Outlook Business (OB): Welcome to the 9th Outlook Business annual private wealth roundtable. While the pandemic has impacted the world in more ways than one, a look at the stock market seems to suggest that it is business as usual. How much of that is irrational exuberance and how much of it is justified?

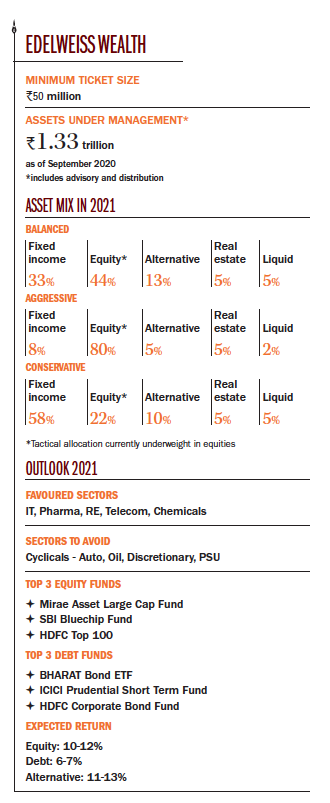

Ashish Kehair, Head, Edelweiss Wealth Management: Markets are never rational and tend to swing towards pessimism or optimism and this year has been the shortest possible period where we have seen both the extremes play out. From a valuation perspective, we are reasonably expensive. But, a sudden trigger could see that settling down to a reasonable level. Hence, we are asking clients to book a part of their profit. So, we are kind of circumspect.

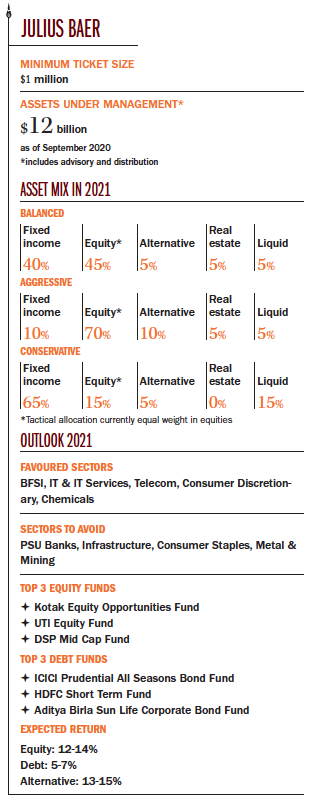

Ashish Gumashta, CEO, Julius Baer India: The world is flush with liquidity and, traditionally, it went into businesses and economic activity but now a lot is going towards investments. My global team states that 36% of the stimulus has moved into savings. Similarly, at Julius Baer, clients are holding 20-30% cash in their portfolio. With interest rates coming down, at every dip, money will keep flowing in. The overnight liquidity that RBI is carrying is significant.

Earlier, money was concentrated in few stocks but that trend is changing. There was talk of value investing even when we met for last year’s roundtable. Finally, now value stocks have started doing well. So, the value trade is playing out. A lot of PSU stocks are trading cheap. In the Indian market, we first saw pharma rally, followed by consumer and that money went into the IT sector. Now, the money is going into financials.

Earlier, money was concentrated in few stocks but that trend is changing. There was talk of value investing even when we met for last year’s roundtable. Finally, now value stocks have started doing well. So, the value trade is playing out. A lot of PSU stocks are trading cheap. In the Indian market, we first saw pharma rally, followed by consumer and that money went into the IT sector. Now, the money is going into financials.

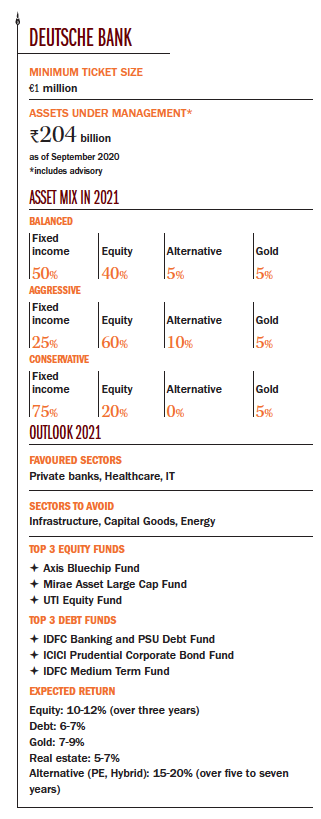

Atinkumar Saha, Head, Wealth Management-India, Deutsche Bank: A year prior to COVID, we still had growth issues with a lot of sectors suffering from demonetisation, GST and then the NBFC crisis. Last year, we were very circumspect about 2020 and COVID just proved to be a spoilsport. Though the market is buoyant, we don’t see client exuberance. They are seeking safer, large cap, fundamentally strong stocks.

