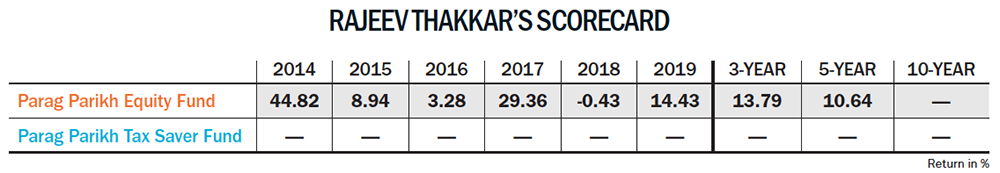

In hindsight, it seems I timed things quite well,” quips Rajeev Thakkar, the soft-spoken, low-key CIO of Parag Parikh Financial Advisory Services (PPFAS) Mutual Fund. He ranks fifth in the five-year category, in the annual best fund manager ranking compiled by Outlook Business-Value Research. Thakkar has generated compounded return of 10.66%, managing assets worth Rs.24.24 billion as of December 31, 2019. But he plays it down saying, “The growth percentage looks high since our base is very, very low… Our equity fund is roughly Rs.27 billion today and our liquid fund included, we are at Rs.31 billion. In a Rs.27 trillion AUM (assets under management) industry, we are a rounding error.”

Thakkar has come a long way having bought LIC HF at Rs.22 during his college days. With a dividend yield of Rs.2, he felt it was a no-brainer. He graduated in 1992, the year when Harshad Mehta’s ‘crazy bull run’ peaked. Three years later, he completed his chartered accountancy. He believes it was the perfect time to be in the trade, when foreign bankers were quitting their jobs to set up investment banks. He feels he has been ‘lucky’ several times — his stint at then hot investment outfit Prime Securities in 1994, handling government bonds in 1997 when it was popular, and moving to equities fulltime in 2003, the “perfect time for it”. Today, he is that rare brand of investor, leading a portfolio covering both Indian and foreign stocks in one scheme. It is a focused portfolio of 25 stocks, in line with his mentor and value investor Chandrakant Sampat’s philosophy of investing in a few quality companies while keeping one’s expenses low.

While sifting through foreign stocks, he evaluates the trade-off between the global parent and the Indian subsidiary. For instance, he chose to stay invested in Suzuki Corp in Japan while selling off Maruti Suzuki in India last year, right before its stock price slumped for a while due to decreasing demand. He says that Indian consumer companies have been trading at high multiples, at valuations that have little to do with a company’s past or market potential. It is entirely based on the investors’ belief that India is an emerging market, where discretionary spending will go up and higher growth than parent will be delivered, but this optimism may be a bit overdone. On the other hand, he says, “The parent company not only benefits through shareholding in the subsidiary but also earns royalty from minority shareholders and has 100% participation in the sales. Sometimes, the important businesses are only at the parent level and not in its Indian arm.” He cites Suzuki’s plants in Gujarat solely for exports, and a JV with Toshiba and Denso for a battery manufacturing plant. Maruti Suzuki, listed in India, has no part to play in any of these.

That said, Indian companies are dependent on the fortunes of their global subsidiaries. “If you are buying Tata Motors here, you are essentially dependent on the performance of Jaguar Land Rover. Similarly, for Tata Global Beverages the key brand is Tetley, Hindalco has Novelis, and Bharti Airtel is also operating in Africa. Again, if you are buying any of the IT companies, their core market is the western world,” Thakkar explains. He adds even other analysts or investors when assessing Wipro, TCS or Infosys surely look at Cognizant, Accenture and IBM for comparative valuation.

