Cheenu Gupta, fund manager at Canara Robeco, is nothing if not thorough. When she started her career, as an equity research analyst at UTI Mutual Fund in 2006, she put in legwork that any rookie would proudly look back at. For every company that she was covering, she met the company management and the business heads, visited every manufacturing plant, and spoke to nearly everyone in the supply chain, besides reading analyst call transcripts and talking to sector experts.

Cheenu Gupta, fund manager at Canara Robeco, is nothing if not thorough. When she started her career, as an equity research analyst at UTI Mutual Fund in 2006, she put in legwork that any rookie would proudly look back at. For every company that she was covering, she met the company management and the business heads, visited every manufacturing plant, and spoke to nearly everyone in the supply chain, besides reading analyst call transcripts and talking to sector experts.

“My stint at UTI trained me to do exhaustive research into every stock and not just rely on numbers,” she says.

It is tiring work, but the excitement keeps Gupta going. She had grown up seeing her family invest money in fixed deposits and when she discovered equity investing, she found it fascinating. “It was the idea of putting passive money to work that interested me,” she says. After graduating in engineering, she pursued her PGDBM in Finance, when she made her first equity investment.

LEARNING THE ROPES

She learnt a few hard lessons early. She had put her money in Ispat, which was trading cheap then. A few years later, crippled by huge debt, it began to lose value. “I don’t think I was ever able to recover my money,” she says. Another investment where she lost money, as a student, was Indian Hotels. They had prime assets, but the stock corrected for cyclical reasons. These encounters taught her that business is more than valuation, that other factors such as corporate governance and sector related cyclicality, headwinds and tailwinds matter too.

After her masters, she joined UTI, where her conviction in looking at a company from every angle strengthened. In 2012, she made her transition into a fund manager’s role with Tata AIA Life Insurance. In 2018, she moved to the mutual fund sector, as a fund manager with Canara Robeco.

