In the stock market, the law of demand works in reverse. Higher the price, higher is the demand. This year as the stock market climbed to a record high, one would think investors would have flocked to equities like there was no tomorrow. But no, that was not quite the case.

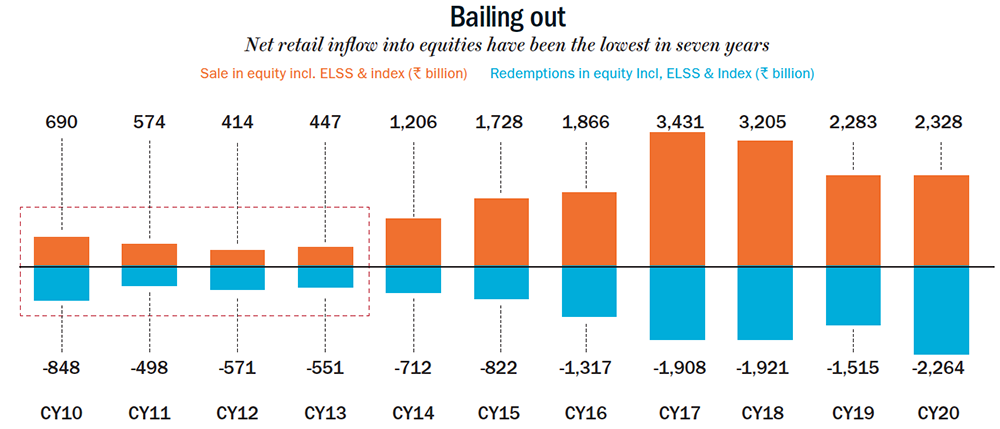

Domestic mutual funds did end CY20 on a record high with equity assets under management (AUM) touching a new peak of Rs.9.5 trillion. But much of the rise in assets came because of rising market value and not because investors chose to keep the faith. Sales of equity schemes rose 2% to Rs.2.32 trillion, compared with the previous year. Redemptions were Rs.2.26 trillion (up 49%) during the pandemic-struck year. In other words, inflows (net of redemption) into equity funds hit a seven-year low at Rs.64 billion (See: Bailing out).

Dhirendra Kumar, founder-CEO of Value Research, points out that this is not as bad as it looks, because the redemption comes after three years of record net inflows. “While there has been some amount of profit booking by investors, we are also seeing a nice build up in monthly SIP flows of Rs.10 billion in equity funds, which have been rather sticky through the years.”

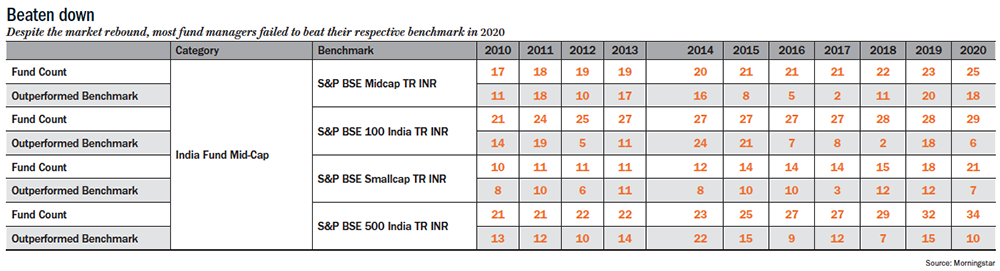

That is the story of fund flow. In terms of performance, the story is a bit underwhelming when it comes to active fund managers. According to data from Morningstar, over the past five years, the number of large-cap funds outperforming the index has fallen from 21 (out of 27 large-cap schemes) in 2015 to 6 (out of 32 large-cap schemes) in 2020. That is, the universe of large-cap schemes has expanded but the number of outperformers has dropped. The story is similar in the small-cap and multi-cap categories where only 7 out of 21 schemes and 10 out of 34 schemes have beaten their respective benchmarks (See: Beaten down).

