Over the past four months, the engineering and consulting firm Praj Industries has done well in the stock market — its stock has more than doubled in value, climbing to levels seen more than a decade ago.

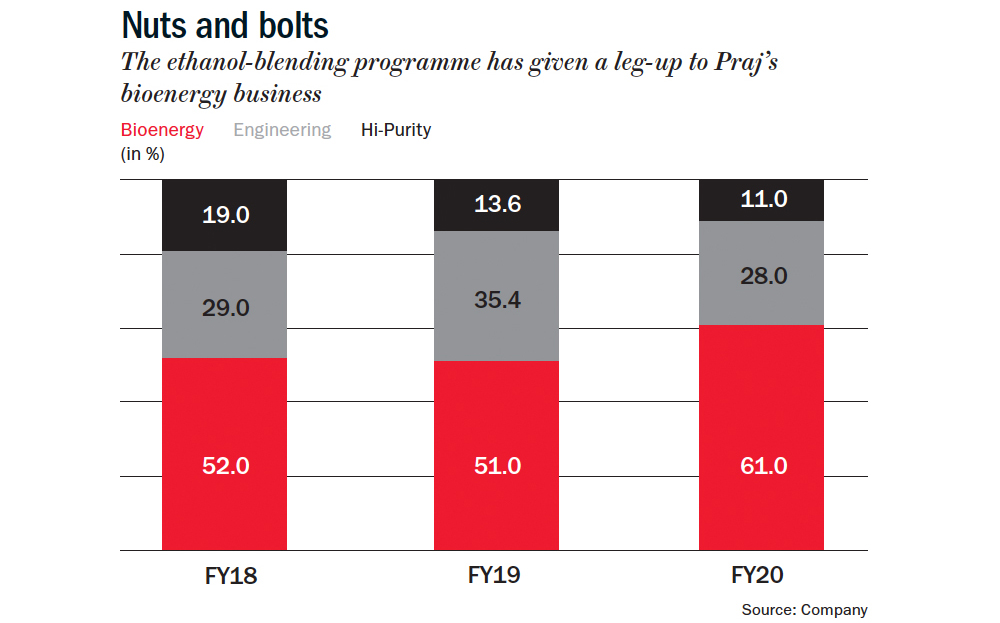

This impressive performance is largely because of the Indian government’s (GoI) aggressive policies on ethanol blending, including advancement in the deadline for increasing the ethanol percentage in the petrol mix, to 10% by 2022 and 20% by 2025. This would mean a 3x increase in capacity of ethanol-producing refineries to 10 billion litres, of which 40% could come from sugar/molasses and the rest from grain. Praj, which makes most of its revenue from bioenergy (61% in FY20) and engineering (28%) verticals (See: Nuts and bolts), possesses the best technology for both.

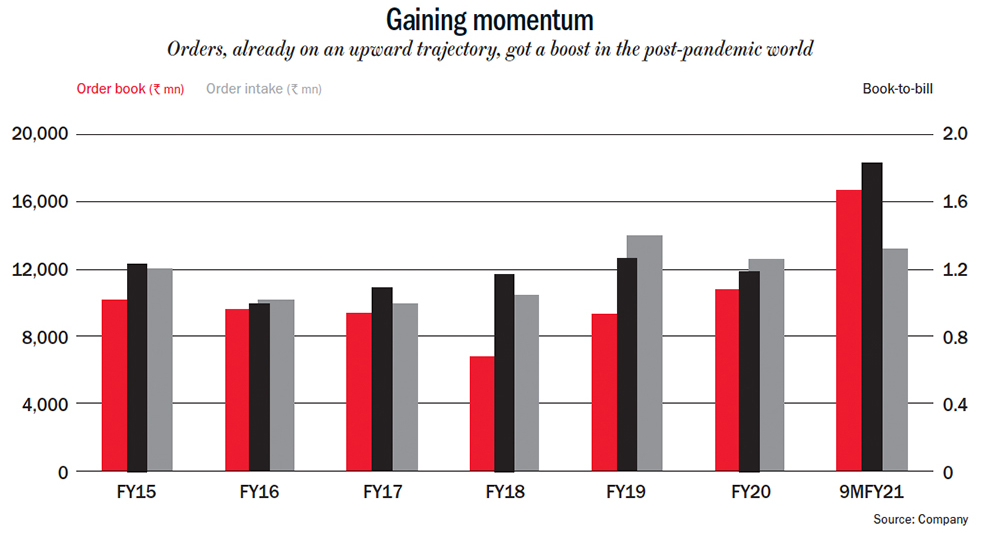

If the blending target is met, Praj could have a business opportunity worth Rs 140 billion in the next three to four years versus its current order backlog of Rs 16.7 billion. Its order book has already picked up over the past one year to the highest level in five years (See: Gaining momentum).

‘Bio-economy’ charged

Praj designs and supplies bio-energy related equipment and technology; is engaged in water and waste-related discharge systems; and makes both food grade and pharmaceutical grade alcohol. As India’s foremost industrial biotech company, Praj is at the centre of the ‘bio-economy’ revolution through its pioneering work in second-generation agri-feedstock to blend with petrol; bio-gas plants using agri-residue instead of natural gas; and solutions for zero-liquid discharge. Praj is working on breakthroughs in renewable chemicals, biodiesel and sustainable aviation fuel.

A massive chunk of its revenue — 80% — comes from India and the rest comes from overseas markets. It has offices in the US, UK, Brazil and Thailand, and has collaborations with companies in Brazil (Dedini), the US (Gevo) and Sweden (Sekab). Praj has been listed on BSE and NSE since 1996.

