If something remains cheap well into the bull market, then one needs to be wary. Wise words. If past bull cycles are anything to go by, chasing value well into the bull market is fraught with risks of one ending up holding value-traps. Unless, there is a deep disconnect between the market’s perception and the underlying reality in those picks. In such cases, disconnects can give rise to disproportional returns even if the markets have moved past their initial momentum. Entertainment Network India (ENIL) is one such stock where the disconnect runs deep.

Market in its myopic view is looking at this opportunity as a pure-play radio business, which it is, but in the shorter-term. Over the medium to longer term, the business is undergoing a dramatic transformation from radio to digital ad-solutions play.

The Broad Rationale

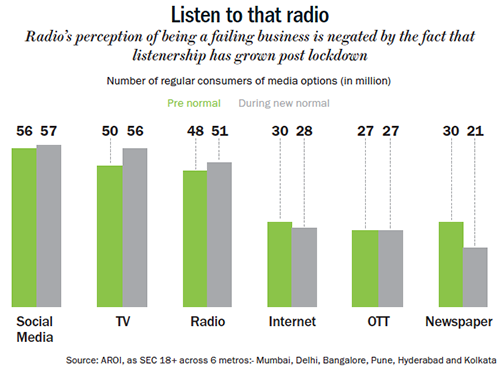

Market perceives radio as a failing industry with declining listenership and falling advertising revenues. This is not entirely true since survey after survey shows that radio is still relevant for local advertising and will continue to constitute 4% to 5% of the overall advertising pie. More importantly, listenership has grown during the lockdown period (See: Listen to that radio). However, advertising revenues have seen a steep fall in this period.  Market, in its short-sighted view, perceives the advertising revenue challenge in the lockdown period as a structural issue.

Market, in its short-sighted view, perceives the advertising revenue challenge in the lockdown period as a structural issue.

While this disconnect will be corrected when visibility in advertising revenue returns, the bigger story the market is missing is the transformation the company is undergoing.

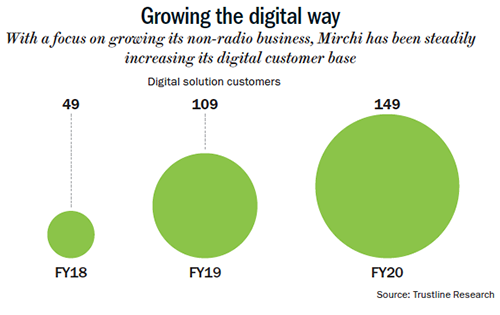

Currently, the non-radio revenue constitutes about 30% of the total. Significant part of this 30% comes from low-margin, event-driven, on-ground activities with only 8% to 10% coming from digital-advertising solutions. But, the company is working to grow the share of digital-ad solutions and content business (multimedia content and OTT originals) to the top-line significantly (see: Growing the digital way). In fact, the management’s intent is to take the non-radio share to near 50% in the next three years. Towards this, the company is likely to launch a huge re-branding exercise.

In the stock market, currently, digital-ad solutions companies such as Affle India trade at prohibitively high PEs. Against this, at the current valuation, this opportunity is trading at a hugely attractive 15%+ free cash flow (FCF) yield (FY22E). In addition, we expect the company to benefit even in the radio business: one from the ad-cycle turn in FY22 and two from the market-share gains from impending consolidation in the radio industry.

One of the big players, that is Reliance Big FM (ADAG group), is likely to lose market share over time on management’s ongoing messy battle (the company has been in the market for sale for many months). This and the growing challenges small players face are likely to lead to big market share gains for the top players. Company maintains its market leadership in FM radio business with 73 frequencies in 63 cities (51% of the stations are in A+, A and B category circles) along with 25 online stations. Company’s market share has climbed by 650 bps in FY20 to 37.8% market share.

