On a cold January evening, Union Minister for Road Transport and Highways, Nitin Gadkari took the podium on the 62nd Foundation Day of the one of the country’s oldest PSUs, the National Projects Construction Corporation (NPCC). One would have expected accolades coming the management’s way, instead, the minister engaged in some plain-speak.

Gadkari pointed out that, in a ministry that had awarded Rs.14 trillion worth of orders, to have a PSU such as NPCC clocking a business of Rs.10 billion was not desirable. “There is no dearth of orders, but NPCC has to rise up to the challenge. I have saved you once but will not always,” said Gadkari. A loss-making unit, NPCC was on the verge of closure with the current NDA government looking to divest 100% of its holding in 2017.

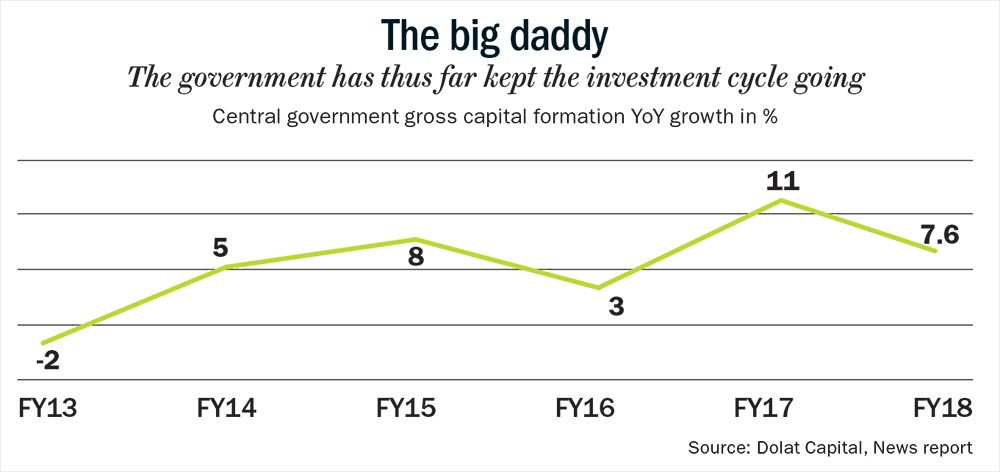

When the proposal came up for discussion, Gadkari revealed that he decided that he would resurrect the PSU by offering it bigger orders. In fact, it’s not just NPCC, but even the private sector that has been a big beneficiary of the current government’s spending push. Since FY14, government spending, including that of state-owned PSUs, has kept the economy’s investment cycle moving (see: The big daddy). But with government’s spending slowing down and the private sector yet to join the party, the road ahead for infra and capital goods companies could be challenging.

Roadrunner

Gadkari’s obsession with targets reflects in the pace of road construction in the country — it has seen a drastic improvement from 11.7 km/day in FY14 to 27 km/day in FY18. Though the pace is way below the target of 45 km/day that the minister had set, the road developers had no reason to complain.

FY18 saw a record 17,000 km in road projects, the highest-ever in a year, being awarded. Over 90% of these contracts were based on the hybrid annuity (HAM) and engineering, procurement and construction (EPC) models. According to Crisil, road construction companies are set to clock 20% revenue CAGR till 2020 given that they had an order book of Rs.1.3 trillion in FY18.

On the back of a strong performance, the stocks of top five road companies by market cap such as Dilip Buildcon, NCC, Ashoka Buildcon, and Gayatri Projects have shown a CAGR of 14% to 67% over the past five years (as of FY18). However, over the current fiscal, these very stocks have dipped, with Dilip Buildcon falling 62%, while the others have dived anywhere between 22% and 31%. The Street’s exuberance has been tempered by the realisation that the developers may not be able to execute the projects as expected. There are concerns around financial closure of Rs.760 billion worth of HAM projects awarded in FY18. Of the 104 HAM projects awarded to date, only 56 have achieved financial closure.

Jitendra Gohil, head of equity research – Credit Suisse Wealth Management, explains the reason: “We are seeing HAM projects struggling for financial closures post IL&FS collapse, both public and private sector banks have turned wary of infra lending.” Further, with eight public sector banks under the Reserve Bank of India’s Prompt Corrective Action Plan, sectoral and borrower exposure limits are stringent.

Under HAM, the government commits up to 40% of the project cost, while the developer funds the remainder with debt and equity. The NHAI is responsible for toll collection, while the developer receives annuity. As per Crisil, HAM projects being awarded over the next two years will need Rs.700 billion of funding through a mix of debt and equity. Companies will have to raise Rs.120-Rs.150 billion in equity to invest in new HAM projects.

