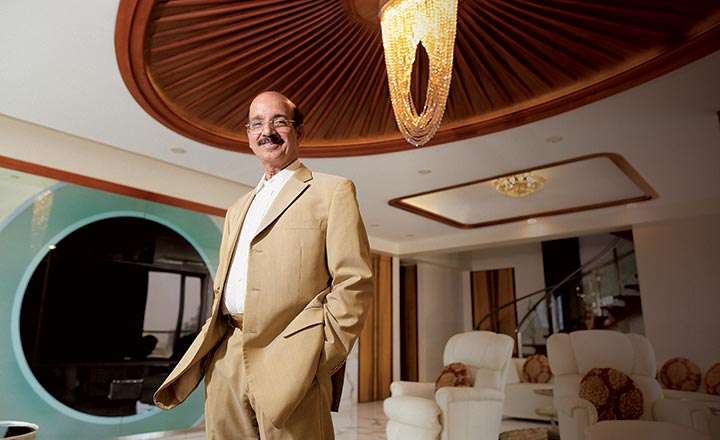

Dr Ramakanta Panda is always pressed for time, and that’s not suprising for he is the country’s top cardiac surgeon. There is a slew of patients waiting even as Outlook Business caught up with the 64-year-old at his office at Bandra Kurla Complex (BKC). Having operated on personalities such as Dr Manmohan Singh and Tarun Gogoi, he knows more than a little about the heart and, money as well.

For many years, Panda’s preferred asset was land, mostly located in Maharashtra and his home state Odisha. “Land is finite and it is hard to go wrong with it, if you identify locations and the development potential,” he says. However, very little money has gone into this hard asset over the past five years. “Prices have gone through the roof and it’s crazy,” he admits. Panda points to the area around his hospital in Mumbai’s BKC, which he bought in 2000, after arriving from the US. It was his first big-ticket investment. In less than five years, prices went up 40x. “I wish I’d bought more land then,” he says with a chuckle.

Panda’s money is largely managed by his two confidantes, whom he has known for over 25 years. The strategy is to invest 40% each in bonds and equities, aiming for a return which is 2-3% higher than inflation. “For the past few years, the return has been around 10-12%, post tax,” reveals Panda.

The brief to his team is succinct — opt for a mix of stable and risky investments. “Eventually, that combination does work out well,” feels Panda. One cannot help but prod him on what his investment in land has yielded. “It has rarely been below 25%,” says Panda. Today, the surgeon’s investment in real estate, besides land, is restricted to residential apartments. “However, making money in [residential] real estate is difficult since developers enjoy a lion’s share of the profit, leaving little on the table in terms of appreciation.”

Over the past five years, Panda has taken to angel investing with a focus on IT and healthcare. Here, his daughter, who is in the middle of an MBA at Wharton, is his guide. “She likes technology and I understand healthcare,” says Panda. “Some investments may not go right, but it is healthy bet,” says Panda as the telephone rings, reminding him of his next appointment.