The youngest NBFC on the banking street, Aavas Financiers, is today one of India’s fastest growing semi-urban and rural-focused housing finance companies. We believe that the Jaipur-based eight-year-old entity is the next Gruh Finance in the making, a stock that has not only created considerable shareholder value, having not only risen 70x over the past 10 years, but has also become the poster boy of semi-urban housing finance.

We are not necessarily suggesting that the stock price of Aavas will have the same appreciation over the next 10 years but, over time, the company certainly has all the ingredients to become a successful housing finance company.

Initially promoted by AU Finance (now AU Small Finance Bank), the bank sold most of its stake to two large private equity funds — Kedaara Capital, one of India’s largest homegrown PE fund with $1.5 billion in assets under management (AUM), and the Partners Group, a large global PE fund with an AUM of $83 billion. Together these funds hold 58% and are, hence, the promoters of the company, with both having one board seat each. The company not only has a distinguished board but also a formidable leadership team. For example, Sandeep Tandon, one of the independent directors on the board of Aavas, is a very successful serial fintech entrepreneur. The senior leadership owns 7.5% of the equity, while AU Small Bank retains an equal stake. The CEO, Sushil Kumar, is a former ICICI Bank veteran who has over 17 years of retail finance experience.

Underserved Market

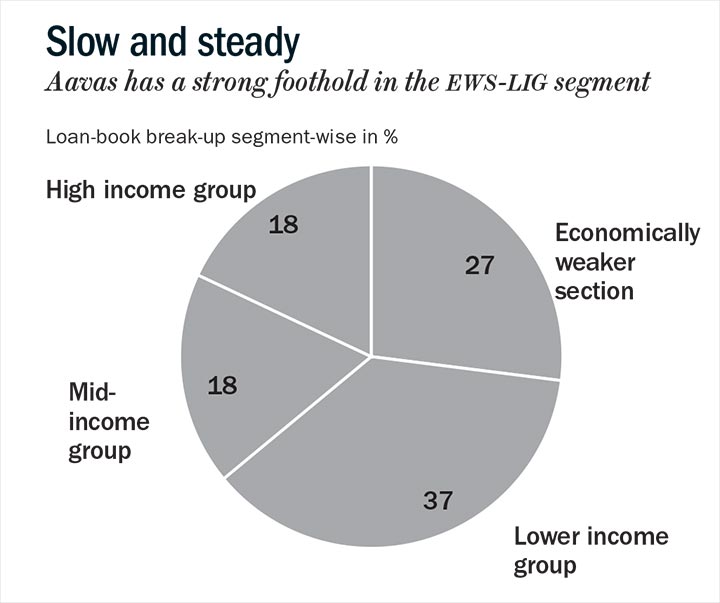

Aavas is primarily engaged in the business of providing housing loans to customers belonging to low and middle-income segments in semi-urban and rural areas. These are credit-worthy customers who may not have income-proof documents such as IT return, salary slip and, hence, are financially excluded by other large housing finance companies and banks. Aavas uses a unique appraisal methodology to assess the customers individually, who are predominantly self-employed and aspire to own a home. Around a third of the financier’s customers are first-time borrowers with a bulk of the book comprising loans for home, for land purchase, construction or home improvement. The financier’s strategy is to focus on funding of purchase and construction of single unit dwellings for self-occupation. It caters to customers in the segment of sub-Rs.1 million average ticket size along with good asset quality.

In the seven years since it set up operations, the NBFC operates in 10 states including Rajasthan, Maharashtra, Gujarat, Madhya Pradesh, Haryana, Uttar Pradesh, Chhattisgarh, and Delhi, with a network of 210 branches and 2,500 sales people. As of December 31, 2018, it has financed over 83,000 homes with has a cumulative disbursement of Rs.70 billion.

Secret Sauce

The biggest risk in lending to the financially excluded is the fear of bad loans. However, Kumar and his team run a tight ship and have been able to keep gross non-performing assets (NPAs) down to 0.58% and net NPAs to 0.49%. For loans disbursed over the past 24 months, 1-plus day past due trends are even better than for the overall portfolio, a testimony to the NBFC’s strong credit experience despite diversifying away from its home state of Rajasthan.

