While buying insurance as an instrument of safety, against future contingencies, comes as a natural choice to consumers, evaluating the same business from the perspective of an investor is a completely different ballgame. Insurance as a business is characterised by high, uncertain risks. Profitability, surprisingly, plays a smaller role than client stickiness in determining the long-term sustainability of the business. Thus, it becomes crucial to adopt a different framework to evaluate the business.

The life insurance industry in India has witnessed two key turning points: one in FY08 and the other in FY15. The period till FY08 was the growth phase of the industry dominated by unit linked insurance products (ULIP). But the 2008 recession and the changes in laws governing ULIPs, followed by changes in regulations for traditional products, unleashed a tumultuous phase that lasted till FY15. Major regulatory changes for traditional products came in 2013, that included a complete ban on NAV-guaranteed products, aligning cost structures, increase in sum assured, cap on commissions, reduction/removal of surrender charges and minimum surrender value. A change in the ULIP guidelines had resulted in a degrowth of individual retail business by 40% for the industry.

During the downturn, players realigned their strategy towards a more balanced product-mix, improved their persistency ratios (indicator of client retention) and increased the use of the banking channel (bancassurance) for distribution. An improved regulatory regime around the mis-selling of products also led to increased customer confidence. The icing on the cake was the upward revision in foreign direct investment from 26% to 49% in 2016.

Against such a backdrop and aided by a buoyant market, it’s not surprising that five insurance players went public in CY17. In fact, the insurance sector accounted for 62% of the entire funds raised through IPOs. Currently, there are three listed private life insurers: ICICI Prudential Life Insurance, SBI Life Insurance and HDFC Standard Life Insurance. Max Financial Services, which houses the life insurance business, was demerged from Max India in 2016.

Casparus Kromhout, CEO, Shriram Life Insurance, perceives the renewed vitality around insurance as a function of wider macroeconomic factors and the fact that life insurers have hit a purple patch. “After a span of nearly six years, life insurers are seeing double-digit growth,” says Kromhout. The Street too is bullish on the sector. Anoop Bhaskar, head of equities, IDFC Asset Management, who has invested in the stocks of life insurers, says, “The fact that financialisation of savings should benefit the sector and that these [insurance firms] are fairly large-sized businesses is a source of comfort. Just as housing finance as a theme did well, we believe insurance could perform well over the next couple of years.”

The ‘valuation’ game

While all the listed life insurers are profitable, they cannot be viewed through the traditional prism of earnings growth. Pointing out the fallacy of relying on bottomline, Kromhout says: “Profit is not the most important thing to look out for in a growing business. In the first ten years, post liberalisation, most insurers were bleeding and had accumulated losses of Rs.20,000 crore. During this process, they were also growing very strongly.” Shriram Life, which started out in FY07, was profitable for every year, except in FY10. “We were making profit because we did not invest heavily in building our distribution capacity, as we were cross-selling our products to Shriram group’s customers. But we did not grow so fast. Now, we are at a juncture when we have to invest in growing the business.”

Given the nature of the insurance business, analysts and industry experts believe that one should look at the embedded value (EV) of the business. It is the sum of the present value of expected profit from existing policies and the net asset value of the capital.

Kotak Mahindra AMC’s CIO (equity) Harsha Upadhyaya, who holds Max Financial Services, ICICI Lombard, SBI Life and HDFC Standard Life across three funds managed by him, explains, “The EV is usually given out by an insurance company by assigning a probability to future earnings and by also looking at the value of existing investments.” For example, an insurer, after deducting the costs from a premium received, invests the balance in equity and debt instruments. The insurer makes a profit on this investment, which could be realised over an extended period of time. “The present value captures projected future profit from in-force policies, while the net asset value of capital and surplus represents the funds belonging to shareholders that have been accumulated in the past. Hence, EV gives a fair idea of the strength of the business,” elaborates Upadhyaya.

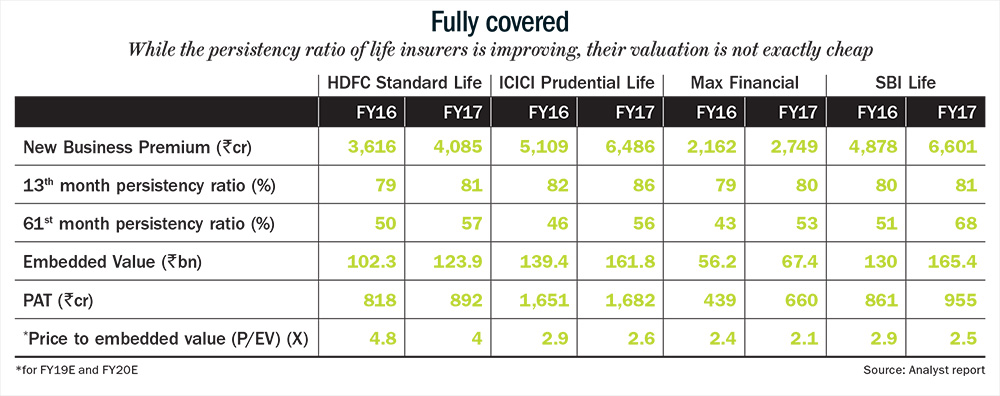

Analysts then value the business based on EV multiples. Of the firms listed thus far, on the basis of one-year forward price to embedded value (P/EV), HDFC Standard Life is the most expensive at 4.8x, followed by ICICI Prudential Life at 2.9x, SBI Life at 2.9x and Max Financial Services at 2.4x. Kromhout explicates, “In matured markets, typically the market value (capitalisation) of a life insurance firm is very close to its EV. But in emerging economies, given that insurance is a growing business, one tends to see EV multiples.”

