Never in my wildest dreams did I imagine that one day on these pages I will be recommending a steel pipe company as my investment pick for the year. And yet here I am doing so, fearlessly and shamelessly!

Eight years ago, driven by prejudice of what I considered a commodity play, I had turned down an opportunity to buy 50% stake in APL Apollo at less than Rs.100 a share. The stock, has since, turned out to be a multibagger and now trades upwards of Rs.1,900 a share. I turned down this opportunity because I made a cardinal error of judgement: I did not believe in the exceptional vision and entrepreneurial capability of a man called Sanjay Gupta. Today, I treat the same man with undiluted reverence and place him on par with the very best entrepreneurial stalwarts of our country. Gupta deserves probably even greater respect: unicorns run by other revered entrepreneurs are businesses which are more easily amenable to branding, and many of them occupy the services space such as IT and financial services, but Sanjay’s towering achievement is that he has created a very desirable consumer brand from a commodity-style manufacturing play.

In 2008, when I met Gupta he was barely 38 years old. Rustic, unpolished and with no management degree to buttress his resumé, he did not inspire much confidence — but how wrong was I in grossly underestimating him. Over the next few years, this unassuming young man would transform his fledgling company into a steel processing powerhouse where its products would command a premium in the market place and make APL Apollo a brand to reckon with. The manner in which he went about this transformative journey is the stuff that case studies at leading business schools are made of.

Radical transformation

The first thing that Gupta did was to hire the best management talent. Unlike many founders who are afraid to yield to professional managers, he unhesitatingly placed them as heads of critical functions and empowered them. Today, the company is run by professionals with a strong emphasis on research and development besides product innovation. Once this pillar was put in place, he went about transforming this mundane B-to-B business into a customer-centric B-to-C business.

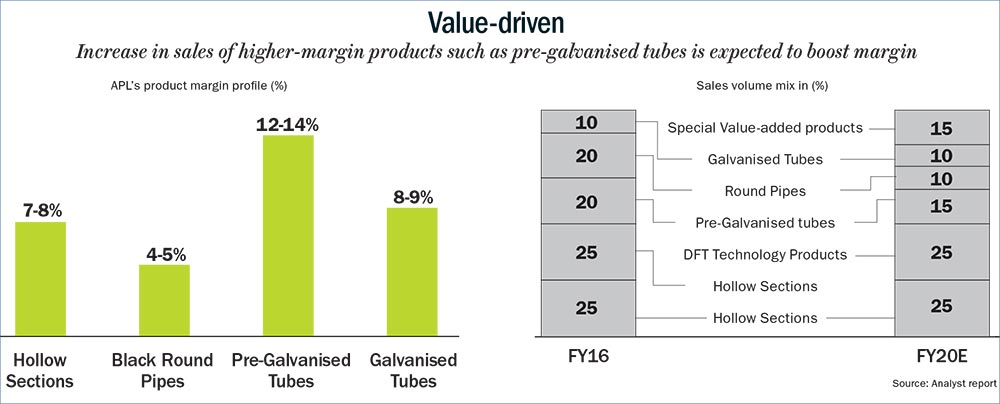

Three key measures helped him achieve this transformation. Gupta scouted across the world for the best technology, adapted it to Indian conditions, and made product innovation as the hallmark of his company. Today, his latest import, the direct form technology (DFT), allows APL Apollo to save as much as 4% on raw material costs, thus allowing the company to ramp up its operating margin from 5.8% of sales to almost 8% of sales.

Customers are no longer restricted to pre-determined sizes of steel pipe but can order sizes customised to their needs. APL Apollo was the first company to introduce pre-galvanised pipes and coated pipes. This customer-centric focus extended to developing new applications across several sectors—construction, railways, automotive, roofing for affordable housing—enabling the company to grow at 27% CAGR over the past five years, which is three times the average industry growth of 9%. Cost-effectiveness was the single-minded focus as Gupta expanded capacity strategically: APL’s plants were set up across the country so that the company could stay close to its customers and, hence, incur the lowest logistics cost.

Making of a powerhouse

Today, APL Apollo is the leader with 13% market share. The company’s industry-leading growth is largely owing to its core strategy of focusing on innovation, branding/distribution and capacity expansion. Over the same period, earnings expanded at 24% CAGR. The company is looking at increasing its capacity by 54% to 2 million tonne by end of the current fiscal. This will include the addition of DFT-based capacity, which is expected to result in superior products and shorter delivery timelines.

The company’s market share in the next three years is expected to rise to 17% at the expense of its competitors and the unorganised market. Again this performance would not have materialised without establishing perhaps the most extensive nationwide network of motivated distributors and retailers who are richly incentivised for superior sales performance. Currently, over 80% of the company’s revenue comes through its own distribution network of 625 distributors and 40,000 retailers spread across 300 cities/towns in the country.

In 2013, the company had embarked on a major branding exercise to create awareness and visibility around its products. These initiatives resulted in higher sales growth in tier II and III cities compared with tier I cities. The company is now working with a reputed marketing consultant to launch new products under the “APL Apollo” brand. It is also targeting 30,000 signage boards across the country for higher visibility and has earmarked 0.5% of its FY17 revenue for this exercise. The efforts are already paying off. Improving brand strength has also helped APL Apollo bring down its debtor days from 40 in FY13 to 24 in FY17. Inventory days, too, have fallen from 52 in FY13 to 38 in FY17, through efficiencies in manufacturing and by leveraging on the company’s strategic manufacturing footprint.

Staying hungry

Marketing genius apart, Gupta has demonstrated remarkable financial savvy and discipline. By optimising capital expenditure, the company has maintained an attractive return on invested capital of 20%-plus, which is set to exceed 30% by FY20. He has relied on internal cash generation to increase capacity and is averse to debt: the company is expected to be debt-free in the next three years. But the leverage is not humongous either. The debt on APL’s books is currently over Rs.590 crore and the debt-equity ratio is just around 0.83x. Gupta also understands the importance of good corporate governance: the company’s books are audited by a Big 4 auditor; it has a distinguished board of industry experts; and is committed to policies that encourage sustainable development.

It’s close to a decade now, but Gupta’s hunger for growth remains intact. While the company may have guided for lower rates, knowing him for the past nine years, I know he will not be satisfied with a revenue growth rate of less than 25% CAGR. And with operating leverage kicking in, operating profit should rise at a CAGR of over 30%. The confidence around APL is also on account of the fact that it has a presence in sectors that are not cyclical. Around 30% of APL’s retail sales are to the household sector, 30% to the infrastructure sector and the remaining 20% comprises agricultural pipes and scaffoldings. Direct sales to real estate and infrastructure projects account for the balance 20%. Against such a backdrop, a stock that trades at 14 times estimated FY19 earnings is cheap. And it is cheap because the stock is under-researched and under-owned. APL Apollo operates in a sector which is non-sexy. It’s when APL delivers results year after year, which surprise and sparkle, will fund managers shed their bias and buy into the vision of Sanjay Gupta just like I did grudgingly.

Whatever any one may think; I am a convert. I may be buying the stock 19 times dearer, but when I wake up five years later, I am convinced that it would be at least three times my purchase price. And I can live with that. Gupta is a man of promise and what we have seen thus far is just the beginning of his overarching ambition.

The writer holds the stock in his personal capacity