India’s fformer cricket captain MS Dhoni earned his moniker Captain Cool by taking risky bets and backing them with enviable calm. He delivered victories by placing his trust in younger players when others looked askance, promoting himself up the batting line when required even when others doubted his motives and refusing to counter sledging with abuse.

India’s fformer cricket captain MS Dhoni earned his moniker Captain Cool by taking risky bets and backing them with enviable calm. He delivered victories by placing his trust in younger players when others looked askance, promoting himself up the batting line when required even when others doubted his motives and refusing to counter sledging with abuse.

Dhoni inspires Invesco Mutual Fund’s Dhimant Kothari, who can relate to the cricketer’s “controlled aggression and conviction”. Both are good at spotting diamonds in the rough and both can wait patiently for the stones to breakthrough with their brilliance.

Kothari, who is partial to value stocks and “growth (stocks) at a reasonable price”, prides himself on picking up stocks at their earnings as well as valuation-cycle lows. He says there is a wrong perception about value, that is, buying low P/E stocks.

“There cannot be a cut-off P/E that a value fund should restrict itself. If the current stock price is factoring only 15% growth, whereas the company can potentially deliver 20% growth, then there is value arbitrage or opportunity. Also, if the company is growing at 15-16% but the P/E is 20x, then it is still a reasonably valued company or growth available at reasonable price,” he mentions.

FINDING HIS FEET

This fund manager was initiated into the world of finance early. His father was a traditional bookkeeper, writing books of accounts in Gujarati, and the younger Kothari would accompany him to his office and banks, and for cash collection. While he found the work interesting, he noticed that his father was not getting paid enough for his effort and realised a professional degree could make a huge difference. Therefore, along with his graduation in commerce, he decided to pursue chartered accountancy.

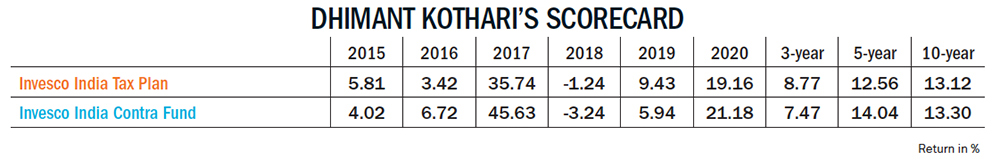

During his internship, Kothari found accounting and auditing less exciting than he had imagined. He needed a new direction and found it as a research analyst with Crisil in 2004. “That stint helped me build in-depth understanding of sectors and develop strong analytical rigour,” says Kothari. Seven years later, in 2011, he joined Invesco as a buy-side analyst and tracked commodity stocks for eight-and-a-half years. In 2018, he was made a fund manager and in two years, he was given charge of Invesco’s biggest funds — Invesco India Tax Plan and Invesco India Contra Fund.

Today, he oversees more than 50% of Invesco’s AUM.