Yet another key operating metric to evaluate the performance of an insurer is in terms of persistency. In other words, how many policyholders continue to renew their policies or continue to pay the premium. The Insurance Regulatory and Development Authority (IRDAI) regulations require firms to disclose persistency ratio for the 13th, 25th, 37th, 49th and the 61st month. The global standards for the 13th month persistency ratio is about 90%, while for the 61st month is about 65%.

According to Vidhi Shah, analyst at Prabhudas Lilladher, persistency ratio for insurers was low in FY12 owing to regulatory changes in ULIP products coupled with a subdued equity market. The 37th month persistency rate had dropped sharply for major private players in FY12, but eventually improved on account of revamped product offerings and reduction in the mis-selling of products. Currently, in terms of the 61st month persistency, SBI Life is the best performer at 68%, followed by HDFC Life at 57%, with ICICI Prudential at 56% and Max Life at 53%.

What’s the topline?

For insurers, new business premium (NBP), which is the amount of premium collected from new policies in a particular year is the topline. Increase in NBP not only leads to an increase in the value of new business (VNB) but also results in high acquisition costs and commission expenses at the start. “Thus, unless the premiums continue for more than five years, it can lead to negative impact on the profitability,” says Shah.

VNB is defined as the present value of the expected future earnings from the new policies written during a specified period, and it reflects the additional value to be generated to shareholders as a result of writing new business. This measure becomes important in the first year: when insurers get new clients, they have to set aside a huge sum towards likely claims expected at a later stage. Indian GAAP does not allow insurers to amortise the cost, which means that all the costs have to be accounted for in the first year itself, resulting in significant reported losses. Among the listed players, as of FY17, SBI Life has the highest VNB at Rs.1,037 crore, followed by HDFC Standard Life at Rs.910 crore, ICICI Prudential at Rs.666 crore and Max Life at Rs.499 crore.

But to generate new business, insurers have to also ensure optimal utilisation of marketing and distribution costs. Further, unlike the mutual fund (MF) industry, there are certain constraints on life insurers when it comes to distribution, a vital channel to gain a competitive edge over peers. “The distribution channel for insurers is not an open market unlike mutual funds. Today, a MF distributor can sell mutual funds of any AMC, while an insurance distributor can sell products of only three insurance firms. Earlier it was restricted to only one,” says Upadhyaya. Not surprising that in light of this restriction most insurers are relying on bancassurance or on their parent’s network, in case they are institutionally owned. “For example, HDFC Bank and SBI have the highest competitive advantage in the banking industry and if you can associate with them, obviously it gives you a great edge. This has happened to their own sponsored insurance companies,” he adds.

Sangramjit Sarangi, CFO of SBI Life, asserts that while there are differences in distribution costs, depending on the presence or absence of bank-channel, from a long-run perspective, they do not make a major difference. It is only in the initial years of the business being set up that the banking channel gives some competitive edge and helps in containing costs. “But over a period of time, the difference between agency and bank channel eventually converges since the persistency of a policy sold by an agent tends to be much higher vis-a-vis a policy sold through a bancassurance channel,” explains Sarangi.