Further, a good chunk of FII flows has gone into few stocks. As a result, very few PMS and mutual funds have been able to beat the benchmark. Though earnings are gradually improving, the valuations look rich. As far as GDP growth is concerned, by 2021-end or mid-2022, we should be back to pre COVID levels. If the situation doesn’t really deteriorate further and we don’t see a relapse in the next six months, then the optimism will continue.

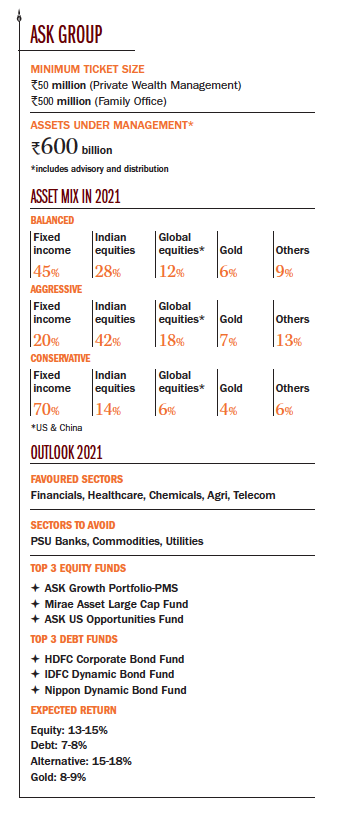

Rajesh Saluja, CEO, ASK Wealth Advisors: With regards to COVID, the jury is still out on whether there will be another lockdown or how much time the vaccine takes. With unlocking underway, we have seen indicators such as PMI, power consumption, etc., showing an upward trend and that has changed the sentiment towards investing. As far as liquidity is concerned, close to $5 trillion-6 trillion of direct fiscal stimulus has been announced by the top 20 economies.

Now, this is close to 7% of 2019 global GDP and the same figure during the 2008 global crisis was 3-3.5%. So, about 2.5-3x the amount of money that got printed in 2008, has got printed this time. When you have so much liquidity and low interest rates, you are going to see money moving into equity, gold, technology through private equity or listed space, or even real estate.

Optically, it looks like we have seen a run-up because seven to eight stocks have gone through the roof. But, there is still a good amount of value left, if you look at valuations from FY22-23 perspective. Most of our clients have taken this opportunity as we have been overweight on equities for the past six months, though we have gone neutral now. Improving fundamentals, improving economy, huge amount of liquidity and better sentiment are what will keep the market going.

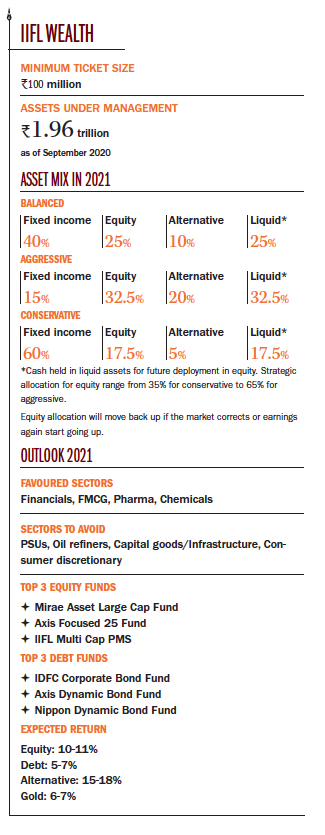

Yatin Shah, Executive Director, IIFL Wealth: For the first time, we have seen three crises bundled in one – economic, humanitarian and financial. So, there is no playbook. The US Fed does not want a financial crisis, and for that reason, asset prices have been kept high through low rates and excess liquidity. Much of that liquidity has found its way to emerging markets.

Going into next year, we are focused on three things: one is risk appetite which drives asset allocation, second is valuation of various assets, and the third is interim return, because for the first time in 20 years, savings bank rate is higher than the return generated by liquid funds.

OB: Yatin, do you think we can head higher from here or are we in bubble territory?

