A few years ago, I had started tracking HOV Services when it was trading at Rs.35 levels, and covered it extensively in my valuation workshops and even on my blog. This Pune-based BPO was set up in 1989 as Codec Communications. However, its Indian operations is not the story — the value lies in the company’s investment in the Nasdaq-listed Exela Technologies. But before that, we need to know how the script unfolded in the past.

Art of undervaluation

In late 2014, SourceHOV Holdings, a company in which HOVS LLC, the US subsidiary of the Indian entity, held an investment, completed a merger with BancTec Group. Post-merger, HOVS LLC’s stake in SourceHOV increased from 26.1% to 44.8%. HOVS LLC’s investment was then valued at $95 million (Rs.582 crore). Accordingly, additional capital reserve of Rs.582 crore was recognised as the fair value of investment in the associate. The 26.1% equity stake was proposed to be sold to the US-based HandsOn Fund 4 LLC, whose ultimate beneficiary owners were the promoters of the Indian listed entity. The deal sounded like a bonanza for HOV Services shareholders since the stake would have amounted to Rs.464/share. But the valuation was too low in my view and should have been closer to $250 million. The merged entity, although loss making, had nearly a billion dollars in revenues and was a leading transactions processing company, catering to several Fortune 500 companies. I was proved right.

A group of minority shareholders moved a petition before the Company Law Board over the terms of the deal. The transaction, finally, did not consummate owing to shareholder litigation and transaction delays. The company, however, did bring in the value of $95 million into the books of the Indian entity in FY15 and did an annual impairment test under Accounting Standard 28. While there was no impairment, HOVS LLC’s share of loss, as per equity method of accounting prescribed by AS-23, was consolidated in the financial statement. Through notional, the carrying value of the investment was reduced to Rs.20 crore, as on March 31, 2017, owing to adjustment on account of the share of the loss (equivalent to the percentage of equity holding), actuarial losses and foreign exchange variations.

Street dance

When the deal was first announced, HOV Services stock hit a high of Rs.191 in November 2014 but fell below Rs.60 in 2015 when the proposed stake sale did not go through. It recovered though in 2016, to Rs.130 levels. But what happened in February 2017 just reinforced my view that the investment in SourceHOV was indeed undervalued. In February 2017, a business combination was announced between SourceHOV Holdings, Novitex Holdings and Quinpario Acquisition Corp 2 to form Exela Technologies Inc, which was to become one of the largest global providers of transaction processing and enterprise information management solutions serving over 3,500 clients across 55 countries.

Though the share price zoomed to a high of Rs.350 in May 2017, it now trades at Rs.270 levels given that stock price of Exela, which got listed on Nasdaq in July 2017 at $10, has since halved to $5 levels. At Rs.270, the market cap of HOV is just Rs.337 crore, while the current value of its 19% holding in Exela is Rs.967 crore at its share price of $5.20 and taking into account the rupee at Rs.64.75 to a dollar. At $10, the investment value of Exela was close to Rs.2,000 crore ($300 million), vindicating my assertion that the value was close to $250 million rather than just $95 million.

What the combination is all about

In July 2017, Exela Technologies was valued at $2.8 billion, 7.3 times its post-combination operating profit of $385 million projected for 2017 compared with competitors Broadridge, Genpact, WNS Holdings and HMS Holdings, which were quoting at 10-12x EV/EBITDA multiples.

Exela caters to the top 10 US banks, 9 of the top 10 US insurance companies and all the top five US healthcare players. Around 91% of its business comes from the Americas, with a majority of revenue coming from information and transaction processing services (ITPS) followed by healthcare services and legal-loss prevention services. The company has also announced a buyback of up to 5 million shares over the next 24 months. Exela’s Q3FY17 revenue was $358 million, while EBITDA was $88 million. The revised revenue guidance for 2017 has been pegged at $1,450 million-$1,470 million and EBITDA in the range of $350 million to $370 million. Though at the net level, there will be a loss.

