One of the critically acclaimed films of 2019 was a satire on a poor family’s attempts to sponge off an extremely wealthy one. The ugly truth of social inequality aside, Parasite is a movie that cleverly packages the enterprising spirit of the Kim family. But instead of going great lengths to mooch off other people’s money, they could surely have learnt some lessons from Shridatta Bhandwaldar.

The Canara Robeco fund manager fell in love with equities in 2006 while pursuing his MBA in finance. He has advice that would have solved all of Kim family’s problems. “What drove my interest in equities is that you can be a parasite by being a minority shareholder and create a lot of wealth for yourself,” says Bhandwaldar and adds, “This is a platform that allows you to benefit from the efforts of best companies and their managements.” That might sound super easy, but the modest veteran has honed his research skills and patient approach over a decade. In 2016, he joined Canara Robeco Mutual Fund as a fund manager for its various schemes.

He has his three years of experience in the capital goods and infrastructure to thank for shaping his investment philosophy. After covering these sectors between 2006 and 2009 at MF Global Securities and Motilal Oswal Financial Services, he learnt that these are relatively weak businesses. “They have to deal with governments, have weak cash flows and low RoE and RoCE. They can make some money for one to two years, but one can’t create wealth out of these kinds of businesses,” says Bhandwaldar out of experience.

After all, he witnessed the infra cycle tank post 2007. Economy-related sectors do really well during an upcycle, but are hit the hardest when things go bad. “They saw tremendous growth but the moment the cycle reversed, problems such as balance sheet trouble showed up. There was growth without cash flow and we saw a lot of wealth destruction. This was a huge learning curve and helped me shape my investment thought process,” recalls Bhandwaldar.

Armed with this experience, he started looking for companies, which have traits contrary to infra or capital goods. “The business should have characteristics like capital efficiency, growth opportunity, capable management and high RoCE,” he says.

Quality is everything

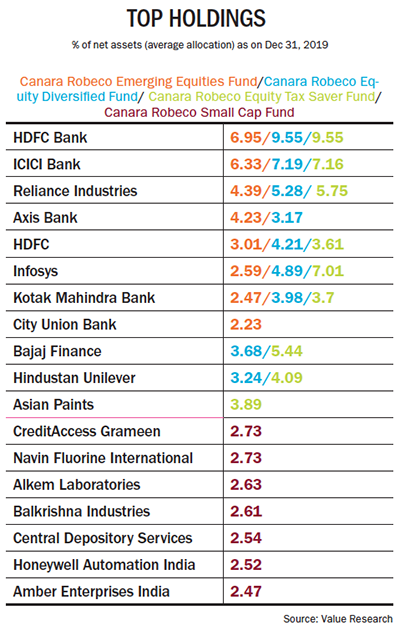

His knack for identifying quality cushioned him from the NBFC carnage that followed the IL&FS fallout. Mid-sized NBFCs and banks were trading at extremely high valuation compared to Tier-I lenders such as HDFC Bank and Kotak Mahindra. Interest rates had started to harden and Bhandwaldar realised that he should steer clear of NBFCs. The two banks stocks had strong liability franchises with proven track record of growth and were niche players in their respective segments. Plus, with PSU banks losing market share over the past two years, these private banks looked more attractive.

He went overweight on them and also added Bajaj Finance to the mix. These three stocks today account for nearly 17% of the Diversified Equity Fund, with HDFC Bank, Kotak Mahindra and Bajaj Finance delivering 26%, 28% and 66% CAGR return over the past three years, respectively and he continues to be bullish on financials. “Market share gain and balance sheet and P&L repair are the two themes that we are playing. We are relatively constructive on financials with strong liabilities or access to liabilities,” states Bhandwaldar.

He went overweight on them and also added Bajaj Finance to the mix. These three stocks today account for nearly 17% of the Diversified Equity Fund, with HDFC Bank, Kotak Mahindra and Bajaj Finance delivering 26%, 28% and 66% CAGR return over the past three years, respectively and he continues to be bullish on financials. “Market share gain and balance sheet and P&L repair are the two themes that we are playing. We are relatively constructive on financials with strong liabilities or access to liabilities,” states Bhandwaldar.