Shah: There is strong correlation between risk-free rate and valuation in equities, and if the cost of capital comes down, the P/E ratio expands. Investors are now attuned to a ‘new normal’ because it has been almost a decade or so that central bankers have kept rates low. So, I would not bet against it.

You might look at the P/E band of Nifty for the past 20 years and feel we are in an overvaluation zone. But, index weightages have changed from industrial manufacturing, oil and gas, and banking that were guzzlers of capital, to getting overweight with technology, pharmaceuticals and FMCG which don’t need capital, have high cash flows and zero debt. Hence, you can’t say that 20-year Nifty P/E was 16-18x, and therefore, it is now overvalued.

OB: Ashish, given that you are circumspect, how comfortable are you about valuations being justified beyond FY22?

Kehair: FY21 is a unique year with once in a 100-year situation, and you have to write it off. FY22 is when things normalise, if we get the vaccine. But, you will also see interest rates starting to go up if the economy starts doing well, with inflation kicking in. Our view has always been that you have to respect valuation at all periods of time. The past six months gave a good opportunity for clients to increase their allocation. If something goes untoward in the economy, it will again be a good opportunity to increase allocation because structurally things are not going to change.

So, if you get that kind of chance that you got in late-March or early-April, you can increase the allocation substantially. But if the Nifty ranges between 12,500 and 10,500, we will keep shifting our allocation from overweight to underweight. Right now, we are mildly underweight, ever since crossing 11,700-11,800. We hope the market keeps going up, but you need to respect valuation as you never know when an unknown devil is going to hit you.

OB: In this kind of scenario, where do you see value?

Kehair: We see value in mid and small caps because most of the money has gone into few large stocks and at 50-60 P/E, you don’t get value. I am still bullish on IT and pharma. Although pharma had a run-up, it came after a five-year lull. IT has been doing reasonably well with companies guiding a two- to three-year optimistic scenario. You don’t see the likes of TCS and Accenture, normally giving a long bullish outlook. So, that gives us significant amount of confidence.

We also like real estate. I think a couple of things are working out – home loan rates below 7%, which was last seen in 2007. Then, the gap between FD rate and residential and rental yields, which for the past 10 years was 2.5-3%, has shrunk. Now, FD rates are between 4% and 4.5%. So, low mortgage rates with real estate prices remaining stagnant is the ultimate chemistry for real estate to start working. Once real estate starts doing well, it has a huge positive impact on the overall economy. OB: Just to go back to that point, Ashish, about the right chemistry for real estate, considering that real estate prices have still not come down sharply, isn’t the math more about the EMI you service versus the rent you have to pay?

OB: Just to go back to that point, Ashish, about the right chemistry for real estate, considering that real estate prices have still not come down sharply, isn’t the math more about the EMI you service versus the rent you have to pay?

Kehair: Partially agree, because if you go out today and put money on the table, in the past six months, there has been a 10% decline and the price per se from 2013-end to 2020 has been stagnant. There was 10x run-up from 2003 to 2013, but if you do a 17-year CAGR, that comes to 7-8%, which is the long-term real estate return. Now, if the difference between mortgage – 6.5% and rental is say 3%, you need 3.5% capital appreciation to plug that gap. This gap is the narrowest in the past 10-15 years…

OB: Though real estate is very location specific, even 3% rental yield seems steep…

Kehair: After the price correction, no. If you look at markets where there is hardly any development happening, say Bandra (West) in Mumbai, the range is 2.5% to 3.5%, but if you go closer to BKC, then you could get 3.75% or 4%. It is location specific, and just like equities, you have to pick the right sector/stock. We are seeing bottoming out of real estate and you may see a pickup from here. In the past two months the kind of activity which we are seeing, I have not seen in the past five to six years.

OB: Rajesh, would you want to come in on that?

Saluja: Ashish is absolutely right. In the past three to six months, at least, low-cost and mid-income housing has seen an uptake. For example, a project by Dosti of 1,800 flats in Thane-Bhiwandi got 60% booking in one month but the ticket size of each flat was Rs.2,500,000. So, you are seeing some demand coming back because of low rates and because prices have corrected. If you sit across the table with developers, you are getting deals. Even on the luxury side, buyers are getting 20-30% off from the original rate.

On the real estate fund side also, we are noticing a big trend. Earlier, the stress was with developers, now the stress has moved to lenders. So, banks and NBFCs are approaching us to take over projects because they want to get that loan off their balance sheet and are willing to take 40-50% kind of haircut. We have launched another real estate fund because if we sign a deal where you can get 50-60% haircut on today’s price and bring in a credible developer, you can still generate very good return for clients.