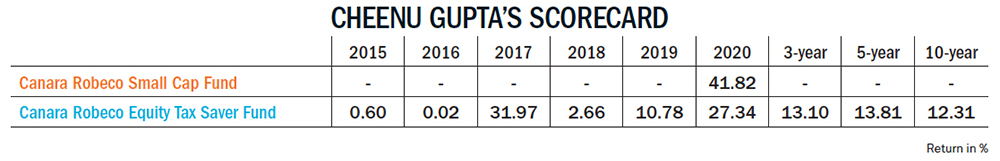

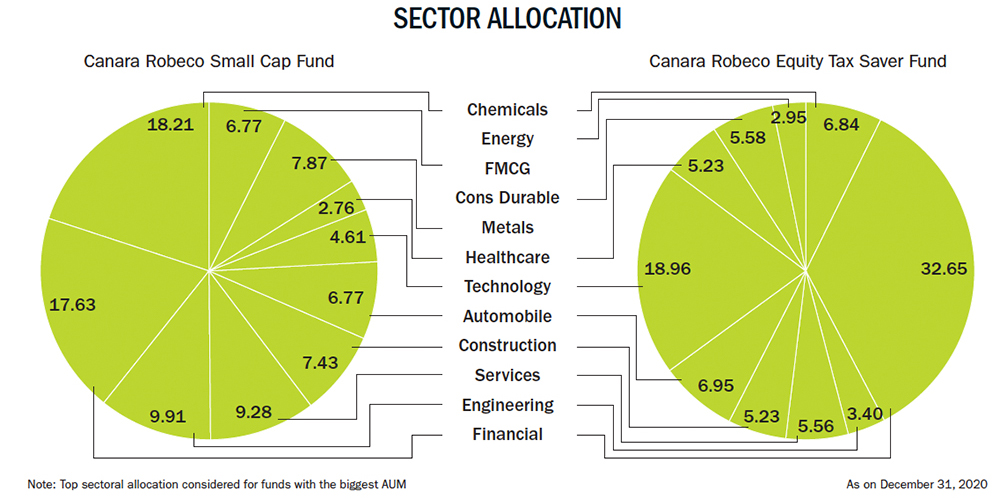

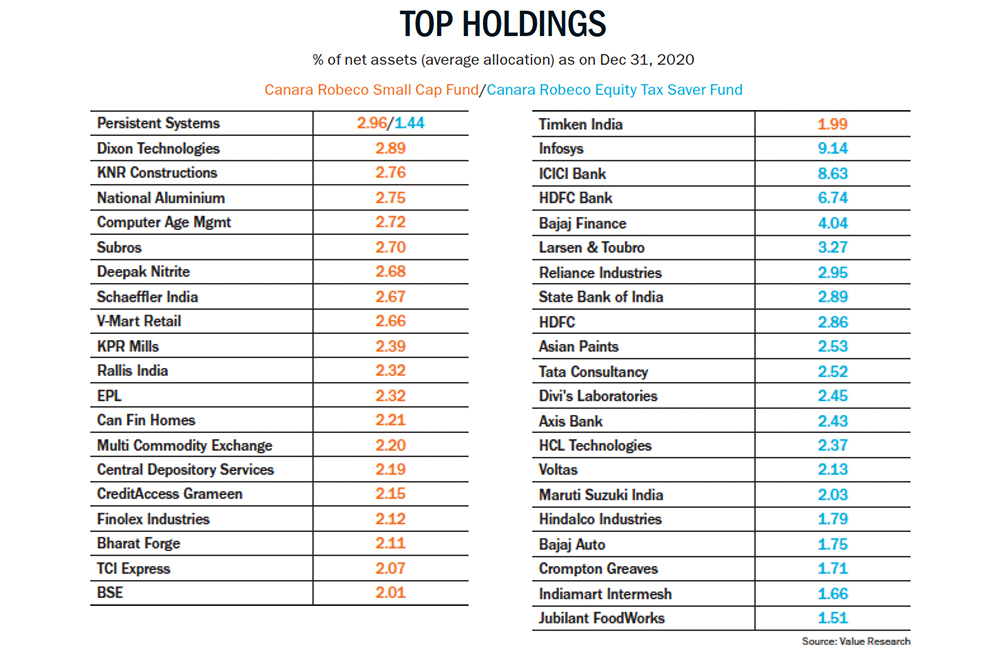

Today, Gupta oversees four funds. The biggest is Equity Tax Saver Fund, which has an AUM of Rs.16 billion. The others are Consumer Trends Fund, Small Cap Fund and, most recently, the Infrastructure Fund.

Over the years, she has come to rely on a few investing principles. Two are from Warren Buffett: on buying businesses that have pricing power and customer loyalty and investing only in businesses that she understands well. In the initial days of her career, there was a chance to bet on a medical-technology company. But she couldn’t make sense of the products or the company, which was the only one in that space, and so she didn’t buy into it. The decision served her well. The company went on to do badly and was revealed to have poor corporate governance.

Over the years, she has come to rely on a few investing principles. Two are from Warren Buffett: on buying businesses that have pricing power and customer loyalty and investing only in businesses that she understands well. In the initial days of her career, there was a chance to bet on a medical-technology company. But she couldn’t make sense of the products or the company, which was the only one in that space, and so she didn’t buy into it. The decision served her well. The company went on to do badly and was revealed to have poor corporate governance.

Another investing learning has been from Philip Fisher, who had said that it is not always necessary to buy into a company at cheap valuation. Many a time, you get good businesses but trading at a valuation higher than what you would have liked, but if a company has a technological edge or if it has the capability to generate superior return, then it makes up for the valuation gap. As an example, she cites IndiaMart which was trading at Rs.3,000, which the team felt was expensive, but after researching it they realised that the company had potential to show good growth based on digital enablement for MSMEs, especially in the post-pandemic era. “In addition, the company had demonstrated good cost control and enjoyed significant operating leverage. We went ahead with the buy. It is today trading at 3x,” she adds.