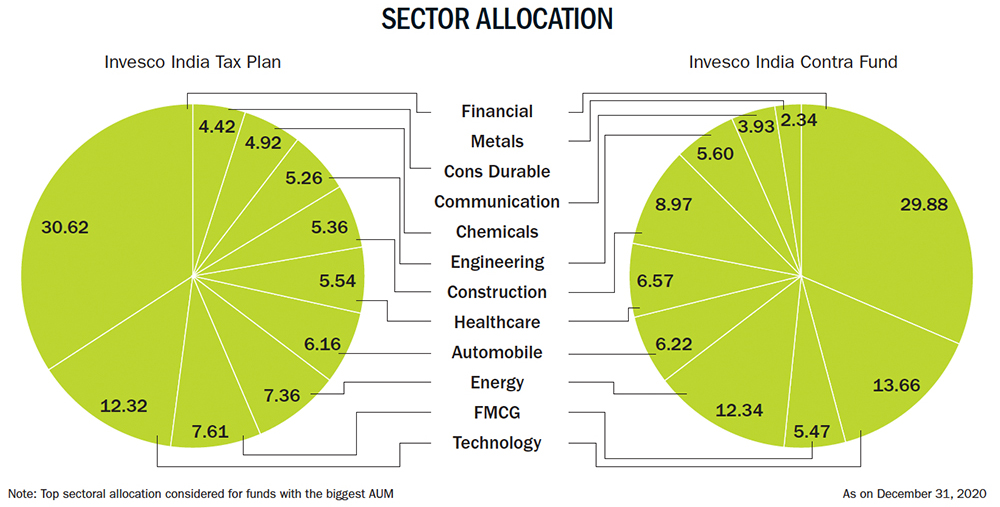

Invesco’s Contra Fund, Kothari says, enters a segment when its cycle looks most unappealing. For example, the financial sector was ignored till September 2020, because there were elevated concerns of near-term, credit-cost uptick and sluggish growth. “Contra Fund attempts to capture such opportunities where there is near-term pain and thus investor attention is minimum,” says Kothari. While investors were focused on consumer discretionary and information-technology stocks, which were leading the rally, Contra Fund scaled up the exposure in the financial sector.

Kothari explains why: “The sector was well capitalised and meaningful provisions were already carried in the balance-sheet.” So, during May-September 2020, when the earnings outlook was bleak and investor attention was minimal, Contra Fund took a well-researched, contrarian stance and scaled up exposure in financial sector, from 23.8% as on May 31, 2020, to 27.2% as on September 30, 2020, and further to 29.6% as on October 31, 2020.

“The fund endured the initial pain, as the financial sector did not participate materially in the runaway market,” he says. Nifty had moved up from 9,000 odd level to around 12,000 in September 2020, but the Nifty Financial Services Index was muted and stuck around the 10,000 mark till September 2020.

“However, it will eventually pay off,” he says. They got in at a lower price and he believes there will be double beta earned by FY23, when the economy will recover. When the economy recovers, there will be higher lending growth which translates to higher net income, and fewer bad loans which translate to lower credit costs. Thus, they would have the earnings and valuation-multiple expansion.

“However, it will eventually pay off,” he says. They got in at a lower price and he believes there will be double beta earned by FY23, when the economy will recover. When the economy recovers, there will be higher lending growth which translates to higher net income, and fewer bad loans which translate to lower credit costs. Thus, they would have the earnings and valuation-multiple expansion.

Balance sheet, capital allocation and cash flows are Kothari’s touchstones, whether it is to evaluate financial, commodities or turnaround companies. “I can live with some misses on profit and loss for a quarter or two but am intolerant to balance sheet deterioration or poor capital allocation,” he says.

“Cyclical companies with strong balance-sheet and lean costs can endure the downcycle well and provide strong return through earnings and valuation multiple up-tick in the upcycle. Turnaround companies need a strong revival plan, but the plan will only work if there is no further slippage in their balance sheet. Capital allocation is important because those decisions go a long way in determining long-term shareholder wealth creation by any company,” he adds.

