Following an unrelenting rise over the past 18 months, the winning streak for small and mid-cap stocks has come to an end. Since the beginning of this calendar year, BSE Small-Cap Index and Mid-Cap Index have fallen by 20% and 15% from their respective highs. May was the worst month for mid-caps in the past one-and-half years with the index plunging by 6.8%. A cloud of uncertainty now looms over these indices with several coveted names no longer being investor favourites.

Till December last year, mid-caps and small-caps had a great run due to the good macro-environment and fund flows. Over the past six months, micro-environment has improved but macro has become challenging. A weakening macro-environment triggered by increasing crude prices and depreciating rupee has fuelled market volatility forcing investors to take shelter in large-cap stocks. “When liquidity tightens, interest rates start rising and inflation returns. In an increasing interest rate scenario, the equity valuation in terms of multiple takes a beating and it’s usually the mid-cap universe that suffers more than large-caps,” says Pankaj Tibrewal, equity portfolio manager, Kotak Mahindra AMC. In the mid-cap space alone, 55 stocks plummeted between 10%-30% and another 24 fell by 30% or higher.

That fall was not only due to the change in market sentiment. Re-categorisation of mutual fund norms has also contributed to the fall. Fund managers had to re-arrange their portfolio after Sebi-issued new guidelines for categorisation of mutual fund schemes. The mid-cap segment now includes the 101st to 250th stock ranked by market capitalisation. The 100th stock by market capitalisation today has a value of around Rs.300 billion while the 250th stock is roughly Rs.95 billion. “Mid and small-caps had witnessed a run-up resulting in high valuations. Emergence of new macroeconomic headwinds like rising crude oil prices and a falling rupee along with restructuring of the mutual fund schemes because of regulatory reasons, has led to unwinding in mid-cap stocks” says Amishi Kapadia, senior president, YES Securities.

The good news is not all losses in mid-caps are driven by deterioration in company fundamentals. Here are a few which continue to report healthy numbers and may get a second look from investors.

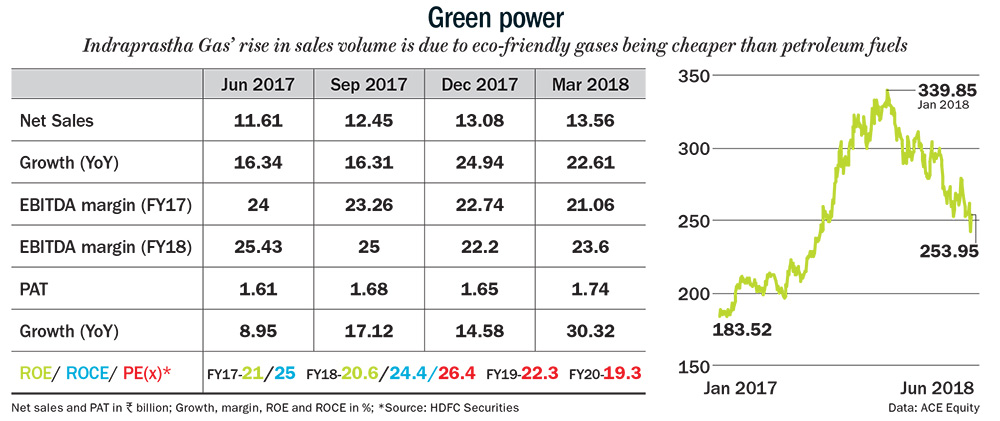

Indraprastha Gas

Despite reporting healthy revenue and profitability in Q4, the stock received a severe beating, losing 28% since the beginning of the year. The city gas distribution company reported robust revenue growth of 23% YoY led by 11% YoY rise in sales volume in the last quarter. India’s shift towards natural gas, which is environment-friendly, has driven sales volume and analysts believe that the volume growth momentum will continue as the government focuses on green initiatives. “The switch over to CNG continues to grow owing to regulatory push and cost benefits of using natural gas. CNG prices are currently 39% and 45% less than diesel and petrol respectively,” says Nilesh Ghuge, analyst, HDFC Securities. With the prices of gas being relatively cheaper to petroleum fuels, the company enjoys pricing power (see: Green power). IGL’s latest decision to increase prices by 3% on May 29 soon after raising them by 0.9% per kg a month back reflects the company’s ability to ride on the impact of higher crude oil prices to some degree.

Besides, the company is also in growth mode. “IGL is expanding its pipeline to new areas like Karnal, Rewari and part of Gurugram, which will add PNG volume. CNG volume will also continue to be robust, owing to conversion of Ola, Uber and private cars. Monopolistic business model and robust growth from investments in subsidiaries coupled with a foray into newer geographies make us remain positive about IGL,” says Ghuge.

