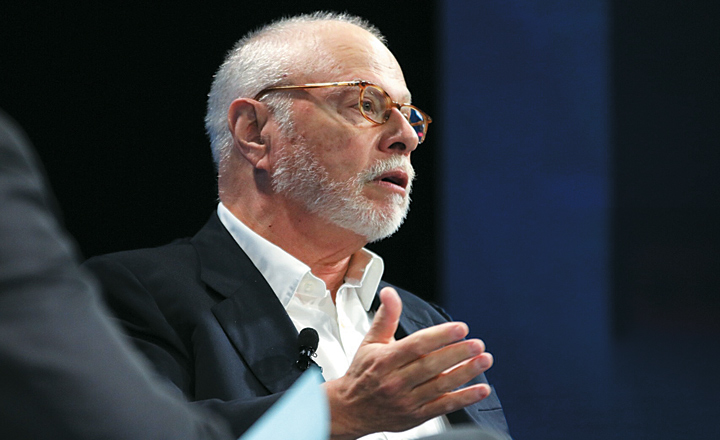

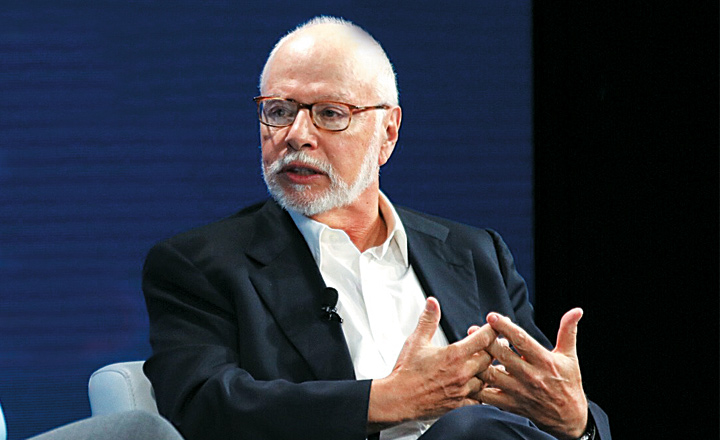

Activist investor Paul Singerdoesn’t think conflict is brewing with Samsung Electronics Co, one of the latest targets in his quest to push for changes that benefit shareholders.

He said he is encouraged by Samsung’s public comments that leaders of the South Korean company are receptive to the ideas recently put forward by his firm, Elliott Management Corp.

“We are optimistic about that one — we think it’s a tremendous platform and a tremendous value,” Singer said during an appearance at The Wall Street Journal’s WSJDLive 2016 global technology conference.

In early October, Elliott disclosed an effort to push Samsung to reshape and simplify its complicated ownership structure, by bundling its various ownership stakes in the other Samsung entities into a new holding company. Singer said it had also proposed a US stock listing for the company, whose shares have been only traded in South Korea.

Elliott disclosed its effort after Samsung announced its recall of the Galaxy Note 7 but before its decision to kill the product altogether. Singer said Elliott’s efforts to push for changes at Samsung were unrelated to the product problems, which doesn’t “shake or shatter our belief” about the possibility of changes that could reward holders of the company’s stock.

Singer, a billionaire and famed stock picker, founded Elliott in 1977. The firm has become one of the most successful activist hedge funds. His firm and other activist investors have pushed companies in many industries to make changes aimed at boosting stock prices and rewarding shareholders. Activists have targeted big US tech companies including Apple Inc, Microsoft Corp. and Qualcomm Inc, prodding the companies to buy back more shares and boost dividends.

Elliott and others investors also recently launched a coordinated effort, called the Council for Investor Rights and Corporate Accountability, or Circa, to make the case to lawmakers and the American public that their investment strategy is beneficial to companies and the US economy.

Their push follows criticism by politicians that include Democratic presidential candidate Hillary Clinton, who last year proposed changing the tax code to crack down on “hit and run” activists.

Singer said that the short-term image is misplaced, when it comes to Elliott. He says his firm typically holds stakes in companies for two years, compared with the one-and-a-half years he said is the average for other institutional investors.

He said his firm does extensive research before deciding to take positions in companies. “We don’t just show up,” he said.

Singer said one of its most successful efforts was at Citrix Systems Inc, a software company that he said had made a series of ill-conceived acquisitions and other steps that had destroyed shareholder value. After reaching a settlement with the company in 2015, Elliott pushed for change that included replacing Citrix’s chief executive. Jesse Cohn, who leads Elliott’s activist efforts, took the rare step of joining Citrix’s board.

Singer said he is very excited about the potential at Citrix now. “For the last couple of quarters the revenues in its core product have grown,” he said.

Edited excerpts from an interview at The Wall Street Journal's WSJDLive 2016 global technology conference.