"Many men go fishing all of their lives without knowing that it is not fish they are after.”

The quote by author Henry David Thoreau in some sense summarises the way 56-year-old Alluri Indra Kumar has gone about building Avanti Feeds, which has today emerged as the country’s biggest shrimp feed company with over 40% market share and a nascent but promising shrimp processing business. Kumar’s tryst with destiny began in the ’90s when the aquaculture wave first hit India, especially in the southern belt. Sensing an opportunity in the feed space, till then dominated by MNCs, Kumar, then in his 20s, convinced his father, who was in the tobacco processing business, to make the switch. It was in 1992 that Avanti Feeds came into being and two years later, Kumar got a technical collaboration going with Ping Tai Enterprises of Taiwan.

Five years later, in a step that would mark the company’s forward integration, Avanti forayed into shrimp processing after it bought out an existing unit for Rs.2 crore. That’s the time Pramod Ranjan, who was exclusively exporting shrimps from India to Australia, met Kumar through an agent as he wanted to explore an opportunity to export to the US. “In the very first meeting, Kumar came across as a hands-on guy keen to make a mark in his business, and, most importantly, a person whom I could trust implicitly both in terms of integrity and capability,” mentions 50-year-old Ranjan, who now besides the seafood business also heads his family-owned Oriental Hotels, in which Indian Hotels Company holds 32% stake. That Kumar wanted to be taken seriously was proved when, in a bid to make a breakthrough in the US shrimp market, he pulled down the very unit that Avanti had bought for Rs.2.5 crore. Darden Restaurants, the Orlando-based multi-brand restaurant operator, had sent its head of quality assurance down to India in 1999. “When he visited Avanti’s unit, the gentleman suggested several changes in the production flow that required a major revamp at the plant,” recalls Ranjan. Despite the significant cost involved, Kumar took his chance. “My dad wasn’t convinced but allowed me to take the call,” adds Kumar. Though twice the acquisition cost, given the upgrade cost an additional Rs.2 crore, the decision altered Avanti’s growth trajectory. “His desire to stay ahead reiterated my faith in him as a long-term player and that partnership has continued,” says Ranjan, who bought the first consignment of Avanti’s shrimps into the US in 2000.

Even as Avanti was building up the processing business, there was trouble in store for the feed business. “The second-gen at Ping Tai was enamoured by the IT boom that had swept Asia and chose to exit the feed business,” recalls Kumar. But that was not the only jolt for Kumar, who faced a personal tragedy when he lost his father in 2002. “Although the business was my idea, he was always the person I looked up to for advice and guidance. It was personally a challenging phase for me,” he confides. Yet the biggest decision that paid off for Kumar was to seek out a technical alliance with Thai Union Frozen Products — Thailand’s biggest seafood and feed producer — in 2003. But as providence would have it, it was post 2009 that a new chapter began in Avanti’s growth story.

Black and white

Thanks to the aquaculture boom, Andhra Pradesh — with a coast line of 974 km and 1.75 lakh hectare brackish water area — emerged as the hub of shrimp production. Until 2009, India was only farming black tiger shrimps but was no match to South East Asian nations such as Thailand and Vietnam, the biggest players then in the market. The downturn of 2008 proved to be the proverbial nail in the coffin as black tiger shrimp exports plummeted amid a growing preference for pacific white shrimp, also called as Litopenaeus vannamei, thanks to its lower production cost and higher yields. Between FY02 and FY08, Avanti clocked an average turnover of Rs.158 crore, but sales slumped to Rs.73 crore with a loss of Rs.10 crore in the crisis-ridden FY09. “It was a challenging phase but the efforts that we put into realigning the business paid off,” claims Kumar. To begin with, the company had to convince farmers of the need to switch to the new shrimp breed by closely interacting and training them. A practice that has since continued with a team of 240 officers always out on the farms. Kumar explains how feed conversion ratio (FCR) is important for shrimp farmers, “Since shrimps have the lowest FCR, they need the least amount of feed per unit of body mass, and, hence, are most profitable for farmers. On an average, 1.5 kg of feed yields 1 kg of shrimp. Unlike fish, which come up and eat feed, shrimps eat at the bottom. Hence, the feed should also not disintegrate too early.”