Global Play

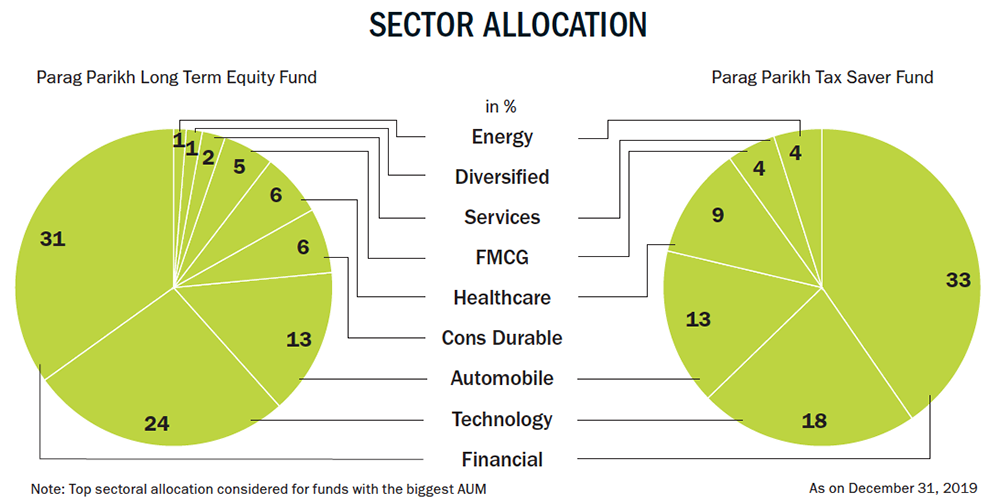

For his global picks, Thakkar sets aside nearly 30% of his AUM. Indian companies get roughly 65% (so that local investors can avail the tax advantage of a domestic equity fund) while the remaining 5% is held in cash. As of December 2019, the portfolio break-up for Parag Parikh Long Term Equity Fund stood at 65.98% in Indian stocks, 28.83% in foreign stocks (including ADR/GDR), leaving cash reserve of 5.19%. This mix not only acts as a buffer, it also helps him chase opportunities that the domestic stock market does not capture, such as the one in consumption.

“Today, consumer electronics is the second-largest category for imports after crude oil — it’s not gold. We are spending more on buying smartphones than cars. However, most of these handsets are either of American, Chinese or Korean origin… None of the existing listed companies are participating in this segment,” he says. Over the years, Thakkar’s key bets internationally have been mostly in FAANG with the exception of Nestle in Switzerland, AB InBev in Belgium, Standard Chartered in UK and Suzuki in Japan. Currently, his portfolio has Alphabet, Amazon and Facebook. He had invested in Apple, too, but his fund exited within a year, even as the company’s stock continued its ascent. Thakkar says it was a value buy at $95, which they cashed out at $170-$175. “We were not that comfortable at the higher price because the core of their business, smartphones sales, has matured quite a bit,” he says.

“Today, consumer electronics is the second-largest category for imports after crude oil — it’s not gold. We are spending more on buying smartphones than cars. However, most of these handsets are either of American, Chinese or Korean origin… None of the existing listed companies are participating in this segment,” he says. Over the years, Thakkar’s key bets internationally have been mostly in FAANG with the exception of Nestle in Switzerland, AB InBev in Belgium, Standard Chartered in UK and Suzuki in Japan. Currently, his portfolio has Alphabet, Amazon and Facebook. He had invested in Apple, too, but his fund exited within a year, even as the company’s stock continued its ascent. Thakkar says it was a value buy at $95, which they cashed out at $170-$175. “We were not that comfortable at the higher price because the core of their business, smartphones sales, has matured quite a bit,” he says.

This caution is exercised even when expanding his foreign portfolio. Mostly, it has been limited to North America, Western Europe and developed Asian markets such as Japan. He keeps away from China because of its short history with private capital and a long shadow of communism. Its legal systems and financial practices are not as evolved as in the western markets. “If you search on the internet, there will be many fans of Alibaba, then there will be another group claiming all the numbers are fake and over-reported,” he says, and shares an anecdote of a notice that was sent to the Chinese stock exchange by a local company. It read: ‘Our Company was shifting offices and we had put all our servers in a container. Now, that container has gone missing, so we cannot report any financial numbers.’ “One is more comfortable with SEC regulations and board systems,” he says.

Being a global investor comes with its set of challenges. For one, the fund manager needs a way to reduce risk of fluctuating currency on the net asset value (NAV). PPFAS MF does this by selling future contracts on dollar-rupee, enough to hedge a substantial (75-90%) portion of their exposure in foreign stocks. “Irrespective of the movement of underlying currency, the value of the portfolio and the hedge move uniformly, either upward or downward. When the expiry comes, typically we roll it over,” he says.