There are multiple reasons for that. Aavas’ underwriting risk is offset by its in-housing sourcing model where the employees don’t have any monthly targets; they don’t use direct sales agents. While this does push up the cost, it has kept NPAs low. Hence, of the 400 underwriters that they employ, 150 are chartered accountants and 89 are lawyers. Also 100% of customers must come to the branch to sign the papers, a system similar to what HDFC used to follow. Aavas has also made large investment in data analytics and tech to increase asset quality and reduce turnaround time from 20-plus days to 13 days. Also, Aavas has stayed away from builder loans or under-construction or investment property loans.

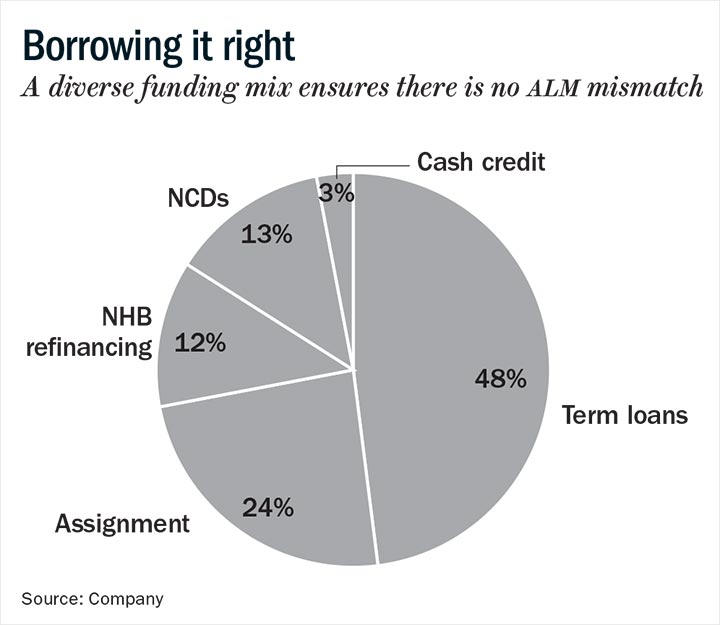

Further, unlike NBFCs which faced asset-liability mismatch (ALM) recently, Aavas has no ALM mismatch. Up to 49% of its funding comes from term loans and, more importantly, it has no commercial paper issued, which had hit the ALMs and, consequently, the stock prices of several NBFCs have dropped the past 12 months. Aavas’ average borrowing tenure is 11 years, while its average loan tenure is 15 years at origination and 7.5 years after prepayment. It recently raised Rs.2 billion through a maiden issue of rupee-denominated Masala bonds from the CDC Group, the UK-based development finance institution, and refinance assistance of Rs.5 billion from the NHB. Such long-term investment commitment in a challenging liquidity scenario demonstrates the trust being placed on the NBFC.

Leveraged For Growth

As of the third quarter of FY19, Aavas had a Tier-I capital adequacy of 67.8% and, hence, is highly under-leveraged. The NBFC does not need to raise equity for the next few years. Given its average cost of borrowing is 8.82% and the average yield is 13.94%, Aavas enjoys spreads of 5.12%. While net interest margins have risen to 9.06% from 8.76% YoY, return on asset is a healthy 3.21%. Hence, it comes as no surprise that CARE increased the rating of Aavas from A+ to AA for long-term bank facilities and from A+ to AA- for long-term instruments and subordinated debt.

We believe that both funds Kedaara and the Partners Group will sell their stake as their respective funds near the end of their terms. In doing so, the stakes will be sold to large institutional investors, making the shareholding of Aavas similar to other professionally run HDFC, HDFC Bank, ICICI Bank and Axis Bank.

The stock, which got listed in last October, currently trades at over 4x estimated FY20 price to book. The stock is clearly not cheap, but then nor are HDFC, HDFC Bank and Gruh Finance. Having grown its branch count by nearly 4x since FY16, and given its plans for further substantial addition, asset growth should remain robust in coming years too. Considering the long duration of borrowings, positive funding gap and low competitive pressure, Aavas should be able to enjoy better loan spreads even in a rising rate environment.

Importantly, there is significant housing shortage in India, mostly in the lower-income segments in urban (95% of urban housing shortage is in economically weaker section (EWS)/lower income group (LIG)) and in rural (90% of housing shortage is in EWS/LIG segment) areas, which are Aavas’ target segments. Thus ensuring enough room for growth. Often in India, we find that good companies are not cheap and they remain expensive for a very long time. We believe that Aavas deserves a premium valuation given its strong management, under-leverage, and a high growth trajectory.

The author holds the stock in the fund’s portfolio