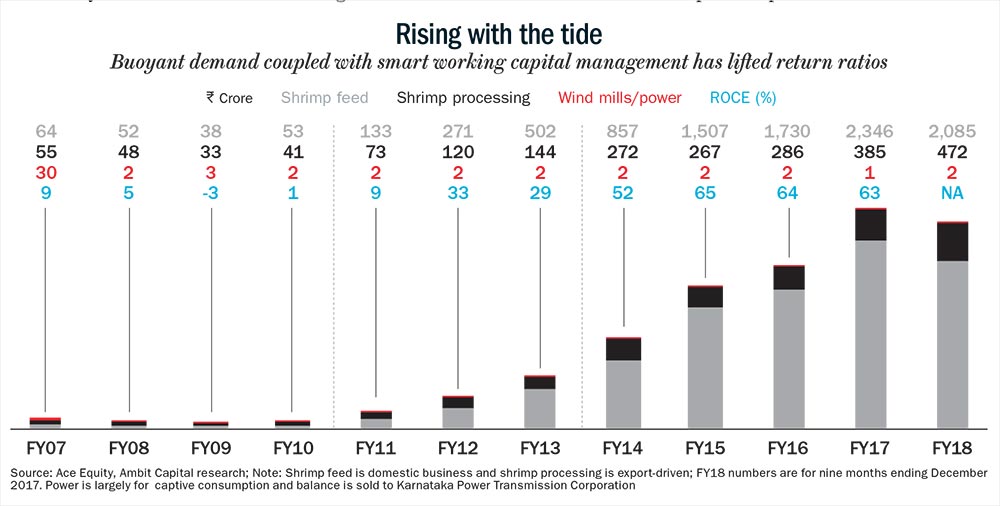

From a market share of just 7% in FY09, Avanti rode the boom in vannamei shrimp cultivation that saw India overtaking its South East Asian neighbours to emerge as the single largest shrimp supplier to the US. In a strategic move that was also a first in the domestic shrimp feed industry, Thai Union picked up a 15% stake in Avanti Feeds. “We knew that just as Thailand had gained from black tiger shrimp farming, a similar phenomenon would play out in India and since we were also strong in white shrimp feed formulation, joining hands made sense,” explains Wai Yat Paco Lee, Thai Union’s director on the board of Avanti Feeds. Thai Union’s bet did pay off as Avanti’s feed business just exploded from Rs.38 crore in FY09 to Rs.2,346 crore in FY17, growing at a CAGR of 58% and it continues to grow with revenue up 28% y-o-y to Rs.2,085 crore in the first nine months of FY18. Catering to over 13,000 shrimp farmers across the country, shrimp feed now accounts for 86% of Avanti’s revenue. Andhra remains the biggest market, contributing 50% to the feed business and is a state where Avanti reaches out to over 8,000 farmers. Mannamei is the company’s flagship brand bringing in 90% of the revenue, while brands, Titan and ProFeed, for black tiger shrimps account for the balance. The other big players in the market include the likes of Thailand-based CP Aquaculture, Waterbase, Cargill and the likes. The feed, which is a balanced mix of dried fish powder, de-oiled soya cake and white flour, is sold in 25-kg bags and currently retails at an average of Rs.80 per kg. While small farmers carry out aquaculture in less than 5 acres of land and account for a majority (75%) of Avanti’s revenue, the big farmers with over 100 acre-plus farms bring in the rest.

What has also made the growth enduring for Avanti is the shift from a credit-based system to a cash-based one. Prior to 2009, feed was sold on credit to dealers, who, in turn, would sell it to farmers on credit. But when exports fell post 2008, a lot of farmers struggled to pay their dues, thus increasing the pressure on Avanti’s working capital. “The idea to offer credit cost us dearly,” recalls Kumar. Today, the company sells feed to its 200-member strong dealer network, on a cash basis, in lieu of a 5% discount. Nearly 85% of the feed business is cash-driven and the rest is offered on credit to dealers but against some collateral or a trade deposit. The move fetched huge dividends: a negative working capital and improved profitability have bolstered Avanti’s return on capital employed from less than 1% in FY09 to 63% in FY17.

