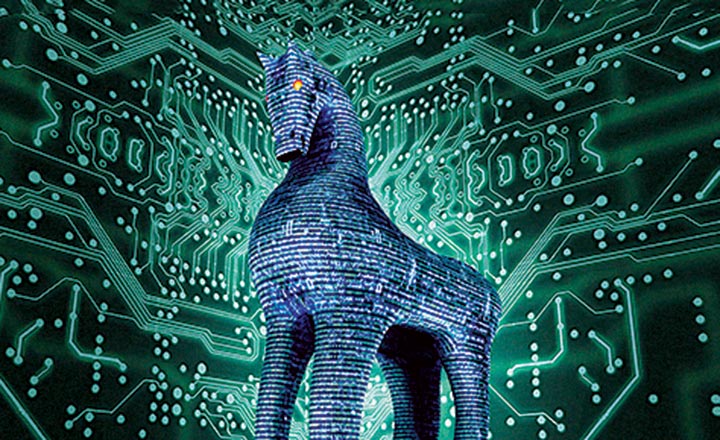

The adage “Beware of Greeks bearing gifts” is normally used to refer to an act or event that masks a hidden destructive agenda or force. The phrase originates from Greek mythology, specifically the ending of the Trojan War, when the Greeks and Trojans had fought to a standstill.

The Greeks were camped outside the walls of Troy but their attempts to breach the city by force had been fruitless during a 10-year siege. In a fit of desperation, the Greeks changed tack and devised the idea of constructing a large wooden horse to pose as a peace offering to the Trojans. When this wooden horse was left at the gates of Troy, the Trojans believed the Greeks had left it as a pious act of surrender. Welcoming the gift, the Trojans opened their gates and wheeled the horse within their walls, which was a calamitous error. The belly of the “animal” was filled with armed soldiers who now within the city walls would soon destroy Troy and allow the Greeks to claim victory.

The Trojans had taken the innocuous looking horse at face value. It looked harmless, so they lowered their physical and behavioral defenses that had withstood the Greeks for years. When faced with overt danger they had repelled the Greeks, but when faced with what looked to be an act of surrender, their appreciation of the risks that lay ahead failed them.

The paradox of risk

Investors aiming to generate long-term capital gains from equities face a similar situation to the Trojans. Perception and reality with regards to the face value of the risks that they face are not necessarily the same. The basic premise for generating good returns is to buy an asset at a low price, and sell it at a high price. This would appear to be a relatively simple task yet it is not easy. This is because of the paradox of risk – the conditions that bring about both low and high asset prices are contradictory to the prevailing mood and investment outlook. When assets are at a low price and give the prospect of capital gains, the environment is often characterized by poor economic conditions, fear and risk aversion. Paradoxically, optimism is the breeding ground for increased investment risk. After a period of significant capital gains, and when market participants are confident in the future prospects for equity markets the risk of capital loss is often high. The stock market is the only market in the world where people will “run away” from it when it is on sale and buy more from it when the goods are expensive.

This is not how we shop when buying goods and services in our daily lives, so why do investors fail to heed this paradox? There are two main reasons which both lie with the mental short cuts or heuristics that we have used to survive and adapt in a complex and uncertain world.

The first is that humans have a tendency to extrapolate present conditions into the future. The thinking goes, if it is warm and sunny today, it will be the same in the future. Investment markets though have proved to be “seasonal” throughout their history with bouts of long glorious summers, and harsh cold winters in price terms. What we experience today is not necessarily the same conditions that we will face in the future.

Contextualizing the perils of investing in emerging markets

The overall economic and business environment most economies are experiencing today is favorable. The global economy has responded to coordinated action by central banks. Historically low interest rates have given individuals and corporations the confidence to engage in new activity. Strong business conditions have been accompanied by re-ratings of some stocks to new all-time highs in terms of the multiple of book value at which stocks trade.

Historically, investors in the market have also paid significantly lower multiples at times when economic conditions and profits have been less strong. There is a cyclical element to the requirement for semiconductors despite a long-term trend of increasing demand. It is this willingness of some market participants to pay a high multiple for future cash flow or asset value on cyclically strong profits that sows the potential seeds for the risk of capital loss.

We believe the high multiple is a “Trojan Horse.” It looks innocuous, but its occurrence at a time of high profits magnifies the risks of holding the equity and the potential for future capital loss.

The second factor is that humans are inherently social animals. Our predecessors were required to hunt in packs to ensure their survival and this is deeply ingrained within our collective psyche. To that end the market and business leaders often behave in a way that demonstrates that it is better to fail conventionally than to differ from the crowd.

To act upon the paradox of risk in investment terms, means at times differing from the crowd and facing the risk of failing unconventionally. The price of an asset in a marketplace is a simple function of supply and demand. When buying at a low price it is when the selling pressure is high, and when selling at a high price it is when the demand is high.

Investment risk ≠ volatility

The majority of investment industry literature and communication of risk revolves around considering risk as the volatility associated with the returns of an investment relative to a benchmark. It utilizes the “Greeks” to numerically convey this volatility, such as Alpha (the relative outperformance versus a benchmark after adjusting for the level of risk taken) and beta (the correlation in movement of an asset to a benchmark). This may allow a comparison of portfolio managers and their respective funds in a quantitative measure, but in many ways it can lead to suboptimal returns. When seen within the context of the paradox of risk, volatility or sharp changes in the price of an asset are not necessarily a bad thing. Volatility creates conditions to buy assets at a lower price and potentially sell them at a higher price. It is something that investors should harness and not fear. It does, however, require a long-term time horizon because one has to have the ability to look through and wait for the changes in any given environment.

Conclusion

The world has changed significantly since the time that the Greek mythic tale of The Trojan Horse was written. We live in a world where we are bombarded with data and news that are all designed to feed us with more information. This is intended to create knowledge and ultimately better outcomes. It is important, however, to step back and understand that simple and effective investment insight can be created by considering the powerful and timeless forces that drive human behavior, markets and asset prices.

We believe that through a focus on considering “the Greeks” as a proxy for risk, a significant proportion of investment industry analysis and focus is too short term. It prioritizes trying to understand and quantify the reason for the volatility and its impact on short-term returns, rather than characterizing the overall attractiveness of an asset price or asset class as one looks to the future. The true risk is that a number, a quantitative measure or even a wooden horse may not turn out to be what it initially seemed. The Trojans may have not learned this lesson, but it does not mean that we need suffer their fate.