IGL offers investors a rare mix of volume growth and healthy margins, which is a sweet combination. At Rs.253, the stock trades at 22x FY19 earnings, which seems reasonable. In times of volatility, IGL is also a safe-haven given the stable nature of its business.

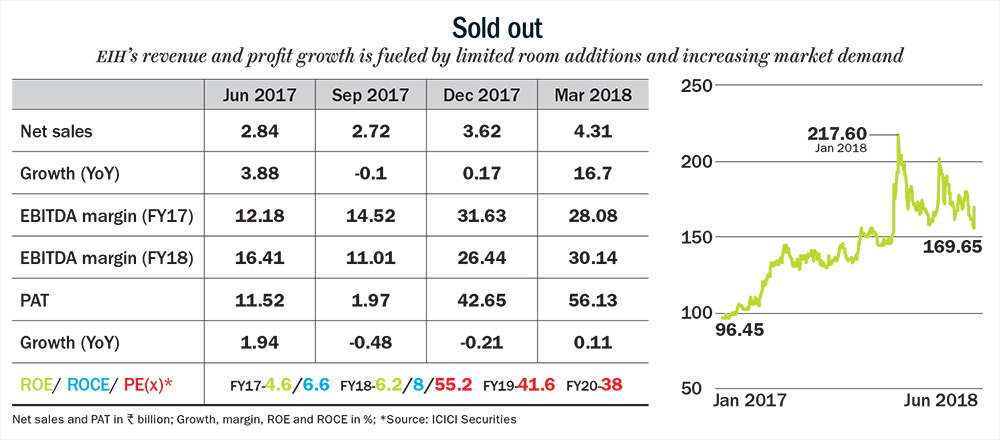

East India Hotels

East India Hotels (EIH) has also been a victim of mid-cap sell-off, despite reporting robust growth. The hotel industry has been witnessing growth mainly led by healthy increase in the number of foreign tourists, limited new room additions and an uptick in domestic demand. “Given that the major chunk of room supply will only come post 2022, EIH is well placed to take benefit of low supply and high demand,” says Rashesh Shah, assistant vice-president at ICICI Securities (see: Sold out).

EIH witnessed an upward trend in revenue and profit, led mainly by re-opening its main property in Delhi. While its revenue grew 19% YoY in March 2018, net profit increased by around 11% to Rs.1.79 billion in FY18 from Rs.1.03 billion in the previous fiscal.

Analysts are backing the company, which runs luxury hotel chains — Oberoi and Trident, to lead the industry owing to the impending launch of six new hotels with 893 rooms that are in various stages of construction and are expected to be operational in the next three years. They expect revenue to grow at 15% CAGR in the next three years. “The properties of EIH are strategically located in business as well as leisure hubs. The rise in the occupancy levels supported by healthy demand would lead to rise in room rates going forward, thus, leading to robust margin expansion,” says Shah.

The uptick in demand will also improve the company RoIC, which is expected to reach double digits in FY19 from 6.2% in FY18. “If you don’t expand in hotel industry you don’t make profit. We believe the company’s balance sheet is in a better position to fund these expansions,” says Shah. As the economy rebounds, EIH’s strong presence in business hubs will also boost revenue.

Expansion at a time when government thrust on tourism is increasing puts the company in pole position to exploit rising demand, according to the analyst. At Rs.170, the stock trades at 55x current year earnings and 3.4x book value. Its fixed assets valued at Rs.23.78 billion should provide a good cushion to investors.