One of the big players, that is Reliance Big FM (ADAG group), is likely to lose market share over time on management’s ongoing messy battle (the company has been in the market for sale for many months). This and the growing challenges small players face are likely to lead to big market share gains for the top players. Company maintains its market leadership in FM radio business with 73 frequencies in 63 cities (51% of the stations are in A+, A and B category circles) along with 25 online stations. Company’s market share has climbed by 650 bps in FY20 to 37.8% market share.

Big Market Opportunity

Digital marketing is no longer limited to innovative enterprises. Everyone across the spectrum (including the companies from the small and medium segment) is seriously looking at the online presence and is willing to spend for that. As per industry estimates, digital-ad spend is likely to match and even move ahead of TV-ad spend in the coming years. In FY22, projections are that the digital-ad spend would be near $4 billion or 40% of the total ad spend.

As it happens with any industry that is new and breaching boundaries, industry participants and especially the incumbents fail (often blinded by their legacy interests) to grab the emerging opportunities. That misstep leads to the entry of new players. Thus, in the early days of digital-advertising boom, it was not the ad agencies that grabbed opportunities thrown up by it but tech companies that sensed the tectonic shift and made an early bet. Of course, tech companies got the head-start because of the need for tech expertise in terms of search engine optimisation (SEO), app development, analytics and so on. But what stopped the ad-agencies from acquiring or outsourcing the tech expertise to address the growing digital needs of their clients? Nothing.

As it turned out, tech companies only went so far as SEOs, apps and analytics. They were found wanting when it came to the crucial part of the digital campaign — that is, content. Digital advertisers that sensed this shortcoming started building content teams in-house and began relying on the digital marketing companies only for tech expertise and for running the campaign. As a result, it evolved more as a hybrid model, as industry insiders like to say.

But, because of this stunted evolution, the industry grew to become a splintered one with a large part of the market still addressed by a multitude of marginal players and predominantly from technological side. Even today, the top player controls less than 5% of the market as per industry estimates.

For the advertisers, the other pain point was lack of integration between various forms of campaign, that is, digital, traditional media and the on-ground cover. In addition to building skills for content in-house, the advertisers had to swallow the pain of integration by building captive expertise on that.

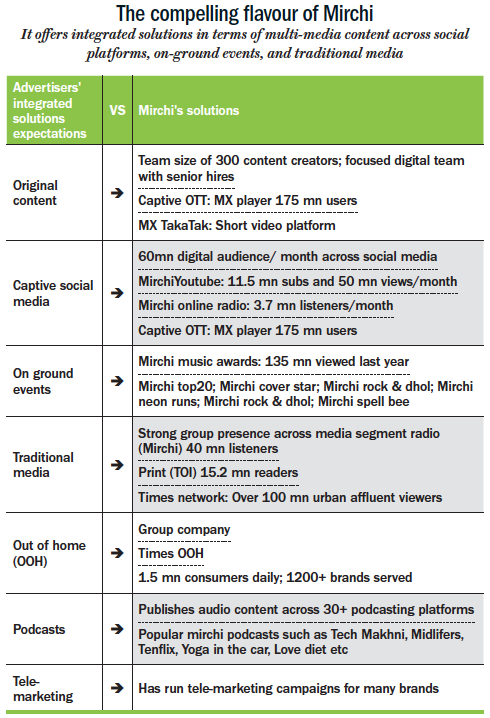

There has emerged an immense need for an integrated digital-market player, who can offer multimedia content across social media platforms with the required tech expertise. For advertisers, if the same player can also offer on-ground cover and a reach through traditional media, it will be icing on the cake. Advertisers’ wish list does not end here. They also want the marketing company to do messaging across captive social media channels that has high following. If someone can offer such an integrated solution, large advertisers will lap it up and thank with folded hands.

ENIL sensed this gap way back in 2017 and started building the ad-solutions business with rigour and vigour. Recently it even dropped ‘radio’ from its Radio Mirchi logo. Now the company has planned a huge rebranding exercise around this brand/logo and has strengthened its digital team by forming a separate vertical with senior-level leadership.

