I have always believed that sustainable wealth creation happens when a great management team operates in a large opportunity size with a “right to win”.

In 2013, a National Football League veteran Tom Coughlin and David Fisher brought out a book titled Earn Your Right to Win. It was on preparing so hard and with a detailed structure that you take your chance of winning, as a team or an organisation, above the average.

Max Life Insurance, the fourth largest life insurance company with a market share of 10.6% among private players, has all of the above. Over the last 20 years, it has consistently delivered and outperformed peers on parameters that matter in this sector, such as product, persistency (which measures customer stickiness or the number of times a customer renews his/her policy), productivity, profitability and return ratios.

Its holding company is Max Financial owning 80% stake, with the balance 20% to be held by Axis and its subsidiaries.

While rest of the industry ran after fancy, non-traditional products such as unit-linked insurance plans or ULIPs to chase faster, short-term growth, Max Life stuck to the known and familiar.

To better appreciate this, perhaps we need a quick look at what forms traditional and non-traditional products in insurance. Under traditional comes par products that allow policy holders to participate in an insurance company’s profits and protection products that are primarily for life cover, and under non-traditional, comes non-par and ULIP. Non-par products offer guaranteed returns but are prone to interest-rate cycles and carry balance-sheet risk, and ULIP ones offer market-linked returns like a mutual fund and are therefore vulnerable to market cycle.

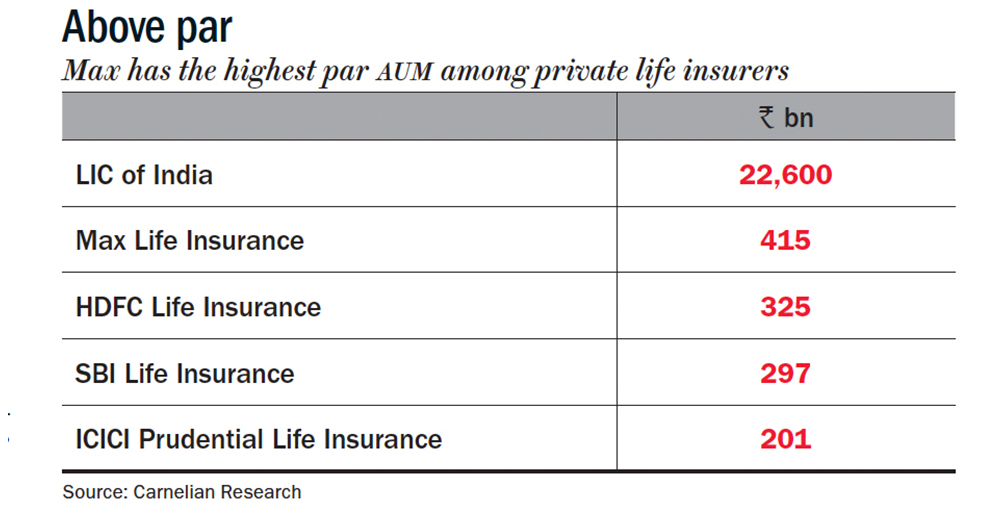

Max’s par AUM is Rs 420 billion, which is the second highest in the industry, next only to the behemoth Life Insurance Corporation (LIC) (See: Above par). Its par AUM is much higher than industry leaders such as HDFC Life and SBI Life. This clearly demonstrates the quality and sustainability of the business Max has built.

It has worked hard to improve its persistency, which has consistently remained at 80%, much higher than peers such as Bajaj and Aditya Birla with 70%-75%. The former’s persistency is in line with large-bank-backed insurance companies such as HDFC Life and SBI Life. Higher persistency means low customer attrition, leading to higher embedded value and return ratios (ROEV).

Despite being conservative in its product portfolio, the insurance company has been first in implementing innovative practices to improve the customer and employee experience, and these have later come to become the industry practice. It has painstakingly built the ‘right culture’ that has ultimately given it the ‘right to win’. Let’s look at some of the things it has done to set itself apart.

For one, there has been the ‘free-look period’ Max introduced for its customers, the first of its kind in the industry. Customers are given full freedom to surrender the policy and get full refund during the ‘free-look’ period. This has since become an industry norm. Then, instead of merely selling policy for selling’s sake, the company started a practice of following up with the customers after the sale to ensure that he/she understood the product and was not mis-sold. The customer could opt for a refund if he/she desired. This led to sharp increase in persistency as mis-selling was reduced and product suitability was ensured.