The cash reserve of 5% also helps in making the most of global opportunities. “It is to ensure that we are able to buy any stock whether in India or globally, if it were to fall and become attractive at any point of time,” he says. Thakkar agrees that it could be a pain in the short run, if the market is running away and the cash is not yielding much. But with the volatility, which comes with 24-hour news cycles, “where you’ll have different tweets coming from different people and countries threatening each other” which can cause geopolitical or other tensions, cash in hand helps a fund react quickly. “You’ll always see ups and downs in the market and that creates opportunities for long-term investors, to buy stocks at attractive prices. We don’t mind small amounts of cash lying in our portfolio looking for an opportune time to purchase,” he says. In 2018, when the correction happened in the larger market, this cash reserve helped, along with the fund’s India and global allocation, and its smaller presence in small and mid-cap stocks.

Value seeker

You could hedge against many surprises but the best would be to have no surprise at all. A dyed-in-the-wool value investor, Thakkar has been a long-time Warren Buffett and Charlie Munger disciple. But his initial learning, he says, has come from Sampat’s school of thought. “He made me understand the value of quality in a business and not to just rely on simplistic parameters such as price earnings and dividend yields.” Before meeting him, Thakkar was largely buying cheap stocks instead of quality businesses.

Be it Google, Facebook or HDFC Bank, he likes to keep his strategy simple — look for the survivors and top players as the market continues to consolidate. Couple that with a good business model and quality management at the helm, and you have the recipe for a perfect investment! When peers emphasise more on growth or volume, Thakkar sees it only as a part of the larger story. Growth must come with profitability for the shareholders. “We look at pricing power and competitive intensity apart from volume growth,” he says.

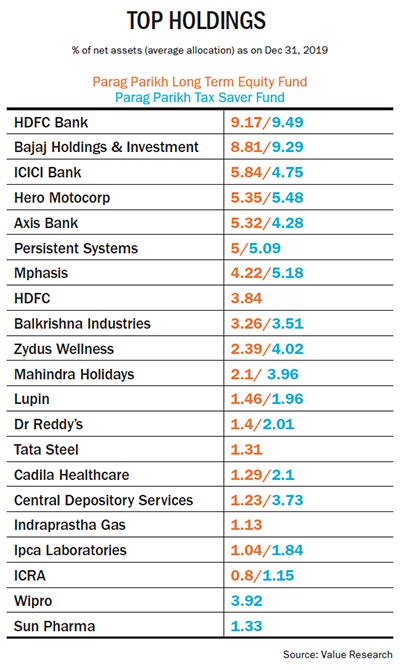

HDFC Bank is a prime example from his portfolio illustrating this investment rationale. “HDFC Bank is in a competitive area and because of their track record and perceived safety, they have been able to raise savings account balances at 3.5% interest rate, whereas other newer players are struggling to raise deposits despite offering nearly 6-7% interest,” he says. The other is Alphabet, which he started investing in since 2011 (Google then). Currently, it’s the topmost holding in the scheme with 9.42% allocation, followed by HDFC Bank at 9.17%. “Alphabet has a monopoly in search engine and is one of the few established players in digital advertising,” he says. His portfolio is definitely overweight on tech companies but Thakkar says that lines between a tech company and a non-tech company are fading as tech companies such as Amazon now meet traditional needs like retail or entertainment.

HDFC Bank is a prime example from his portfolio illustrating this investment rationale. “HDFC Bank is in a competitive area and because of their track record and perceived safety, they have been able to raise savings account balances at 3.5% interest rate, whereas other newer players are struggling to raise deposits despite offering nearly 6-7% interest,” he says. The other is Alphabet, which he started investing in since 2011 (Google then). Currently, it’s the topmost holding in the scheme with 9.42% allocation, followed by HDFC Bank at 9.17%. “Alphabet has a monopoly in search engine and is one of the few established players in digital advertising,” he says. His portfolio is definitely overweight on tech companies but Thakkar says that lines between a tech company and a non-tech company are fading as tech companies such as Amazon now meet traditional needs like retail or entertainment.