Many large-cap funds failed to beat their respective indices – with 57% large-cap funds underperforming both the Nifty 50 and the Sensex – and fell behind passive funds, even on an annualised daily rolling return over a 20-year period (as of CY20). The underperformance has become more glaring ever since the regulator has mandated the use of total return indices (TRI) as the benchmark, which not just takes into account stock return but also the dividend paid out.

When the going gets tough

The big change in the mutual fund industry has been reclassification of market cap categories. Unlike in the past, where large cap meant any stock from the top 100 and 200 stocks, now fund managers have to pick from the top 100 stocks by market cap. “Intuitively, prior to 2018 definition, some large-cap funds were also running mid-cap exposure typically more than 20-30%,” points out Kaustubh Belapurkar, director, fund research at Morningstar Investment Advisers India.

While the reclassification has narrowed the field, there are other factors too contributing to the worsening underperformance. For instance, since 2015, when the Employees Provident Fund Organisation (EPFO) was mandated to invest in equities, the inflow into exchange-traded funds – the only mandated equity investment by the Central Board of Trustees – has resulted in a steady flow into index stocks. “Over the past two years, if you combine the inflows of the EPFO and the NPF (National Pension System), we are talking of Rs.50 billion of monthly SIPs coming into Nifty ETFs, which was never seen in the past,” points out Kumar. According to Crisil, CY20 saw equity ETFs mopping up flows of over Rs.510 billion, taking the total assets under this category to Rs.2.56 trillion.

While the ETFs are gaining, active fund managers will have to run at twice the speed to stay at the same place. “This will be a problem some years from now. When you think of large-cap funds and Nifty, large-cap funds in a regular plan will have a cost of 1.75% and in a direct plan will have a cost of 1%, while you get the ETF at 10 basis points. Those fund managers will have to beat it by 1-2% every year to match the index, which means the odds are against you,” adds Kumar.

While the ETFs are gaining, active fund managers will have to run at twice the speed to stay at the same place. “This will be a problem some years from now. When you think of large-cap funds and Nifty, large-cap funds in a regular plan will have a cost of 1.75% and in a direct plan will have a cost of 1%, while you get the ETF at 10 basis points. Those fund managers will have to beat it by 1-2% every year to match the index, which means the odds are against you,” adds Kumar.

Besides, the sharp rally in a handful of index heavyweights has also made it tougher. For instance, Reliance and Infosys, which have a combined weightage of 18%, has seen a sharp rally of 70% and 30%, respectively. “When heavyweights move up in such a fashion, many managers will struggle to beat the index,” says Belapurkar. If a fund manager was underweight these stocks, the performance of the rest of the portfolio may not compensate adequately. “Also, with the 80:20 norm for large caps, there is limited scope to generate alpha from non-index stocks,” feels Belapurkar. However, Kumar believes the solution is pretty simple: “What stops a fund manager from going overweight on a stock that is rallying? You don’t go 11% in Reliance but you can go 9%. If Prashant Jain (HDFC MF) feels SBI has to be 9%, he makes that happen. Besides, can’t an fund manager really spot 30 good stocks that can beat the index?

That is easier said than done given the construct of the market. Right now, mutual funds own about 7.5-8% of the overall Indian equities market cap while FIIs remain the biggest with 20% ownership. As mutual funds become more and more prominent players, their rate of outperformance is bound to come down. In the US, active fund managers own 55% of the overall market, but 85% of the active funds have failed to beat the S&P 500 for the past 10 years.

How they fared

As of CY20, among the large-cap funds, six schemes managed to better the 16.84% return of the BSE-100 TRI with Canara Robeco Bluechip Equity Fund (23.06%) and Axis Bluechip Fund (19.72%) leading the pack. The worst performers were Nippon India Large Cap (1.5%) and HDFC Top 100 (5.91%).

