Chennai-based Take Solutions, which caters to life sciences and supply chain management, had an uneventful FY20. New additions to the company’s order book stood at $20 million in Q4FY20 – the lowest in several years. Due to the pandemic, business slowed down from mid-February in Europe and the company’s clinical trials, BA/BE studies came to a standstill. Consequently, the company at the Ebitda level recorded a loss of Rs.1.55 billion in Q4FY20 compared with profit of Rs.1.03 billion posted in Q3FY20 and Rs.810.69 million posted in Q4FY19. The company logged a loss of Rs.129 million pre-tax in FY20, a huge decline from the Rs.2.15 billion profit registered in FY19.

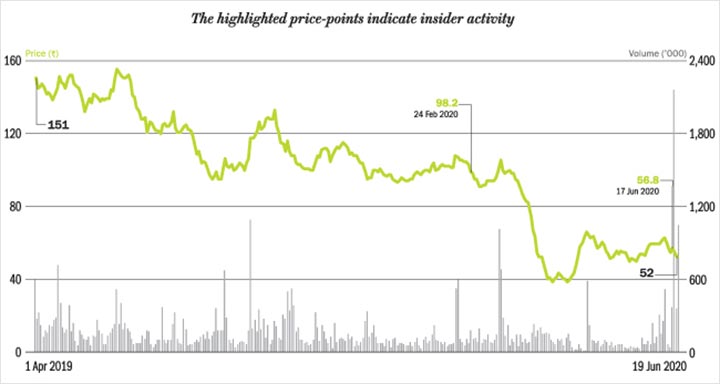

While it is not clear if it was an immediate corporate liquidity requirement or personal compulsion, managing director HR Srinivasan on June 17, five days after the release of FY20 earnings, offloaded 8.24% worth Rs.632.8 million in a bulk deal to Shriram Group. The holding changed hands from Asia Global Trading and Esyspro Infotech to Shriram Group Executives Welfare Trust and SVL Limited, at Rs.51.9/share.

Srinivasan still individually holds 0.09% stake in the company. He is also a director on the boards of Envestor Ventures and Aakanksha Management Consultancy and Holdings that hold 5.24% and 0.39% stake, respectively. In fact, Envestor Ventures had increased its holding from 0.3% to 5.24% after acquiring shares worth Rs.733 million sold by majority owner Take Solutions Pte on February 24 at Rs.100.5/share. This bulk deal was done few days after the announcement of Q3FY20 results and few days before the market came crashing down due to COVID-19. Since then, the stock has not shown any sign of recovery. It currently trades at Rs.52, compared with its 52-week low of Rs.37.

Shriram Group, which has a diverse portfolio of businesses, might have been driven by the market opportunity in life sciences outsourcing business, which is expected to reach $44 billion in 2021. According to Take Solutions, life sciences contribute 94% to its revenue. However, according to a January 2020 report by ICRA, SVL’s financial profile has remained weak as “dividend income from its investee companies has dwindled over the recent fiscals, with the future dividend potential remaining uncertain”. If Take Solutions’ financial performance does not improve, then it might be an added woe for SVL.

Meanwhile, Sundaram Small Cap Fund has maintained its stake in Take Solutions at 1.44%, but foreign investors have cut their stake from 10.32% in December 2019 to 10.26% in March 2020.