To ask for one’s best investment is like asking one to name the best book that they have read, and there are rarely any one if they have read enough. Over a period of time, I have come across several worthy managements and quality businesses that have produced highly satisfying long-term outstanding outcomes. So, at one point if it was Infosys and Wipro, then in more recent times, Bajaj Finance, Motherson Sumi, Eicher Motors, Page Industries, PI Industries and Gruh Finance have been very rewarding. Even some of the pharma companies like Sun Pharma, Ajanta or Lupin, despite suffering over the past couple of years, have been very fruitful investments overall. Hence, to pick one out of a dozen or more fine investments over a long period of time would be a bit unfair for the many other names that are there. But since the construct of the article demands picking just one, I will pick Bajaj Finance with the clear proviso that many others are almost equal contenders for the title. Bajaj Finance is an interesting instance of a reasonable business that has turned out to be an extraordinary one. It is a company where the quality of the management materially exceeds the quality of the business.

It popped up on our screens which we tend to review on a monthly basis. At that point, research reports on Bajaj Finance were non-existent, and so we decided to go and meet the management. I wanted to understand the opportunity size, how much sustainable growth the company could carve out without diluting the book quality, the capital efficiency and whether the growth would be with or without meaningful payout. I always prefer to meet the management before investing. While management quality is important in any investment, in a finance firm, it acquires an extraordinary dimension. In the finance business, more so than in any other, your only line of defense is the quality and capability of the management. It is a business where a rupee of net worth is levered 5x to 15x. Therefore, even if 5-7% of your assets go wrong, your net worth can become zero. Given that it is an NBFC, P/B or RoA would have been the conventional way to assess the value of the stock. But like the P/E multiple that reveals little, the P/B multiple for a finance firm hides a lot. It reveals more when you back it up with capital efficiency, growth rate and its sustainability, asset quality and the underlying payout ratio. All of that needs to be built into your calculation to arrive at a realistic value for the finance business. Our dialogue with the company clearly impressed us about the strategy and clarity with which they were approaching the business. To be sure of what I was getting into, I decided to test their processes by availing of a loan for an AC. They process the loan at the shop itself, in minutes, by accessing your credit score, and their collection efficiency is seamless.

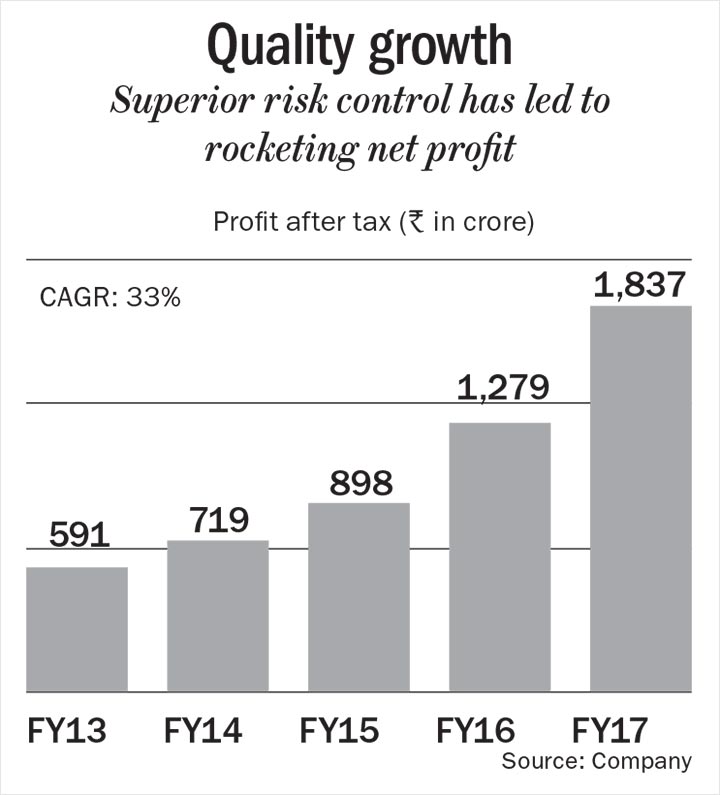

While the sector presented superb long-term opportunity, the stock delivered a splendid return due to what the management has done. I am not getting carried away by the staggering 75% annual return that it has generated over the past eight years. I’m much rather impressed by the over 60% per annum compounding of profit during the same period. This is because consumer durables financing has been a bit of a graveyard for other finance firms, with many NBFCs or private banks not having had meaningful success. Therefore, when Bajaj Finance entered the sector, the odds were not in its favour but they mapped the opportunity well, and scaled it even more diligently.

Giving out fewer loans with longer duration is relatively much easier than giving out several short duration loans. This makes housing finance a simpler and superior business because the relative size of the loan is bigger, the duration is longer, and you get a sustained benefit if you fund the right asset. Comparatively, giving out millions of smaller loans which expire in a shorter period of time means that you not only need to recover them, but also replace them fast enough to achieve higher growth. That kind of business is invariably more difficult, as it tests the management’s ability to not just grow and scale, but achieve superior asset quality and capital efficiency as well. Bajaj Finance is in fact a well-oiled machine that is relentless in lending and recovery.

