In 2014, private equity deals in India crossed the $15 billion-mark. After hitting a three-year low of $8.85 billion deals in 2012, private-equity investments were at a seven-year high. That’s when the story of a luggage company that was the target of a takeover bid by one of the top three global PE firms started to unfold.

The PE firm in question had $80 billion in assets and the company being targeted was the luggage company, Safari Industries. Initial discussions were cordial. According to the PE firm’s initial term-sheet, it would invest Rs.50 crore in the company and another Rs.20 crore would be brought in by the promoter-MD, Sudhir Jatia. However, soon after the term-sheet was issued, the firm revealed its true intentions. For a PE firm of this size, a Rs.50-crore investment was not a meaningful allocation. It wanted an investment vehicle that it could use to acquire luggage-making companies worldwide. It wanted the promoter to run the show as a minority shareholder. Delisting Safari from the Indian bourses and relisting it on NYSE was the eventual plan.

Unsurprisingly, Jatia declined the terms. After serving as MD of India’s largest luggage-maker —VIP Industries and 22 years overall in the luggage industry, Jatia bought majority stake in Safari Industries to continue doing what he does best. Becoming a marginal stakeholder in the same business was not an acceptable proposition, especially when the business was showing signs of a turnaround.

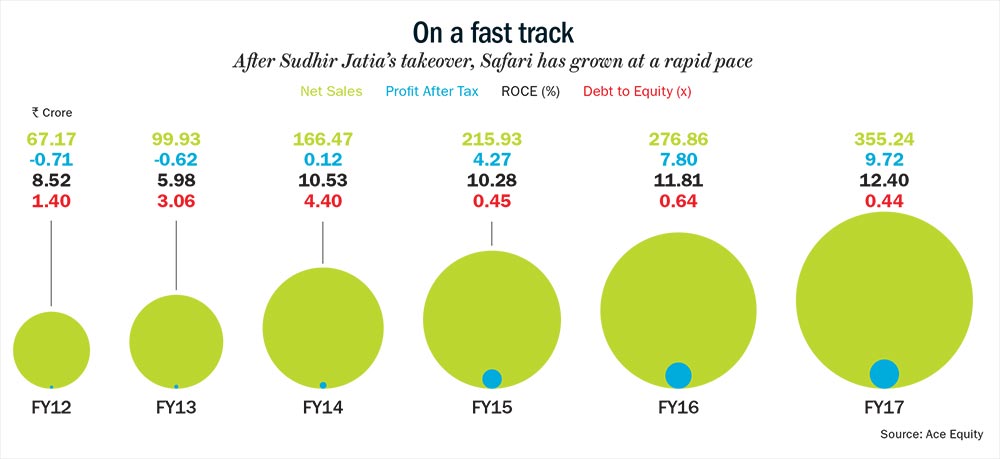

Safari’s topline had grown from Rs.67 crore in FY12 to Rs.166 crore in FY14, compounding annually at 35%, after Jatia took over in September 2011. Jatia says that reaching this scale didn’t require anything special, but just following basics like reaching out to dealers. The earlier management didn’t push the products as much because they were in ‘sell’ mode. However, the bottomline didn’t move much. It just crawled into the black in FY14 from being marginally in the red for the previous two years.

In those initial years, profit was not a major concern. Instead, the focus was on gaining some scale so that it can move from being a bit-part player to a more relevant one. “Having a small topline made us vulnerable. At that scale you can be easily destroyed or killed. So, to prevent that, topline became our priority. In this industry, if you don’t have scale, you cannot expand and you don’t get a good supplier base,” Jatia confides.

The turnaround

Safari priced its products aggressively in the market. Expenditure related to discounts and rebates grew to Rs.5.1 crore in FY14 — 3% of the topline — from being nil in FY12. Safari saw bulk of its sales coming from the Canteen Stores Department (CSD) in those initial years. Jatia says that the company focused on CSD at first, as Safari had a long-term presence in it, hence it was easier to revive the brand there. By FY14, sales from the army accounted for 65% of Safari’s overall topline. Today, sales from CSD account for 35% of overall topline as Safari has ramped up its presence in other channels — hypermarket, e-commerce, multi brand outlets (MBOs) and exclusive brand outlets (EBOs).

