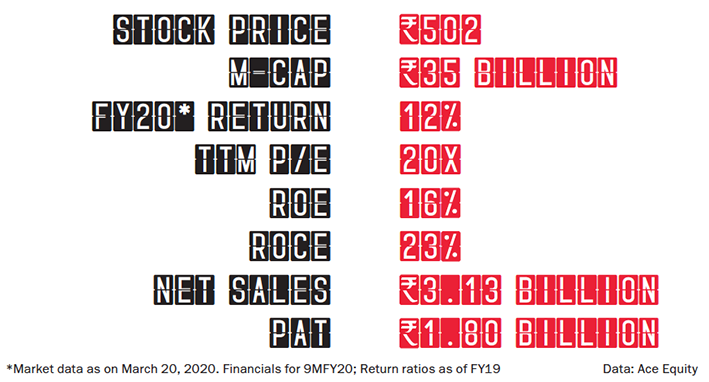

What do you love, in the time of corona? The question is inspired from the title of the famous Gabriel Garcia Márquez book, set in a period of cholera epidemic. We are in a similar situation. Much like the book’s protagonist Florentino Ariza, in times of market carnage like the one we are facing due to Covid-19, it is difficult to maintain a sense of equanimity. In the present milieu, many investments offer mouth-watering valuations for good businesses. But, my love for a clean, strong balance sheet and transparent management draws me towards Nesco, which has a history of healthy return ratios combined with an attractive valuation (that could get cheaper).

What do you love, in the time of corona? The question is inspired from the title of the famous Gabriel Garcia Márquez book, set in a period of cholera epidemic. We are in a similar situation. Much like the book’s protagonist Florentino Ariza, in times of market carnage like the one we are facing due to Covid-19, it is difficult to maintain a sense of equanimity. In the present milieu, many investments offer mouth-watering valuations for good businesses. But, my love for a clean, strong balance sheet and transparent management draws me towards Nesco, which has a history of healthy return ratios combined with an attractive valuation (that could get cheaper).

Originally known as New Standard Engineering Company, Nesco figured out the potential of real estate and a way to commercially exploit it by creating an IT park lease rental business. And in the ’90s, it converted itself into a pure lease rental play. Its 65 acre land in Goregaon, Mumbai, has excellent connectivity — it is in close proximity to both the airports, and is right on the Western Express Highway. As an offshoot, the company also started a hospitality business and continues to run a legacy engineering business.

Additionally, Nesco has embarked on an expansion plan that, in the short run, will add significant IT park space, to increase leasable area. To take advantage of the Mumbai Development Plan for 2034, Nesco plans to create a holistic growth programme including, potentially a hotel. The entire exercise is expected to be financed internally without equity dilution or debt and, interestingly, in some instances, even from customer advances. This makes for a formidable investment case. Now, let us dive into each of its diversifications.

Exhibition Centre:In FY19, Nesco generated revenue of Rs.1.56 billion with an EBIT of Rs.1.26 billion from this business. It has a leasable area of ~0.65 mn sq ft. Typically, the space sees large, sizeable exhibitions every alternate year. The third and fourth quarters tend to be the best ones, while the second quarter is often weak due to the international calendar. It plans to construct the New Business Exhibition Center with built-up area of ~0.15 mn sq ft, which is expected to be completed in a few years.

