Frank Underwood, the central character in the Netflix original House of Cards, was Machiavellian — murdering people, ordering hits on colleagues and even killing a dog. He lived by “hunt or be hunted”. The Indian software business is just as ruthless. Senior management here may assume the title of a gardener or retire to help lesser-privileged children, but everyone knows that unless your business keeps pace with clients’ ever-changing needs, you might as well be potting grass. The rule in the IT industry, in a twist to Underwood’s maxim, is “disrupt or be disrupted”.

HCL Technologies caught on to this in 2016. This leading IT player in the country and in the world decided to shut down four physical data centres out of the six in India and move towards new digital technologies such as social, mobility, analytics and cloud (SMAC).

“We are not investing in data centres anymore,” said the-then CIO of HCL Technologies Manoj Kumbhat, adding that the company’s total IT investment on SMAC would go up significantly. Over the past three years, its digital service vertical has grown at a CAGR of 30%, and now has more than 220 clients.

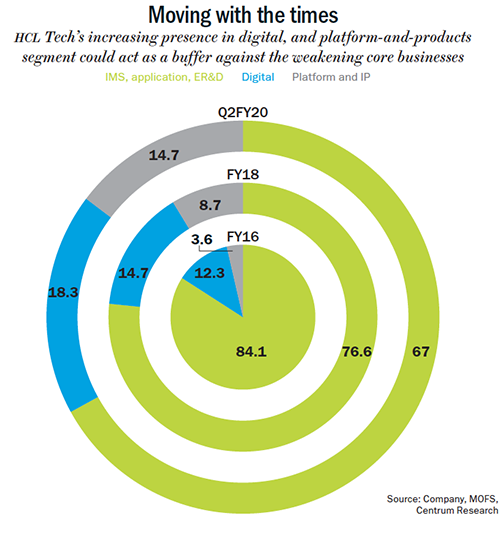

The share of revenue from these services, which include SMAC, has gone up from 12.8% in FY17 to 18.3% in Q2FY20. The company also ramped up the use of SMAC in its other verticals such as infrastructure management services (IMS), products and platforms. Recently, HCL Technologies started a separate Google Cloud Business unit and entered into an IP partnership with IBM for cloud solutions in February this year.

Analysts believe they are headed in the right direction because demand for these newer technologies is only set to rise. “Hybrid cloud adoption is increasing within the largest 2,000 enterprises globally. Also, now there is a big opportunity in mid-sized enterprises’ cloud adoption, which was a segment not catered earlier by Tier-I IT companies,” says Apurva Prasad, AVP-research, institutional equities, HDFC Securities.

This is not the first time the tech company has adapted to changing market needs. In 2008, when the recession struck, IT companies in India had been largely following the linear model of growth — the client was charged in direct proportion to headcount deployed on the project. This became unmanageable over time, because of various factors including employee cost and high attrition, so companies moved to non-linear growth models in 2012-13. This is essentially getting more revenue per employee with disruptive technologies and more efficient cost structure. HCL Tech did this by developing software code or automation to replace manual work. It also imparted cross-skills to its employees to increase productivity and bagged fixed revenue contracts instead of being paid by the hour.

“Interestingly, our profit (growth) outgrew revenue significantly at 66%. This is a validation of our non-linear strategy,” said R Srikrishna, the-then corporate vice president of infrastructure and healthcare services sales in the Q4FY13 earnings call.

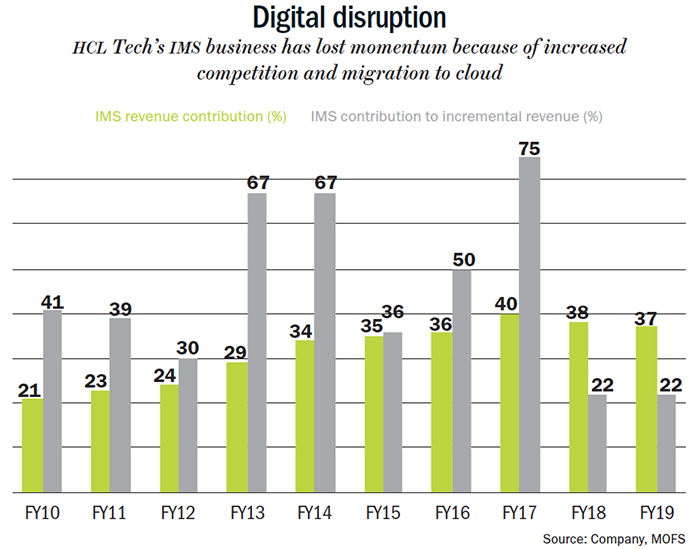

The use of non-linear model coupled with the company’s focus on the IMS vertical paid rich dividend. IMS, which had contributed 21% to the overall revenue in FY10, added 35% to the topline in FY15. Over the same period, net profit rose from Rs.12.59 billion to Rs.73.01 billion.