Besides the early momentum from the CSD channel, realigning the product portfolio helped Safari grow rapidly. In FY12 when Jatia took over, the bulk of Safari’s sales (60%) came from hard polypropylene luggage. As an industry veteran, Jatia was clued into the changing preferences towards soft luggage. By FY14, soft luggage accounted for 80% of Safari’s sales, while hard luggage was just 20%.

Now, Safari doesn’t want to remain in the polypropylene business for long. By FY19, Jatia says Safari will be out of the hard luggage polypropylene business as it wants to focus on the hard luggage polycarbonate business, which is where customer preference has been veering.

Safari had already set out in that direction. But in FY14, when it needed capital to make this transition, banks were reluctant to lend to the company as it had a net worth of just Rs.12 crore (FY14). “The company was not ‘bankable’ because of its weak balance sheet. We had cleaned up the books and incurred losses as a result. We had taken write-offs for all damaged inventory and junked old machinery manufacturing hard polypropylene luggage. All this had eroded the net worth of the company. That is when we got capital from Tano Capital. We recapitalised the balance sheet so that the future growth was not hampered,” says Jatia.

Jatia finally had a deal with a long-term investor on terms that were far more agreeable. Tano Capital, which invests in growth companies in India and China, agreed to invest Rs.50 crore and Jatia would bring in another Rs.20 crore. In FY15, Safari Industries’ net worth stood at Rs.74 crore. With that its gearing also saw a significant improvement from 4.4x to 0.45x in FY15. Safari’s cost of borrowing improved from 14-15% to 8-9%.

Brownfield drive

That’s when Safari set up a polycarbonate plant at Halol, where it had a factory for manufacturing polypropylene luggage. The investment was funded partly through bank loans and partly through equity. Safari, which imports soft-luggage from China in bulk, also set up an office there to reduce the inventories and control working capital.

“With the heavy polypropylene luggage losing its relevance, we got polycarbonate machines to replace the older polypropylene machines. This was not a greenfield capex. It was just re-orienting the existing factory,” Jatia says. To start with, Safari had a capacity of 27,000 pieces a month. The plant was set up at a cost of Rs.7 crore. In a year, the polycarbonate plant was running at full capacity. That is when Safari expanded the capacity to 55,000 pieces per month with additional investment of Rs.7 crore.

Just two months back, the existing capacity again reached full utilisation. It recently expanded the capacity to 80,000 pieces per month at an additional cost of Rs.7 crore. The entire process of setting up the capacity and then expansion cost Safari Rs.22 crore. The debt component was largely raised to meet working capital needs. Jatia says that if he were to make a greenfield capex for the polycarbonate plant, the costs could have been as high as Rs.40 crore to Rs.50 crore. The existing infrastructure has room for three more machines that can expand the capacity to 1,00,000 pieces per month at an additional cost of Rs.5 crore to Rs.6 crore.

In the past 4 years, share of polycarbonate in Safari’s topline has gone from nil to 22.5%. Currently, 90% of the hard luggage that Safari sells is polycarbonate luggage. The balance is soft luggage, which includes backpacks and school bags as well.