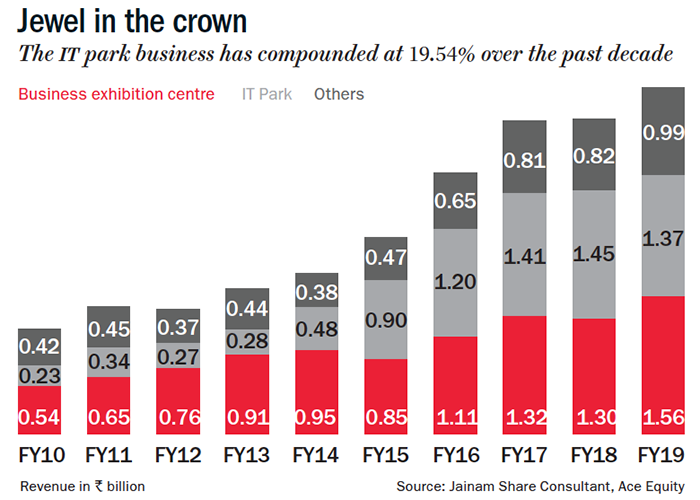

IT Park:Nesco currently has three operational IT buildings with a total of ~2 mn sq ft leasable area generating revenue of ~Rs.1.37 billion in FY19 (See: Jewel in the crown). The construction of IT park 4 is also completed, which will add another ~2 mn sq ft of area. The handover of premises to lessors is currently underway. There are plans to construct one more building that will add 0.13 mn sq ft, in the next four years.

Hospitality:Nesco has created food courts on its premises and is now looking at this business as a profit centre. For FY19, this division brought revenue of ~Rs.350 million and an EBIT of Rs.70 million on capital employed of ~Rs.250 million. The company set up a state-of-the-art kitchen for Rs.150 million and is expecting this business to grain traction.

Hospitality:Nesco has created food courts on its premises and is now looking at this business as a profit centre. For FY19, this division brought revenue of ~Rs.350 million and an EBIT of Rs.70 million on capital employed of ~Rs.250 million. The company set up a state-of-the-art kitchen for Rs.150 million and is expecting this business to grain traction.

Engineering Division: Nesco makes surface preparation systems called ‘Indrabator’ shot blasting machines. For FY19, the revenue from this was ~Rs.350 million with an operating profit of ~Rs.70 million. Despite being the company’s legacy business, this division has become relatively insignificant. But, it plans to continue this operation without any further investment.

Exhibiting promise

All in all, the company plans to add over 4 mn sq ft of space over the next many years incurring a capex of Rs.20 billion. The leadership team of Suman Patel and his son Krishna Patel, both with a strong pedigree and an excellent record on governance issues, shun models such as JV or REIT structures and continue to focus on basics.

While the sheer size of Nesco’s land parcel gives it a competitive advantage, Reliance Industries plans to build a large convention centre in BKC, Mumbai. This might pose a direct threat to Nesco. However, due to the location, the size would be smaller than Nesco, which would limit it to only certain types of exhibitions. Also, combining forces for both companies — if it ever happens — could attract larger exhibitions, some of which do not happen in India or are moved to NCR for various reasons. A price war could lead to potential lower yields for both.

Nesco faces various risks. One, if the economic slowdown persists, exhibition revenues could be affected due to lower occupancy. This can also reflect in the IT parks. Two, the large convention centre being built by Reliance Industries in BKC could compete for revenue. Three, a pandemic such as the coronavirus can pose considerable threat to the exhibition business, as congregation of large crowds is discouraged. Four, as work-from-home becomes an acceptable corporate norm post Corona, commercial real estate will also see challenges in the coming year.

However, in our view, issues such as the coronavirus will blow over. Locational advantages and top class infrastructure will ensure that Nesco’s rental business is not at significant risk.

The company trades at a valuation of ~20x trailing 12-month earnings. This considers a reduction in rentals due to tearing down of one structure for a new development and does not include the just operationalised IT park. However, earnings are likely to be lower in the current year due to the pandemic, and hence, valuation will seem elevated. But, taking into account consistent return ratios, long history of positive free cash flows and growth in revenue and earnings, the business offers good prospects to warrant making an investment case. In each of the businesses, increasing leasable area and rising rentals offer growth opportunities. If one applies a cap rate (not preferred), the numbers could become even more attractive. Also, in case of a benign interest rate environment, lowering cap rates would increase valuation.

Future growth plans, sufficiency of internal accruals to fund growth, a competent management, size and locational advantages of the asset, and an attractive valuation make Nesco a solid business. So much like the protagonist of Love in the time of Cholera, Florentino Ariza, I keep going back to one of my old favourite stocks — Nesco!