The Kaushambi office of APL Apollo Tubes is humming with the Indian Premier League (IPL) vibe. There are cut outs and posters of the Delhi Capitals, and staff wear the team’s jerseys. The steel tubes and pipes company is debuting as a sponsor this season, with Rs.80 million for the Delhi team.

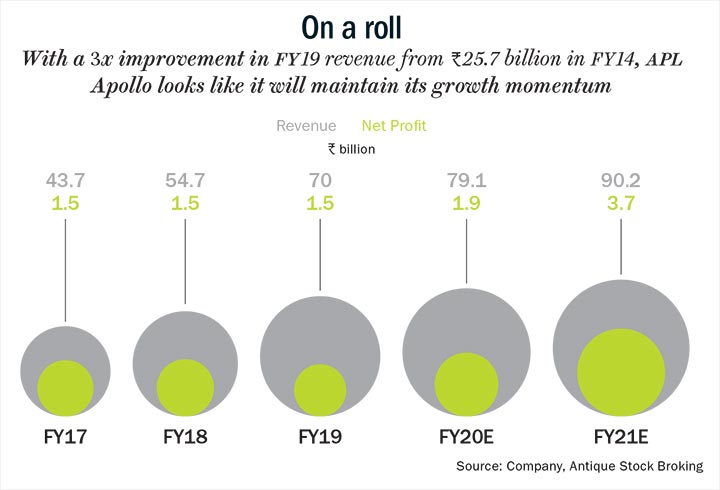

The chairman, Sanjay Gupta, looks excited. He has to award the Man of the Match trophy this evening, for a game between Mumbai Indians and Delhi Capitals at Delhi’s Feroz Shah Kotla ground. But this is not all that gets him animated. He is also keen to talk about his company’s growth over the past eight years or so. APL Apollo has grown to be a billion dollar top-line company, with an estimated revenue of over Rs.70 billion for FY19. This is an improvement of nearly 3x from Rs.25.7 billion in FY14. The bottom-line has also nearly tripled from Rs.580 million to Rs.1.5 billion over the same period (See: On a roll).

“I spend around 30-40 days each year in markets such as Germany, Japan, and China scouting for insights and new technologies,” says Sanjay. Such hunts have ensured that APL Apollo has earned an edge in several categories of steel tubes such as hollow sections and pre-galvanised (GP) pipes with technologies such as direct forming technology (DFT) and Tricoat.

Sanjay is more than willing to explain every innovation at the company. “Look at this steel door frame. This (a hollow-section design with strength similar to a solid section one) is our patented product. We are selling three million a year today. Two years back, this market didn’t exist. I want to replace wood frames with this (the industry sells door frames worth an estimated Rs.1 trillion every year),” he says. The hollow-section costs 50% less than a wooden frame. “Half of the market (for hollow section of 3 MT and GP of 1 MT) today has been created by APL Apollo,” says Anubhav Gupta, AVP, project advisory, Emkay Global.