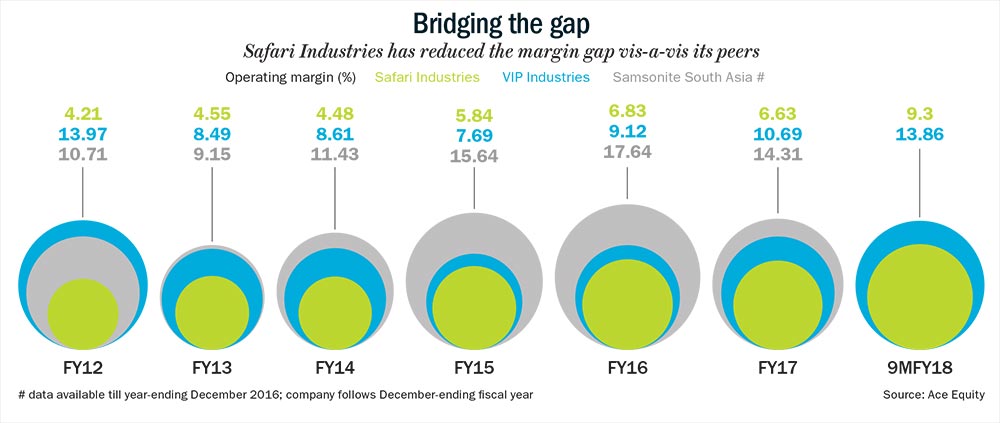

The rising share of polycarbonate and soft luggage in Safari’s overall sales has also improved the company’s operating margins from 4.48% in FY14 to 9% in 9MFY18.

With polycarbonate becoming 50% of the global market, Jatia feels that it is a matter of time before consumer preferences in India also shift from soft to polycarbonate luggage. Sumeet Nagar, co-founder of Malabar Investments, whose fund, Malabar India Fund, bought 2.64% stake in Safari Industries on February 14, 2018, adds that getting into polycarbonate was a timely strategic move as it gave the company an entry into an emerging product category where it had a more level-playing field with the bigger players. Investment from Malabar has further improved Safari’s credit rating from a C in FY14, which was just a notch above default, to an AA by agencies today. The cost of borrowing has thus reduced further to 7%.

Backpacking value

Having discontinued most of its polypropylene SKUs, Safari decided to build its portfolio of brands. In September 2015, Safari entered into an agreement with the debt-laden Genius Leathercraft which was looking to sell its brands to settle outstanding loans. Brands like Genius, Genie and Magnum became part of Safari Industries’ brand basket after it paid Rs.5.5 crores to acquire these. The Genius and Genie brands marked Safari Industries’ entry into the school bags and backpacks segment.

With this segment having the highest share of unorganised segment, Safari Industries has launched as many as 15 SKUs in the backpacks space to tap shifting preferences towards branded and organised players. Safari’s new backpack collection is mostly focused on the college segment where the presence of organised players is minimal with VIP and Samsonite focusing on laptop bags. For the school bags segment, which also has limited presence of organised players, Safari Industries is leveraging the Genius and Genie brands as these can be strong growth drivers.

“Safari’s Genius and Genie brands are currently have marginal presence, but they have the potential to grow substantially. In the school bags space, the replacement cycle is as short as a year (vs two-and-a-half years for laptop/office bags). However, other branded players are not really focusing on this space,” says Bhargav Buddhadev, analyst at Ambit Capital.

As for pricing, Safari has chosen to peg its products at the lower end of the price band for branded products to entice customers looking to graduate to branded products. “Safari’s school bags are priced at Rs.1,000- Rs.1,500 which is at a modest 25-30% premium to unorganised players and 20%-25% discount to branded players like Wildcraft,” says Buddhadev.

So far focusing on the value segment has helped Safari Industries become a relevant player in the highly competitive luggage industry. Even competition has been taking note of Safari’s growing presence. While commenting on the competition from Safari in the value segment during VIP Industries’ recent earnings call, MD Radhika-Piramal acknowledged that Safari has a good product range and product mix at entry-level price points.

Today, Safari Industries accounts for 14% market share in the Rs.2,600-crore branded luggage segment. VIP Industries is the market leader with a 50% market share, followed by Samsonite with 35% market share. With the unorganised market being 3.5x of the organised market, there is a lot of room for Safari to grow as first-time buyers of branded luggage look for affordability. However, focusing on the value segment has led to lower margins for Safari vs its peers.

For instance, Safari’s operating margin as of 9MFY18 stood at 9.3% which was 456 basis points lower than VIP Industries. Compared to Samsonite (FY17 numbers not yet available), Safari’s operating margin was 748 basis points lower as of FY16. The difference was as high as 976 bps compared to VIP Industries and 722 bps compared to Samsonite when Jatia took over Safari in FY12. Besides economies of scale and improving product-mix (soft luggage and polycarbonate), better working capital cycle has also helped Safari bridge the gap on margins vis-à-vis its peers.

