After a three month buying spree, the momentum among foreign institutional investors has finally hit the brakes, turning net sellers of Indian equities in the first week of July. The breather comes at a time when investors are treading on caution ahead of the July 9 reciprocal tariff deadline, the upcoming Q1 earnings season, persisting global uncertainties and high valuations in the domestic market.

VK Vijayakumar, Chief Investment Strategist at Geojit Financial Services, echoed concerns over the softening momentum in FII buying this July, stating that any reversal in sentiment will hinge on two key catalysts.

“First, a trade deal between India and the US could prove to be a strong positive, not just for overall market sentiment but also for foreign inflows,” he said. The second trigger, according to him, is the upcoming earnings season. “Signs of a genuine recovery in corporate earnings could draw FIIs back. But if either of these disappoints, it may weigh on both the market and FII participation,” Vijayakumar cautioned.

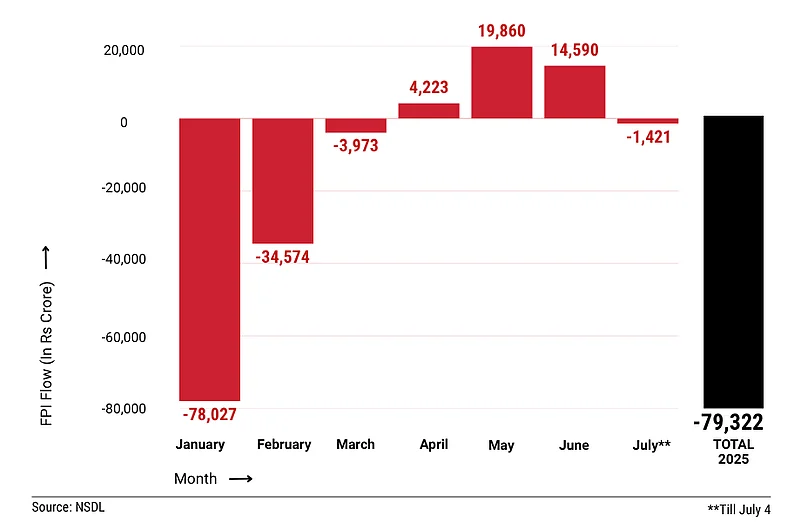

The trend of FII buying began in April, but gathered momentum in May. During the April-June period, FIIs lapped up Indian equities worth a whopping Rs 38,673 crore, data from NSDL showed. In stark contrast, they’ve sold domestic shares to the tune of Rs 1,421 crore in the first week of July, emerging net sellers on all four occasions, according to NSDL.

Vijayakumar further noted that in the latter half of June, FIIs turned net buyers in financials, automobiles and auto components, as well as oil and gas. However, they trimmed positions in capital goods and power. “There’s a clear trend of profit booking in sectors that have seen strong recent gains,” he observed.

Trivesh D, COO Tradejini drew a similar parallel, highlighting that the Nifty touched an eight-month high on June 30, and Bank Nifty an all-time high on July 2, which means profit booking did kick in after the strong rebound.

Uncertainty over the tariff deadline, stronger US assets and global cues have also added to this outflow, Trivesh D believes. Despite that, he pointed that that a closer look at the FII flow data reveals that the daily selling trend is getting smaller, which means the pressure is reducing.

Even though the Nifty 50 and Bank Nifty indices managed to hit some peaks last week, their overall move through the period was largely unchanged. The benchmark Nifty 50 moved just 0.2% in the first four days of July, reflecting profit booking and heightened risk aversion among investors.

Looking ahead though, the ongoing week will provide some clarity on Trump’s July 9 deadline for reciprocal tariffs, possibly taking away the regulatory roadblock affecting the market.

“This week, we will have trade deal clarity as well. If trade talks surprise positively or TCS delivers strong earnings, FII flows could swing back. Otherwise, cautious moves may continue till clarity emerges,” Trivesh D said. “So, we can say, T for Trade Deal, T for TCS, and T for Thursday, that is going to be the market trigger this week.”