The right mix

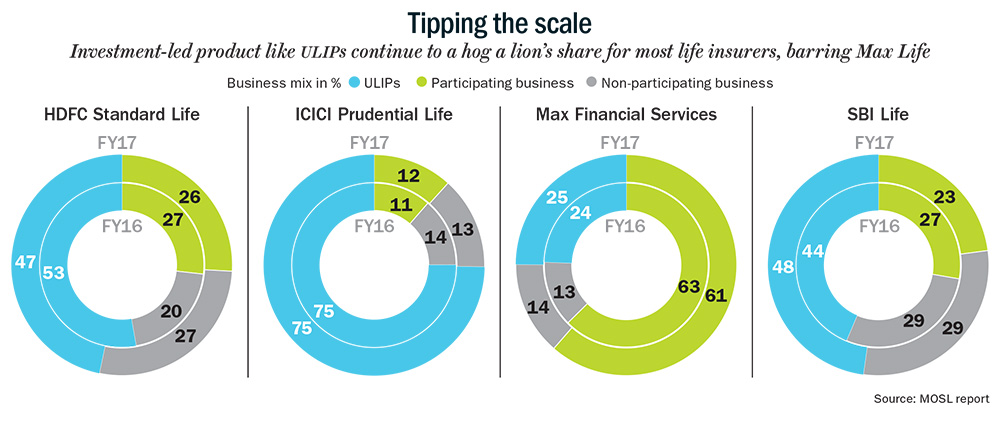

The product mix for life insurance firms also plays an important role in evaluating the robustness of a business, depending on the proportion of ULIPs or pure term policies to the aggregate business. Prateek Agrawal, CIO, ASK Investment Managers, says, “The most profitable segment is the pure term, the higher the better. But the risk is that if you are offering a guaranteed return, then in a declining interest rate scenario it can be a problem.” Alpesh Mehta, deputy head of research, Motilal Oswal Securities, adds, “A higher proportion of ULIPs in the aggregate business will be more volatile for the balance sheet, compared with an insurer that has a more balanced product mix. In case of ULIPs, if the capital market is not doing that great, then there is a possibility of some customers moving out. ”

Among large private players, ICICI Prudential has the highest share of ULIP products, followed by SBI Life, HDFC Standard Life and Max Financial Services. While Max Financial Services is working towards increasing the proportion of ULIPs in its overall business, HDFC Life has the most balanced product mix (See: Tipping the scale). Though the margin is higher in protection plans such as term and endowment plans compared with ULIPs, in terms of capital requirement, ULIPs need less capital from an insurer as investors bear the risk in this market-linked product. However, Harshad Patil, CIO, Tata AIA insurance, adds a rider, “While ULIPs help insurers to shore up their topline, the proportion of ULIPs to the overall business depends on the performance of the capital markets as well as their volatility. We need to understand the quality of the ULIP portfolio by studying the pattern of surrenders across market cycles.”

Sandeep Batra, executive director, ICICI Prudential Life, however, believes ULIPs are still a good bet for customers. “We view the market opportunity as two different segment: one, savings (comprising ULIPs, participating and non-participating) and second, protection. The premium for savings products will remain the same across participating, non-participating and ULIPs. But, ULIPs offer the most compelling proposition to the customer due to minimal or nil surrender charges, transparent and low charges and flexibility to choose asset allocation without cost implications. A policyholder can choose to have 100% debt allocation strategy.”

The flip side though is the number of surrenders that goes with ULIPs. Shah of Lilladher states in her report that ICICI Prudential has the highest surrender rates among all the major private players on account of higher share of ULIPs. In FY17, ICICI Prudential’s surrender ratio (surrenders/total premium) was 53% in FY17 compared with 27.5% for HDFC Standard Life. Not surprising that Vibha Padalkar, CFO, HDFC Standard Life, emphasises on the importance of having a balanced product mix, since concentration on any single segment results in major losses from any macroeconomic or regulatory headwind. “The ideal balanced product mix would be about 50-60% ULIP, 25-30% participating business, and the balance can be non-participating business.” Sarangi of SBI Life adds, “Some companies are good at selling ULIPs, while some at traditional products. Hence, every insurer has to play to its strength.”

While getting the right product mix remains an evolving exercise, what’s common to life insurers is their focus on chasing individual business rather than group business as margins are very high in individual business. Group business, besides being lumpy in nature, is also low on stickiness and is extremely price sensitive. Hence, insurers do not focus on these products. Agrawal of ASK sees merit in the approach. “Individual insurance business is preferred, given its granularity, sustainability and relatively higher margins.”

Premium for growth

Today, insurance players are improving their persistency ratio with the 13th month ratio above 80%. Against this backdrop, it’s not surprising that their valuations (estimated one-year forward P/EV) are in the range of 2.5x-4.0x (See: Fully covered). Though the valuation looks expensive compared with Asian peers, which trade in the range of 1.0x-1.5x, Agrawal believes the valuations are justified given the significant under-penetration of insurance in India. “The valuations are driven by the sustainability of growth, which is a combination of under-penetration, regulatory support, and potential improvement in margins.” Concurring with Agrawal, Shah of Lilladher says, “Life insurers’ embedded values are expected to grow at 15-20% CAGR over the next two to three years, led by the expansion of new business margins, from the current 16-22% to 18-25% and improvement in operating metrics.” Batra of ICICI Prudential expects the life insurance industry to grow in line with nominal GDP. “The mortality protection market in India is estimated at $8.56 trillion, which represents the difference between the income required by a family to maintain their living standards in case of unfortunate death of the earning member. Due to these factors, we expect to see a good growth in protection business.”

While the opportunity size is huge, what will also help the private life insurers will be their focus on balanced product and distribution mix. Analysts prefer HDFC Standard Life and Max Financial Services for their focus on long-term savings and protection products and high new business margins compared with ICICI Prudential and SBI Life. Though LIC remains a formidable competitor, it is almost entirely reliant on agency channel and does not sell much ULIP products. “Both of which mean that it could lose some of its existing market share of 50% in new business to private players,” mentions a Citi report. If that indeed is the case, private life insurers have enough business coming their way.