It is therefore that she relies on PEG ratio, rather than only focus on P/E. “A high growth company can trade at a higher valuation and within a few years its multiple can catch up with that of an established company growing at a normal rate,” she says, adding, “Though here the debt-Ebitda ratio also becomes important to see if the growth is coming at the cost of high debt and if leverage is under control.” As an example, she cites Jubilant FoodWorks. Its P/E ratio may look high at 60x, but growth is around 30-35%, so the PEG ratio will be around 1.7x-2x which looks good against a regular company with PEG at 1.5x. Similarly, Titan was trading at around 45x, around three years ago. Then, other companies were trading at around 30x-35x. But, if you take into consideration Titan’s growth potential, which was estimated at 30%, then the PEG ratio comes to 1.5x. “Then 45x looks like a good ratio to invest in,” she says.

It is therefore that she relies on PEG ratio, rather than only focus on P/E. “A high growth company can trade at a higher valuation and within a few years its multiple can catch up with that of an established company growing at a normal rate,” she says, adding, “Though here the debt-Ebitda ratio also becomes important to see if the growth is coming at the cost of high debt and if leverage is under control.” As an example, she cites Jubilant FoodWorks. Its P/E ratio may look high at 60x, but growth is around 30-35%, so the PEG ratio will be around 1.7x-2x which looks good against a regular company with PEG at 1.5x. Similarly, Titan was trading at around 45x, around three years ago. Then, other companies were trading at around 30x-35x. But, if you take into consideration Titan’s growth potential, which was estimated at 30%, then the PEG ratio comes to 1.5x. “Then 45x looks like a good ratio to invest in,” she says.

DIGGING DEEP

Gupta also follows Fisher’s Scuttlebutt method. Scuttlebutt takes its name from the cask that held water in a ship, and around which sailors gathered to exchange gossip; sort of like watercooler chatter. This method of investing encourages a person to talk to everyone associated with a business, such as customers, competitors and suppliers, before buying.

While analysing Sun Pharma, her team spoke to various pharmacies and looked at the number of drugs sold and prescribed and found what made prescriptions for certain drugs move faster than others. They found why doctors align with a few companies. “Sun Pharma stood out when it came to on-the-ground demand amongst various stakeholders, and not just the numbers,” she says.

The company’s execution plays an important role, and Sun Pharma scored high on that. “On paper, its peers had similar looking product portfolios. But Sun was delivering far better,” she adds. It showed in the way Sun was handling its sales, distribution, and in the smaller things such as getting USFDA approval and launching the product on the planned date.

Scuttlebutt was used also for Asian Paints. Her team spoke to various paint dealers and suppliers and realised that they treated this brand differently from others. “You understand the brand equity a company holds. So, then you wait for the right time to pick up stakes in these companies, perhaps some bad quarters. During those times, you can pick up these stocks cheaper as you know in the long run they will do well,” she says.

These principles help her build conviction in stocks, which she seems to rely on heavily. Talking about what has helped her grow the Equity Tax Saver Fund, Gupta says, “When I took over three years ago, it was not such a well-performing fund and the key change that I did was exiting the positions where we did not have much conviction and at the same time going overweight where the conviction was higher. That is how we restructured the portfolio.” The sectors that they stepped out of included construction and OMCs. On the other hand, they added companies under the discretionary consumption category such as Voltas, Titan, Asian Paints and Jubilant FoodWorks.

For the Consumer Trend Fund, Gupta says they keep an eye out for trends. “That is how we managed to get stocks such as electronics manufacturer Dixon Technologies and air-conditioner contract manufacturer Amber Enterprises quite early in the cycle. When we noticed how digital advertising is picking up, we recently added a company from this segment, called Affle Technologies,” she points out.

Besides trends, she also looks at the competitive intensity in a sector and the regulatory headwind or tailwind. “For example, increasing USFDA related compliance issues for the pharma industry or the taxation of cigarette industry are a headwind for ITC. On the other hand, self-sufficiency supportive schemes such as PLI acted as a regulatory tailwind for electronic contract manufacturers such as Dixon and Amber,” she says.