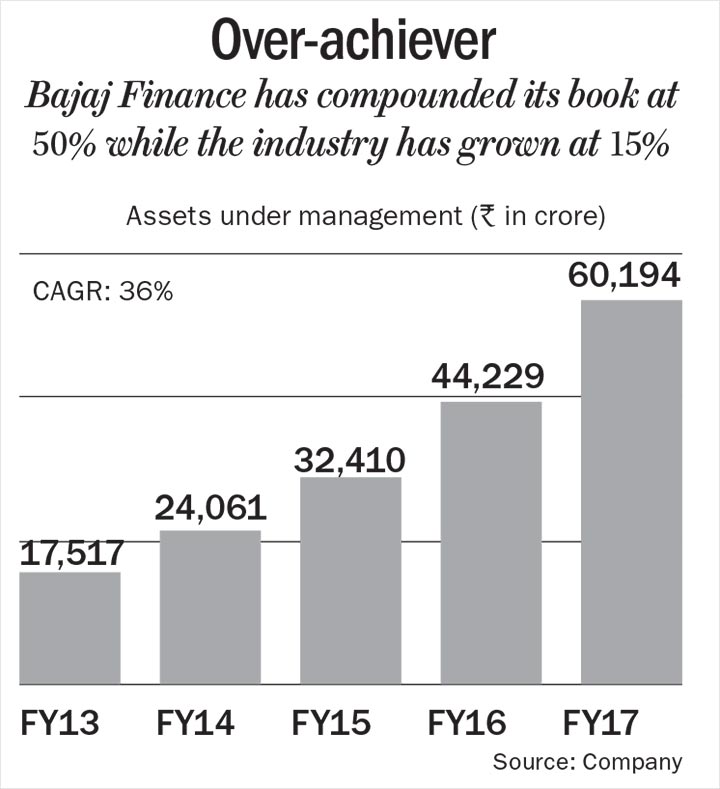

Normally, long-term growth for a finance firm is constrained by its capital efficiency, and to deliver growth much in excess of it is a challenge. Something or the other gives way when you try to do that. Then what is the magic formula behind this financing powerhouse? One, relentless execution; two, great use of technology; and three, consistently deconstructing the moving parts of the business to ensure superior risk control. Despite the frenetic growth of the business over the past eight to nine years, you have seen the asset book maintain its pristine quality. The gross and net NPLs continue to be around 0.5% and 0.25% respectively. These are easily amongst the best numbers that you can find anywhere. It should be noted that it is not that the industry has grown at such a blistering pace; this is the company carving out an extraordinary growth path for itself. Bajaj Finance has grown its book at 50% every year over the past eight years, while the industry has grown at about 15%. Growth has been equally brisk on a larger base over the past five years, as the asset book has compounded at 36% from Rs.17,500 crore in FY13 to Rs.60,000 crore in FY17, and net profit has compounded at 33% from Rs.600 crore to over Rs.1,800 crore. The company has used cross-selling very effectively to grow its book as well as maintain effective control over asset quality. Its reach and processing speed are also formidable entry barriers. It is now present in 318 cities via 14,000 dealer outlets. Invariably, when you run a large asset book, you are bound to make some mistakes. But wisdom lies in recognising those early on and fixing them quickly. In the case of infrastructure funding, they have been smart enough not to get drawn for a long period, taking large write-offs and not allocating further capital.

We first bought into Bajaj Finance in July 2009 when its market cap was under Rs.1,000 crore, and still continue to hold it when it has exceeded Rs.100,000 crore. Over the years, they have evolved from being just a two-wheeler and three-wheeler financier to now lending across 18 different verticals. Bajaj Finance’s payout has been like that of a normal finance firm at 12-13% but they have been growing at such a massive pace that they retain bulk of the earnings. It continues to be one of our top holdings and we have bought more as our own asset book has grown.

Staying with my analogy, much like the fact that along with many good books, there are enough not-so-good books that one has read, so is the case that along with many good investments, there are enough suboptimal choices one has made. Let me hasten to add that the failure invariably has been at my end rather than with the investee firm. The format of the edition demands it to be labelled as ‘Worst Investment’, but I would prefer to describe it as ‘Difficult Investment’. I would also like to reiterate that the appellation of ‘worst’ lies with my decision-making and it has nothing to do with the investee firm. Recalling my difficult investment reminds me of the opening lines of Charles Dickens’ A Tale of Two Cities: “It was the best of times, it was the worst of times, it was the age of wisdom, it was the age of foolishness, it was the epoch of belief, it was the epoch of incredulity…” I get that ambivalent feeling when I recall one of my most challenging investments because while it did extraordinarily well (from the price that I first bought, it went up an incredible 250x in a rather brief period), it also collapsed equally dramatically. It was a company called Visualsoft that was into creating components and assemblers and a suite of technology around software services. The failure did not really lie in the investment as much as it lay with me, but I am getting ahead of myself.

