It was in 1954, when Hindustan Antibiotics first set up its manufacturing facility in Pimpri-Chinchwad and since then, the industrial hub has evolved into one of the biggest automotive hubs in the country. Home to auto original equipment manufacturers (OEMs) such as Tata Motors, Force Motors, Bajaj Auto, Mercedes-Benz and Volkswagen, the cluster seems to have gotten back on track. During our previous visit in 2014, the automotive hub was battling sluggish demand and rising inventory, in the middle of a painful slowdown. At that time, manufacturers that were highly dependent on exports, fared well. With the domestic auto industry in a much better shape now, as compared to 2014, around 85% of the respondents in our survey said revenue growth in FY18 was stable to positive.

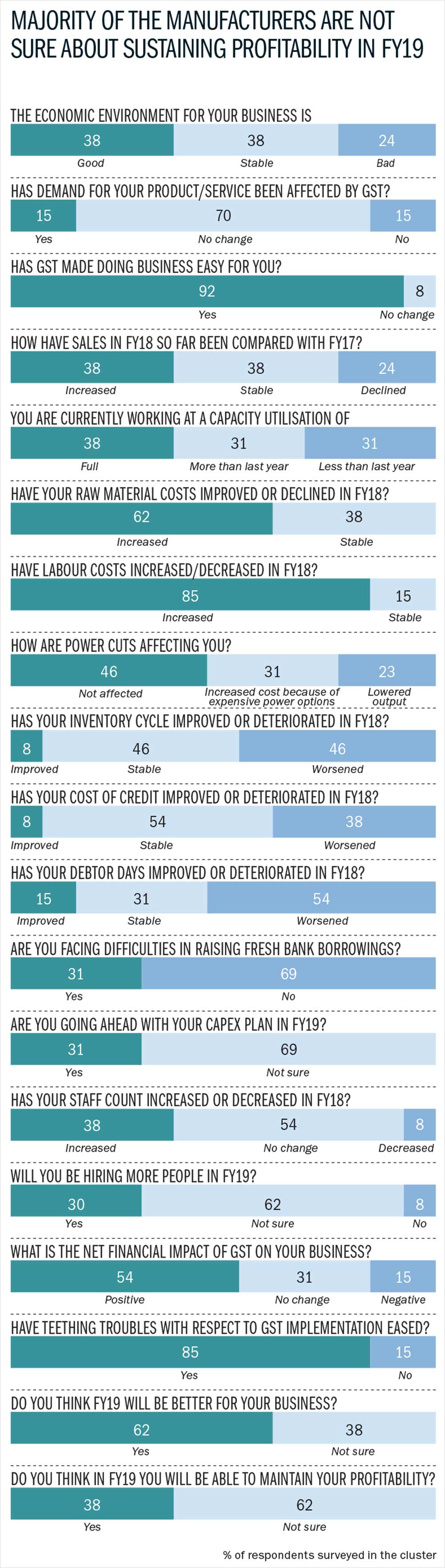

Although auto is the dominant industry in Pimpri-Chinchwad, the hub also houses companies in the engineering, pharmaceutical and the information technology space, thanks to its proximity to Mumbai and the availability of skilled and unskilled manpower. While Goods and Services Tax (GST) did bring some uncertainty, it didn’t have any major impact on the business, post the initial hiccups. In fact, only 15% of them feel that GST had a negative financial impact on their business. But more importantly, most of them are concerned about future demand. Owing to the uncertainty about how demand will pan out in FY19, almost 66% of the manufacturers surveyed, said they are unsure about expanding capacity and hiring more people in the coming fiscal.

Ready but not ready

Last year, in July, when the country replaced the plethora of taxes with GST, although it didn’t take the manufacturers in Pimpri-Chinchwad by surprise, some struggled to adjust to the new tax regime. But now after the chinks have been ironed out,85% of them agree that the teething troubles with GST’s implementation are over. “We did have a few operational difficulties initially but GST has reduced our paperwork considerably and we are happy,” said Nandlal Khatan, managing director, Pune Techtrol. The firm that clocked revenue of Rs.125 crore in FY17 provides level gauges, switches, controllers and transmitters to Tata Motors, Maruti Suzuki, Thermax and L&T.

Earlier, manufacturers were required to obtain multiple registrations (unit wise for factories and depots), service tax, value added tax (VAT), central sales tax, and Octroi. With GST, the process has not only been simplified, but the tax rate has come down to 18% from 28-30% for manufacturers in certain sectors. Sanjay Deshmukh, managing director, Induction Equipment, explains how his company’s production took a serious hit in the first four months after GST was implemented. “Our orders were delayed since about 30% of our suppliers stopped supplying raw materials owing to the prevailing confusion in the market,” he says. The company specialises in induction, which is a process used to harden steel and other alloy components for automobile companies. Some of its clients include, Bharat Forge and Renault. Induction Equipment made up for lost time by increasing its focus on exports — thanks to a larger customer base in Middle East, the company hopes to end FY18 on a better note.