Gumashta: You are also seeing a lot of foreign investment, from the likes of Brookfield and Blackstone. The big foreign players are picking up a chunk of land or REITs or assets, so I feel the cost of financing for the bigger realty players and builders will come down significantly. REITs have become an investment category in a client’s portfolios. This was not the case 12 or 18 months ago.

In terms of prices, besides a few pockets of Mumbai, the rest of India has already witnessed a correction, whether it is in Gurgaon, Bengaluru, Hyderabad or Chennai. Another aspect which supports real estate investment is that clients are a bit disillusioned with fixed income and the related volatility that we have seen over the past two years. Interest rates are also an important trigger, especially if you consider that borrowing rates have come off to sub-7%.

OB: But, are we ignoring the impact of a contracting economy, job losses and the new reality of work from home?

Saluja: Work from home has both positives and negatives. The reality going forward is that many people would want to get a bigger house compared to where they were staying because even today we notice, while doing virtual calls, some children running past or sound of cooker going off, etc. So, going forward you will see a hybrid model in many cases.

On the commercial side, if one industry goes through a challenge, there’s another industry that comes up which has requirements. For instance, now you suddenly have foreign funds coming in to buy real estate, and they need offices. You have e-commerce platforms which are expanding at a fast pace. They, too, need office space. Commercial hinges a lot on location and supply-demand. So, we see commercial continuing to do well.

There are many markets where there has been hardly any supply over the past six to seven years, there are certain markets where there is too much of supply, whose prices may remain depressed, but AAA quality buildings still command good tenants. In India, while tech companies have asked employees to work out of home, the pace at which they are winning new business is so dramatic that they will actually start hiring in big numbers in another three to six months. So, the requirement will be there once again because, in India, many do not have the best conditions at home to work as effectively.

OB: Are you seeing a noticeable dip in residential inventory across major markets?

Saluja: It is not going to be over so quickly as, in residential, there is a lot of supply that had come up in various pockets. The economic slowdown has also created uncertainty in the mind of home buyers. So, people want things to stabilise before making that purchase. The past six months has given them an opportunity because of low cost of funds and discounts. But, you will see over the next one or two years, this inventory getting absorbed, specially those projects where there is surety of completion.

Gumashta: People have lost faith in an under-construction project. They say, “You get the building ready, then we are willing to purchase the flat”. The view is not bullish, but it is much better than what it was 12-18 months ago.

Saha: Deutsche Bank doesn’t advice clients on real estate but we get insights from the lending side of the book. While large developers are saying that the market has started to grow, they are not taking over distressed projects because it is still not coming cheap. They feel the cost of debt is high and it has to narrow before it becomes really profitable for them. Third, I believe micro markets have started picking up especially on the commercial side because we see lot of HNI clients sniffing for deals. While I don’t really see a secular revival in real estate, there are opportunities coming up with good developers in the form of REITs.

Saha: Deutsche Bank doesn’t advice clients on real estate but we get insights from the lending side of the book. While large developers are saying that the market has started to grow, they are not taking over distressed projects because it is still not coming cheap. They feel the cost of debt is high and it has to narrow before it becomes really profitable for them. Third, I believe micro markets have started picking up especially on the commercial side because we see lot of HNI clients sniffing for deals. While I don’t really see a secular revival in real estate, there are opportunities coming up with good developers in the form of REITs.

OB: Ashish, are you recommending REITs over fixed income to your clients as well?

Kehair: Embassy and Mindspace have held on to their prices. Embassy at Rs.400-plus was yielding 3.5-4%. Now, it is below Rs.400 and yields about 6%. Commercial real estate is an alternative to fixed income because the yields are around 6-7%. Residential behaves in a different manner, more like equity. There are periods where you will go through a lull and then you see an upside.

I don’t feel in the next five to seven years, real estate will underperform debt, where you will not get more than 4.5-5%. Clients, though, tend to get anchored to the past six months or one-year return. In that context, you have to see where real estate fits into each client’s portfolio mix.

OB: Yatin, how are you approaching real estate?

Shah: I don’t see many of my clients wanting to own commercial standalone units, which they thought was a good thing — own an office and earn rent on it. They are happy to earn 7% post-tax dividend yield and capital appreciation of 3-4% through REITs. We have started with 10%, for most portfolios, whether it is conservative, moderate or aggressive. We have gone at least 10% into REITs because there is nothing left in fixed income.