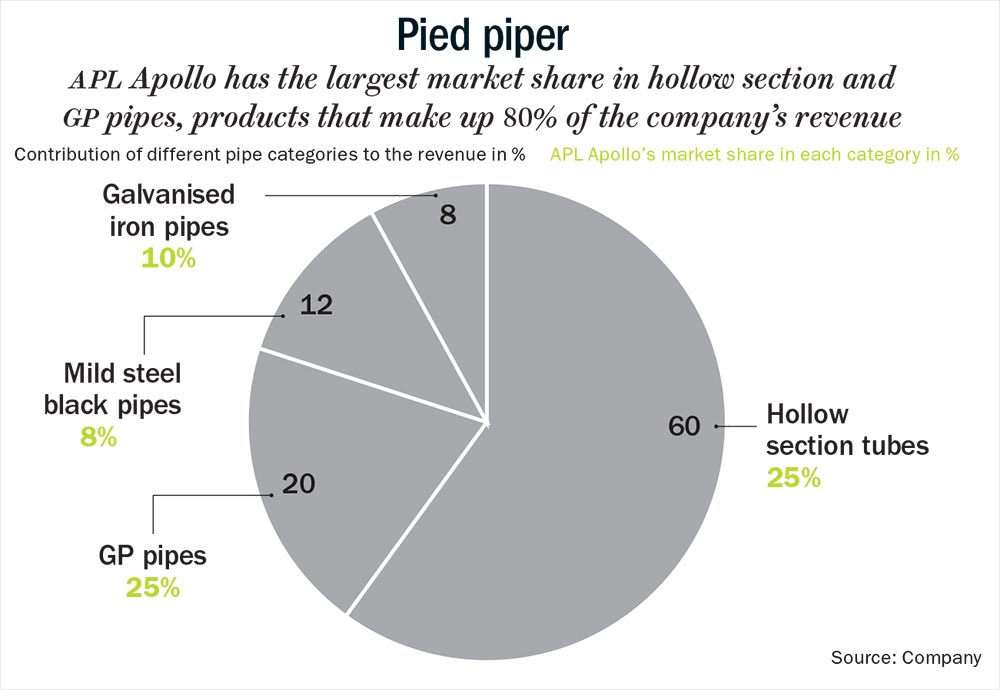

The company’s main product categories include hollow section tubes, GP pipes, mild steel black pipes and galvanised iron (GI) pipes. APL Apollo has the largest market share of 25% in hollow section and GP pipes, because it invested in technological innovation ahead of others, and has multi-location manufacturing that helps in rationalisation of costs and bringing prices down (See: Pied piper). The other players in the pipes space are Surya Roshni, Jindal Pipes and Hi-Tech Pipes, with market share under 5% in both of these categories. In GI pipes, a traditional category, APL Apollo has a 10% market share, and in black pipes, 8%.

Sanjay has ambitious plans. “I even want to replace your home’s PVC pipes,” he says. 60% of their revenue comes from building material; the remaining from agriculture, infrastructure and auto engineering. The PVC pipe market is big and expected to grow to $6.2 billion (at 10.2% CAGR from 2017) by 2023. Hoping to topple that might seem to be a recklessly optimistic goal, but he has defied conventional industry wisdom.

For example, foot-overbridges have conventionally been made with concrete. APL Apollo engaged with authorities to suggest the use of tubes/pipes, for quicker and safer building of these bridges. Using tubes in a project with the National Highways Authority of India led to a 10% saving — out of 72 tonnes of steel for the project, 65 tonnes were used. Till date it has used tubes for two such projects. Similarly, the company is championing the use of cheaper hollow flat tubes as an alternative to wood planks used in making truck bodies. These tubes were developed just three to four months ago, and are currently being retailed. These planks will have other end uses such as staircases as well.

From the beginning, Sanjay was mocked for thinking that he could grow a new market by innovating in tubes. The industry thought the steel tubes market was dying, continuously losing market share to PVC in the GI pipes space. But he went against the prevailing thinking.

One of the company’s vendors and an old hand in the steel industry, Shankar Batra of Tata Steel BSL says, “He is way ahead of the competition. If this is a marathon, he is at least five laps ahead.”

Batra had known Sanjay’s father from the company’s early days, when the former was with Steel Authority of India in Ghaziabad. Bihar Tubes (the name changed to APL Apollo in July 2010) was one of SAIL’s smallest customers at that time amongst big names such as Jain Pipe, Jindal Pipes, Aatma Pipe and so on. “But Sanjay forged a whole new path when most people played safe in this industry. He took a lot of calculated risks, did a lot of R&D, and never repeated the same technology when he started a new plant,” says Batra. “Besides, he developed new end uses for the products.”

Grounded Learning

Sanjay’s father shifted his pipe-trading business from Bihar to Delhi in 1986. At that time, their main plant, manufacturing GI and black pipes, was in Sikandrabad, in the Bulandshahr district of Uttar Pradesh. He joined his father in 1987, as soon as he was out of school, barely 16-years-old. The confines of their plant would become college for him since he didn’t pursue formal education thereafter.

His father passed away in 2002. “I had worked with him for 16 years, gaining a lot of experience,” he says. “At that time, this industry was totally lala type.” It was an unorganised industry, not run professionally. But, it also meant an opportunity for transformation. “In 2002, we partnered with a Japanese company to make pre-galvanised tubes in India,” he says. The Rs.50-million investment in technology helped them make 150 metre pipe per minute, against the earlier 20 metre pipe per minute, reducing cost and improving productivity. While competitors remained manpower intensive for a long time, Apollo kept upgrading its technology. Two years ago, the company invested Rs.1.5 billion for DFT in all their plants, to process 2.5 MT.

With DFT, they can customise tubes to any size, any shape as per the demands of customers. “By directly forming, we reduce 3% to 7% on cost. In the conventional process, a new size or shape required investments in dye casting and a lot of time. With DFT, the line changeover time, too, reduced from 10 hours to half an hour, making production of small quantities viable,” says Sanjay. Over the past five years, the company has spent Rs.5 billion to Rs.6 billion on capex, which has helped increase its product basket 5x — from 200 to 1,000. Its competitors have a count of 200 products.

“You can get to acquire and implement such technologies only when you have attained a certain level of scale in the business,” says Anubhav, who feels that DFT is a path-breaking technology.

