Remember the childhood science experiment of burning paper with a magnifying glass. It was fun creating fire without matches. It was, of course, no wizardry. It was all about focusing the sunlight using magnifying glass. Focus is a powerful trait and together with specialisation, it can create extraordinary and durable competitive edge for businesses. Durable competitive advantage or moat, as it is called, can help create superior economics in businesses, meaning high pricing power, sticky and predictable revenue streams with fabulous free cash flows. Such businesses usually come with superior margin profile and high return metrics measured by return on equity (ROE) and return on capital employed (ROCE). They don’t guzzle capital to fund the growth because of free cash flows, and, usually, depend less on debt to fuel their growth.

Niche leadership

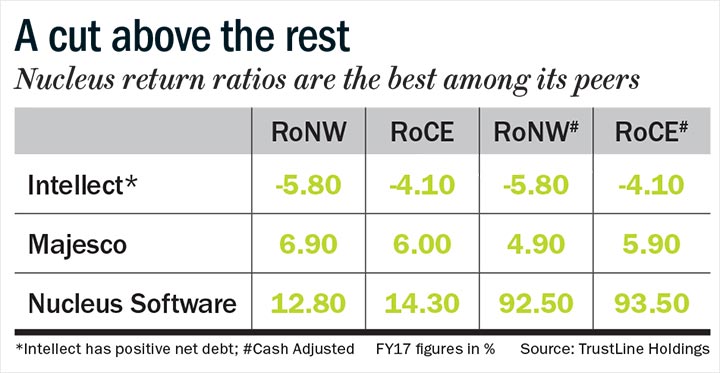

Nucleus Software is one such fascinating company that has built an extraordinary moat by specialising in a much-differentiated product space of loan origination and lending. Within its flagship award-winning FinnOne Neo platform, Nucleus has built the next generation lending suite to shape the future of lending across retail, corporate and Islamic sectors for banks, non-banking finance companies (NBFCs) and financial services companies. Its lending suite runs the back-end of almost all leading banks and NBFCs in the country. Be it HDFC bank or Bajaj Finance, they call Nucleus for their lending solutions. It has to its credit, the covetous Global No.1 lending product award by IBS Publishing (UK) for seven consecutive years. Not a small feat for a homegrown company to achieve this at a global stage with the who’s who as competition.

Not very often, one comes across a great business at a great price. It is a rare thing in the investment world. But, a myopic market can tend to be inexplicable at times. It can misprice a magnificent business to maniacally low levels. Nucleus was one such hidden gem that was mispriced not too long ago. Though the stock has been partially rerated, it still offers reasonable upside for patient investors on rising prospects for its cloud offerings.

Lean patch

It was not without reason that Nucleus was out of favour. The company went through (is still going through to some extent) a very sluggish phase of growth for a protracted period since 2011. Sales growth was flattish at 6.1% over the five-year period between FY13 and FY17. More importantly, the domestic business was lacklustre with its share languishing below 17% of the overall revenues in this period, with the rest coming from exports. The company used this slow phase to invest ahead in the product cycle. Challenging as it may be, Nucleus went in for a complete recoding of its lending platform FinnOne to come out with an all-new cloud-compatible market-beating FinnOne Neo suite. This new version created huge upgrade opportunities, besides opening up the untapped NBFC market, for its competitive cloud offering. Huge investments have gone into revamping its products over the past few years and so is the case with investments on the sales engine. The company invested over Rs.110 crore during FY12-FY16 to ramp up its lending platform. The R&D investments for FY12 and FY13 was over 15% of revenues and came down gradually to 7% in FY16. With the product and sales investment phase behind, pay-off time is not far away.

Silver lining

With its flagship solution making a mark in the cloud, it could potentially change the entire business landscape for the company. The addressable market could change multifold for this solution. Going by the growing number of registered NBFCs and by the RBI’s regulatory push for IT automation, estimates indicate that the NBFC segment alone would invest over $2 billion in cloud over the next five years. Add to this, the growing number of small banks, payment banks and fintech companies (in the digital lending space) that would ramp up cloud investments significantly in the coming years, the market potential is huge and can be multiple times the current market cap of the company. With no upfront investment for cloud solutions and the flexibility of a phased rollout, it could make the solution affordable for many small NBFCs which did not have access to high-end solutions such as the FinnOne Neo.

The cloud business’ revenue model is based on selling licences. Rough estimates indicate that an NBFC would require one licence for every Rs.2.5 crore of lending book. The company is likely to generate over $1 million of cloud business over 4-5 years from a lending book size of Rs.500 crore that is growing at a reasonable clip. Currently, cloud constitutes less than 5% of the company’s overall revenue and is expected to go up to over 20% over the next 3-4 years. With cloud emerging as a sweet spot, Nucleus’ quarterly deals have seen a sharp uptick. Some of the notable names in the NBFCs that had gone live on Nucleus cloud are Manappuram Home Finance, Shubham Housing, Five Star Finance and Finnova Capital. With NBFC and microfinance sectors in a growth phase, it will be only a matter of time before this translates into higher growth for the company. The economics of business will go from good to great for Nucleus with the cloud business gaining traction.

The significance of the cloud business has not to be seen so much from the revenue prism but from a profit perspective. While the business is unlikely to be over 20% of the topline even after three to four years, it does have the potential to more than double the bottomline for the company over the same period. We expect profit to grow at a CAGR of over 25% during FY18-FY20. We estimate a significant increase in free cash flow (FCF) during this period from the current level of over Rs.50 crore.

On cloud nine

We initiated our initial buying at Rs.60-plus levels in 2012. We continue to like the stock even after it has made nearly 8x return at over Rs.550-plus levels. The stock, which, in fact, gained over 55% in less than a month, has been partially rerated because of the recent buyback and the market’s recognition of the increasing traction in the cloud business. The promoter’s decision not to participate in the buyback, too, has been taken very positively by the Street as it reflects the promoter’s confidence in the company’s future. The reason being that the growth in Nucleus’ intrinsic value has always outpaced the rise in its stock price. Adjusted for cash of Rs.389 crore (as on September 30, 2017), the business is available at just over 2x the sales, while globally such businesses are valued anywhere between 3x and 4x of their sales.

Given the traction in the cloud business and increasing share of domestic business on rising prospects in the lending space, Nucleus’ FCF is likely to grow multifold in the coming years. Even on a conservative growth assumption of over 15% CAGR in its FCF for the next five years, based on a discounted cash flow model, the intrinsic value for the business works out to over Rs.2,500-3,000 crore. Since Nucleus’ cash-adjusted mcap is only around Rs.1,200 crore, the stock offers significant upside for long-term investors despite its recent stupendous rally. If NBFCs are hot in this bull market, can a software company that runs their backend be far behind?

The writer and clients of his firm have a position in the stock

Just one email a week

Just one email a week