When you own a racehorse, why trot. By the same logic, in a growing economy like India, it makes sense to invest in growth-oriented businesses, like Mirae Asset’s Neelesh Surana does. He identifies opportunities in the most unlikely of spaces, including in mid and small-cap companies, without compromising on his exhaustive checklist. The Union Budget’s poor show in stimulating demand does not worry him because Surana believes it is just one of the factors and that the consumption slump will soon end.

When you own a racehorse, why trot. By the same logic, in a growing economy like India, it makes sense to invest in growth-oriented businesses, like Mirae Asset’s Neelesh Surana does. He identifies opportunities in the most unlikely of spaces, including in mid and small-cap companies, without compromising on his exhaustive checklist. The Union Budget’s poor show in stimulating demand does not worry him because Surana believes it is just one of the factors and that the consumption slump will soon end.

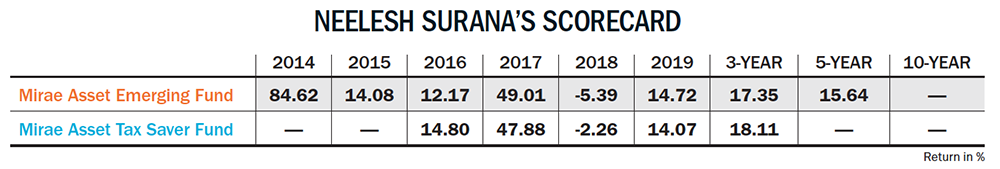

He ranks at the top, both in the 10- and five-year Outlook Business-Value Research Best Fund Manager Ranking, with compounded return of 17.39% and 14.37%, respectively. In an exclusive interview with Outlook Business, he shares his secret behind generating alpha

Describe your investment strategy.

At Mirae Asset, our investment philosophy is centred on buying quality businesses at a reasonable price. We have a well-diversified portfolio with holdings across sectors. When it comes to stocks, we look at three things — the business, the management and a stock’s valuation. With regards to businesses, the approach is to identify a growth-oriented one. Since India is a growing market, ideally, a business should grow in double digits or twice that of real GDP growth in the country. Then, besides assessing basic hygiene in terms of governance, we also try to understand the perspective of the leadership. We believe the management of a company has a large role to play in wealth creation. The third filter is valuation — the value has to be bigger than the price so that there is ample margin of safety.

Does this strategy differ when it comes to buying small and mid-caps?

The framework of stock-selection does not change regardless of the market capitalisation. The only difference is that expectation is higher for mid and small-caps. They should have higher growth and better RoCE so that there is more margin of safety.

What parameters do you take into account before investing?

We like to see low-teen to mid-teen growth. The house filter for RoCE is 15% pre-tax. Our valuation parameter varies across the character of the business, but generally we prefer around 15-20% difference between value and price. We also follow discounted cash flow (DCF) valuation method, or even reverse DCF, to find implied growth.

What has driven alpha for you?

A lot depends on the research team and the process of selecting a stock. It is important to maintain certain hygiene during the process. Selecting stocks instead of taking sectoral calls also helps in the creation of alpha.