R Shankar Raman, Larsen & Toubro’s wholetime director and chief financial officer, had commented in an earnings call that the HAM model is unsustainable. This is because, he said, developers today don’t have the deep pockets they had 10 years back. Gohil feels that though the NHAI has the ability to spend, HAM players will find raising equity a challenge. “EPC-focused companies are better off in the roads space, today,” feels Gohil.

Vinayak Chatterjee, chairman of Feedback Infra, an infrastructure services company, points out that the infra sector needs to revive the public-private partnership (PPP) model that lost momentum over the past decade, since public expenditure is not enough to counter the decline in private investment. Though the Kelkar Committee has submitted measures in its report to revive the PPP model, no concrete steps have been taken by the government since the report was submitted in 2015. Some of the key proposals of the panel include sourcing long-term capital at low-cost, by allowing banks and financial institutions to issue deep discount bonds, also known as zero coupon bonds. Besides, after the successful completion of projects, equity in the project may be offered to long-term investors, including overseas institutional buyers. Importantly, the report has also sought protection for the private sector against any abrupt changes in the economic or policy changes. “There has been a virtual disappearance of PPP and I think whichever government comes to power has to implement the report and implement all steps to revive confidence in PPP,” opines Chatterjee.

Weak Transmission

Even as the roads sector is facing headwinds, the other sector that is seeing a slowdown is domestic transmission. Power Grid Corporation of India (PGCIL), which accounts for over 45% of the country’s annual transmission capex and the biggest customer for transmission equipment suppliers, has been going slow in placing orders. In FY18, PGCIL orders stood at Rs.90 billion, a 68% fall YoY and the lowest since FY09. The top four players (KEC International, Kalpataru Group, L&T, Skipper) bagged 75% of orders awarded by PGCIL in FY18. The trend has continued in the current fiscal as well with orders placed in H1FY19 plummeting 51% YoY to Rs.22 billion.

Sharan Bansal, director of the Kolkata-based Skipper, says, “The T&D sector in the first four years (since FY14 to FY17) saw a good number of projects from the PGCIL, state electricity boards and private players. However, in the current fiscal (FY19) we are seeing a slowdown.”

While revenues have been down in the third quarter for the company, Skipper currently has an order-book of Rs.26 billion, which in FY14 stood at Rs.10 billion. “Q3FY19 is indicative of the general execution challenges in domestic T&D industry and also some liquidity challenges being faced in the infra sector. However, we believe that Rs.400-Rs.500 billion worth of orders are expected from PGCIL but there is no visibility when it will come,” mentions Bansal.

According to India Ratings & Research, delayed payment realisation from PGCIL in H1FY19 is likely to have some negative rating implications, if improvement is not seen for a prolonged time period.

One of the other major reasons that the T&D sector is struggling is that the power sector itself has not yet found its feet. “There are hardly any thermal plants (which contributes more than 60% of electricity generated by India) coming up,” says Bansal. According to Siva Subramanian, director, India Ratings, the reason that thermal power sector hasn’t seen new projects because of the availability of stressed assets. “Many of them are available at a discount in the bankruptcy market,” says Subramanian.

According to India Ratings, the pace of resolution of stressed thermal capacities continues to be slow with the sector having seen resolution of around 2 GW thus far of the 40 GW stressed assets. The primary reason has been the significant hair-cuts being suggested, presence of multiple lenders and issues related to the settlement of past capex dues for under-construction capacity. But since green-field projects take much longer to implement, power sector companies are willing to wait out the resolution delays rather than invest in new projects.

What compounds the scene in the power sector is that the renewable space, saw around 2.4 GW of central and 1.5 GW of state sector bids being scrapped in 2018 owing to higher tariffs. The slowdown narrative is increasing getting all pervasive.

Still In The Woods

According to the Centre for Monitoring Indian Economy (CMIE), project announcements in the nine months of FY19 are already down 7% year-on-year. As of December 2018, stalled projects stood at a massive Rs.11.8 trillion, accounting for 10.8% of projects under implementation. About 82% of stalled projects belong to the private sector and is one of the major reasons for subdued new project annoucements.

Interestingly, as per a report from Dolat Research, which has taken the gross fixed asset (GFA) formation of India Inc as a proxy for capex, the GFA growth of all companies over FY92-FY17, shows that growth rates peaked at over 30% during FY92-FY97, as the country opened up in the post liberalisation phase. The second growth-rate high was during FY05-FY12 when industry utilisation hit a ceiling and the rates hit the 20% range. Post 2010, as capacities peaked and coincided with the lag effects of the global financial crisis, capex growth plunged to 10% growth, with the numbers being sub - 5% for the past two years.