Things were going well till 2016. Post that, it faced a slowdown in its core revenue generator, which is IMS, because of increased competition and migration to cloud technology. IMS largely involves building and maintaining either physical data centres (servers) or cloud-based network. Companies started preferring the latter and HCL Tech’s offering was largely in the former. HCL Tech, along with other tech companies, decided to shift focus to the cloud but that meant slackening of revenue growth in its IMS segment (during the transition). In a 2018 interview, HCL Tech president and chief executive C Vijayakumar had acknowledged this and said: “As most clients embrace the cloud, we are seeing some softness in the infra business… About half of our total IMS business is data centre business.”

For FY19, IMS contributed around 37% of the revenue, but its share in incremental revenue growth has seen a drastic drop (See: Digital disruption).

For FY19, IMS contributed around 37% of the revenue, but its share in incremental revenue growth has seen a drastic drop (See: Digital disruption).

With the company facing weak revenue in its core business, HCL Tech swung for the fences by buying IBM products for a whopping $1.8 billion in 2018! To get some perspective, it accounted for around 20% of HCL Tech’s overall annual revenue (FY19) and was the largest acquisition by any Indian IT company. Its stock price dropped 8% on December 7, 2018, when the deal was announced.

Pay-off

Just as it seemed like everything was headed downwards, there was a revival. The company bagged transformational deals across verticals and, within a year, saw revival in demand in its organic businesses (IMS and Engineering R&D, or ER&D). Moreover, there is clarity about the revenue it could earn from IBM products.

Abhishek Shindadkar of Elara Capital states that the major deals (Nokia, Broadcom and Xerox) won in the past few quarters has led to a revision in growth guidance — it was raised to 15-17% for FY20 from 14-16% earlier.

Added to that, renewal of many IMS deals are due and these renewal deals are a $125-billion market growing at 2-2.5% each year. HCL Tech is perfectly placed to make the most of this, being one of the top two Indian companies offering IMS services.

Like IMS, the ER&D vertical, under which HCL Tech provides software and platform engineering solutions, is also expected to drive revenue growth. Globally, corporates are set to spend more — $781 billion — on ER&D by 2022 and Indian IT players will make more than a third of what they are earning now ($42 billion from the current $28 billion). And HCL Tech being a prominent player in this space will make a packet. It has 65 out of the top 100 engineering spenders in its kitty and has strengthened its position by setting up more than 80 engineering labs and 100 client development centres. HDFC Securities’ Prasad says that the acceleration of HCL Tech’s organic growth (highest in Tier-I IT) will be thanks to the scale of its business in ER&D and IMS, besides its large deal wins.

High-margin play

Besides the organic business showing signs of recovery, the company has also taken steps to increase its revenue from other avenues such as platform and products (P&P). In line with this was the IBM products buy. The contribution of P&P segment to overall revenue has gone up from 3.6% in FY16 to 14.7% in Q2FY20.

P&P is also more profitable. While digital services fetch 13-14% Ebit margin, P&P yields 32-33%. “This segment has strong gross margins because of high license revenue and product maturity,” says Prasad (See: Moving with the times). The company even carved out a separate entity in FY19, named HCL Software, to focus on organic and acquired P&P. In addition to this, it has an AI-powered digital enterprise DRYiCE and industry-focused IP platforms. A Motilal Oswal Financial Services (MOFS) report notes: “...HCL Tech has not lacked aggression in exploring new avenues, of which the IBM partnership seems to be the biggest bet”. The company expects the acquisition to clock $625 million in revenue annually and managed to get off to a decent start with revenue of $107 million in Q2FY20.