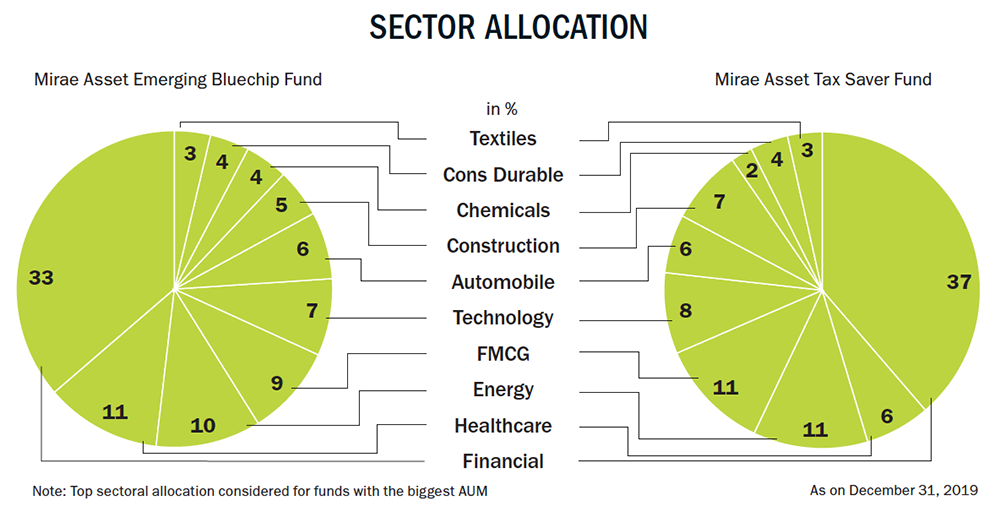

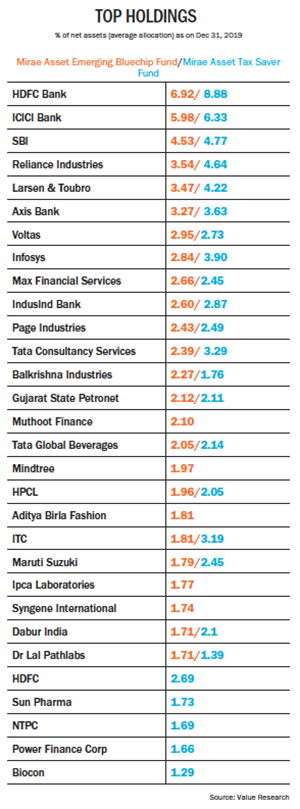

Banks and financials have a higher allocation in your schemes. What makes you bullish on this space?

First of all, market share is shifting away from government banks to private financiers because of their strong asset and liability franchise. Over the FY19 base, more than 50% of the delta earnings growth is going to come from financials over the next three years, especially due to turnaround in corporate banks. Financials have higher weightage in all portfolios as the benchmarks have a large weightage to this sector. We like banks that have better RoE and growth. Some have been impacted by corporate NPAs and their mean reversion is in progress. This is where we see a large opportunity. In addition to this, there are retail-oriented banks, which have done well even during challenging times. Other financials we are optimistic about are insurance companies, which we believe have a long runway to grow since various financial products are under-penetrated.

The value gap between troubled PSU banks and private banks is highest right now. As the sector goes through a complete cleanup, won’t it be more rewarding to bet on beaten down PSU banks?

There are strong and weak banks in both private and PSU space, but the starting point should not be cheap valuation. It is important to select strong franchise both on asset and liability side within financials, at reasonable valuations. The choice available in the sector is vast.

Do you see value in NBFCs or is it still a space to stay away from?

Given the ongoing credit issues in this space, it’s best to avoid weaker names (particularly on liability franchise) irrespective of valuation. We are positive on select NBFCs, which have differentiated lending book, strong liability franchise and are available at reasonable valuation.

Any other sectors you are bullish on?

We see opportunity in many sectors, particularly in pockets of the market where earnings visibility is patchy but valuations are extremely attractive. Earnings growth has been momentarily impacted in pockets such as telecom, private capex and healthcare. Their current level of profitability does not reflect long-term potential. Because of the polarisation in the market, they are beaten down and have become much more attractive.

In addition, our portfolio is skewed towards consumer-oriented businesses subject to a valuation filter. We believe that the longer-term theme is intact here. In many products where penetration level is low, the opportunity to grow is significant. Increasing compliance in the economy is favouring the organised sector. So, large companies are becoming much larger.

What kind of growth and P/E framework do you think is appropriate since most of the consumer stocks quote at P/E of over 50x?

What kind of growth and P/E framework do you think is appropriate since most of the consumer stocks quote at P/E of over 50x?

P/E multiple is a function of expected rate of growth, longevity of growth, and RoE. In general, DCF-based valuation is a better tool, particularly in the consumer sector as it captures growth and RoE better. Overall, investors should be careful while looking at stocks with forward multiple in excess of 50x unless confidence on longevity of growth is high.