I keenly started tracking and investing in software stocks in the early 90s after Infosys got listed in June 1993. The Infosys management was a breath of fresh air and the business catered to a large opportunity as India had strength in the area. The capital efficiency of the business was superb: it was a free cash generating machine even when it was a relatively much smaller business. Software services businesses needed some capital from time to time as their growth rates were extraordinary, in some cases at over 100% annually for a length of time. Valuations, even by conventional logic, were reasonable, Infosys was trading at a high single-digit or double-digit multiple, Wipro was slightly more expensive. I felt that the businesses were not adequately valued for any apparent reason, except perhaps for the lack of familiarity among investors. To me, everything looked good about these businesses: the management quality, the size of opportunity, the earnings growth and its quality as well as the valuation. When the rerating eventually happened, these stocks compounded phenomenally.

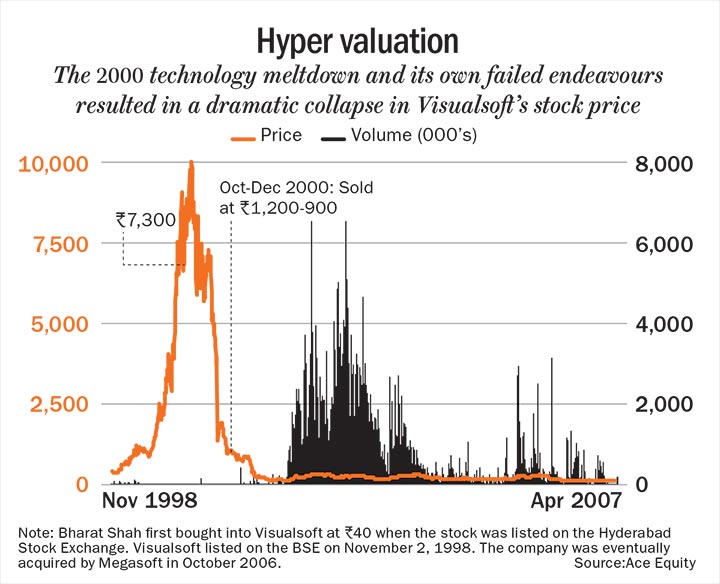

I first bought a major stake in Visualsoft at about Rs.40, sometime in the mid-90s, as the price seemed right and the differentiated business model appealed to me. Partly, it was an overall positive impression about the software sector and partly the appeal of a judicious diversification within the technology space. I already had Infosys and Wipro in my book, and I entered the semi-product technology space with the hope and belief that Visualsoft might actually grow into a technology platform. Clearly, that hope was subsequently belied and I failed to judge whether a small firm had indeed the capability to do what they needed to do to become a successful technology firm. Technology is a space where it is easy to become dreamy-eyed and in which you believe that you have something that can alter the world. And you do need some amount of optimism and belief for you to be actually able to do that.

Visualsoft wanted to go down the path of full-fledged technology products, but could not succeed in their endeavour. After the technology meltdown of 2000, they even diluted their semi-product stance and went back to a normal software service business in which they did not have any real or greater competitive advantage compared to the bigger firms like Infosys, Wipro or TCS. I exited when I realised that my assumption about how the business would play out was not accurate. The fact that valuation had overreached was beginning to be quite clear and there were some challenges that were beginning to loom large on the overall sector in 2000-2001.

I finally sold the position in the range of Rs.1,200-900 from October-December 2000. I did sell some stake earlier at about Rs.7,300 but that was a small part and even then, that small selling recovered the entire cost of the holding. It feels surreal even now, when I recall that move from Rs.40 to Rs.10,000. When I look back at it, I wonder whether I was foolish, brave or reckless to have waited all the way to Rs.10,000 and not having pulled the plug in between. At various stages, it would have still been a great unlocking, but I probably was on a trip, I think, and while the trip was en route, I never thought that I had to disembark. I probably got carried away by the glamour of technology. And sometimes, the price rise affirms your business belief even more. The rude shock was the realisation that the price rise was not entirely an affirmation of the underlying potential of the business.

Software stocks were, in that frenzy, underjudged, overbelieved and overvalued. When it was going up, it looked like a dream sequence, and when it ended, it looked like a nightmare and that contrast in the same investment was because I did not disengage at an appropriate point in time. The key failure was overly getting carried away by the future, not realising that even if the future were to hold out as one thought, still the current number, in terms of valuation as well as the relatively small size of the business, needed to make sense.

In investing, the eye is on the future. But businesses go through their spasms, and sometimes the spasms can even kill the business. Even when I sold it, it was still at a significant multiple of the price that I bought it at. While we still made a significant profit, the sore point was that there was so much money on the table that I let go. That left a psychological scar. My biggest learning is that one should not get carried away and keep assessing the business and valuation continually. There has to be a valuation rationality, which connects the English of the future with the mathematics of today. There has to be symphony between the two rather than the English dominating the mathematics. Now, I am much more watchful, and in some cases, when the valuation doesn’t make sense, I take appropriate action, be it by reducing my holding or moving out of it entirely. You can’t get emotional; if you do, you can end up paying heavily. In the case of Visualsoft, emotion clearly overshadowed rationality.