Cleaner wheels

The company’s core business is to offer sustainable solutions for transportation. The demand for this is likely to rise due to voluntary adoption by the private sector across the world to meet their emission targets and through policy changes such as carbon taxes on use of fossil.

Besides the global move towards decarbonisation, there are the Indian government’s reforms and schemes promoting cleaner fuels. The government’s blended-fuels push is likely to accelerate new ethanol capacity to 100-200 kilo litres per day (KLPD) versus the earlier 50-60 KLPD. On a state-wide basis, where Food Corportion of India’s (FCI) warehouses have surplus, grain-based distilleries would be set up. Praj provides technology for both grain- and sugar-based distilleries, and is one of the four to five companies globally that has the technology for second-generation biofuels. These are made from non-food feedstock, which include agri-residues such as corn cobs, cotton stalks, and rice and wheat straw. Praj's first plant is scheduled to be commissioned in 2HFY22.

Supported by another GoI scheme, the Sustainable Alternative Towards Affordable Transportation (SATAT), Praj was meant to start its first commercial compressed bio-gas (CBG) facility in April 2021. It is currently at an advanced stage of completion and the announcement of commercial commencement has been delayed because of the pandemic’s second wave. If the first few plants work as per expectations, the government envisages setting up 5,000 such plants at a cost of $25 billion over the next four to five years. Praj is confident it has a better technology for CBG compared to its peers, which gives 30-40% higher yield.

The other big opportunity in the transportation segment is in diesel blending. This is a much larger market compared to petrol blends because the use of diesel is 4-5x of petrol. Praj is also developing a sustainable aviation fuel to replace aviation turbine fuel.

After transportation sector, the company’s big business comes from the manufacturing sector, in the treatment of effluents and water. This is a major source of pollution and mandatory adoption of zero liquid discharge (ZLD) might be implemented soon. Currently, Praj gets most of its orders for this from India, but there is potential for growth in the overseas markets too. As India takes a position on the global climate agreements — November 2021 is the UN Climate Change Conference in Glasgow, on national commitments on emissions — the opportunity for ZLD and other tools of decarbonisation would increase.

Some other opportunities for Praj are in the area of pharma grade alcohol because many countries now want to make their own sanitisers following the pandemic.

Fall and recovery

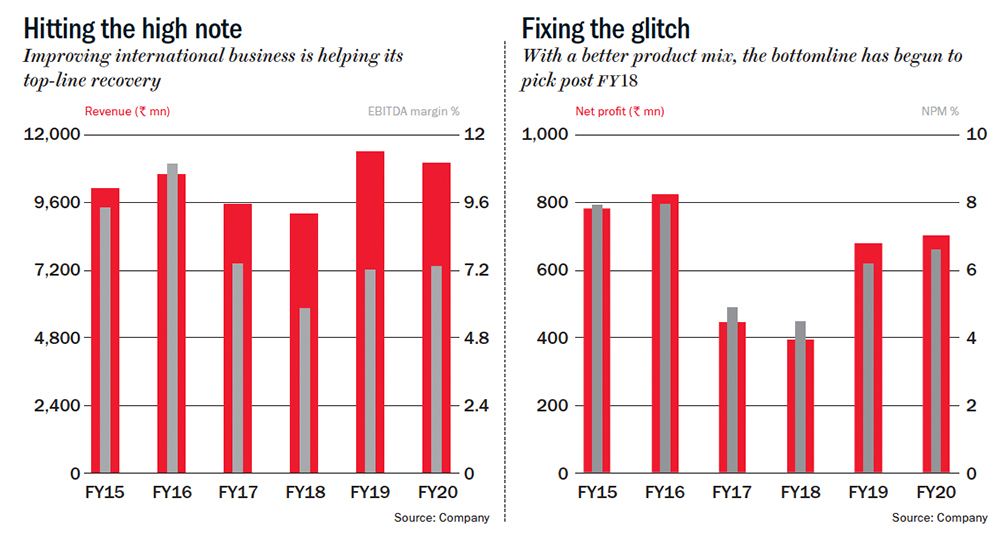

The company’s sales and earnings have dropped and then recovered over the past five years.

Between FY15 and FY18, the company saw fall in its revenue and EBITDA margin because of a scarcity of international business, but now both its domestic and international businesses have picked up and the numbers are improving (See: Hitting the high note). In FY21, though it saw its revenue and EBITDA margin dip significantly in the first quarter, the numbers recovered to over Rs 2.4 billion and over 10% in the third quarter. In the same period, the company had seen a decline in net profit and net profit margin because of a less-favourable product mix besides the decline in international business. Now these numbers have not fully recovered but they are strengthening with the expanding order book (See: Fixing the glitch). In FY21, both net profit and net profit margin slid into the negatives in the first quarter, but climbed back up to over Rs 250 million and over 10% in Q3FY21. In fact, these numbers were better than the pre-pandemic numbers reported in Q3FY20.

If the market that Praj is targeting is so promising, are there other competitors that the company needs to be concerned about? Not really.

Praj is a unique company in terms of having an exclusive business model based on the bio-economy. Some of its peers have competing products but not the kind of wide array of solutions that Praj possesses. Hence, it is not directly comparable to any of its peers.

On the whole, the company is bang in the middle of a quickly expanding industry, and it has expertise and the product line to make the best of it.

Disclosure: Neither the writer nor his clients own the stock.