The company currently has five plants, four in west Godavari in Andhra Pradesh and one in Gujarat. Thai Union held over 9% stake in the Gujarat feed unit but post its amalgamation with Avanti Feeds in 2012, the stake went up to 25%. With the recent commissioning of a 175,000-tonne mill near Rajahmundry, Avanti’s total feed capacity has increased to 600,000 tonne per annum. Currently, the Rs.6,000-crore organised feed market has around 10 lakh tonne capacity and another 100,000 tonne capacity is in the pipeline. But there is competition from unexpected quarters. In 2016, the government-owned Central Institute of Brackishwater Aquaculture (CIBA) unveiled a new feed, Vannamei Plus, made out of locally available ingredients using indigenous technology. After successful trials in Gujarat, Andhra Pradesh and Kerala, where it received good harvest results, the institute is looking at bigger farmers making the switch. KK Vijayan, director of CIBA, believes the prices of branded feeds are on the higher side as companies have to incur marketing and distribution costs. “We have created a feed, which costs around Rs.55-60 per kg, depending on the fishmeal cost, with the same protein content. Since feed accounts for nearly 50-60% of the total production cost, our feed will mean huge savings for small farmers.” In Andhra, Karuna Raju, a farmer from Guntur district with 600 acres under Vannamei cultivation, invested Rs.1.5 crore to build a feed mill using CIBA’s technology to produce Vannamei Plus for his 50 hectares of shrimp farm. “Besides using it for captive consumption, we are also selling it to small farmers at Rs.60 a kg. With a production cost around Rs.55-56, it’s a decent 10% margin,” mentions Raju, who is planning to ramp up production to 4 tonne per hour from the current 2 tonne per hour by 2019.

As long as shrimp prices are above production costs, farmers make money. But if shrimp prices stay lower and feed prices go up, they will incur a loss. For now, Avanti Feeds is raking it in. As of 9MFY18, while the feeds business clocked revenue of Rs.2,085 crore, profit came in at a record Rs.493 crore against Rs.285 for the whole of FY17. In gross margin terms, that’s 23.64% — a record high in the history of the company. Though shrimp prices vary depending on season and demand, currently because of an extended winter season in the US, shrimp prices have fallen. The rates for 40/30 count shrimp are quoting at Rs.290/kg against Rs.400 last year and Rs.390 a kg against Rs.500 last year. The cost of production is currently hovering around Rs.200 per kg of shrimp. “In the current set-up, farmers are first in line to take a hit rather than the companies. If the cost of production increases and shrimp prices fall, the impact is much more severe on farmers than the companies,” points out Vijayan, who is seeing CIBA’s feed gain ground in Tamil Nadu, Kerala and Gujarat. Waterbase is also in talks with the institute to source the technology. Kumar though is not perturbed by the development. “Companies can influence dealers but it’s ultimately the customer who is making the final call. Pricing is not the issue. If the FCR is poor, then even if the price is low and the farmer has to double the feed for a similar output, so where’s the advantage? All shrimp feeds tend to have protein content of 36% and fat at 5%, but quality comes from the formulation as there are 15 different types of ingredients,” explains Kumar, adding that sustainable margins in the feed business always hover around 10-12%.

Given that the feed business is largely a domestic-focused one and accounts for a lion’s share of revenue, Avanti has to look beyond its core business to keep growing. Lee agrees. “Avanti already has a large market share in feed but to grow the business at the same rate as it did in the past is difficult. At best it can grow in line with the overall market, but the shrimp processing business will grow faster.” Echoing Lee’s views is Sumeet Nagar, who had invested in the stock five years ago after a year-long due diligence. “Globally, processing is twice that of the feed business. For Avanti, processing is just a fraction of its overall business and, hence, we believe it can be 10x bigger than what it is today,” says the co-founder of Malabar Investments.