The cash conversion cycle has improved to 121 days in FY17 from an average of 152 days seen in FY11-FY12. Having gained a certain scale, Safari could negotiate better credit days with its soft luggage suppliers in China. It got a 60-day credit from its Chinese suppliers in FY16 that increased Safari’s payable days from eight days to 29 days (VIP stands at 47 days). Safari’s ROCE has improved from 10.5% in FY14 to 12.4% in FY17.

Building on scale

Going ahead, Safari Industries would try to close the margin gap with its peers by bringing some premiumisation to its flagship brand — Safari. Jatia says that Safari would not be positioned as a premium brand like Samsonite, but for its existing customer base in the value segment a certain ‘pride of ownership’ would be attached to it. While so far Safari’s branding was largely through its EBO channel, going ahead Jatia says it would incur A&P spending to communicate its new positioning to its consumer-base. The Magnum brand would eventually be moved to occupy the value segment as the Safari brand gets a bit premium. Buddhadev at Ambit says that channel checks done by them show that the Safari brand can command as high a selling price as Rs.5,000. Currently, the average selling price of the brand is Rs.3,000, which means there is still some pricing potential within the brand that can be unleashed, if there is some additional investment in it.

So far, Safari’s decision of staying away from A&P was justified as it didn’t have funds to allocate. But, as the company has now gained scale it can invest a meaningful amount in A&P that can move the needle. “A share of 2-3% of a small company’s topline would mean just a Rs.4crore- Rs.5 crore spending on A&P. With such a small budget, you would get drowned by your competitors’ A&P. However, when you have a bigger scale the A&P spending can become meaningful and make an impact,” says Nagar.

Safari currently has a brand-push strategy. For instance, it follows a point-of-sale model (POS), which entails appointing a salesperson in every departmental store to push sales. Once Safari Industries is able to create a strong brand pull, it can save on these costs and improve its margins more. Also, cost related to discounts and rebates would taper off. Over time, it can also use its brand equity to create a franchisee model for its EBOs to save on the rental cost of Rs.4.2 crore.

Safari is as efficient as its rivals in sourcing soft luggage requirements, which helps it reduce another significant cost head. In the luggage industry, finding vendors in China, which is the hub for soft luggage, is not easy when you are a sub-scale company. But, Safari has been able to source 75% of its soft luggage by leveraging Jatia’s relationships with Chinese vendors from his time at VIP and Aristocrat.

Going ahead, Jatia feels that it is important to de-risk the company from Chinese manufacturing. “China sooner or later would lose its cost advantage. It is no longer a third world country. Eventually, we will have to move manufacturing to India by finding dedicated vendors or taking up manufacturing ourselves. There are no firm plans as of now, but maybe in 18-20 months we will have to look at that possibility,” Jatia says. He adds that having a local manufacturing would improve lead time for the company and thereby make the working capital cycle more efficient.

Last leg

The luggage industry today has several tailwinds with consumer preferences shifting from unorganised to the organised segment, airline traffic at all-time high and high two-wheeler penetration leading to more use of backpacks. Most importantly, because of the bulky nature of the SKUs, not many brands get shelf space in stores which makes the organised luggage market an oligopoly.

Going forward, Buddhadev says that the shift from unorganised to organised segment will happen at a rapid pace. “As more millennials get in the consumption mode, the value of branded players will grow. The replacement cycles will also come down as users don’t want to repair but buy new items,” he adds.

So far, the luggage industry has been growing in the mid-teens for the last several years, Safari has handsomely outpaced that growth. “When you are able to grow at a fast pace, many of your fixed costs like distribution costs, rental costs, office costs etc. go down as the throughput increases. If Safari is able to continue on this trajectory, it would not only beat industry in terms of growth but also see sharp improvement in margins,” Nagar says.

Safari Industries’ earnings are expected to grow at 58.74% CAGR over FY17-FY20, while VIP Industries’ earnings are expected to grow at 25.2% CAGR. The valuation difference between the two companies though is not as stark with Safari trading at 34x FY20 earnings, and VIP at 30x FY20 earnings. On a relative basis, Safari should offer a better ride.