Similarly, when the cost of raw materials and the price of oil started falling in 2017, Bhandwaldar was quick to realise that the tide was turning in favour of FMCG companies. He factored in margin expansion and benefits from GST implementation for the sector. From 6-7% of total allocation in the portfolio, FMCG was bumped up to 11-12% by 2018. “If you look at gross margins of FMCG companies, they have expanded by 300-500 basis points over the past three years,” he says. His top picks in this space — Hindustan Unilever and Britannia — paid rich dividend and both rose by a whopping 124% and 99% in terms of absolute return, respectively. Of course, these companies also perfectly fit into his investment philosophy of pursuing robust business model with strong brand recall. “Once you invest capital, you should be able to generate enough return on equity and cash flows to keep the business growing without incremental external capital for long periods. A great example would be any FMCG company, which generates high RoE and RoCE and lot of free cash. Once the initial phase of investment in brand creation is done, growth keeps flowing,” explains Bhandwaldar.

While identifying winners in the domestic market, Bhandwaldar also kept US trends on his radar. In 2016-17, investors were flocking towards Indian pharma companies that had a strong presence in the US, but Bhandwaldar played a different game — he focused on players dominating the domestic market. “We realised challenges with US generic pharma companies and focused solely on API and domestic-focused players,” says Bhandwaldar. Thus, even when the Nifty Pharma Index has been on a downtrend, his picks such as Divi’s Labs, Abbott India, IPCA Labs and Alkem Labs have given stellar return over the past three years at 41%, 42%, 31% and 13% CAGR, respectively.

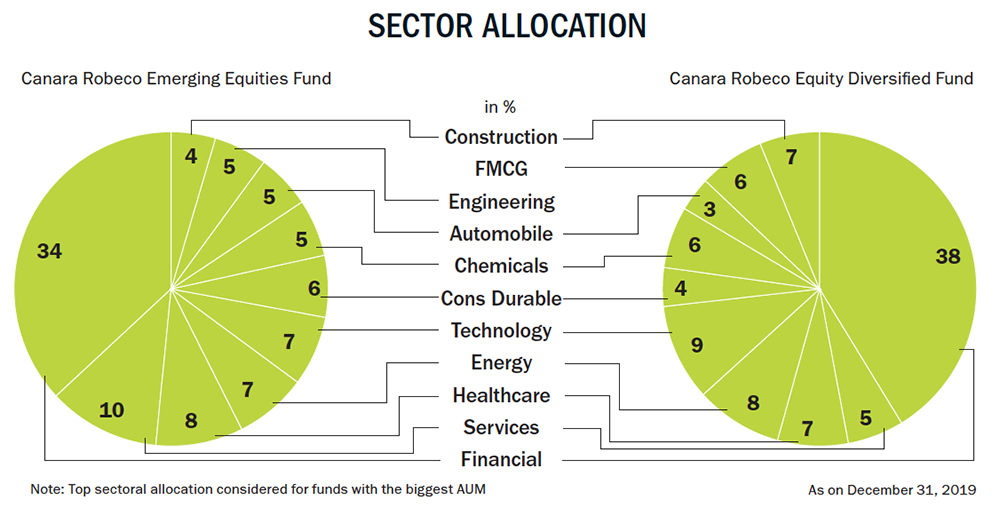

And who said high return only comes with high risk? According to Value Research, his investment style is graded ‘low’ in terms of risk. “Focusing on quality compounders has helped us in reducing risk and volatility in the portfolio. This is also in line with our fund’s investment focus of BMV — business, management and valuation,” says Bhandwaldar. For instance, non-cyclical businesses such as finance, IT and consumer non-durables account for 55.34% of the Equity Diversified scheme.

“There is a myth that high risk means high return. Sometimes, it may lead to high return, but not all the time. You can get high return even by taking low risk,” says Bhandwaldar. One of the best aspects of betting on compounders is they help one tide over volatile times and deliver outperformance. So, quality non-cyclical compounders form around 70-80% of his portfolio and capital-intensive cyclical companies form 10-20%. “Typically, our allocation in asset-heavy businesses will always be controlled based on the macro economy. We own a few stocks in sectors such as telecom, chemical, cement, utilities, but their overall weight is limited,” says Bhandwaldar.

