November 2011 survey by real estate analytics provider and research agency PropEquity covered 8,200 ongoing residential projects in 10 Indian markets and found 67% of them behind schedule with an average delay of almost nine months. In markets such as Hyderabad, Gurgaon and Ghaziabad, up to 76% projects witnessed execution delays ranging between nine and 11 months. Mumbai and Navi Mumbai, one of the biggest macro markets with close to 2,500 projects between them, have up to 60% buildings behind schedule by around nine months. Unnervingly, this chasm between the commitments made and their actual delivery is only expected to grow manifold in the coming years. And despite their dubious track record on the delivery front, developers across markets are sitting on all-time high delivery commitments from 2012-14.

For instance, Gurgaon is an important micro-market in the National Capital Region (NCR). Between 2008 and 2010, a PropEquity study found that 18,162 residential units were completed or scheduled-for-completion in Gurgaon — all of them already sold off to buyers. In the next three years (2012-14), the cumulative delivery commitment of developers in Gurgaon alone is 92,483 units — an over four-fold jump. “Successful execution of these projects by developers with insufficient experience and dismal delivery track record is impossible,” says Samir Jasuja, founder and CEO, PropEquity.

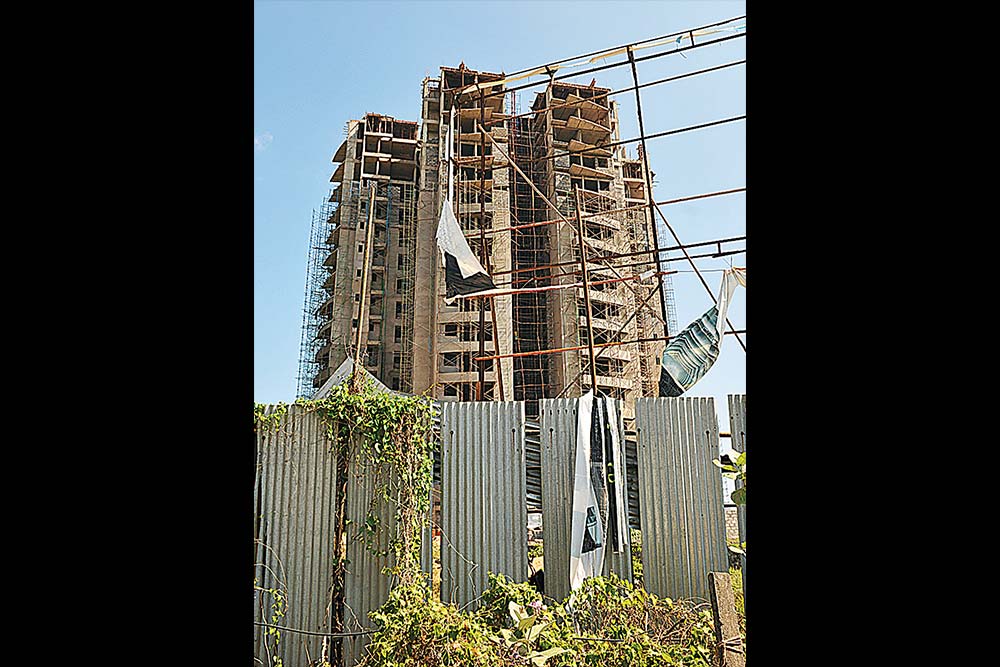

Outlook Business decided to do a sample on-ground check of seven project sites in Mumbai, Chennai and the NCR. Here’s a synopsis of what we found:

National Capital Region (Gurgaon, Faridabad, Greater Noida)

Greater Noida, now famous for its F1 track, was already well-known for its planned urban layout, modern expressway and clusters of residential and commercial complexes in sectors. Jaypee Greens’ Moon Court is coming up at one end of the golf course, just next to Pari Chowk at the entrance to Greater Noida. “Moon Court? Great choice, selling very well,” hollers a property dealer in Greater Noida over the phone, and adds, “Delivery in the next six months.”

A visitor might expect to see almost-ready towers with landscaping and interiors in progress but beyond the guard-manned gates and the ornate fountains, civil construction is underway at full flow in the five 15-19 storey towers, all of them in different stages of construction. “There have been a lot of payment delays for sub-contractors in this project,” says an on-site source.