OB: That sort of leads to the next question, which is, how is debt looking? Is the worst over in terms of defaults? What would be the outlook for debt funds over the next one year?

Kehair: AAA debt funds have left hardly anything on the table. Investors are unknowingly taking a duration risk by locking in investments at current low yields in longer maturity (seven- to 10-year) products because the difference between short- and long-term yields has created the possibility of a reasonable MTM (mark-to-market) gain over a one- to three-month period. But, the possibility of gain owing to a further fall in interest rate from here on is limited. On a temporary basis, you may still make money, but then you should be quick to move back, because when the cycle turns, you will see negative return.

There are also some pockets, although controversial ones, which are emerging in credit funds where we feel value could emerge. But again with a pinch of salt, people who can take on losses and volatility, should enter into it, because I don’t want a situation where clients, due to absence of yield, start taking undue risks. Debt is supposed to give your capital and interest back, and one should not unnecessarily take that 25-50 basis points extra and risk the whole capital.

If commercial real estate tanks, then REITs will be impacted but if it stays the way it is, I think it is one of the best places to be right now. There is only one InVit asset in India which has given stellar return. I think IndiGrid bottomed at Rs.85, right now is Rs.110, plus it has given 12% annual distribution. The other area which could emerge for ultra HNIs, which has not seen success till now, are low volatility, long-short funds. Given where inflation is, I don’t think you can expect nominal return to be very high.

Saha: Our pool of clients is very cautious. We think the market still has a lot of bleeding possibilities and, therefore, we need to watch out for areas which will throw up a lot of credit risk. With the government extending the moratorium, we think NPAs are getting postponed. We will not see the actual figures till the real data comes in, maybe nine months to one year from now.

Having said that, if demand picks up within this time frame, companies or individuals will be able to get their businesses back on track. But the risk is that if demand doesn’t pick up, then you might see more bleeding in that area. It will impact medium to large size companies as well. That’s what our reading is and, therefore, you must be very clear when investing in the debt space.

So, we are clearly positioned for AAA rated and that also with companies where there is high level of cash. Apart from AAA rated, some long-short bond funds have done well and those need to be looked at. I don’t think there is any need to be adventurous in debt because it has to give you stable return. If you want to take little risk, get into equities but do not take equity risk in a debt portfolio.

OB: Yatin, are you also erring on the side of caution?

Shah: We like hold-to-maturity products. We don’t play credit bucket in mutual funds and we did not have a single rupee in Templeton MF, not because we expected that Templeton will face liquidity challenges, but because the strategy had ALM mismatch. Investors can redeem next day, but you are lending for three to seven years. With hold-to-maturity products, all investors exit together after two or three years, which is not the credit strategy in open-ended credit funds.

OB: Rajesh, do you think the worst is over for debt in terms of credit risk or should one look at earning high yield by slightly increasing the risk profile in the portfolio?

Saluja: Government borrowing has pretty much stayed within limits, and RBI measures have also eased benchmark rates and kept spreads under control. But, we still find that there is some play in the three- to five-year tenure, both in G-Sec and AAA papers, and even a little bit in AA because we also monitor AA companies on the equity side. Good MLD (market link debentures) of some good AA, AAA names which are more tax efficient, and REITs continue to be a good play in fixed income. Whatever risk has to be taken should go into the equity side.

OB: Ashish, since you mentioned value investing earlier, one real dichotomy is the contrasting way in which the debt and equity of PSUs are being priced. What is the rationale?

Gumashta: What was happening is that the government was continuing to supply equity by doing these ETFs, so there was constant supply of equity from the PSU side. But, it seems there will no longer be dilution through ETFs. The second part is that if one or two genuine divestments happen, not one PSU buying the other, rather if BPCL were to actually get sold, it would give a lot of comfort to investors that the government’s intent is actually to get out of business. In my view, this would have implications for the valuation.

Further, ESG as a theme has caught on and we should not ignore it because most of the global investors are very serious about it. Look at ITC, Coal India, NTPC, they are all cash generating businesses, but because of the ESG theme, a lot of global players are not investing in them. My gut feeling is that some of these businesses will do well again. The moment this starts to materialise, I believe we will see the valuations improve. When I say value investing, it’s not necessarily in the textbook sense; it’s about companies which have very stable return businesses, such as PowerGrid. Those, in my view, are areas with potential.