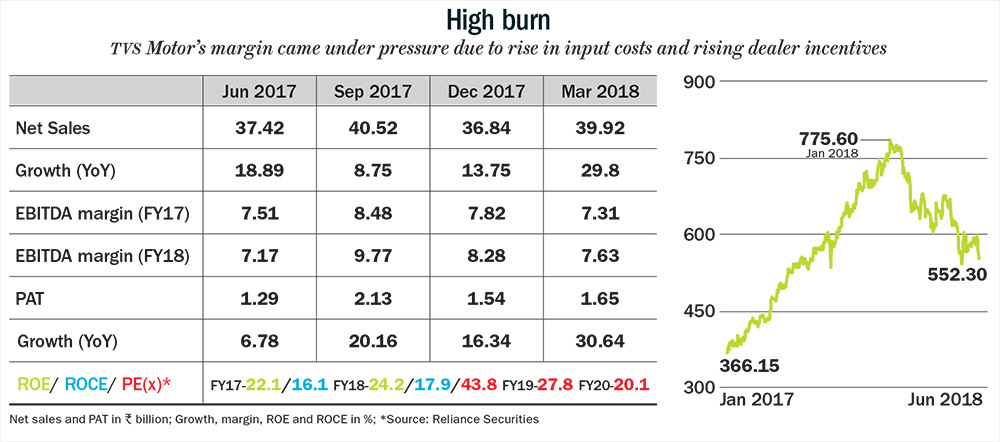

TVS Motor

TVS Motor also suffered a similar fate as other mid-caps with the stock plummeting more than 25% from its high of Rs 767 in January 2018 despite strong sales volume performance. TVS Motor’s volume surged by 32% YoY driven by the success of new Apache, Jupiter and NTORQ (see: High burn). However, higher input cost, increased dealers’ margins and one-time promotional expenses hit the margins and possibly spooked investors. Despite Q4FY18 being a better quarter for its motorcycle segment, margins fell below the previous quarter.

But analysts believe that the rising cost of raw materials should not perturb investors anymore as the company has implemented two consecutive price hikes in April and May to pass on the inflation cost and dealers’ incentive to consumers. “When there is strong demand in the market for a company’s models, it has a decent pricing power. TVS’ sales volume reflects the demand for its models and the company has already taken the price hike for majority of models in the month of April and May into account. These would take care of the major portion of cost inflation,” says Mitul Shah, vice-president — research, Reliance Securities.

The depreciating rupee is also expected to support margins as the company outperformed the industry in exports. Export volume grew by 49% YoY to 160,994 units due to a 50% and 82% rise in two-wheeler and three-wheeler volume, YoY, respectively.

Rich product mix and strong brands are expected to help TVS Motor ride the rural consumption growth story. “We envisage double-digit volume growth for the company fuelled by improving rural demand and favourable monsoon. TVS is better placed in the domestic two-wheeler space with a strong product portfolio at present,” says Shah. At Rs 555, TVS trades at 27x FY19 earnings compared with 17x and 16x for rivals Hero MotoCorp and Bajaj Auto.

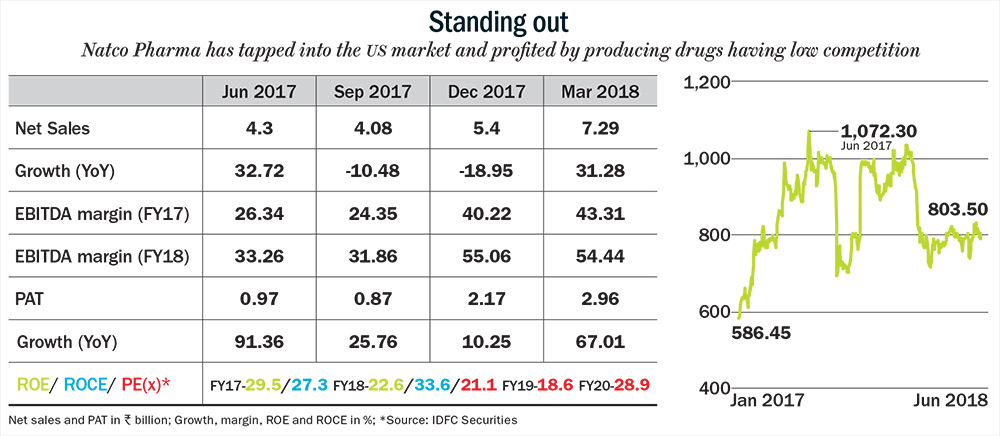

Natco Pharma

While its peers are grappling with pricing pressure in the US and lacklustre growth in the domestic market, Natco Pharma reported net sales growth of 31% in Q4FY18 as compared to Q4FY17. The drug maker even rewarded its employees with a one-time special bonus in June for the second year in a row. But the Q4 results have failed to arrest a slide as the stock dropped 22% from its high of Rs 1,034 in January.

Natco Pharma’s revenue jumped 36% YoY in FY18 driven by windfall from limited competition in segments in which the company operates in the US. The company has carved out a niche market for itself in the US by tapping into areas like generic Copaxone where there is less competition (see: Standing out). Copaxone, which is the most prescribed drug for a brain-related disease — relapsing multiple sclerosis (RMS) in the US, is touted to deliver revenue for Natco Pharma, before losing steam in FY20 as its rivals launch their generic versions. “Natco’s product strategy of focusing on segments where there is less competition has handsomely paid off. Unlike other players, they haven’t chased all the products and have focused on areas where there is limited competition,” says Praful Bohra, senior analyst, Equirus Securities.

