Sensex today: Indian equity markets witnessed a sharp surge during the morning trade session on Tuesday with benchmark indices soaring over 2%. Investor sentiment took a positive turn as the Trump administration provided some relief on the tariff front. From a 90-day pause to exempting electronic goods, including laptops and semiconductors, from the tariff imposition.

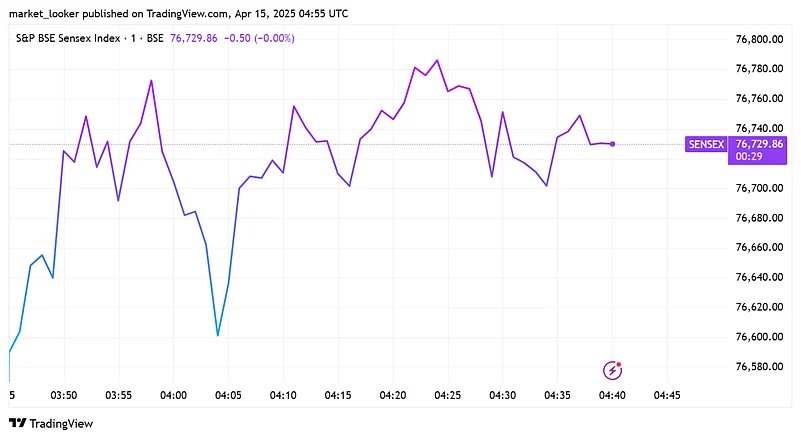

BSE Sensex was trading at 76,741.42 level mark, up by around 1,500 points, whereas NSE Nifty surged over 480 points and was trading above the psychological 23k level, at 10:10 am

From the Sensex pack, IndusInd Bank, Tata Motors, LT, Mahindra and Mahindra, Adani Ports and HDFC Bank were among the top gainers. Nearly all stocks were trading in green, excluding Asian Paints, ITC, Nestle India and HUL, from Sensex 30.

However, Nifty FMCG remained the worst-performing sector and was trading in red despite the broader market rally.

Uncertainty remains high

"S&P 500 is up by 9% from the April lows, on the tariff pause. Since Nifty is up only 3% from the April lows we have some catching up to do. This catching up and some short-covering will keep the market strong for the day. But investors have to understand that the uncertainty triggered by Trump is very much alive and, perhaps, more uncertainty is likely to come with sectoral tariffs, which Trump has declared are going to come," said VK Vijayakumar, chief investment strategist, Geojit Investments.

Other Asian markets, including Japan and China, traded in bullish territory. Both Nikkei and Hang Seng witnessed a surge of 408 points and 40 points, respectively.

However, D-street analysts continue to raise the banners of uncertainty high, warning investors of heightened volatility owing to turbulent global macros. Just last week, D-street witnessed Nifty Vix, the fear gauge of the equity market, surging to an all-time-high level of over 65%

During this period of heightened uncertainty and potential volatility, it would be better for investors to focus on strong domestic consumption sectors like financials, telecom, aviation, hotels, hospitals and selectively on autos, said Vijayakumar.