OB: Can you expand on the pockets of value that are you looking at?

Gumashta: Right now, it is mainly companies in the public sector and some stocks impacted by ESG such as ITC. My personal opinion is that if ITC’s business is split, the consumer business may get a very high valuation. Similarly, banks such as ICICI Bank are trading 1.3-1.8x above their book value. I also see a lot of value in mid-sized banks, mid cap IT, auto and auto ancillary businesses. Right now, only a handful stocks are going up, but when the rally turns broad-based, you should see some of these other sectors doing well.

OB: What should one expect in terms of return over the next year?

Saluja: There are two things: one is excess liquidity, and second is lower return on fixed income. So, you are going to see money coming into equities. Though the market appears high, there is still huge value in financials. People are still concerned about NPAs, loans, moratorium and how much of that will be recoverable. But on a month-on-month basis, you are seeing improvement. So, financials, which include insurance, AMCs, NBFCs and private banks offer good value. Agri and agri-related businesses, and auto also offer a lot of value.

On a year-on-year basis, the index has probably moved or come back to pre COVID level but broad return has hardly been 4-5% in equity. I think one can easily get double-digit return in equity in a well-managed portfolio, and I don’t see COVID as a very big risk any more. I think there is a clear realisation that you can’t shut down the economy completely again.

Fixed income will get you 4-7% kind of return without risk and maybe one can add some high yield debt. We also believe that gold as an asset class is an important aspect. We have been overweight on gold for the past one year and even on four- to five-year basis, given that global GDP is $90 trillion and global debt is $270 trillion. So, the amount of money that has got printed will move into hard asset classes — gold, distress real estate and equity. Gold will give fixed income kind of return, and if you are lucky, it should be better.

Gumashta: Our product head expects 12-14% equity return, 5-7% in debt and 15% in alternatives. For us, gold is a big asset class. Our call is to buy gold on dips as we think the meat of the rally is over. Clients should continue to diversify their assets and international portfolio should be a significant part, at least 10-15% of one’s asset allocation, especially towards the US and China.

Saluja: International exposure is also a key part of our allocation. For both the US and China, we have a global fund for the past three years. We have also been bullish on China since the past one year. We have been allocating around 8-10% of the client portfolios to international equities and will continue to do so.

Saha: The return from equity will be around 12-14%, fixed income cannot really go beyond 5-6% or so. Gold is one forecast we are positive on with 7-9% kind of return. The alternatives should give you around 15-20% return. We still feel a lot of the mid cap stories will ultimately become large cap, so you need to spot them well and those are the ones we are looking for. We think uncertainty is going to remain for at least three years or so and gold or any other commodity will be an interesting asset class to invest in.

We still feel a lot of the mid cap stories will ultimately become large cap, so you need to spot them well and those are the ones we are looking for. We think uncertainty is going to remain for at least three years or so and gold or any other commodity will be an interesting asset class to invest in.

Shah: We also see a lot of opportunity in alternatives. India has over $40 billion worth of unicorns, and most clients don’t have access to it. We are launching a technology fund which is going to be pre-IPO and growth companies, where we get to participate in the India tech story. Investors are underexposed and we want to take that allocation to 10-20% of the portfolio. REITs is another big opportunity. The third is asset-backed credit funds, be it promoter shares or real estate. It is seeing 12-16% return because mutual funds and NBFCs have vacated this space.

Kehair: It is difficult to project a one-year return, especially for equities. Debt, in my view, if you stick to the quality-end of the curve, would be somewhere around 4-6%, if you are able to do some bit of duration. Add some MLDs and REITs, then you can see 100 basis points alpha over that.

We only started adding gold to the portfolios in the past six to eight months, though we should have started long back. Our theory on gold is very simple: there is rupee depreciation of 3-4%, global interest rates are at zero, so with a little price appreciation in gold, you will start beating debt meaningfully over a 10-year period.

As far as international asset allocation is concerned, US and China are not only providing you the consumers but also have some of the finest companies in the world, and unfortunately, there is no other way to get access to those companies.

I am not bullish on alternative. I don’t think alternative assets are giving 14-18% kind of return these days. Post tax, post expenses, 10-11% is what clients are getting, but if you look at fixed income at 4%, that is still 700 basis points more. We want to maintain the strategic asset allocation of clients, but also look for tactical investments as and when market gives you those opportunities.

OB: Thank you gentlemen for the insights and wish you all a very Happy New Year!