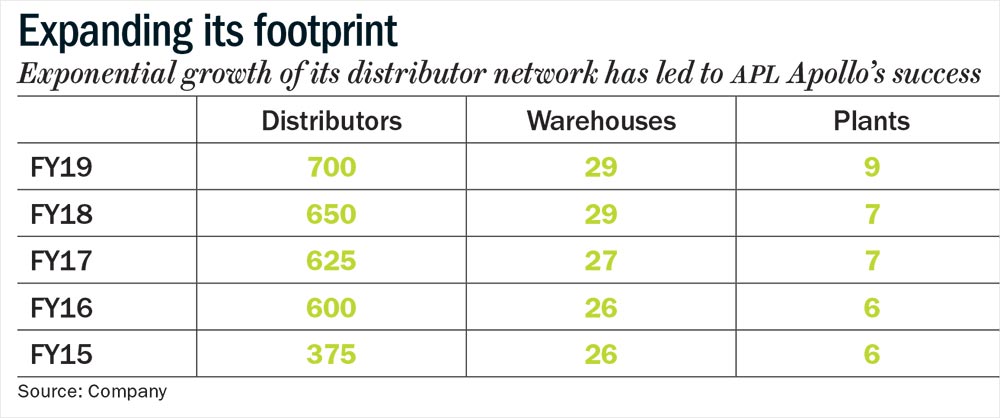

But technology was only one aspect of the long-term strategy. They worked intensely on the distribution from 2011, opening pan-India warehouses. In the pipes/tubes category, this was a first. So, the turnaround time was reduced to two days from five, helping grow the customer base.

If APL Apollo has been able to turn a commodity into a brand, it’s because the management chose its battles wisely. “APL Apollo didn’t disturb the organised players in this space. They went after the unorganised players’ market. So the large players were least bothered by their presence for so many years,” says Anubhav.

The CFO of the company, Deepak Goyal confirms this strategy. These tubes were never a big priority for big guys such as Tata Steel or Essar Steel since they were focused on their primary product — steel. Pipes market was too small, crowded with inferior quality products and many unorganised players.

“In the light thickness tube (for example 1.2, 1.3 mm and so on) space, organised sector wasn’t doing much. There was a clear gap,” says Goyal. Next gap was in structural tubes. Indian market was all about round tubes. “Manufacturers were hardly making any square or rectangular ones. So, we focused on building this range, used in window and door frames, agriculture and so on,” he says.

The small players, with their limited capital and management bandwidth, took time to come out of the inertia. Meanwhile, APL Apollo was optimising its offerings. Goyal shares an example: “The 360 degree zinc-coated GP pipes were used, because that was the only option available. But the Indian buyer didn’t need that kind of coating. He just needed rust resistant tubes, not necessarily water resistant. We provided the right solution (GP pipe) at a reduced cost.” This market today is 200,000-300,000 tonne, and the company has captured 25% of it. Their competitors started making GP after four to five years.

Besides spotting new opportunities in tube manufacturing, APL Apollo also rationalised its supply chain. Till ten years ago, most of the industry was based in North India (Jindal Pipes in Hisar, Haryana; Surya Roshni in Bahadurgarh, Haryana and Hi-Tech Pipes in Ghaziabad), but raw material (steel) was available in the South and West. To optimise the production cycle and cut down costs APL Apollo opted for greenfield and brownfield expansion.

In 2008, they acquired a small Bengaluru-based company Shri Lakshmi Metal Udyog for Rs.200 million. Six months later, a new plant was set up in Hosur, with an investment of Rs.1.25 billion, which today has a capacity of 0.5 MTPA. In the same year, they bought Metalex for Rs.70 million. In 2010, APL Apollo bought a plant in Thane (which today has a capacity of 0.45 MT) for Rs.400 million from Lloyds Line Pipes. In 2016, a new plant was set up in Raipur (with a capacity of 350,000 tonnes) for Rs.1.6 billion; and, in April 2019, Sanjay bought a plant from Shankara Pipes in Chennai for Rs.700 million. All of these were funded via internal accruals. APL Apollo has a total debt of Rs.8 billion today, of which, Rs.4 billion is being used for capital investments, and the other Rs.4 billion for working capital.

Anubhav says that their multi-locational plants have helped reduce cost, and improve profitability. “Total freight cost for transporting raw material and product from the North was around Rs.6,000 per tonne until 2008, when they started their buying spree. This has been reduced by half over the years,” says Sanjay. Raw material for all regions still comes from South and West, but the final product is consumed locally.