A pall of dust hangs over the air as helmeted workers bustle about, trucks wait to be unloaded and massive cranes port bundles of steel. A friendly labour contractor lets the cat out of the bag. “It will take at least another one-and-a-half years [for the apartments] to become possession-ready,” he says.

Jaypee started marketing and selling this ambitious project of two- and three-bedroom luxury apartments in 2008. The company claims to have sold off 270 of the 275 units in the Moon Court project and says all of them should be ready for possession by the end of 2012. “Go for Sun Court, another adjoining project,” says another property dealer in all earnestness. “It will be delivered this year on time.”

On the 90-m wide peripheral road connecting the Golf Course Road to the Sohna Road in Gurgaon’s Sector 66 lies Emaar MGF’s Palm Drive, a project with 1,200 units as a mix of high-rise apartments, villas and penthouses. “It got sold out early perhaps because of its proximity to the international airport 20 km away,” says a dealer. Palm Drive was supposed to be completed in September 2010. However, a site visit reveals that only the bare structure has been built for all the 13 towers. Construction for villas and low-rise apartments, which are part of the project, started only in June 2011, almost four years after bookings opened.

An online group of 220 Palm Drive home-owners has been active since 2009. “The company is non-committal to any date for the handover of the apartments,” says Kamal Abrol, a member and owner of a 2,125 sq ft apartment he booked in September 2007.

A few kilometres away, at Gurgaon’s sectors 86, 90 and 91 — plugged as ‘new Gurgaon’ — construction activity is now in full swing at DLF New Town Heights, a project launched in February 2008. Almost all of its 4,000-odd units have been sold out. The original completion schedule for the first phase of the project was February 2011. In fact, project construction has picked up speed only in the last one year. Several bare, high-rise structures stand ready, but work on the interiors and landscaping is yet to start. Construction workers on the site expect at least a year’s labour ahead of them for the apartments to become possession-worthy.

What galls many of the buyers is the high-handedness of the developer when it comes to paying compensation for the delay, which as such adds up to only about ₹10 per sq ft and is payable at the discretion of the developer. Also, “DLF can choose not to pay this penalty if we delay our dues by even two days,” says a buyer. In most cases, the developer refuses to adjust the penalty compensation against future payments by the buyer. Moreover, the penalty levied on home-owners for any delay in payment is much stiffer — they have to shell out 15% of the instalment. “On one hand, I am paying banks an interest charge of 11-12% per annum for my mortgage but for the delay in delivery, I only get 3% per annum as compensation from the developer,” laments another buyer.

In another corner of the NCR, at the industrial township of Faridabad, BPTP’s Princess Park project was among the first mid-income affordable group housing sites in the locality popularly known as Nahar Paar. Launched towards end-2005/early-2006, Princess Park was BPTP’s flagship project with price tags of between ₹25 lakh and ₹50 lakh for two- and three-bedroom apartments. Spread over 18 acres, the project houses 1,000-odd apartments across 12 towers with 14 to 19 floors each.

Delivery was promised in 2009. But in January 2012, only three of the 12 towers were almost ready for possession; a fourth had “a couple of months to go,” said a worker at the site. Another batch of three or four towers should be ready over the next six months. Home-owners say the company has informed them privately that it will start issuing possession letters in February. But the wariness in Pankaj Rawat’s voice is stark. Rawat booked a three-bedroom apartment at Princess Park in 2007 and he says bleakly, “Three of those towers have been ‘almost ready’ for the last two years.”

Most home-owners have seen the super built-up areas of their apartments go up by up to 30% in the last three years. So, the home-owner with a 1,000 sq ft apartment ended up paying for 1,300 sq ft as the super built-up area increased along with a larger common area. Rawat’s home is likely to come at a price of

₹38 lakh, as against the ₹32 lakh he had budgeted at the time of booking in 2007.