Despite these rigorous checks, sometimes there are slip ups. Once they invested in a construction material retailing company, which they liked for its growth and delivery competence. But very soon, that façade began to crumble. “Often, they were writing off debtors as bad debts. When the company stopped supply to these non-paying customers, these customers stopped paying the money owed. It particularly stood out because it was a significant number, especially when compared to their profit. That clearly showed the poor quality of the business model. I got out of the stock early booking a small loss,” Gupta says.

A fund manager’s biggest enemy is his/her ego, she says. “It is difficult to accept that one has gone wrong, cut your loss and get out of a stock,” says Gupta.

STAYING FLEXIBLE

After demonetisation and COVID-19, she has developed a higher appreciation for Nassim Taleb’s antifragility concept. Before that, Gupta’s idea of an ideal business was one with a robust business model, one that could resist crumbling under any adverse situation. She names ONGC and Tata Steel as companies in this category. After these challenging situations, she has been looking for resilience in companies, that is, companies that adapt to regulatory change. Antifragile companies, she says, innovate during a crisis. To illustrate, she points to Titan, which restructured its business to deal with regulatory change, and Jubilant FoodWorks.

Jubilant booked a loss in Q1FY21 but they soon made the situation work in their favour. They shut down 105 stores and started charging customers a delivery fee, realising that buyers were showing willingness to pay for delivery. “It added 300-350 basis points to their profit margin,” says Gupta. Jubilant also launched a delivery service Ekdum for biryani, which is one of the topmost selling items in the QSR industry.

The second half of FY21 has worked like a dream for investors, she says, with nearly all stocks outperforming and giving good return. That said, it may not be easy to make good return in FY22, she says. “Investors will need to be selective and look for companies that have used this year to add to their ammunition, to perform better in FY22,” explains Gupta.

“Any sector or stock facing regulatory or cyclical tailwind is good. For example, the auto segment is now benefitting from cyclical tailwind, with sales picking up post the BSVI transition in FY20 and further helped by increased demand for personal mobility. The government is also looking at increasing auto manufacturing in India supported by PLI schemes. Therefore, it would be interesting to look at a company that can really take up more manufacturing and substitute auto or auto-parts imports,” she says.

Gupta is also bullish on banking, IT and infrastructure. “In banking, data points such as slippages, restructuring have turned out to be very favourable versus expectation. The IT industry has already had a good year and they are still talking about a good pipeline and good visibility because of speeding digital transformation which has become far more important. Infrastructure will see a lot more attention from the government,” she says.

She is less enthusiastic about staples and telecom. “Over the last two to three years, staples have been benefiting from top-line growth as well as good margin expansion. Almost all FMCG companies in staples have seen their margin expansion in the range of 500-800 basis points. For them to increase their operating margins further, given the current situation, seems difficult. They have done everything from digital marketing to enhancing employee-side productivity. They would get top-line growth. but bottom-line growth will not be as much,” she says. As for telecom she would avoid because of lower chance of further ARPU increase in view of competitive intensity.

Sometimes, a fund manager misses out on a good opportunity. Gupta believes that it is never too late to remedy that. “There are times when you miss out on a stock for some reason, maybe the stock has run up too fast or you have chosen to book profit quite early, or you believe that the valuation is too high for comfort. But later, whenever you are convinced that the business model is worth it, you can always check back into a good investment,” she says.

In 2012, she picked up Britannia and it doubled in a year’s time. At that time, she thought it was the right time to book profit. But the stock after doubling to Rs.470 kept on delivering good numbers, quarter after quarter and increased to Rs.700. She later invested in it again at that higher level of Rs.700 and in the next five years the stock became a 5-bagger to reach Rs.3,500. Had she not accepted her mistake of selling early and then invested again, she would have missed the bigger opportunity.

Gupta’s philosophy is to dig deep before investing, and if you have still got it wrong, correct it at the earliest. It seems simple enough. But aren’t simple things the hardest to do?