A fascinating new book titled Reimagining India: Unlocking the Potential of Asia’s Next Superpower by Clay Chandler and Adil Zainulbhai of McKinsey & Company features an essay titled ‘Butter Chicken at Birla’, written by Aditya Birla Group chairman, Kumar Mangalam Birla. He recounts the story of how his group adapted with the times:

When I took over the company in 1996 at age twenty-nine, after the sudden death of my father, no meat was cooked in Birla cafeterias, no wine or whiskey was served at company functions. Seven years later, we bought a small copper mine in Australia. The deal wasn’t a huge one, worth only about $12.5 million, but it presented me with a unique challenge of the sort I had not yet faced as chairman. Our newest employees were understandably worried about how life might change under Indian ownership. Would they have to give up their Foster’s and barbecues at company events? Of course not, we assured them.

But then several of my Indian managers asked me why they should have to go meatless at parties if employees abroad did not. At Marwari business houses, including Birla, the top ranks of executives traditionally have been filled with other Marwaris. I had introduced some managers from other firms and communities, and they had raised a valid point. I was genuinely flustered. My lieutenants were relentless — I had never faced a situation where my own people felt so strongly about something. Yet, at the same time, I knew vegetarianism was a part of our values as a family and as a company — a core belief! I had broken a lot of family norms, but I thought this one was going to be multi-dimensionally disastrous for me.

Fortunately, my grandparents merely laughed when I approached them with my dilemma: They understood better that our company had to change with the times.

He goes on to detail how his group has become one of India’s “most globalised conglomerates with operations in thirty-six countries on five continents, employing 136,000 people”.

Since I took over as chairman, we’ve made a dozen acquisitions overseas, worth a total of more than $8 billion, in sectors as varied as mining, pulp, aluminium and insurance. We’ve branched out into Australia, America, Canada, and Europe.

We have expanded internationally for many reasons — sometimes to spread our bets, sometimes because we found it impossible to open a plant in India as fast and as cheaply as we could abroad. In each case, we’ve made our decision based on whether or not the deal would increase shareholder value.” (Emphasis mine)

Let’s look at the largest of those dozen acquisitions and see what impact it has had on shareholder value. This was the February 2007 buyout of aluminium giant Novelis, which, Birla writes, “made us the biggest producer of rolled aluminium in the world.” Hindalco was indeed on a ‘roll’ in early 2007. After all, the company would soon deliver its highest annual EBITDA of more than a billion dollars on its highest annual revenue of $4.5 billion. The company’s superb profitability — pretax ROE would be 40% in FY07 — was largely a function of the company’s well-deserved reputation as one of the world’s lowest cost producers of aluminium.

Nevertheless, the price tag of $6 billion was a very large sum of money for the acquisition, given that Hindalco’s market cap just before it swallowed Novelis was $4.5 billion spread over 1.2 billion shares. And what is Hindalco’s market cap now? $4.4 billion spread over 2.1 billion shares.

Price is what you pay, value is what you get

We know Hindalco paid $6 billion for the acquisition (I will qualify this later). What did it get in return? I obtained the quarterly and annual filings made by Novelis with SEC and the picture — you guessed it — does not look pretty. The deal was closed on May 15 2007. From May 16 2007 to March 31 2013, Novelis reported pretax losses aggregating to $2.8 billion. Revenues over the same period totaled $53 billion. Seems like Novelis turned out to be a lemon, right?

But was it a lemon before the acquisition as well? Let’s see. SEC filings by the company show that from January 2004 to May 15 2007 (just before the company was acquired), pre-tax earnings totalled to a minuscule $27 million on aggregate revenues of $30 billion.

Novelis was a lemon before the acquisition and it remained a lemon afterwards as well. It is not surprising that just when Birla was gushing all over the media about the wonderful acquisition he had just finalised, Ed Blechschmidt, the then CEO of Novelis, had this to say about the very same deal: “After careful consideration, the Board has unanimously agreed that this transaction with Hindalco delivers outstanding value to Novelis shareholders”.

How can outstanding value for a seller be outstanding value for the buyer at the same time? Clearly, one of them was going to be wrong. And now we know who that has turned out to be. That this acquisition turned out to be disaster for Hindalco’s shareholders can also be understood in another way, by thinking about the opportunity cost of the alternate use of $6 billion that Hindalco blew up on the acquisition.