Growth processor

While there is enough and more competition in the shrimp processing business with players such as Anjaneya Foods, Devi Sea Foods and the likes, Avanti has created a niche by piggybacking the heft of its Thai partner, one of the biggest seafood importers in the US. “We are not concerned about competition as we are not acting as partners but as a stakeholder in the business,” says Lee. In 2015, Avanti had carved out its frozen shrimp processing business as a separate entity in which Thai Union picked up 40% stake. “We are the biggest frozen seafood player in Thailand and one of the biggest internationally. Hence, we believe we can add more value to the processing business,” adds Lee.

From a turnover of less than Rs.50 crore in FY08, the shrimp processing business has grown to Rs.472 crore as of 9MFY18. Sensing the growing opportunity, Avanti has increased its processing capacity of 6,000 mtpa with a recently commissioned plant to 21,000 mtpa. Currently, at 14%, Avanti, which sources shrimp from 400 contract farmers, aims to increase the share of the processing business to 40% by FY22. “Shrimp being a commodity is prone to fluctuating prices, large end user customers such as restaurant groups, prefer to lock-in their prices for a whole year thus taking out the uncertainty factor. This is where different forms of contract farming will eventually evolve and companies such as Avanti can leverage their relationships with shrimp farmers to enter into contracts,” feels Ranjan. Currently, Avanti caters to leading restaurant chains such as Red Lobster Hospitality, Darden Restaurants and distributors in the US such as Arista Industries, aided by Chicken of the Sea, one of USA’s biggest importers owned by Thai Union. With over 15 prominent customers, the US accounts for over 65% of revenue, while European Union accounts for the rest.

It’s no small achievement that Avanti has got a foothold in a market where shrimp consumption has been growing rapidly over the past decade — Americans consume 4.4 lbs per person. Total US shrimp imports topped 664,000 metric tonne worth $6.54 billion in 2017, with India emerging as the biggest exporter at 213,956 tonne worth $2.17 billion. Since the past few years, India has maintained its lead over Thailand, once the US’ biggest source of shrimp before it was affected by a disease outbreak. Though Indonesia has emerged as the next big exporter, Nagar of Malabar believes that unlike India most South East Asian nations are limited by their geographies along the coast.

While the US remains the biggest market for Avanti, it has managed to break through in Japan, which has stringent quality norms. In the past, Indian consignments were rejected owing to ethoxyquin contamination as in Japan such residues cannot exceed 0.01 part per million in any shipment. “It took us over two years to win our customer’s confidence and we’ve earned their approval only recently. Out of a 100-point rating we scored 90,” reveals Kumar without naming the client. The order is for value-added shrimps such as Tempura and the likes. While shrimp processing fetches Avanti an average realisation of 8-10%, value-added products will ramp it up to 10-15%. Avanti is also looking at cultivating sea bass, a protein-rich fish that enjoys high demand both locally and overseas.

Though the US has raised anti-dumping duties on Indian shrimp from 0.84% to 2.34% and the EU has made inspection norms more stringent for aquaculture products sent from India, industry experts do not expect the move to derail India’s gravy train. “The duties will have minimal or no impact on shrimp exports to the US as long as they stay below 5%,” says Ranjan. The reason — the current shrimp price in the US is around $4-4.50 per pound (tail-on variety) and an increase to 2.34% won’t have a significant impact. Structurally, India remains a key market for the US and that is underscored by the recent deal between Andhra-based Sagar Grandhi Exports and Aqua Star, a top supplier of frozen seafood in North America. With a strategic partner, Avanti is already vertically integrated in the global supply chain and is now aiming to be a $1-billion company in three years — through both organic and inorganic means. On the possibility of acquisitions to boost its presence in the US, Kumar says, “We will look at what’s good for the company and that option is always open.”

Over the past decade, Avanti’s stock has seen a 72x jump from Rs.32 (2013) to Rs.2,310 (April 6) against an over 3x gain in the benchmark Sensex. Nagar though has used the euphoria to sell part of his holding. “While we believe the company has strong fundamentals, it’s still a cyclical business,” he avers. But the fact that promoters haven’t sold into the rally could be an indication that the best is yet to come.