P&P is also more profitable. While digital services fetch 13-14% Ebit margin, P&P yields 32-33%. “This segment has strong gross margins because of high license revenue and product maturity,” says Prasad (See: Moving with the times). The company even carved out a separate entity in FY19, named HCL Software, to focus on organic and acquired P&P. In addition to this, it has an AI-powered digital enterprise DRYiCE and industry-focused IP platforms. A Motilal Oswal Financial Services (MOFS) report notes: “...HCL Tech has not lacked aggression in exploring new avenues, of which the IBM partnership seems to be the biggest bet”. The company expects the acquisition to clock $625 million in revenue annually and managed to get off to a decent start with revenue of $107 million in Q2FY20.

IBM’s products add to HCL Tech’s portfolio, and the management believes that it can cross-sell its products to IBM’s large customer base and enter new markets. “HCL Tech will get around 25,000 customers and can make inroads into key markets such as Japan, China and Germany,” says Prasad of HDFC Securities.

The management highlighted in the September earnings call that the migration of contracts, which were with IBM, has started, and will be wrapped up in the next four quarters.

Value Play

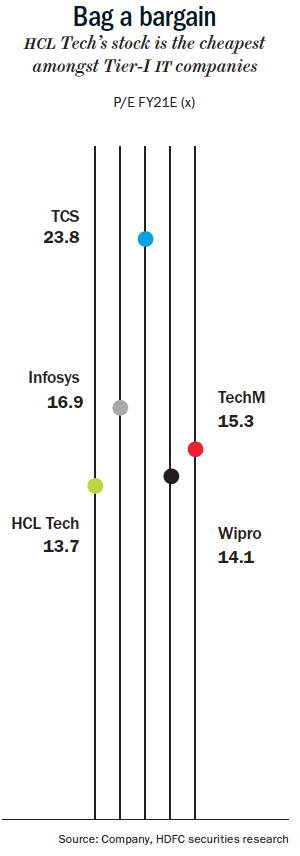

Today, HCL Tech is one of the top four IT companies in India, which provide remote infrastructure management, software solutions and BPO services. With offices located in 26 countries, the company works with diverse sectors from finance, automotive and telecom to media, retail and entertainment. Despite these strengths, its stock trades at a discount compared to its peers — Infosys, Tech Mahindra and Wipro and TCS (See: Bag a bargain).

This discount is being attributed to the capital stress on capital from the IBM products’ purchase, revenue growth slowdown in the core business, weak dividend payout and lower exposure in digital services as compared to its peers. Now the company has started tackling all of these drawbacks.

This discount is being attributed to the capital stress on capital from the IBM products’ purchase, revenue growth slowdown in the core business, weak dividend payout and lower exposure in digital services as compared to its peers. Now the company has started tackling all of these drawbacks.

A lot still hinges on its recent acquisition of IBM products, but strong deal wins and recovery in the core business are seen as big positives by investors. Since its second-quarter results on October 23, the stock has moved up but still trades at an attractive 13.7x estimated earnings for FY21. “Valuation continues to be reasonable in comparison to the portfolio offerings. Hence, we recommend accumulate rating,” says Shindadkar.

HCL Tech’s peers such as TCS, Infosys, Wipro and Tech Mahindra are trading at much higher valuations of 22.3x, 14.9x, 14.1 and 14.3x earnings for FY21, respectively. This, despite TCS and Infosys, having revenue growth estimates of 6.3% and 9.9% for FY20 — lower than HCL Tech. Even Tier-II companies such as L&T Infotech and Mindtree are trading at a higher price than HCL Tech.

Besides strong growth in revenue and margins compared to peers, Deepan Kapadia, analyst, Equirus Securities cites HCL Tech’s other positives such as its strong business portfolio and continued large deal wins. “Large transformational deals increase client wallet share and give stronger revenue visibility for the business going ahead,” states Kapadia.

Also, the company hasn’t witnessed turbulence at the top management level like its peers. While top IT firms such as Infosys have been seeing frequent entry-and-exit in senior management, HCL Tech has remained a stable ship. “This helps maintain a company’s DNA and culture,” says Prasad. He believes that the investments made to build a new portfolio (IBM products) are the biggest risk, but these concerns have been factored in.

Just as Underwood had the ability to recover from political setbacks in House Of Cards, HCL Tech has a track record of dusting off its suit, righting its tie and getting back in the game. That all important adaptability (where the Underwood similarity ends) is what investors can count on.

Just one email a week

Just one email a week