As they say, a picture is worth thousand words (See: The compelling flavour of Mirchi). We can see how ENIL is well positioned to offer integrated solutions. Not many in the industry could or will match this powerful offering any time soon.

As they say, a picture is worth thousand words (See: The compelling flavour of Mirchi). We can see how ENIL is well positioned to offer integrated solutions. Not many in the industry could or will match this powerful offering any time soon.

So, how does one classify this opportunity? Value or growth play? Strangely, it is both.

It is a value-cum-growth play. If growth is in digital, value comes from its radio business. Together, it is a growth-at-a-discount opportunity. Here is why.

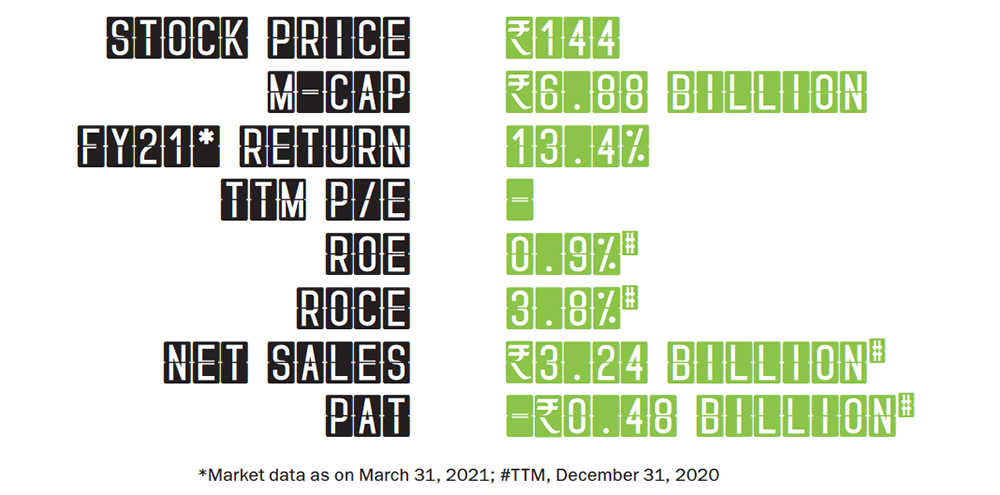

For one, adjusted for cash in the book (₹41 odd per share), it is trading at over 4x EV/EBITDA. For another, when the ad-cycle turns in FY22, their core radio business is likely to throw Rs 1 billion to Rs 1.2 billion of FCF. At the current market-cap of Rs 6.88 billion, it is available at a FCF yield of over 15%.

Then, ENIL is trading at a discount to its nearest competitor Music Broadcast, in-spite of having much larger business in radio, leave alone the ongoing digital transformation. On price-to-book, ENIL is available at less than book while Music Broadcast is at over 1.3x.

Given the capital light nature of digital business and no further capex plan in radio business, ENIL is likely to generate significant FCF in the coming years. Estimates indicate that the annual FCF could surprise on the upside of Rs 1.5 billion in couple of years. Such large accumulation of cash against the backdrop of an already cash-rich balance sheet is likely to lead to large distribution either in the form of buy-back or dividends. As indicated in the earnings call, management is not averse to returning the existing cash (₹41 per share) in the book to the shareholders. Buy-back as a near-term trigger can’t be ruled out.

The pandemic did cause contraction in its advertising revenue but it has since recovered, though pricing pain persists. During Q3FY21, ENIL’s FCT (free commercial time) and non-FCT revenues de-grew by 35.9% and 54.7% y-o-y. Ad-volume increased 12% y-o-y but yield was down by ~28-30%. The management said that pricing recovery lagged behind volume recovery and is expected to reach near normal by Q2FY22.

Most of the radio risks are in the price, while the prospects of digital-ad solutions are yet to be priced-in. This is a classical ‘heads-you-win-tails-you-don’t-lose’ kind of opportunity with a significant rerating potential if radio surprises even marginally amid potential surge in digital revenue.

