Prashant Jain, executive director and chief investment officer of HDFC AMC, has always been optimistic about the market. “Why is the average investor confused by equities? It’s not rocket science: equities are a remarkably simple asset class,” the veteran fund manager wrote in a column for Outlook Business in 2015. His stance has never changed. Five years later, in a concall with clients of Geojit in April 2020, when pandemic fears had clutched the market, he reiterated, “My advice is, this is not the time to think short term, not to be fearful of equity.”

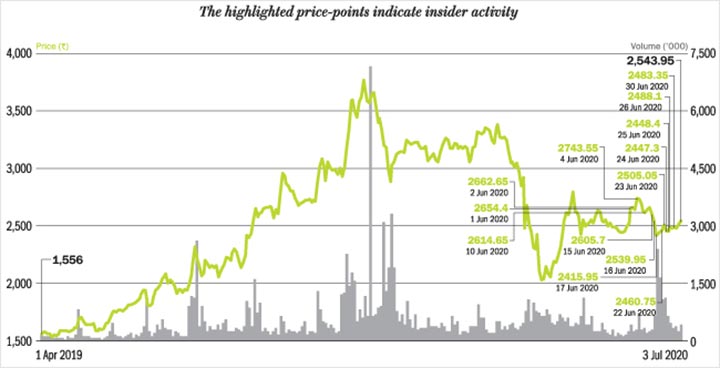

Hence, it came as a surprise when on June 22-23, Jain sold a third of his equity shares worth Rs.747.89 million in the fund house, at an average price of Rs.2,493, reducing his stake from 0.42% to 0.28%. Meanwhile, promoter company Standard Life Investments also offered 12 million shares worth Rs.28.59 billion for sale, reducing its holding from 26.89% to 21.25%. The company informed that the sale was undertaken to comply with SEBI’s requirement of minimum 25% public shareholding in a company. According to the data available with NSE, retail investors bid for 987,191 shares, translating into a subscription of 82%. After the sale, promoters now hold 73.97%, with HDFC holding 52.71%, and the public holds 26.03%.

Recovering from the March low of Rs.1,962, the stock currently trades at Rs.2,480, having gained 125% over its listing price of Rs.1,100 in July 2018. According to ICICI Securities analysts, HDFC AMC’s strong positioning and superior earnings profile deserves premium valuation. “Given elevated economic uncertainty, amid COVID-19, its business model is preferred involving least credit risk. Hence, we maintain our ’Buy’ rating on the stock with a target price of Rs.3,000 per share,” states their report.

With a two-year target price of Rs.3,250, analysts at Reliance Securities are also bullish on the stock. They like the company for its brand equity, pan-India distribution, growth in digital space and strong corporate governance. “No additional capital requirement and no legacy issues make HDFC AMC a favoured play for investors looking for safe play with sustainable investment solutions,” the analysts state.

Undoubtedly, HDFC AMC, which manages assets worth nearly Rs.3.2 trillion, is one of India’s most profitable AMCs. In FY20, the company logged a profit of Rs.12.62 billion post-tax, recording 35.6% growth on profit of Rs.9.30 billion posted in FY19. As HDFC and Nippon Life Asset Management are the only two listed mutual funds in the country, other mutual funds want a piece of the pie, too. Thus, mutual funds have increased their stake in HDFC AMC, from 0.60% in December 2019 to 0.79% in March 2020. During the same period, foreign investors have reduced their holding from 8.14% to 8%.

However, amid the market recovery, Jain’s stake sale might just be the contra indicator to watch out for.