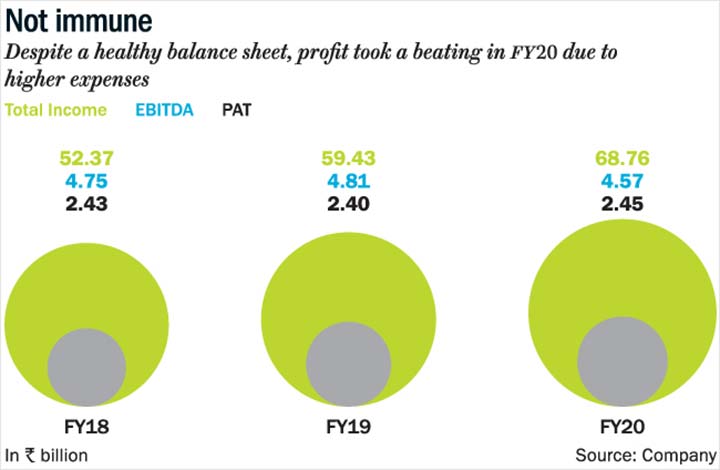

Never recommend ‘A Series of Unfortunate Events’ by Lemony Snicket to someone from the agri-commodities or poultry sector in India. It might just hit home too hard. Just like the Baudelaire siblings cannot shake off their evil shadow that comes in the form of Count Olaf, the agriculture sector has seen more than its share of setbacks. Be it swine flu, SARS virus, bird flu or chickungunya — related to meat consumption or not — the event has usually led to sharp fall in consumption in the sector. And the latest villain seems to have hit the industry the hardest, especially due to rumours of infection and supply chain disruption. At one point in March, broiler prices fell to Rs.4/kg against production cost of more than Rs.75/kg. The impact of the COVID-19 crisis is so widespread that a player such as Godrej Agrovet, which was described as “an agro behemoth in the making” in a Motilal Oswal Securities report last year, didn’t see what was coming. With animal feed segment being the largest contributor to its revenue at 51%, the company reported 16% growth in its topline in Q4FY20, but higher expenses weighed on net profit (See: Not Immune), which fell more than 42% to Rs.692 million. Meanwhile, its stock price hit a 52-week low of Rs.265 in the last week of March. Though it now trades at Rs.350, it is far away from its 52-week high of Rs.598, hit in January.

Despite the prevailing uncertainty, the well-diversified agro-chem player is confident that it will overcome this crisis without much damage. During their Q4FY20 earnings call, chairman Nadir Godrej mentioned that the market has started improving as the price of poultry increases and raw material cost softens. He added, “Our balance sheet remains strong with low gearing levels of 0.3 debt-to-equity and healthy liquidity position.” Analysts monitoring the stock continue to be optimistic even though they have slightly lowered their target estimates for the coming fiscal. So, is this a good time to buy Godrej Agrovet?

Balancing act

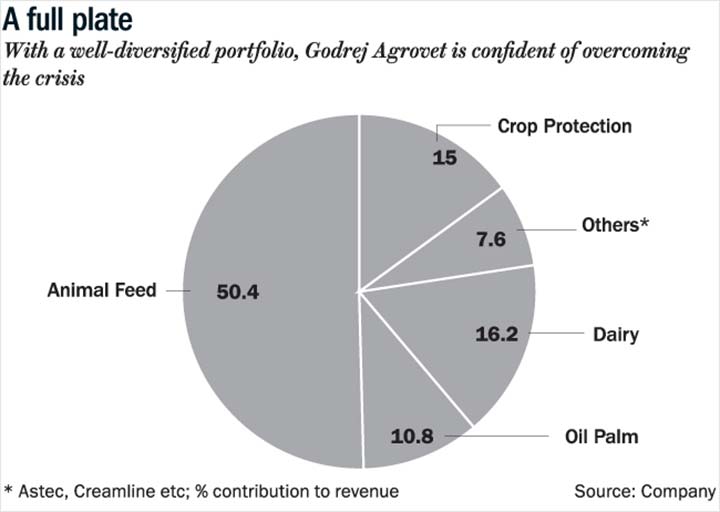

Backed by one of the most trusted industrial groups in the country, Godrej Agrovet leads in most segments that it operates in such as animal feed, crop protection, oil palm, dairy and poultry, and processed foods. Besides organic growth, the company has also expanded through joint ventures. For instance, it tied up with US-based Tyson Foods to launch Real Good Chicken and expand its existing Yummiez frozen foods range. In 2015, the company acquired 57.67% stake in fungicide bulk manufacturer, Astec LifeSciences to fortify its presence in the crop protection business, which includes plant growth regulators, herbicides, insecticides, organic manures and fungicides. This segment contributes 16.8% to the overall revenue of the company (See: A full plate). That same year, they raised their stake from 26% to 51% in Creamline Dairy Products to bolster a segment that contributes 19.7% to their topline. Through Tyson and Creamline, the company has increased value-added products in its poultry and dairy segments, which contributed 29% to overall revenue growth in FY20. They are looking to further grow through more product launches this year. Meanwhile, in Astec, Godrej Agrovet will leverage the advantage of market shift from China to India.

