Recently I came across a term, which was new to me: FOMO. It’s slang perhaps inspired by new age media, which basically implies a form of envy when you miss out on action. And when I looked at what is going on in the financial world for the past few years, it seemed that this ‘infection’ had consumed a significant majority. I don’t claim to have read market cycles over centuries, but I have not seen such extremely narrow and extreme valuations going back several decades. There was FOMO in the real estate space before 2008. Now, pensioners get nothing in their FD, so driven by FOMO, they take equity risks even for their monthly bills. Equity market participants are scared that the market may climb even higher and they will not be able to participate later. Many have FOMO in FAANG (Facebook, Amazon, Apple, Netflix, Google) stocks. Global investors have FOMO on India. Indian investors have FOMO on HRITHIK (HDFC, Reliance Industries, Infosys, TCS, HDFC Bank, ITC and Kotak Mahindra Bank).

How I got sucked in

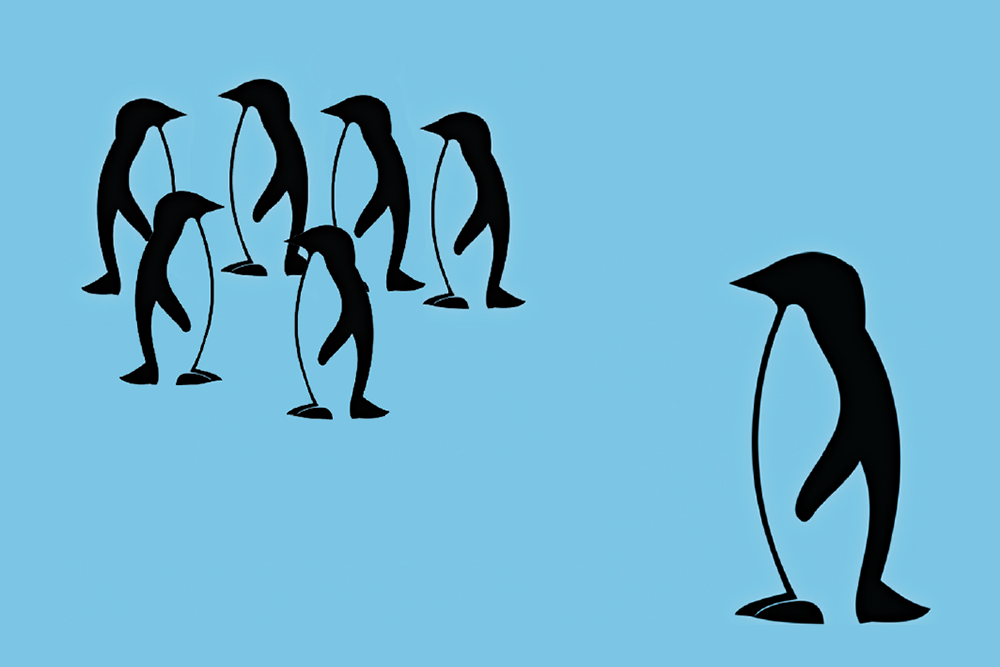

I consider myself a disciplined investor who has the ability to stay away from the crowd for extended periods. And that’s what I did for a good part of two decades before I seemingly (and unknowingly then) succumbed to it over the past few years.

Over the past two decades, I made a tonne of money in bank stocks. In the second round, I lost money in one of the PSU banks. But the bad dream (or should I say sloppy work at my end) did not end there. I had bought two other PSU banks prior to that and two more thereafter. I always knew they were mediocre banks, but in hindsight its hard to pinpoint which one turned out to be the worst in the race to the bottom! I relied too much on their liability franchise and hoped that treasury income and recoveries (with the recovery in the economy) would offset the bad-loan hole they had dug in their income statement, and therefore, also the balance sheet.

Licking my wounds, I limped to my next pit stop: the well-run banks. But my value mindset prevented me from delving into them. So I turned to the NBFCs. Here again, there were two baskets — well-run but highly priced ones, and not so well-run with relatively cheaper stocks. I did not have the heart to pay up for the good ones. And I always knew that the badly run ones are not worth taking the risk in the current difficult economic environment. I held on to my horses while I looked for exploits elsewhere. I invested in some old forgotten PSU behemoths, and some of the newly listed defense and railway PSUs. I also invested in the media sector where the pessimism seemed overdone.