Manish Gunwani, CIO, Nippon Mutual Fund, explains his predicament when he says that the current crisis is different from anything seen in the past. “Unlike the 2008 crisis, apart from companies with weaker balance sheets and weaker managements falling, a lot of good businesses even the market leaders, whether be it in scooters, aviation, retailing, hospitality and FMCG, got impacted massively by the crisis.” For instance, some of the worst performers in the portfolios were from the hospitality sector: Chalet Hotels (-64%) and Indian Hotels (-33%) and in FMCG, it was ITC that fell 22% and in retailing, Aditya Birla Fashion (-44%) What compounded the woes was PSUs like Coal India, Indian Oil, and BPCL which fell 44%, 43%, and 37%, respectively.

Gunwani, however, sees no reason to revisit the fund’s investment thesis. “I will not blame my analyst or research process for the stocks that haven’t done well. Unlike in a normal downcycle in which you check if the economy is overheating or too much debt is building up, this time around that kind of analytics is not valid. In that sense, there is no need to read too much into the investment research process,” feels Gunwani.

HDFC Top 200 fund has been underperforming given the high weightage of PSUs. For instance, SBI accounts for 5.94%, NTPC 3.22%, Coal India 2.84%, HPCL 2.13% & BPCL 1.77%, Power Grid, Power Finance, and REC are under 2%. Belapurkar mentions, “People think that Prashant Jain’s fund hasn’t done well for a long period of time but if you look at the fund’s five-year return, it is actually close to the top quartile. The point is that cycles will play out at different points in time.” For CY21 till date, the fund is up 10.29% even as CY20 leaders Canara Robeco Bluechip is up 4.04%, while Axis Bluechip is down -0.12%. “Post Budget, we are seeing a turnaround in PSU stocks. Whether the momentum will sustain, we don’t know. SBI is still trading at a discount to book value,” points out Kumar.

While the pain for laggards is evident, six outperforming funds have a different tale to tell. IDFC Large Cap managed to outperform the Sensex TRI by 57 basis points. Anoop Bhaskar, head-equities at IDFC Mutual Fund, points out that whichever sector has reported earnings has moved up. “While there are some pockets which are irrational, by far the market has been quite logical. Large parts of the market are fairly backed by earnings growth.”

Concurring with Bhaskar, Shridatta Bhandwaldar, head-equities at Canara Robeco Mutual Fund, whose schemes across large, small and flexi-cap, have beaten their respective benchmarks, says finding the right sectors and within that companies with positive earnings revision has been one key factor for the outperformance. “For instance, within the high-quality bucket of banks, there was a period when corporate banks were going through a clean-up of excesses of the previous cycle. On the other hand, you had the likes of HDFC Bank and Kotak, which besides being well-run banks, were also the beneficiaries of competition being in trouble,” he adds.

The narrative is similar at Axis Mutual Fund with Jinesh Gopani, head-equity, saying: “All the companies with strong balance sheets and strong management have been able to navigate this cycle very well and that showed up in our portfolio as well.” Elaborating on the theme playing out, Gopani mentions that strong players are adding much more heft. “Tier-1 companies in each and every segment are becoming leaders, just like we are seeing in financials where only a handful of private sector banks dominate.”

Within the mid-cap space, of the 28 funds in this category, 18 outperformed the benchmark BSE Mid Cap’s 21.31% return. PGIM India Midcap Opportunities Fund, with assets of Rs.7.13 billion, topped the chart with return of 48.39%. As expected, small-sized funds outperformed their larger peers, this time by 6.30 percentage points. According to Morningstar, the five largest funds with assets in excess of Rs.80 billion dished out an average 23.07% return in CY20, while the five smallest funds with assets less than Rs.2 billion delivered an average 29.37% return.

Interestingly, among the large-sized funds Axis Mid Cap Fund, which delivered the highest return at 11.33% in 2019 even when the benchmark had fallen 2.6%, was again at the forefront in CY20 with 26.01% return. The mid-cap fund focuses on emerging sectors and businesses which can deliver high growth. For instance, in CY20, of the top 10 stocks that comprised 40% of the assets, Info Edge had the highest allocation at 5.2%, followed by City Union Bank at 4.8%, Avenue Supermart at 4.4% and 4.2% each in Voltas, Astral Poly Technik and Bajaj Finance. However, Belapurkar believes that there is another key driver to the fund’s outperformance. “Like most mid-cap funds, Axis, too, had large cap exposure which would have aided the outperformance."