But, in the recent FY21 Budget, the government didn’t take any strong steps to revive consumption demand. Are you still bullish on this sector?

The Union Budget is just one of the factors. It doesn’t affect the long-term theme, which is penetration in various categories. It’s not just FMCG companies that I am talking about. It also includes durables or other consumer-oriented businesses. It could be internet companies or even retail banks. India is a growing market, so you have multiple levers. Growth and penetration will increase as per capita income increases. Rural and urban consumption is soft right now since the economy is going through a rough patch, but it will not last long.

How do you see the IT space emerging? Are their bargains there?

The IT space has businesses with steady growth and strong cash generation. In general, we prefer large-caps within this sector, given their ability to generate and fulfill demand, which is superior compared to most of the mid-caps. They also have a better margin profile.

Outside of banks, what is your take on PSUs?

We are positive on many PSUs, particularly in the utility and OMCs space on account of improving earnings and attractive valuation. The space is relatively amongst the most attractive as current valuation is also exaggerated on account of government supply of stock via ETF, which is more of a technical factor.

Are there any sectors you are avoiding?

We buy businesses with 15% RoCE and around 13-15% growth. We tend to avoid stocks or sectors that do not meet these criteria, especially if they are not generating cash. Our portfolio generally has fewer construction or real estate businesses because the cash flow metrics or RoCE in many of these companies do not meet our filters. In some cases, the management does not make the cut.

Do you feel the large-cap space is in a bubble?

I do not know about a bubble, but the rally is slightly polarised. Even within the large-cap space, you have two sets of companies. For some, earnings visibility is intact. They have delivered good earnings in a challenging environment because of strong franchise and management. They have seen a lot of interest and valuation has moved up. In some cases, there could be a bubble or froth, but one cannot say that about all companies. There is an opportunity, but one has to be selective.

Then, there is the other end of the market where things are getting interesting. These are businesses where earnings growth is patchy and has not been good historically either. But, there is potential for that to change. One can find such stocks in sectors such as metals, utilities and government entities. It gives investors an opportunity to pick stocks from both buckets.

You said your investment strategy does not differ much with respect to mid and small-caps. But they tend to do well when the economy is doing well. Given the current growth rate, are you constructive on this space?

Our core allocation is in large-cap, in companies that have a long way to go. They also have better return ratios and in many cases, there are simply better quality companies in large-cap.

As far as mid-caps are concerned, what happened was that froth built up in the market two years ago. The Midcap premium to Nifty was nearly 30-35%. That has fallen to a discount of 15-20% and would again ‘mean revert’. Essentially, one must buy a mid-cap early so that you get the twin benefit of earnings growth and P/E expansion. The view is to have 70-75% in large-cap and 25-30% in mid-cap. The latter may be momentarily cheaper but one should not have disproportionate allocation to them.

What is your FY21 outlook for the market?

My view is constructive even as the economy is going through a tough phase since I believe things will improve. It is important to note that earnings growth will improve on a lower base. We are looking at 20% compounded earnings growth for three years, which will be driven by a revival in loss-making or turnaround businesses in sectors such as telecom, corporate banks, private capex and healthcare. If you look at their profitability compared to GDP growth, the 1.3% negative contribution will likely turn positive. Secondly, we will see a positive impact of economic reforms and interest rates, which are coming down. This makes overall valuations reasonable. When you see P/E multiples at 15x for two-year forward, it should be seen in the context that earnings are depressed and interest rates have been soft across the world. Overall, expectations are reasonable in the range of 13% to 15% for a timeframe of three to five years.

Could you share some of your key learnings?

As a team, we look at the past and learn from our errors. We have had errors of both kinds, commission and omission, because what is missed is also an error. Another one was selling good high-growth businesses at an early stage. There have been cases when we bought it at the right time and sold a bit early. One of our most important learnings has been to never compromise on the management filter, RoCE and growth prospects. Those businesses don’t create wealth.