In his career spanning over 20 years, a key lesson has been to avoid PSUs and any sector directly getting affected by government policies. This lesson was courtesy Noida Toll Bridge where a public interest litigation challenged the collection of toll. Thakkar points out, “Where public interest is involved, the consideration is never how much money the shareholders have invested or what is the economic return that they should generate.” Hence, it’s no surprise that he would rather invest in HDFC Bank which seems expensive at 4-4.5x P/BV against inexpensive PSU bank stocks at 0.75 or 1x P/BV. According to him, it is a misconception to value financial stocks on price-to-book basis alone and that an investor needs to consider other variables such as cost of funds, net interest margin, cost-to-income ratio, level of NPAs, and credit culture. He explains, “Let’s say if one bank is quoting at a P/BV of 2 and another at P/BV of 4, one also has to look at what price the bank was able to raise funds. Let’s assume theoretically the bank which is cheaper has a much higher cost of funds compared to other banks. Then their net interest margins are low and it will forever earn lower return.”

He has kept away from IPOs too as he prefers assessing a company’s fundamentals over time before investing. That though does not prevent him from betting on companies which don’t have much institutional holding, for instance, CDSL or Mahindra Holidays or even earlier Maharashtra Scooters or VST Industries. Maharashtra Scooters, which Parikh exited about a year ago was a holding held for 15-16 years. He recalls, “We first bought it for our PMS in 2003 and held on. Essentially, it was a purchase where the underlying was Bajaj Group of Companies and it was available at a heavy discount to the underlying business.”

Investing in Mahindra Holidays was driven by its business model, in which operations and assets are funded by customer money; a better option than Indian Hotels, which needs to dip into internal accruals or raise debt to build a new property. “Rooms are a perishable commodity. If it goes vacant for a night, you can never recover the money missed on it. In contrast, the model of Mahindra Holidays is to take money upfront and give the members 25 years of holidays, where they are committed to utilise the rooms. The upfront money covers the cost of rooms, food and beverages. They are probably the only one in India operating at scale with this kind of model,” says Thakkar. Sterling Holidays was a pioneer in the business but struggled with debt, and was eventually acquired by Thomas Cook India.

Not that the upfront money model has always worked for Thakkar. He exited his holding in MT Educare early as the management changed the business strategy. “MT Educare was more of a negative working capital kind of thing where fees are taken upfront from students. Then they got into other things like government skill development programmes and setting up universities and so on.”

Despite every check and balance, Thakkar has learnt that bad news can catch any investor unguarded. Since a prime criterion for him is management integrity, he says it is largely a question of judging past behaviour and not going so much by what a management says. “While it isn’t absolutely black and white, there are shades of gray and you can figure out which is closer to white and which is closer to black. By looking at past behaviour, you can eliminate the most egregious violators,” he adds. He quotes Buffett, “There is never one cockroach in the kitchen… so if you see one, there are always others hiding somewhere.” It is tricky because the signs don’t always show up in the numbers. But there are tell tales. “If someone has a track record of continuous violations on the income tax, GST or company law front, and is constantly getting into dispute with the regulators, suppliers or customers, then you know all is not hunky-dory,” he says.

For instance, Gitanjali Gems had been in news long before its fraudulent dealings with PNB were made public. There were allegations of stock price manipulation, a payment crisis on NSE and so on. “A simple Google search would have given investors an idea of the trouble they had been in,” he says. Thakkar adds that, at times, these signals are hard to read. For example with institutions such as banks, where there are multiple lending lines, nation-wide network and different business lines. If a company that his fund has invested in begins to develop governance troubles, Thakkar says they simply exit. “We don’t have any influence as many companies have promoter holding north of 50%. Our holding is very small compared to the promoters’ holding and legal processes take time,” he explains.

Thakkar hopes someday his fund grows so big that “size becomes a problem”. “Like Buffett and Munger have said, it’s better to have income tax problems rather than income problems. So it’s better to have large sized problems rather than not have problems. But it’s too far away,” he says.