Imagine for a moment that Hindalco had $6 billion of its own money on its balance sheet before the acquisition. Imagine that the annual interest rate on fixed deposits were just 6%. How much money would Hindalco have earned by not buying Novelis and by putting the money at 6% a year in a fixed deposit instead? That number — the opportunity cost of this acquisition — comes to a staggering $360 million a year.

In other words, the target company should have delivered pre-tax earnings of at least $360 million a year for every year after the acquisition. That translates into $986,301 every day or an aggregate of $1.8 billion from the date of acquisition till March 31 2013.

Even if Novelis had miraculously accomplished that feat, this would still have been labelled as a mediocre deal. Instead, the company lost $2.8 billion. The situation has worsened for two reasons: first, Hindalco did not have $6 billion of its own money to buy Novelis — about $5.5 billion of the purchase price was financed with borrowed money. What did this massive borrowing (and additional borrowing for other expansion projects) do to the consolidated financial condition of Hindalco? You can gauge that by looking at the following numbers, which portray the before and after pictures:

• Hindalco before Novelis acquisition (FY07) — operating cash flow: $924 mn, interest paid: $149 mn

•Hindalco after Novelis acquisition (FY13) — operating cash flow: $796 mn, interest paid: $677 mn

That brings me to the second reason why the deal is even worse than it appears, which is: the above horror show is after considering the fact that Hindalco raised fresh equity capital post-acquisition, primarily to de-leverage its balance sheet. Had that not happened, Hindalco would have been in a precarious condition today.

For existing stockholders, the dilution from this new equity injection also increased the cost of the Novelis acquisition. Many analysts don’t get this point, but it remains fundamentally important to understand the economics of this deal. After the acquisition, Hindalco raised $680 million of equity capital in FY08, $650 million in FY09 and $367 million in FY10.

A very large part of this $1.7 billion infusion of equity capital was to restore balance sheet strength after Hindalco acquired Novelis mostly with borrowed money. So, to correctly analyse the true cost of Hindalco’s acquisition of Novelis, one must not just focus on what was paid, but also add the amount of value given away to new shareholders for capital raised to effectively finance the acquisition. Warren Buffett explained this beautifully in his 1982 letter:

In a trade, what you are giving is just as important as what you are getting. This remains true even when the final tally on what is being given is delayed. Subsequent sales of common stock or convertible issues, either to complete the financing for a deal or to restore balance sheet strength, must be fully counted in evaluating the fundamental mathematics of the original acquisition. (If corporate pregnancy is going to be the consequence of corporate mating, the time to face that fact is before the moment of ecstasy.)

While it’s true that some of this money was raised through a rights issue and so the dilution factor is not relevant if everyone subscribed for his or her entitlement, the fact remains that the true cost of the Novelis acquisition to Hindalco’s shareholders was higher that the $6 billion price tag.

Investors poured new money to pay for an acquisition and have nothing to show for it in incremental market value. So, no matter how one looks at it, my conclusion is that this deal was a lemon, not butter chicken. (Apologies to vegetarian readers, just making a point here).