Inflationary mode

While the initial hit caused by GST will eventually normalise, other issues like rising commodity prices, seem to be impacting the cluster a lot more. An increase in commodity prices led to higher input costs for component manufacturers. This along with rising labour costs, meant margins came under pressure for manufacturers in the auto components as well as engineering space. Ideally, they should have been able to pass on the costs to the OEM, but that is not always the case. Rahul Pathak, vice-president, Finearc Systems, which provides automatic welding, application-oriented and robotic solutions to clients such as Toyota, Volkswagen, Honda, Suzuki, Siemens and Mitsubishi says, “The constant pressure on margins is making business a lot tougher. Everyone is looking to cut costs but it is important to pass on the hike. As business gets increasingly challenging, the playing field is not at the same level for everyone.”

According to him, technology becomes a major differentiator and companies who invest a lot in research and development tend to have an edge over others. “One needs to be more innovative and creative, to offer what no one else in the market is offering. For example, we offer cutting-edge technology for the installation of BS-VI engines in vehicles in Europe,” he says with pride. The company employs 200 people and has a turnover of around Rs.100 crore. It caters to clients across 16 countries in partnership with the US-based C&G Systems. Much of the auto component industry’s growth in the medium to long term will be drivenby the increasing components per vehicle due to various technological advancement and regulatory measures (emission, safety regulations). So in a bid to keep up with OEMs, component manufacturers are investing in new platforms keeping in mind the requirements for BS-VI (in 2020).

Show me the money

Hassled by rising inputs costs, delayed customer payments and the need to make monthly GST payments, more than 40% of the businessmen surveyed feel they have to deal with a longer debtors’ cycle and a higher cost of credit. Most of the smaller companies using cash for day-to-day transactions, were majorly impacted by demonetisation. And right when they began recovering, GST was implemented. Shripal Oswal, proprietor, Reliable Enterprises, which supplies raw materials to tier-III and IV automotive vendors, is one such player who feels the squeeze of a rising working capital requirement. “Every month we have to pay GST, but the payments we receive are irregular. So we are facing a severe working capital crunch,” he explains. Oswal finds it very difficult to cope up with GST since his credit limit while purchasing raw material is 30 days, whereas customers take 90 to 180 days to make payment. “There is a need to ensure that everybody in the supply chain gets their payment on time, to ensure timely tax payments,” he says. Before GST, with VAT, vendors had the option to make partial payments and a late payment would attract a penal interest of 1.25% per month. Now, under GST, late payments attract an interest rate of 18% per annum, however, manufacturers do not have the part payment option, which creates a strain on their working capital when customer payments are delayed.

Also, many of these SMEs were dependent on chit funds or bhishi to fund their working capital gap, but the whole system has collapsed post-demonetisation. The smaller players are often forced to borrow money from private financiers at exorbitant rates since banks won’t lend to them. And higher interest payments not only eat into their profitability, but also restrict their ability to expand business. Many of them are hoping that the government would step in. “The government certainly has to look at some kind of funding for MSMEs who struggle to meet their working capital requirements,” says Anant Sardeshmukh, director general, Mahratta Chamber of Commerce, Industries and Agriculture (MCCIA). “There is an inherent weakness in their credit profiles. So banks are always hesitant to lend to them. They have to work on improving their credit profile by constantly demonstrating better fiscal discipline. Otherwise, irrespective of whether we are in the midst of an economic slowdown or boom, they will always have to contend with high interest rates,” he points out.

Tushar Gholap, director, Metrolab Engineering says not only does he have to pay more on his working capital loans, GST has brought in a new problem for him to tackle. Metrolab Engineering, which provides checking fixtures for auto companies, and material handling systems to clients such as Mahindra & Mahindra, General Motors, TACO and Maruti-Suzuki, has around 30-35 vendors. The bulk of them are small vendors and their scale of operations is now a problem for him. “Some of my vendors do not have GST code as their turnover is below Rs.20 lakh, so I have to pay GST for them. It has been a problem not only with our smaller vendors, but transport and hospitality service providers too,” he says. Gholap fears that this will force people to opt for established players and smaller players will end up going out of business.

Tense future

Manufacturers here are also worried about the increasing cost of production; limited availability of industrial land in the town and irregular power supply in non-Maharashtra Industrial Development Corporation (MIDC) business zones. About 54% of the respondents have either shelled out more money for their power usage or have been impacted due to power cuts. According to them, it is also getting increasingly tougher to find land in the MIDC zone — with 24x7 electricity and other government incentives. Avinash Mankar, director, Tara Tools laments, “For manufacturing, we need a lot of space and finding a land in good industrial hubs is no easy task. If majority of our funds go towards purchasing land or rentals, then how are we to invest in technology and grow the business?”

While 62% of the manufacturers are hopeful that FY19 will be good for their business, an equal number is unsure about their ability to maintain their profitability. “Due to increasing raw material prices and competition, our margins will continue to be under pressure. So, I am not sure if we can maintain our profit margins in the coming fiscal even as the demand is picking up,” says Laxminarain Pai, managing director, Pai Brothers, which supplies to clients such as Tata Motors, Bajaj Auto, Force Motors, Mahindra & Mahindra and Bosch.

Despite growing concerns about the ability to maintain profitability, none of it seems to have affected the spirit and optimism of the manufacturers here. A lot of them are betting on the fact that auto OEMs will continue making investments to meet BS-VI norms and it will drive a lot of new orders their way. After driving through steadily in a rather difficult year, entrepreneurs in Pimpri-Chinchwad remain cautiously optimistic.