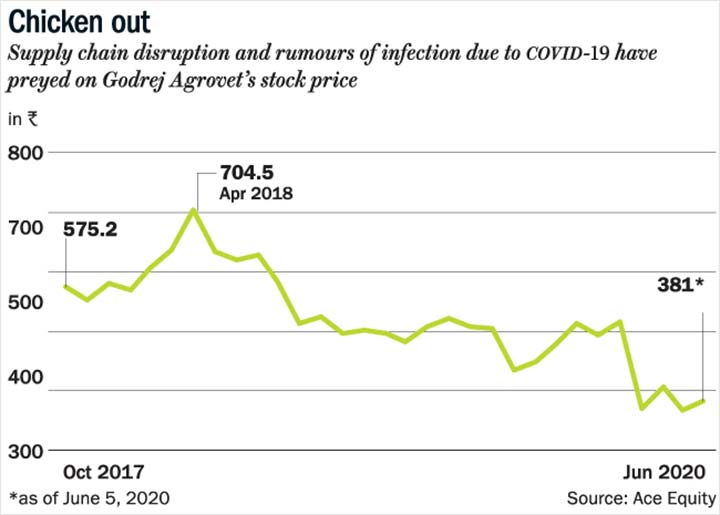

Over the past five years, Godrej Agrovet has seen revenue and profit compound at 8.57% and 12.86%, respectively. Thus, when the company, which was earlier housed under Godrej Industries, listed in October 2017, it was no surprise that it opened with 34% premium over its issue price of Rs.460. “The stock, since its listing, has enjoyed rich valuation due to its parentage, high return ratios and healthy balance sheet,” says Mayank Jhunjhunwala of Kedia Securities. But after intermittent rallies till April 2018, the stock has not been able to reclaim its all-time high of Rs.738 and continues to trade below its issue price.

While COVID-19 came down like a sledgehammer, analysts believe investors are taking into account several factors such as high capex, individual segment-specific concerns and high valuation. The company’s cash flow had taken a hit due to the ongoing capex in most of its businesses along with high capital needs. Like in Creamline Dairy, longer shelf life value-added products mean increase in inventory. “The business was impacted by lower realisations, fluctuations in the input prices of its key raw materials and the lower yield of palm fresh fruit bunch which impacted its operating margins,” adds Jhunjhunwala.

Post the disruption caused by COVID-19, the management is confident about its agro business picking up since they were allowed to begin operations in the third week of April. Another segment that is recovering is dairy, which also falls under essential commodities. Jhunjhunwala believes this is also the perfect time for the company to go deep with its animal feed segment since there are not many organised players in this segment. “COVID-19 would impact the cash flows of small unorganised businesses but Godrej Agrovet with a healthy balance sheet, strong brand name and higher capacities would be able to seize the opportunity,” he explains. With its network and rising demand in the animal feed category during lockdown, Godrej Agrovet can also overcome supply chain challenges much more easily than unorganised players.

Fighting uncertainty

As the coronavirus crisis batters an already weak economy, many analysts are uncertain about how growth for companies in agro and commodity sectors will play out. While maintaining a ‘buy’ rating, brokerage Prabhudas Lilladher has lowered its target estimate to Rs.461. Research analyst Prashant Biyani says, “Even though all of their products are essential commodities, they are mostly targeted for out-of-home consumption.” This includes products across poultry, value additions in dairy and palm oil as well, which is used for cooking in restaurants, hotels and eateries. Apart from a demand hit, price erosion has also hurt Godrej Agrovet in segments such as palm oil. “There will be pressure in the current financial year, and any meaningful recovery, if it happens, will be only in the next financial year,” Biyani adds.

Along with the company’s management team, what should soothe investors’ nerves is the fact that the stock has seen heavy promoter buying. The parent Godrej Industries has increased its holding by nearly 1% through market buying during the current fall. In fact, the biggest chunk was bought in late February at Rs.540 with further addition at Rs.328 and Rs.356.

Biyani says one must buy the stock only if they are willing to hold it for the next two years, and ready to embrace volatility. “I do not see any material upside for the stock over the next few months. Instead, there can be some downside if the market corrects,” he adds. Given the current economic condition, he believes growth will bounce back after FY21.

Godrej Agrovet CEO Balram Singh Yadav stated during the latest concall that their agrochem, Astec and crop protection and aqua feed businesses will improve as normalcy returns. “Even if the size of the market reduces, bigger players will have slightly more market share. Raw materials and feed are coming down. So, we believe that there is opportunity for margin expansion there,” he said.

After all, the lockdown cannot last forever and in whatever form normalcy returns, demand is expected to pick up. At its current price of Rs.381 (See: Chicken out), Godrej Agrovet trades at 36x and 23x its estimated FY21 and FY22 earnings, respectively. Analysts at Motilal Oswal Securities have a price target of Rs.443 citing higher yields in the palm oil business and higher margins in the dairy business. If indeed, all the ‘unfortunate events’ are priced in for Godrej Agrovet, then the scales are tipped more towards reward than risk.