Among small caps, only seven of the 21 funds outperformed the BSE Small Cap Index’s 33.53% gain in CY20. Here again, small won big – five funds had assets below Rs.7 billion and only SBI Small Cap, with assets of Rs.65.94 billion, was the large-sized fund to beat the index. The five smallest funds with assets less than Rs.3 billion, delivered an average of 46.19% in CY20, while five funds with assets in excess of Rs.50 billion each delivered an average of 26.97% during the same period.

Bhandwaldar of Canara Robeco, which beat the Small-Cap benchmark with a return of 41.82%, says, “We look for capital-efficient businesses with potential to grow earnings by 15% plus. Weak quality promoters will hurt you in small-caps.” His picks include stocks from chemicals, pharma (APIs), IT (small), and financial savings beneficiaries such as CAMS and CDSL.

Small-cap funds have the most flexibility given they have the largest universe of stocks to choose from. While the top 100 companies by market cap have been reserved for large-cap funds, the next 150 companies have been reserved for mid-cap funds and small-cap funds can pick anything ranked 251 and lower. This flexibility means the stock-picking ability of the small-cap fund manager will be the single-biggest driver of generating alpha.

It cuts both ways though, depending on the stocks the fund manager picks from the vast universe. This is exactly the reason there was strong divergence in return of small and midcap funds in CY20. For instance, though healthcare, specialty chemicals and IT did well, Franklin India Smaller Companies Fund picks went the other way. Eris Lifesciences (2.04%) fell 50%, Himadri Speciality Chemical (0.74%) fell 77% and eClerx was down 48%. In the case of L&T, exposure to basic material stocks such as Mishra Dhatu Nigam (-19%), Ramco Cements (-43%) and Greenply (-77%) besides consumer cyclicals such as Future Retail and Future Lifestyle cost the fund dear.

Post-Covid, leaders seem to be gaining at the expense of smaller, weaker players. Pankaj Tibrewal, senior fund manager, Kotak AMC, whose small-cap and mid-cap funds beat their respective benchmarks, explains that within mid- and small-cap brackets, more than 50% of the players are leaders in their own categories and have been growing faster than the industry. “For example, in chemicals, five years ago, all of them started as small-cap, then they slowly shifted to mid-cap and now probably some companies are moving towards large-cap,” he says.

However, Gopani of Axis reminds us of the risk inherent in the mid- and small-cap category: “Nobody wants to take the risk of buying into a good story of Tier 3 - Tier 4 stock. In the near term, even if the story is good, it becomes extremely difficult to get out of the stock when you want to. That is a bigger risk you run in the Indian market.”

The market regulator in November 2020 introduced a ‘flexi-cap’ category, which mandates 65% of the corpus be invested in equity, but without any restriction on exposure to large-, mid- or small-caps. This category was introduced as a relief from an order the regulator had passed earlier that year. In September 2020, Sebi had made it mandatory for multi-cap funds to invest at least 25% of the corpus in large-, mid- and small-caps, and there was a concern that multi-cap funds would be forced to buy illiquid mid- and small-cap stocks. This prompted Amfi to push the case for a new category, sans such stipulation, and the flexi-cap category was launched.

Several fund houses then rechristened their multi-cap plans as flexi-caps. However, in terms of performance, this category hasn’t seen too many stellar fund managers. Of the 34 funds, only 10 funds managed to beat the BSE-500 TRI Index return of 18.41%. Of the six funds, Parag Parikh Flexi Cap stood out with 32.29% return as the fund is unique because it invests in foreign stocks as well – 28% of its assets are invested overseas. For instance, of the top 10 stocks, Alphabet (parent of Google) is the top holding at 9.62%, followed by Microsoft at 7.92%, Amazon at 5.86% and Facebook at 4.77%. While some multi-caps have switched over as flexi-caps, funds that are still multi-caps have maintained a large-cap-heavy portfolio, resulting in their underperformance. “Funds like those of Parag Parikh will be one of the best performing funds over a longer time frame of 3, 5, 7-year basis because of the construct of its portfolio. Not surprising that quite a few funds have put enabling provisions in their offer document where in the future they can invest abroad,” says Kumar.

