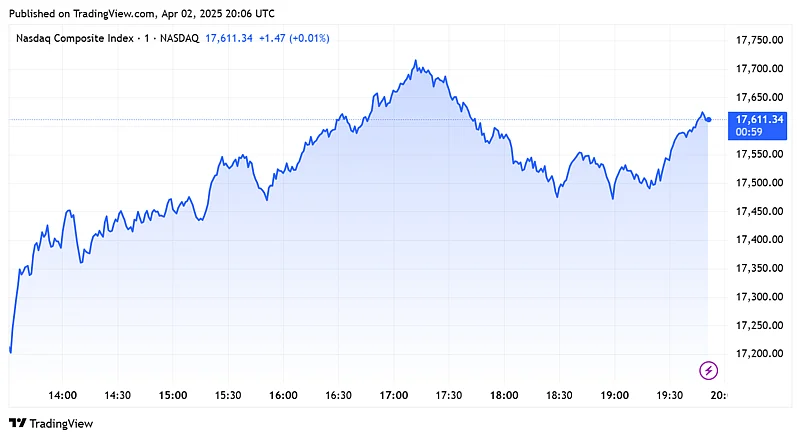

Trump Tariffs: Ahead of Trump's tariff announcement, the US market remained cautiously optimistic. The S&P 500 index was up by over 0.6% or 34 points. Dow Jones followed a similar trajectory and surged by over 260 points or 0.62%. Tech-heavy index, Nasdaq surged by nearly a per cent and was trading around 17,600 level mark.

Trump is all set to announce the imposition of reciprocal tariffs tonight. Investors and policymakers, globally, are now all focused on how these tariffs will be implemented.

As per a report by Emkay Global, the imposition of these tariffs might take a complicated turn. "It must be noted that imposing reciprocal tariffs at an individual commodity level (13,000 items) on nearly 200 countries, would entail managing 2.6 million individual tariff rates, without accounting for exemptions and exceptions – a vast undertaking. This makes it likely that any tariffs, if imposed, will be broad-based," the report read.

How Indian markets might react?

Analysts believe that domestic markets might take a hit from protectionist US policies, as they fuel global risk aversion sentiment. This could prompt foreign portfolio investors (FPIs) to cut exposure to emerging markets, stirring up volatility.

"If tariffs target key sectors like IT or pharmaceuticals, Indian companies with significant US revenue could face headwinds. However, if tariffs mainly focus on China, Indian exporters might benefit from some trade diversion," said Narinder Wadhwa, managing director and CEO of SKI Capital Services Ltd.

While external factors may pressure markets, strong domestic inflows (SIP and DII investments) and economic recovery trends could cushion the downside, Wadhwa added.

Investors should monitor tariff details—whether they are broader (affecting multiple countries) or specifically target China, as per analysts. They believe that defensive sectors like FMCG and domestic-focused stocks might offer relative stability in India. On the other hand, a sharp reaction in US markets could put pressure on Indian IT and export-driven stocks.