So, then why did the Exela’s stock price halved rapidly with its market cap dropping from $1.5 billion to just under $780 million? To begin with, Exela’s shareholder equity is just $42 million, largely decimated by the accumulated post-combination loss of $456 million. I suspect it has a lot to do with QPAC’s poor performance history and continuing negative cash flows. The debt, as on Q2FY18, stood at $1.41 billion. The buyback measure announced by Exela may just be an assertion to stabilise the price and assure the Street that things are well on track. However, the operating sentiment remains challenging and highly competitive in the ITPS & health care services segments and not to mention the half a billion dollar of accumulated losses. However, a couple of US fund managers such as David Einhorn of Greenlight Capital have found value in Exela and have picked up meaningful stakes recently, given that its EV is down to $2 billion and the EV/EBITDA, too, is attractive at 6x compared with peers.

Coming back to HOV Services, the Indian arm generated Rs.16 crore consolidated income in FY17. But since a large part of the value for the stock comes from Exela, the performance of Indian operations is secondary. However, it’s worth mentioning HOV’s foray into environmental solutions, where it has completed projects in Kochi and Ratnagiri for artificial reefs to prevent beach erosion. Interestingly, a fixed deposit of Rs.8.6 crore was pledged with HDFC Bank on behalf of its step-down subsidiary, HOV Environment Solutions (HOVESPL), for a loan. This has now been converted into a loan at 9.1% to HOVESPL. No provision has been made even though HOVESPL has a negative net worth. HOV, however, states that its foray into environment solutions will take five to seven years to scale up, and it will recover the expenses in due course.

True value

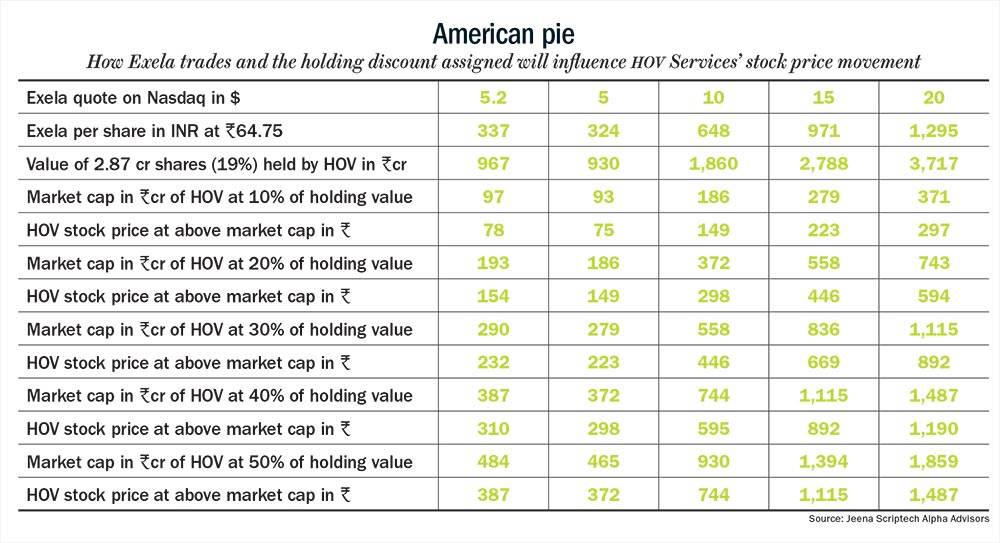

At Rs.270 levels, HOV is available at a 65% haircut on its current investment value in Exela. Effectively, HOV is available for just over $50 million, while its one-fifth stake in Exela is valued at $150 million. I am assuming here that the promoters will not continue to undervalue the stake in Exela and unlock value going ahead. Assuming a rupee-dollar rate of 64.75, I have computed what HOV Services share price should be based on different haircuts and at different levels of Exela stock price. If Exela moves back to $10 and the haircut improves to 50% and the rupee stays at 64.75, HOV will touch Rs.744 levels. There are variables at play in HOV, but then investing was always an art and never a science.

In his valuation training workshops, the writer uses HOV Services and other companies as illustrations to determine value versus price