Besides, what has aided APL Apollo’s growth is the continual development of dealer partners. Sanjay claims they have been incentivising their dealer and distribution partners for the past 25 years — be it expensive foreign trips or Bollywood star nights, get-togethers and meeting the IPL team. APL Apollo hit news headlines seven years ago after taking 1,000 distributors on an ocean cruise for a meet. It cost them Rs.80 million, against their regular foreign trips that cost Rs.50 million for 400 people. The company has 700 direct distributors/dealers, 40,000 retailers, and a market of over 400 towns and cities (See: Expanding its footprint). Surya Roshni and Jindal Pipes’ dealer network is one-fifth of APL Apollo’s. They believe better product availability and portfolio pipeline ensures dealer stickiness.

Anubhav also credits its competitive position. According to him, the competition’s capacity is much lower than its capacity of around 2 MT. Surya Roshni’s capacity is 0.8 MT and Hi-Tech Pipes’ is 0.5 MT.

Brand New

After building a strong product portfolio and forging new markets for his products, Sanjay began working to rebrand his company four to five months ago. They became jersey sponsors (backside) for Delhi Capitals, joining the league of brands such as Samsung and Nokia.

Anubhav says, “They’re not the first ones to take such a path. Astral Poly Technik, a plastic pipes company, roped in Salman Khan recently. It helps you price your product at a premium,” he says. APL Apollo charges 1% to 2% premium on hollow sections and GP pipes.

Sanjay says, “First, I wanted to make myself available from Jammu to Kanyakumari. Once that was achieved, I felt there is a need for consumer pull, too.” The branding campaign is expected to continue for three years.

Growth Pangs

Over the past five years, the company’s top-line has doubled to Rs.70 billion, while margins have risen from Rs.2,800 per tonne to just Rs.3,400 per tonne, for a capex of Rs.8 billion. Going forward sustaining those numbers will not be easy. “We have to take 20% growth each year to gain size to become a large company. We have to balance our margins with volume growth,” Goyal explains. Emkay’s Anubhav feels growing at that rate is easier said than done. “To grow at 20% volume on a consistent basis will be a huge challenge. Sustaining profitability will be even tougher,” he says. “Their Ebitda is Rs.3,400 per tonne. Improving this number to Rs.3,800 or Rs.4,000 won’t be easy,” he believes. Competition is intensifying too. “Surya Roshni is manufacturing from Bengaluru, and Hi-Tech Pipes is setting up a plant in Raipur,” he adds.

However, APL Apollo is moving up the value chain with its recent acquisition. Shankara Building’s tube unit has established manufacturing lines for GI pipes and GP pipes, which are APL Apollo’s high margin and value-added product segments. The management believes improving portfolio of these products will result in higher revenue and volume contribution of value-added segments, thus leading to steady improvement in operating margins.

In early 2018, Rahul Gupta (Sanjay’s son), in his personal capacity, acquired controlling stake in Best Steel Logistics and changed its name to Apollo TriCoat. It has a plant near Bengaluru to manufacture tricoat tubes. In October 2018, Laxmi Udyog (a subsidiary of APL Apollo) entered into a purchase agreement with Rahul to acquire his shares after warranty conversion at Rs.120 and shares from the public with an open offer at Rs.135. TriCoat’s products span across three variants — SureCoat, DuraCoat and SuperCoat, made through the latest Galvant technology, to be used as a substitute of PVC electrical conduit pipes. The acquisition will enable the company to expand its product portfolio in the high-margin coated pipe segment. Tricoat’s products, according to Anubhav, enjoy 2x of APL Apollo’s operating margins. “It should contribute 8/13% to profits in FY20/21, and we forecast consolidated EPS to see 45% CAGR in FY19-21,” says Anubhav in his report.

Though the stock came off its high during the mid-cap meltdown, from Rs.2,100 to Rs.1,470 level, Anubhav believes its current valuation (15.3x P/E) is attractive. Besides, Emkay expects the ROCE to improve to 24.2% in FY21 from 16.8% in FY19.

And, Sanjay is not worried about the short-term fluctuations in business. He sees a lot of scope for the market to grow. Total consumption of steel, worldwide, is 1,600 MT. Of that, 160 MT is steel tubes. India’s current market size of steel tubes is around 8 MT. “The government believes total steel consumption in India can hit 300 MT in the 10 years. With the help of new end-usage in sectors such as housing and airports, tubes can easily be 12% of the total consumption. So, this industry can become a 35 MT one. APL Apollo would capture 20-25% of it. This is my vision,” he says. They have an aggressive revenue target of Rs.100 billion in FY20, and are likely to touch Rs.86 billion, with 25% increase in bottom line.

His hustle will continue till he reaches that mark.