—Shabana Hussain and Sudipto Dey

Chennai

There is nothing old about Old Mahabalipuram Road. The 20.1-km, six-lane IT expressway has the Chennai address of nearly every big name in the IT industry. Their advent forever changed the face of the road and turned the vast, mostly arid expanses of its surroundings into hunting grounds for great real estate deals. The slowdown of 2008 rationalised prices, panicking developers and owners alike, leaving OMR’s realty lurching somewhere between heady development and abject dismay. Jain Housing’s Inseli Park is one such time-warped project on OMR’s Padur stretch.

Slated to start in March 2007, delivery was promised in December 2009. However, till June 2010, the developer waited for permission to raise 18 floors (as opposed to the original 12). “Jain Housing procrastinated with reasons such as non-availability of building materials, rains, floods and non-payment of instalments by some purchasers,” says N Umashankar, president of the Inseli Park Owners Association. Home buyers at Inseli Park say the reasons for the delay are Jain Housing’s long wait for extended approvals, lack of marketing, and their inability to manage a project of this magnitude.

Most owners have paid sums of ₹20-50 lakh. Some owners, who have an arrangement with ICICI Bank and have paid the entire cost of their flats, are shelling out EMIs plus rentals on their existing accommodation. “The interest loss is to the order of 13% per annum but in reality our loss is immeasurable,” says a house owner.

Three kilometres away from Inseli Park, DLF’s Garden City languishes. When it was first launched in Chennai in January 2008, this project was much sought after — the Garden City, spread over 58.5 acres with 21 blocks having 19 floors each, was the realty major’s first project in Chennai. “We blindly went with DLF because of the strong brand value it has in the north,” says a home-owner.

If delays over the lack of approvals weren’t enough, there is also the unresolved question of a 5-acre forest owned by an individual within the project area. “Initially, the forest area was marketed as if it was part of Garden City, which was misleading,” says one resident who pulled out over these concerns. He was not alone. A large chunk of homebuyers opted out in February 2009. Their numbers vary from 550 to 750 (depending on who we asked) but the controversy forced DLF to refund the full booking amount and reduce prices at which it was offering the apartments by 11-18%. Even now, the site is under dispute and awaits settlement in court.

Garden City was to be ready for occupation in June 2011 and is running way behind schedule. Only two towers seem closer to completion; the rest are a long way from it. “We are already in February 2012 and there are still no signs of completion, nor any communication from their [DLF’s] end,” says a home-owner.

The loss is more than just financial. Apart from interest payments (which are substantial given that flats cost from ₹50 lakh to ₹80 lakh) and rent, based on the June 2011 delivery date, some home-owners took admission for their children in the PSBB Millennium School here, which was part of the project. The children are now doing painfully long commutes to the school and back from the city.

Mumbai-based research and consultancy firm Liases Foras has found that of the 2,080-odd residential projects launched in Chennai since 2008, around 43% are delayed by six to 24 months. In around 20 of these projects, the deferred dates of possession ranges anywhere between two and three years.

—Lalitha Sridhar and Kripa Mahalingam

Mumbai Metropolitan Region

The Mumbai Metropolitan Region is not only one of the largest and the most expensive property markets in the country, it also has the dubious distinction of execution delays ranging from six to 24 months in 61% of all projects launched here since 2008. In around 160 (of the 4,000-odd) projects, the delays ranged anywhere between two and three years, according to Liases Foras. Take the case of DB Realty’s Orchid Ozone project at Mira Road, a cluster of 30-odd high-rise buildings with 3,600 flats near the Dahisar toll naka. Property dealers and homebuyers say it was initially a mixed-use project with a mall and shopping complex included, and was later converted into a fully residential complex.

Ramesh Kumar (name changed on request) booked a flat in Orchid Ozone in October 2010 by making a 20% down payment of ₹10 lakh. He expected to get possession of his home in early 2013. On a recent visit to the site, he found that construction was yet to go beyond the car park level in the building in which he had booked his flat. The new delivery date — though not communicated officially — has receded to mid-2014. And, Kumar wants to opt out of the project.

However, that’s easier said than done. A three-year lock-in clause in the contract stipulates that he cannot sell out, and will only get a refund of the down payment as and when the builder gets another buyer for the flat. Company executives continue to claim that a phase-wise delivery will start from 2013 onwards. Kumar has reason to remain unconvinced. “I am stuck,” he says.

—Krishna Gopalan