If we consider the management credentials, ENIL comes out shining. It is part of the largest media group in the country, with 11,000 employees and revenue of more than $1 billion. The group holds a dominant position in all media sub-segments and is led by a passionate and visionary CEO, Prashant Panday, who comes with an enviable industry experience. If we factor in corporate governance, we will find no pledged shares, zero debt, reasonable management compensation (less than 10% of the normalised FCF), a reputed audit firm in SR Batliboi, and no capital mis-allocation history including no unrelated diversification.

Attractive Valuation

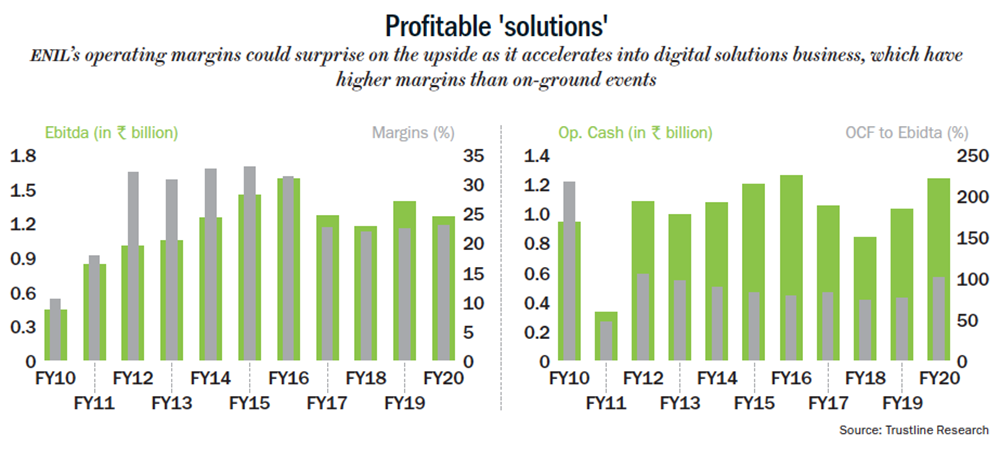

ENIL’s stock has corrected by ~17%/84% over its one-year/five-year high of Rs 182/958 respectively. With the business gaining momentum, we expect 57% earnings CAGR over FY20-FY25E. The stock is available at a market cap of Rs 6.88 billion, which is less than the migration plus new Phase 3 investments of Rs 7.58 billion, with validity of that licence holding for another 10 years till 2030. Operating margins of the solutions business, which increased by over 30% versus 16% two years ago, might surprise on the upside over medium-to-long term, given the management’s confidence in scaling up its digital-solutions revenues (incremental revenues will not increase costs) aided by decreasing contribution of on-ground, event-management business (low margins). The margin trend so far is captured in (see: Profitable ‘solutions’).

The intrinsic value of ENIL, based on projected FCF, works out to be more than Rs 460. This provides over 69% margin of safety at the current market price of Rs 144 which was price as on March 31, 2021.

The intrinsic value of ENIL, based on projected FCF, works out to be more than Rs 460. This provides over 69% margin of safety at the current market price of Rs 144 which was price as on March 31, 2021.

All said and done, even the best of them come with risks. With ENIL, the biggest risk lies in execution. If the management does this poorly in the digital business, they could derail the entire value-unlocking story. While this is a serious risk, going by the track record of digital business over last few quarters and its over 125% growth in Q3FY21, and by the passion of the current management for digital, the company is likely to surprise on the upside on its execution plans.

The second big risk comes from any lengthy delay in the turn of ad cycle for radio business, on resurgence of COVID-19 related lockdowns. Here, one can draw comfort from the third-party industry estimates that the radio-advertising revenues would cross the pre-COVID level by Q1FY22 and would start growing in low double digits from thereon.

Disclosure: ArunaGiri N and his clients own the stock