In 2025, more than ever, Indian small businesses expect to grow following the downturn in 2021 during the Covid-19 pandemic. Many are increasingly focusing on expanding their sales overseas, according to a new survey by global accounting body CPA Australia.

However, the double-digit tariffs proposed by US president Donald Trump could have some sentimental impact, said Prafulla Chhajed, a member of CPA Australia in India and former President of the Institute of Chartered Accountants of India (ICAI), in an interview with Outlook Business.

President Trump, on April 2, unveiled a slew of tariffs on US trading partners, including India, which was hit with a 26% reciprocal tariff on top of a 10% universal tariff. CPA Australia is a leading professional accounting body that provides education, certification, and support to Certified Practising Accountants globally.

Chhajed noted that a combination of positive domestic factors—such as enhanced internet connectivity and supportive government policies in finance and digitalisation—has created a favourable environment for small businesses to thrive.

But the major driving force, according to him, is a "sentimental shift" present across the board. "It (tariff) is there in everybody’s mind, whether it’s a small business or a large one."

"Everybody's really looking at their cash flows, their planning, and all those things—especially if they are in export- or import-oriented industries," Chhajed said.

Micro, Small and Medium Enterprises (MSMEs), which contribute around 30% to India's economic growth, are expected to be “more vulnerable” to tariffs than large corporations, according to an India Ratings report dated 29 April. The credit ratings agency noted that because small businesses tend to face more working capital constraints than large corporations, any slowdown in demand could have a disproportionate impact.

For now, India and most US trading partners are dealing with only the 10% universal tariffs. The Trump administration has paused the implementation of higher reciprocal tariffs announced on April 2 for 90 days and has delayed the 25% auto tariffs. However, China continues to face triple-digit import duties from the US.

Indian Small Businesses’ Big Foreign Dream

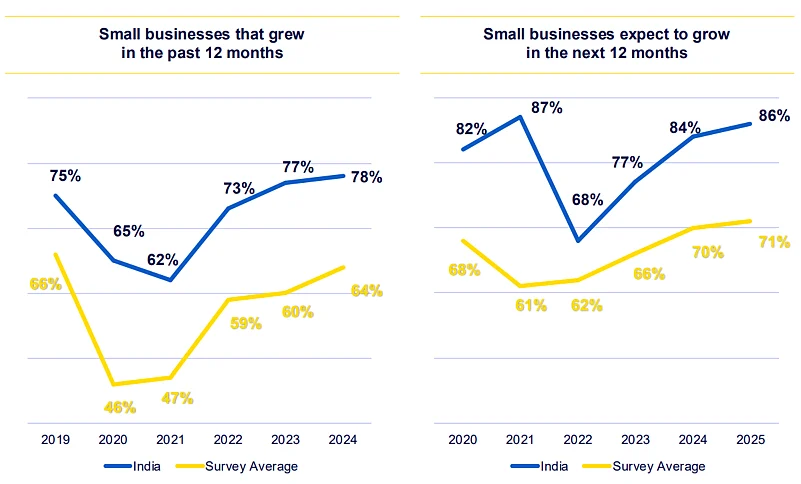

CPA Australia’s 2025 study found that 78% of the small businesses it surveyed had grown last year, and 86% expect to grow further in the next 12 months. This forecast is the highest since the 2021 growth outlook, the accounting body’s study shows.

For the 2025 study, CPA surveyed 507 small businesses across Delhi, Mumbai, Chennai, Bengaluru, and Hyderabad. The sample represented a mix of sectors, including manufacturing (12%), information/media/telecommunications (12%), retail trade (11%), and education and training (10%).

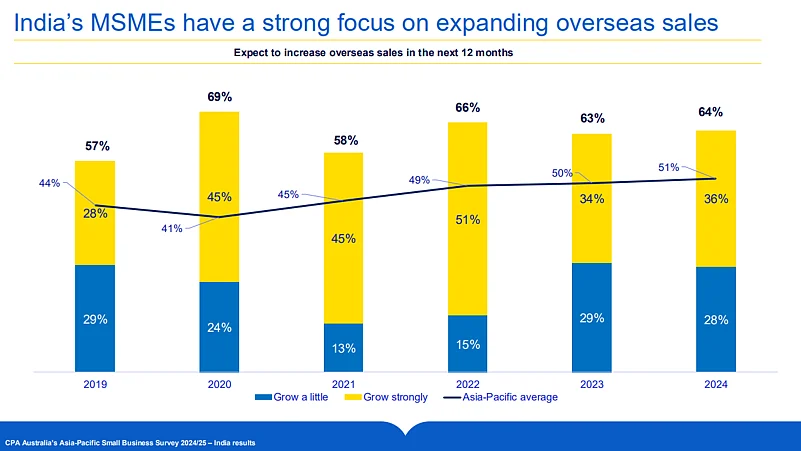

The respondents were also highly optimistic about their overseas sales this year, with 64% expecting an increase.

“Booming global demand for Indian products and services has further buoyed MSMEs, encouraging many to export for higher profits. government schemes offering financial incentives and export support have also motivated more MSMEs to expand their international presence,” said Chhajed.

High Input Costs Continue to Weigh Heavily

The survey also highlighted that rising costs remain the biggest challenge for small businesses.

Last year, 40% of respondents identified increasing expenses for raw materials as their primary challenge, followed by staffing costs, taxes, rent, and utility bills as key pressure points.

Reflecting this burden, among the 72% of businesses that sought external funds in 2024, 34% cited rising costs as the main reason for needing finance, the study found.

Despite these challenges, access to finance remains relatively favourable. Of those seeking external funding in 2024, 43% reported that obtaining finance was easy or very easy. This trend is expected to continue in 2025, with 39% anticipating smooth access to finance, according to the survey.

“The government is focused on improving financial inclusion to help scale up MSMEs, with various schemes offering financial support,” said Chhajed. He pointed to the recent revisions in MSME classification criteria announced in the Budget 2025–26 by Finance Minister Nirmala Sitharaman.

“Small businesses should take note of the significant changes to turnover and investment thresholds under the revised classification. These include increased limits and additional financial support, which should enable more enterprises to access concessional loans, collateral-free loans, and other state-backed schemes more easily,” he said.

At an Outlook event on 11 March, Union Minister of Micro, Small, and Medium Enterprises Jitan Ram Manjhi said his department had provided loan guarantees worth Rs 8.34 lakh crore for MSMEs under the Credit Guarantee Trust for Micro and Small Enterprises (CGTMSE) scheme. This programme offers a guarantee cover of up to 85% for loans up to Rs 5 lakh, and up to 75% for loans between Rs 5 lakh and Rs 5 crore.

According to the survey, in 2024 the primary source of external funding for Indian small businesses was banks, accounting for 38% of total financing. This was followed by support from friends or family (15%) and investors (12%). Personal resources contributed 9%, while venture capital or angel investment made up 7%. Government grants or funds and non-bank financial institutions each accounted for 6%, with the remaining 7% coming from other sources.