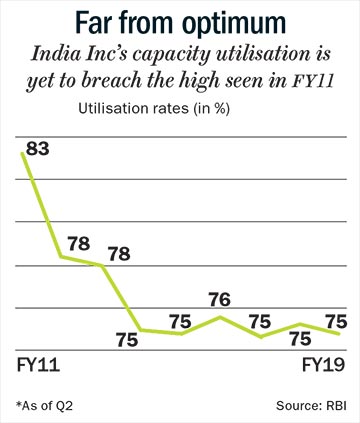

That’s not surprising considering that even peak capacity utilisation rate of India Inc has not yet surpassed the highs seen in FY11. As per the central bank’s OBICUS (Order Books, Inventories and Capacity Utilisation Survey), utilisation levels of India Inc that had hit 83% in FY11 has ever since been hovering at 76% (see: Far from optimum). Though, as per the survey, the average new order book is up at 26% yoy Rs.2.04 billion, going ahead the confidence level of corporates, especially cap goods companies, appears weak. MS Unnikrishnan, MD & CEO, Thermax, says, “In the current year, we haven’t seen large orders. There is only one order worth Rs.1 billion, and the rest are small-ticket orders in the Rs.600-Rs.800 million range.”

The company, which is currently sitting on Rs.65-billion order book, does not see big capex revival soon. “A lot of announcements are going to be made but a lot on paper,” says Unnikrishnan wryly.

View From The Street

The Capital Goods Index, which has clocked 52% return over the past three years, has fallen 11% over the past one year. However, Ajay Jaiswal, president - strategies & head of research at Stewart & Mackertich, believes that the best is yet to come. Over the past 20 years, the capital goods sector (from FY98-FY08) gave a CAGR of 27%, while consumer stocks gave 10-12% CAGR. Over FY08-FY18, while the cap goods showed -2% CAGR, the NSE FMCG index clocked a robust 15.66% CAGR. “This clearly shows that the cap goods sector’s underperformance can’t continue for long. If the GDP has to grow at 7-8%, the sector can’t languish for long,” believes Jaiswal.

But, for now, the challenge is steep. According to a report by Motilal Oswal, project completions declined 30% YoY to Rs.829 billion in Q3FY19, much lower than the average quarterly run-rate of Rs.1.4 trillion seen over the past three years and is also the lowest in three years. Ankur Sharma of MOSL believe the downtrend is post the implementation of structural reforms such as demonetisation and GST (renegotiation of contracts). “Severe impact is seen in sectors such as manufacturing (-85% YoY, Rs.78 billion) and electricity (-60% YoY, Rs.59 billion),” observes Sharma in the report.

That effect is showing in the fact that industrial production has hit a 19-month low of 1.9% in January. Further, a revival in capex would be led by commencement of stalled projects, since new project implementation will take some time coming.

What queers the pitch for cap goods companies is that the greenshoots of recovery is not exactly percolating down to domestic players. “Steel, cement, T&D and airports have seen high investments but rising cap good imports have meant that the cascading effect of higher spending is not entirely coming to Indian cap goods companies,” points out Gohil. Concurring with Gohil is Unnikrishnan of Thermax. “Given that we are more exposed to the private investment capex cycle, we clearly see that the pace of orders is definitely slow.”

With elections round the corner and the fact that government has promised a dole-out of Rs.750 billion to farmers, the fiscal leeway for its spend on capex is limited. With GST collections falling short of the Rs.1 trillion a month run-rate, the revised GDP forecast at 7.4% for FY20 appears a bit stretched given that the current growth rate is 6.6% (as of Q3FY19). “Until the government doesn’t get a special dividend from the RBI and the disinvestment targets aren’t met, it’s a challenge to boost spending,” points out Gohil.

Within infra, assuming conservative order inflows for FY19 and FY20, developers with strong financial health such as Sadbhav Engineering, KNR Constructions and Ashoka Buildcon are being favoured. However, Gohil mentions that one has to be cautious about road stocks. “From FY14 to FY16 we were bullish on infra midcaps, at 9x to 10x PE, and they eventually went to 20x PE. Though the stocks have corrected now, one can only bet on them when there is a possibility of order flow acceleration.”

In the case of T&D sector, Amar Kedia of Emkay Global mentions in his report that despite higher state capex, large companies are struggling, owing to higher demand in the low- and medium-voltage space, where competition is high. The report mentions that even if the industrial and power capex were to accelerate, it’s unlikely that the companies will see a boom similar to the 2004-2010 cycle, where there was substantial order inflows in a short span of time, leading to significant pricing power. “In this context, we fail to understand why T&D sector MNCs such as ABB, Siemens, GE T&D command such valuation premiums,” points out Kedia.

Though the Street expects infra capex to remain the key driver, the expectations have to be tempered as whichever government comes into power, it will have to borrow more and that looks like a stretch, given the state of the fisc. Chatterjee of Feedback says, “The interim budget for FY20 has made adequate provision for all ongoing infra projects, so from a one year view we are covered. Beyond that, you can only wait and watch.”