A lot can happen over coffee! The tagline aptly captures what’s happening at Café Coffee Day (CCD). The company’s subsidiary, Coffee Day Global (CDGL), is the leader with 46% share of India’s café market, thanks to its 1,700 stores spread across 240 cities. The cafe chain’s footprint is nearly three times that of the combined footprint of its next six competitors: Starbucks, McCafe, Coffee Bean & Tea Leaf, Costa Coffee, Dunkin Donuts and Barista. From Rs.6,700 crore in FY14, India’s organised café market is projected to grow at 15% CAGR by FY20. Of the organised café market, the café chain segment is growing at a much faster rate of 20% CAGR. This should, in turn, set the stage for CCD’s coffee revenues to grow at 15% every year for the next two years.

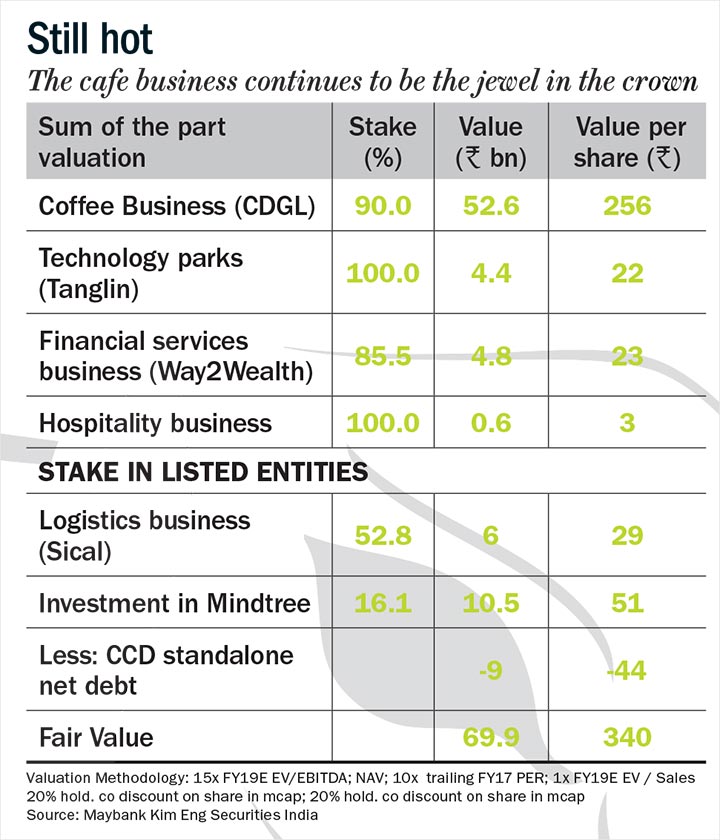

One of the pioneers of India’s cafe culture, CCD’s core coffee earnings before interest and tax is likely to grow at 48% CAGR over FY16-FY19, led by high-margin vending-machine coffee sales and higher revenue per outlet. At 75% of our sum of the part (SOTP) anlaysis, CCD’s coffee business has been resilient amid slower discretionary spending. We foresee a re-rating now because the café business has seen five consecutive quarters of 5%-plus same-store sales growth and a fall in net debt-to-equity to 0.5x in H1FY18 from 2.3x in FY15.

Coffee for all

Generally, it takes about six months for a café outlet to break even. Those in tier II and tier III cities are less profitable because of lower average sales per day (ASPD). CCD has rationalised stores in the past year and will be adding new ones at a measured pace in the next few. It aims to shut down 25-30 stores this year and add another 100, according to reports.

The operating outlets and kiosks, which have been around for two decades now, have provided CCD with a strong understanding of its customer base. It has developed multiple formats and branding strategies to serve different addressable customer segments: CCD for value-conscious youth, The Lounge for affluent customers, The Square for coffee connoisseurs and Xpress kiosks for coffee on the go.

Averaging 800-1,000 sq ft in size, CCD’s outlets can be found in high streets, malls, petrol stations, highways and traffic-dense transportation hubs, airports, etc. The outlets are predominantly located in India’s seven big cities: Bengaluru, Mumbai, New Delhi, Chennai, Kolkata, Hyderabad and Pune.

Historically, CCD’s ASPD has been 30%-90% lower than those of the other leading café and quick service restaurant (QSR) chains. This, coupled with depreciation and interest costs, has weighed on its profitability. CCD’s ASPD is less than its peers as it has chosen to operate largely in the affordable segment, with few stores in the premium segment. However, with the closure of 176 small stores with low profitability in FY15 and 46 such stores in FY16, its ASPD improved to Rs.15,200 in H1FY18 from Rs.10,000-Rs.12,000 in H1FY17.

Importantly, sales per store improved after the company revamped its menus, standardised store interiors, rolled out combo meals, introduced WiFi, loyalty cards and tapped into digital media for marketing. The company is now attracting more youngsters to its stores and as much as 46% of its orders are placed on its app. The move to launch desserts last year has paid off and this year it is launching around-the-clock menu, including breakfast options. These efforts underpin about a third of CCD’s revenue and earnings forecasts for the next three years.

Different flavours

Besides café, CCD has interests in technology parks, office leasing, logistics, financial services, hospitality and IT investments. The firm’s wholly-owned subsidiary, Tanglin, develops and manages technology parks and offers bespoke infrastructure facilities mainly to IT-ITES enterprises. Tanglin has two technology parks: Global Village in Bengaluru which has over 114 acres of land and Tech Bay in Mangaluru with over 21 acres.

CCD has invested in IT-ITES and other technology companies, which include Mindtree, a global technology consulting firm, where it holds 16% stake. It also holds 53% in Sical Logistics and 86% in Way2Wealth Securities, a retail-focused investment

advisory company.

We expect consolidated revenue CAGR of 14% and operating profit CAGR of 15% for these businesses for FY16-FY19, as most of these are self-sustaining and won’t need additional capital. In our view, execution and steady earnings delivery could become major catalysts. Coffee and related businesses contribute 50% to revenue and 25% to EBIT. Another 25% comes from financial services and CCD’s supply-chain business. Of the balance, about 20% is from the leasing of commercial real estate.

A hot cuppa!

Our SOTP valuation pegs CDGL at Rs.256 a share, that’s at a 55% discount to Jubilant FoodWorks’ (Dominos) historical average of 33x. CCD’s stock is down 30% from its issue price (2015 listing) along with other prominent QSR companies, following concerns over a slowdown in discretionary spending. We think these fears have been more than discounted and concerns over its conglomerate holding structure are overblown since the company is not using cash flow of its retail coffee business to finance other businesses anymore.

Despite profit at the operating level, CCD booked net losses in the past owing to high interest and depreciation. But we predict an inflection point in the current fiscal, with increased contribution from high-margin businesses such as vending machines (44,400 machines in H1FY18) and higher revenue per store. These are expected to add 134 bps to CDGL’s operating margin and increase it to over 17% in the coming years. In fact, its operating margin is already superior to that of Jubilant FoodWorks. Higher revenue per outlet, better operating profit, better control of working capital and lower interest rates are expected to aid free cash flow. We estimate that CCD’s cash from coffee operations will be sufficient to fund Rs.150 crore to Rs.200 crore of coffee capex every year over FY17-FY19. Led by stronger operating performances, the return on capital employed will improve from 4.4% in FY16 to 6.4%-8% in FY18-FY19. Return on equity, too, is expected to rise from 0.6% to 6-8.4% during the same period.

The author does not hold the stock in his personal capacity, but has recommended it to clients of Maybank Kim Eng Securities