While the windfall from the US market is set to continue, the company plans to focus on three specific markets — India, Brazil and Canada. The management’s decision to also focus on markets apart from the US comes on back of rise in revenue from Brazilian and Canadian markets. These two markets contributed US$4.5-5 million and C$15 million in FY18.

Natco Pharma is also a leading player in oncology segment with 30 products. The segment has grown at 19% CAGR in last five years contributing significantly to revenue. “Even in India, Natco has been operating in very niche market and has largely focused on oncology segment through diverse range of drugs which has worked well for them,” says Bohra. Analysts also believe that the momentum in oncology segment will continue on the back of incremental launches.

With a series of positive developments including the much-awaited launches for gCopaxone 20mg and 40mg and the launch of gTamiflu, which is an anti-viral for the treatment and prevention of influenza A and B, analysts are buying the Natco Pharma story. “With proven R&D capabilities post successful launch of multiple complex generics and a much stronger balance sheet, Natco has now created a strong platform to make relatively aggressive investment (versus the past) to move into the next growth orbit,” says Nitin Agarwal of IDFC Securities in his report. At Rs 807, the stock trades at 21x FY18 earnings making it an attractive bet as compared to some of its peers like Indoco Remedies and Torrent Pharma which are trading at 40x and 35x respectively. At current valuation, Natco Pharma could be a good addition to an investor’s portfolio.

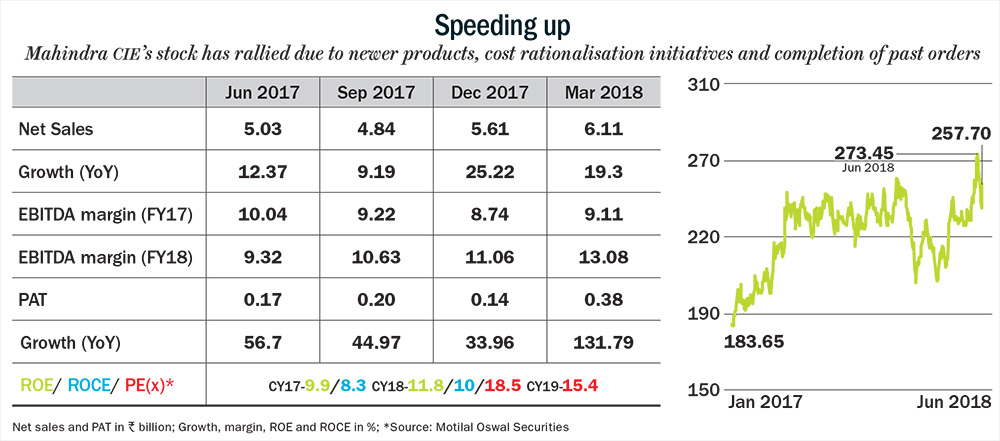

Mahindra CIE Automotive

Like Natco Pharma, Mahindra CIE Automotive’s drop in stock price has also made it an attractive bet. The stock had fallen more than 20% since the start of the year and is recovering. The stock rallied more than 7% on June 30 after 4.9% of the company was traded in a block deal.

The automotive components supplier reported healthy operating performance with consolidated revenue coming in at Rs 19.11 billion up 25.6% YoY in Q4. Analysts believe positive exchange rate drove up the sales by 10% on a YoY basis as the revenue from Europe grew 26.3% YoY to Rs 11.41 billion. The company has also started executing orders which it had bagged in the past, thus, driving up the revenue. In Europe, the company has begun supplying crankshaft from its local forging division.

Mahindra CIE has also implemented several initiatives of cost rationalisation, which have started yielding positive results (see: Speeding up). EBITDA margin increased 254 bps YoY and 170 bps QoQ to 12.1% primarily due to lower employee and other expenses in Q4FY18. The management believes that cost-cutting exercise and operating leverage will further expand margins by 300-400 bps in the next three to four years.

After the fall, earlier this year, investors are lapping up the stock post the Q4 results. Analysts believe there is more upside to the company. “We feel Mahindra CIE provides a unique Indian auto component play, which has a global footprint with global promoters. We expect the turnaround to be significant. The company would find a way to increase efficient and profitable utilisation with no major capex over the next couple of years,” says Nishit Zota of ICICI Securities in his report. On one-year forward basis Mahindra CIE is currently trading at 15x as compared to its peers like Bharat Forge and Ramkrishna Forgings, which are trading at 32.6x and 18x respectively. As the company has a strong balance sheet, sensible management and reasonable valuation, it could be a good bet to ride the rise in automobile demand.