Playing the field

After the fall in stock prices of companies in sectors such as telecom and automobile, they have become inexpensive in terms of valuation. “Amongst the beaten-down sectors, there is value in telecom, something we never had in our portfolio. We added it around 12 months ago due to a simple reason that competitive intensity is going down, which means there will be a lot of wealth creation as earnings expand for the remaining players,” says Bhandwaldar. Currently, the sole telecom stock in Canara Robeco Diversified Equity Fund — Bharti Airtel — accounts for 1.5% of the overall portfolio. Even with the AGR ruling and adverse newsflow for the sector, Bharti Airtel has gained nearly 90% since February 2019, proving Bhandwaldar’s competition intensity theory right. The market expects Bharti Airtel to benefit from increase in tariff rates.

Just like telecom, it has been a dismal year for auto, which has faced a severe slowdown due to weak demand and regulatory changes. As the environment shifted for the sector, Bhandwaldar adjusted his portfolio to optimise return. He reduced his stake in Maruti Suzuki, Eicher Motors, Motherson Sumi and MRF between 2016 and 2018. While he is unsure of the pace of recovery, Bhandwaldar shares, “We are more constructive on the passenger vehicle (PV) segment and auto ancillaries as compared to commercial vehicles and two-wheelers.” He is not yet going full throttle on his investments in the PV and auto ancillary space, with plans to “gradually participate as evidence of volume recovery starts showing up in monthly numbers”. As of now, he has allocated around 2.01% of the portfolio for auto manufacturers such as Maruti Suzuki and Mahindra & Mahindra. Meanwhile, ancillary player Balkrishna Industries makes up around 1.22% of the portfolio.

Clearly, he has always been a proponent of bottom-up stock selection, as he believes it helps in outperforming the benchmark over time. But when it comes to playing sectors, Bhandwaldar dodged a big bullet by staying away from PSU banks. “We didn’t participate in PSU banks because of NPA-related issues as well as challenges arising out of government ownership. So, we saved a lot of pain and money here,” he shares. But it hasn’t been a perfect track record either. “Unfortunately, we missed to put a management filter in a few other non-banking PSUs. These firms have underperformed or lost money for us on absolute basis during 2017-19,” admits Bhandwaldar. Investments in PSUs such as BEL, Engineers India, Coal India and GAIL turned out to be a pain in the portfolio. Despite being large players in their respective sectors and steady earnings growth, their valuation kept on shrinking as they are forced to pay dividends to the government. “The key learning has been that management capability and intention is equally important, if not more important than business and valuation,” says Bhandwaldar who has exited the companies over time.

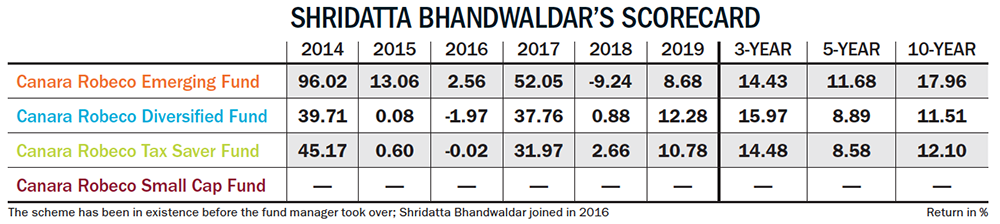

His pursuit of quality stocks has borne fruit and his diversified equity fund has reported 13.97% CAGR over the past three years, steadily beating the benchmark. “Wealth creation or compounding happens in businesses with competitive advantage. It can come from scale, brand goodwill, distribution, technology or regulatory entry barrier,” explains Bhandwaldar. He believes these give much more than just one-time gains.

His pursuit of quality stocks has borne fruit and his diversified equity fund has reported 13.97% CAGR over the past three years, steadily beating the benchmark. “Wealth creation or compounding happens in businesses with competitive advantage. It can come from scale, brand goodwill, distribution, technology or regulatory entry barrier,” explains Bhandwaldar. He believes these give much more than just one-time gains.

Like most value investors, he is a Warren Buffett and Charlie Munger disciple and says with reverence, “They were among the first few investors who followed this thought process and that’s why I appreciate them”. This thought process has helped Bhandwaldar remain conservative and give utmost importance to quality and growth. His philosophy to find opportunity in other people’s effort has no doubt helped him solidify his position as one of the best performing mutual fund managers.

Just one email a week

Just one email a week