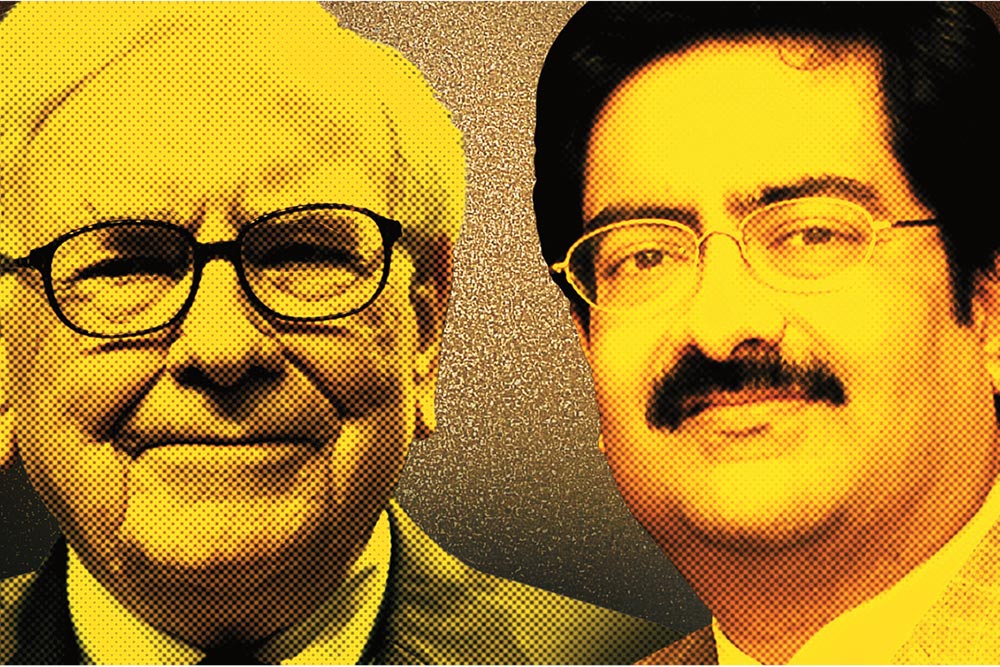

Birla V/s Buffett

The funny thing is that if you go back to the time of the acquisition and look at the press releases, media interviews and letters written by Birla to Hindalco’s shareholders justifying the acquisition, there is little mention of concepts like profitability, opportunity cost and per-share intrinsic business value. Instead, I found words like big, expand, global and vision. Here’s a sample:

The acquisition of Novelis is a landmark transaction for Hindalco and our Group. It is in line with our long-term strategies of expanding our global presence across our various businesses and is consistent with our vision of taking India to the world. The combination of Hindalco and Novelis will establish a global integrated aluminium producer with low-cost alumina and aluminium production facilities combined with high-end aluminium rolled product capabilities. The complementary expertise of both these companies will create and provide a strong platform for sustainable growth and ongoing success.

Hindalco is offering $44.93 a share, amounting to ₹26,400 crore once Novelis’ debt of $2.4 billion is included in the transaction value. The per-share price is nearly a 17% premium to where Novelis’ shares were trading on Friday. Novelis shares have more than doubled in the past year after touching a 12-month low of $17.89 a share last February. “When you are acquiring a world leader, you will have to pay a premium. This is something reasonable,” said Kumar Mangalam Birla, chairman of the Aditya Birla Group, whose flagship company is Hindalco.

I am indeed delighted to share with you that Hindalco today, with the acquisition of Novelis, has become a truly global corporation. It ranks among the top five of the world’s aluminium majors. With a combined turnover of US $14 billion, your company is already in the League of the Fortune 500. Collectively, your company and its subsidiary Novelis boast of over 33 plants spanning 13 countries and anchored by a 32,000 workforce belonging to over 15 nationalities.

With its value-added products and as a global leader, Novelis makes a perfect fit for Hindalco. The acquisition is also the key to fulfilling our global aspirations. It is in line with our long-term strategy of expanding our global presence across our various businesses.

I do realise that in the short term, it does cause a strain on your company’s balance sheet. However, if you look at the bigger picture, this is one of the most striking acquisitions and over the long term will undeniably create enormous shareholder value. I look forward to your support and understanding on this acquisition.

With Novelis we have added several Hindalcos in size at one go. The expansions at Hindalco means that we would add about 50% of the Hindalco-Novelis combine in the next 3-4 years. I believe Hindalco has never had headier times than today.

Now, contrast that with the words of Warren Buffett, who is regarded as one of the world’s best acquirers

of businesses.

A managerial ‘wish list’ will not be filled at shareholder expense. We will not purchase entire businesses at control prices that ignore long-term economic consequences to our shareholders.

Leaders, business or otherwise, seldom are deficient in animal spirits and often relish increased activity and challenge. At Berkshire, the corporate pulse never beats faster than when an acquisition is in prospect.

We use debt sparingly and when we do borrow, we attempt to structure our loans on a long-term fixed-rate basis. We will reject interesting opportunities rather than over-leverage our balance sheet.

Many years ago, I read a wonderful quote from an excellent book that I wish Birla had read before he completed the Novelis deal.

The objective of our company is to increase the intrinsic value of our equity shares. We are not in business to grow bigger for the sake of size, nor to become more diversified, nor to make the most or the best of anything, nor to provide jobs, have the most modern plants, the happiest customers, lead in new product development, or achieve any other status which has no relation to the economic use of capital. Any or all of these may be, from time to time, a means to our objective, but means and ends must never be confused. We are in the business solely to improve the inherent value of the equity shareholders’ equity in the company.

Had Birla read, understood, internalised and followed this advice and that of Buffett, I doubt that Hindalco’s minority shareholders would have been stuck with a lemon today (tequila not included).

Note: I have no position in Hindalco’s stock or any of its derivatives