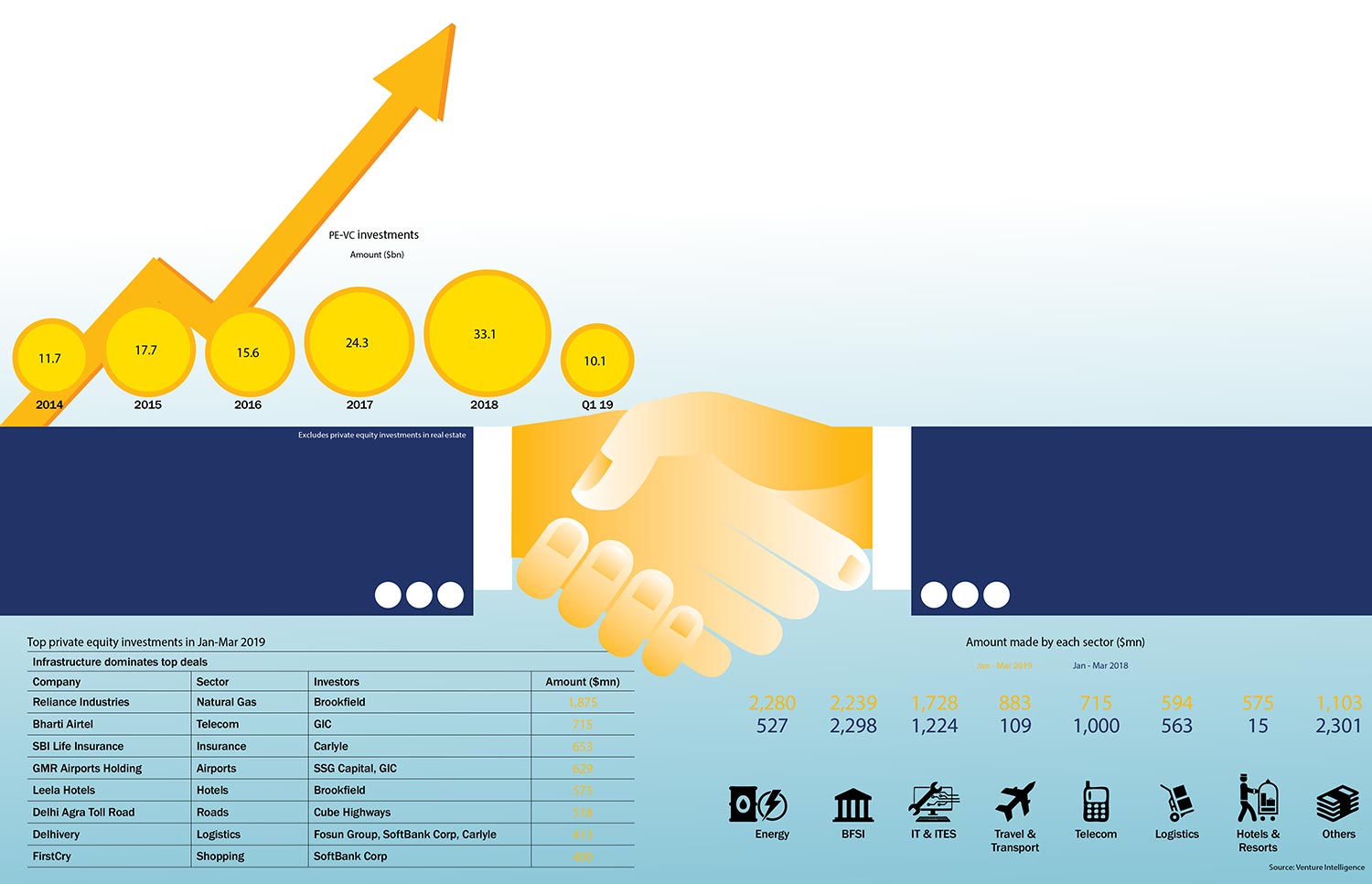

The rush of private equity (PE) seen last year has not slowed down in the current calendar year. PE investments in the country had already hit a record high of $33.1 billion in 2018 across 720 transactions, according to data from Venture Intelligence. In fact, the inflows in CY18 had surpassed the $24.3 billion high of CY17 in its first nine months! The mega investments in consumer internet and mobile start-ups such as Swiggy and BYJU'S towards the year-end, catapulted CY18 flows by 36% year-on-year.

Building on the momentum, PE and venture capital firms invested a record $10.1 billion (across 159 deals) for the quarter ended March 2019. The investment value increased 26% compared with $8 billion (across 208 transactions) recorded in Q1 of CY18 and 39% higher than the immediate previous quarter (Q4CY18), which had witnessed $7.3 billion being invested across 178 transactions. The latest quarter witnessed 23 PE investments worth $100 million-plus with six deals above the $500 million range compared with 17 such deals seen in the same period last year.

Infrastructure related companies accounted for 48% of the investment value during the March 2019 quarter accounting for $4.9 billion. The largest investment was from Canadian asset management firm Brookfield's, following its $1.8 billion acquisition of Reliance Industries’ 1,400 km natural gas pipeline infrastructure from Kakinada to Bharuch. The second largest investment was the $715 million investment by Singapore sovereign wealth fund, GIC, in mobile services company Bharti Airtel. Among other top investments, global tech investor SoftBank invested in e-commerce focused logistics firm Delhivery and omni-channel baby products retailer FirstCry. The financial services vertical was the second-most favoured destination for PE investors in Q1FY19, attracting $2.2 billion across 20 PE investments. Among the top investments in the sector was Carlyle's acquisition of a 9% stake in SBI Life Insurance for $653 million.

The fact that CY19 is an election year does not seem to rankle foreign investors who are also pumping in money in the public markets as well. Clearly, the India Growth story continues to mesmerise investors and it is evident from the fact that inflows in 2013, a year before elections, had fallen 39% to $3 billion. But over, the subsequent five years, the numbers have just hit the roof. This is one true piece of statistic that PM Modi can talk about in his pre-poll blitzkrieg, but whether it will fetch him dividends at the hustings is a different story.