STICKING TO CONVICTION

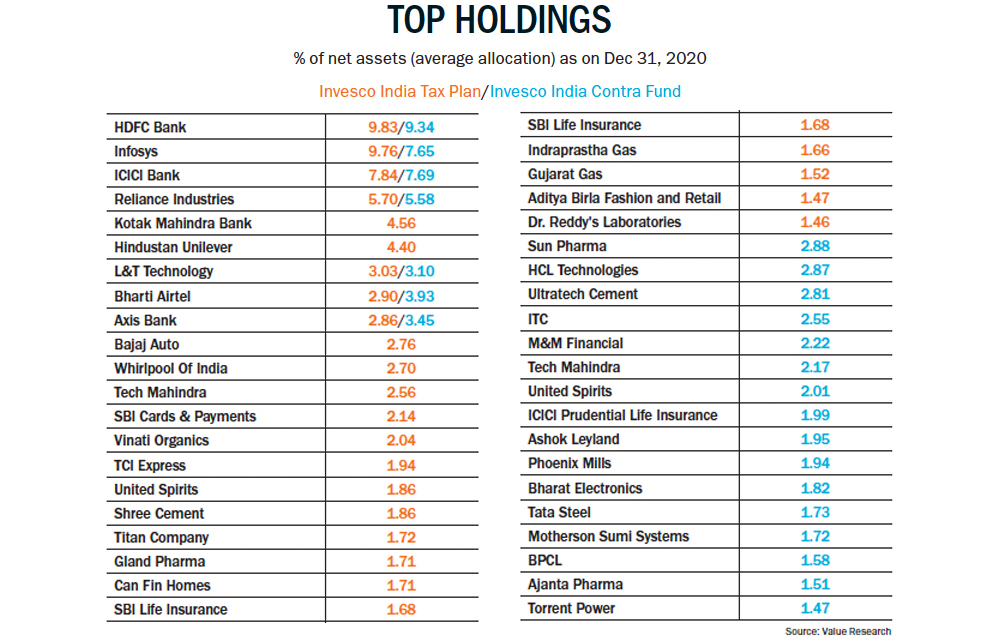

Being able to align buying and selling of companies in alignment with their cash-flow cycles, he says, has been central to his triumphs. “Reliance Industries has been by far one of the biggest successes. We didn’t own it considerably during the phase of its meaningful capex cycle and entered it when the capex was done, and it was time to reap the fruits of the same,” he says.

Kothari’s weakness lies in early selling. “I need to work on that,” he says, adding, “One should not time the market. Disciplined, long-term, systematic investments in alignment of one’s financial goals and risk appetite increases probability of success meaningfully. In the stock market, processes and discipline usually lead to wealth creation, randomness cannot guarantee it.”

Another learning for him has been to restrict interaction with a company’s management to understanding its business and its running, and nothing further. Anything more and he says, “we can get coloured by their opinions and outlook”.

With every company, he starts by evaluating a few financial parameters such as above nominal GDP growth potential for the foreseeable future, 15% RoCE, more than 4x interest coverage and 65-to-70% Ebitda to operating cash flow conversion ratio. He goes through its historical track record to gain a good understanding of promoters and management, by looking into their experience, succession planning, related-party transactions, group businesses, promoter leverage and so on.

“Major diversified groups have collapsed due to aggressive expansion plans and leverage. Even good franchises within the troubled group have seen value erosion,” he says.

After these rigorous checks are done, he does not allow much churn in his portfolio. He keeps 60-70% of it as an anchor portfolio, “which you can sleep over”. “These are steady-state, high quality compounders. Here I do not bother much about every quarterly result or every noise the market is making. The balance 30% is your beta portion, where you have to be very hands on, such as knowing when to enter or exit,” he adds.

While COVID-19 brought challenges, Kothari says that it also brought out winners. “Corporate India was forced to innovate, try cost-saving measures and transform itself. During the lows of late March and early April, the market painted every stock with one colour — red — even the so-called blue chips were down 40-50%. It gave us a once-in-many-years opportunity to get into high-quality, high ROE companies with a solid-track record at a good bargain.”

While overall valuation for FY21 looks abnormally high, Kothari believes things will level out soon, with global liquidity giving a multi-year runway for growth. “Corporate India has meaningful operating leverage (increase in profit can be disproportionately higher than increase in fixed cost) as capacity utilisation is sub-70%, has introduced few cost-correction initiatives post COVID, which can lead to permanent uptick in margins, and will see increase in profitability after the corporate tax cuts last year,” he says.

Of course, with the recovery in sight and valuations picking up, people will expect more. “Earnings delivery will be more critical unlike a few months back, when expectations were low,” he adds. During August-September 2020, the valuations were low since people expected “prolonged weakness in the economy”. But now, there is an assumption of recovery by FY22.

He has witnessed two global crises in his career, the one in 2008 and the one now. Both had governments and central banks work in sync to increase global liquidity and give stimulus to the economy. In 2008, recovery came three to four years later and he expects the same this time.

Risk to positive outlook in the near term, says Kothari, is the efficacy of the COVID-19 vaccine that can delay the recovery. If India lags compared to the rest of the world in recovery, then it could bring imported inflation (with prices of commodities such as oil and metals going up) before growth picks up.

Kothari plans for the long-term but has allowed himself leeway to play for the short-term rewards too. The market is everchanging, but he believes a fund manager’s success ultimately depends on independent thinking and following one’s conviction.