Anyway, back to the main story. The defining moment for me to get sucked in even deeper came when a friend got me a pre-IPO deal in RNAM. But it came at a price outside my comfort zone. I was walking out of the deal when its parent caught my attention. HFCs had already run-up, and so had the asset advisors/managers. I thought that its parent would be a great way to play the financial sector, something I had missed out. It ticked many right boxes. I would get an NBFC play, a housing-finance play and an asset-management play all rolled into one. Plus, it did not appear very expensive then. I ignored the risks across that came with the business group, like the risks associated with very complicated corporate structure. I always knew the liability-side to be brittle, but the astonishing ease with which refinancing was taking place made me somewhat ignore that risk. Remember, we are talking about pre-IL&FS crisis days.

There was another theme doing the rounds — insurance. A slew of IPOs were lined-up, both in life and non-life space. Prior to that, Max Financial was already listed, and while I was trying to get a better understanding of the business muddled with unusual technical terms, the stock price kept chugging along. The pre-IPO price also kept pace with the listed Max, and both started chasing each other. In the mad rush, I bought into the listed idea before I could get a handle on the business.

Finally, there was bad assets resolution under way. There were two ways to play it: either become a bidder, or do it via an ARC. Edelweiss fit the bill for this one with the same checklist.

FOMO + Value Investing = Disaster

As things stand today, I am under water to the extent of 70% each in four PSU Banks and 90% in another. Amongst the NBFCs, I am down 95% in one, 65% in the other and thankfully, only 20% in the third one. I have never seen such deep cuts at the stock level ever before. And there have been so many stocks with such deep cuts, that I have not even seen so much red ink at my portfolio level before. Despite being an investor for two decades, I committed a series of cardinal sins. I didn’t do thorough homework. I ignored the risks I knew existed. I invested even before I understood the business well, let alone the valuation. I bought stocks near their lifetime highs. I held on to them despite the risks becoming reality and the cuts growing deeper. And most importantly, I chose a poisoned pond to fish in. I did not put the financial sector in Charlie’s ‘Too hard pile’. Nor did I wait for Buffett’s ‘Fat pitch’. And all because of what: FOMO!

Thankfully, the allocation I made to all the above financials was less than 10% of my portfolio. And there were other balancing parts that paid for my sins. Half of my PSU bank losses were covered by IT stocks. Half of my NBFC losses were made good from investing in corporate non-PSU banks. I made bucket loads in one rail PSU and a reasonably handsome amount in one defense PSU. And of course, the fixed-income part of my portfolio also provided stability to the overall portfolio.

More than losses in that isolated part of the portfolio and regardless of the fact that they were well offset by other parts, it’s been a humiliating experience followed by a very humbling experience for me.

Learning the hard way

If I look back upon this episode, I am reminded of the deeply enlightening conversation between Lord Krishna and Arjuna on the Mahabharata battlefield. Arjuna asks the Lord, “Why do people make mistakes and suffer despite knowing what all the virtues are?” The Lord replies that it’s one’s inability to control one’s desires that leads them to take convoluted decisions and actions despite knowing that they are not based on sound fundamentals. That apart, another valuable lesson has been that sometimes we have this tendency to extrapolate and presume what worked in the past shall work in the same manner in the future, too. The flaw with such an argument is that no two situations are exactly identical and therefore it’s pertinent that we distinguish the intricate differences between the situations and modify our course of action accordingly. After all, history doesn’t repeat itself; it need not even always rhyme. Finally, the Graham in me came to my rescue again, since even though the basket approach did not save me, but diversification was my saviour. So, it’s a given that mistakes shall be made by almost everyone, and sometimes even grave ones. But it’s paramount to ensure that such mistakes don’t kill us. As long as we live to fight another day, we should be okay.

And yes, if you are sucked into FOMO, ensure you are playing on the voting machine and not on the weighting one. When in Rome, do as the Romans do. And if you don’t, expect to be flogged! Well, one should be flogged if you are FOMO’d, does not matter where and how you play. But I wonder if history shall rhyme this time?