Where’s the alpha?

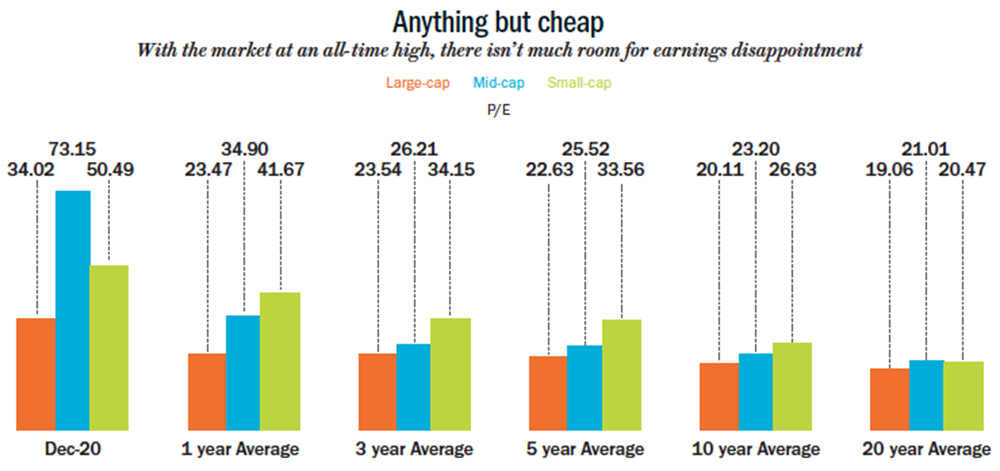

With the market at an all-time high, it is not surprising that valuations across large, mid and small caps are no longer cheap (See: Anything but cheap). Against such a canvas, the opportunity to outperform remains tough for fund managers. Tibrewal is playing it conservatively. “We have a growth-oriented mindset, but we want growth at a reasonable price. We try not to overpay. As a house, we focus more on the balance sheet and cash flow, and less towards P&L, since that is where the real strength of a company lies. So, this framework helps us avoid mistakes, especially in a large universe,” he explains.

While redemptions have continued for the seventh straight month as retail investors are cashing out, Gunwani believes the breadth of the rally is finally widening. “We are still on the side of cyclicals such as banks, CVs and industrials, since we think India is still in the early stage of an upcycle. We expect earnings growth will continue to overpower the rising interest rate.” After many quarters of repeated downgrade, post Q3FY21, analysts are now looking at sharp earnings recovery in FY22. “Given that FY21 was a washout year, the market is expecting 25% to 30% growth in FY22. On trailing basis, the market looks expensive but on forward basis, if corporate India will deliver earnings growth, the market doesn’t seem so expensive,” believes Tibrewal. Both the US and domestic bond yields are showing upward pressure and that could spark a sudden reversal of FII flows. But Bhandwaldar believes that, even if there is 5-7% correction, as long as the broader construct is not broken, there is no cause for worry.

Belapurkar believes investors would be better off identifying fund managers with a distinct investment style and own a diverse set of them. “Today, growth managers are the toast of the town. Tomorrow when value starts doing well and by end of 2021, people would have forgotten Axis and Canara and would be chasing HDFC and Nippon. By then, the market cycle for value stocks would have probably already played out. Also, no fund manager will change his style because the cycle is against him. Better would be to build a portfolio comprising growth, value, and growth at a reasonable price.”

Though fund managers are keeping the faith, retail investors are still wary with several turning direct equity investors — a record number of demat accounts have been opened in recent months. Bhaskar, who has seen several market cycles believes the trend will reverse soon. “For now, it’s like a revolt against fund managers. But, in one correction of 10%, where some stocks will be down 30-40%, investors will again flock back. We have to bide our time.”