Even before data intelligence became a thing, Max had begun to use it, in the early 2000s. It started capturing data at a granular level. For example, it started a pin code level of risk analysis. This granular risk analysis practice has helped them avoid risky business, reduce claim ratio and offer highly competitive pricing compared with competition. Overall, Max has built a massive edge to win customers over along a robust agency channel. The company’s heavy investment in building digital capability proved advantageous when the country went into a lockdown following the pandemic.

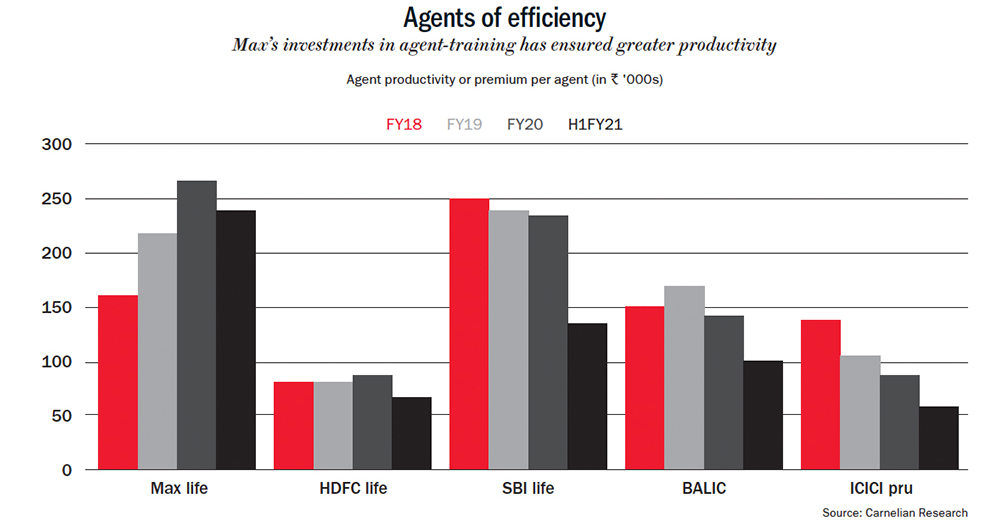

Max has also invested heavily in building a proprietary agency distribution channel, just like the LIC, but most interestingly it poured money into training agents, ensuring that the quality of their agents was far better than others’. Agents of Max were trained to understand customer needs and risk profile first, before recommending a product. Well-trained agents armed with the best products resulted in the insurer having the highest productivity in the industry — Max’s agent productivity is 2-3x that of peers, in terms of premium per agent (See: Agents of efficiency).

Max has also invested heavily in building a proprietary agency distribution channel, just like the LIC, but most interestingly it poured money into training agents, ensuring that the quality of their agents was far better than others’. Agents of Max were trained to understand customer needs and risk profile first, before recommending a product. Well-trained agents armed with the best products resulted in the insurer having the highest productivity in the industry — Max’s agent productivity is 2-3x that of peers, in terms of premium per agent (See: Agents of efficiency).

Besides skilling its employees, the company has worked on its industry-leading human-resource (HR) practices, including their incentive system to motivate their employees. Max Life, at rank 24, is the only life insurance company to be listed in India’s top 100 in the Great Place to Work survey for 2020.

Above mentioned steps, which may appear small but are significant, have helped Max build a solid franchisee over the years. It is so sturdy that even post-pandemic, Max has had an outperformance of 11% (Max grew by 4% in comparison to the industry which de-grew by 7%).

We believe that the compounding engine will keep going for a fairly long period, because of the large opportunity and concentrated market share amongst few players. Axis Bank’s partnership under the guidance of the bank’s CEO Amitabh Chaudhry, the man behind the creation of HDFC Life, can only open up new vistas of growth. Hence, we believe that Max’s speed in gaining market share will accelerate from here on.

Industry snapshot

Private sector has been consistently gaining market share in the life insurance industry over the last few years. Currently, the industry is divided between the behemoth LIC with 47% market share and private players with 53%, in terms of annual premium equivalent (APE). Among private players, 75% of the market share is held by the top six players, followed by a long tail of 17 players. By FY25, the private sector is expected to gain more ground with 56% market share, and the industry leaders should surely benefit from this.

In life insurance, India is a fairly underpenetrated market. Presently, new business premium stands at 2.8% of GDP, which is significantly lower than that of developed economies. By 2025, we believe this penetration will increase to 3% of GDP because of various factors such as an increase in the absolute number of working people and increasing need for life insurance. This should lead to the industry premium growing at 15-18% CAGR.

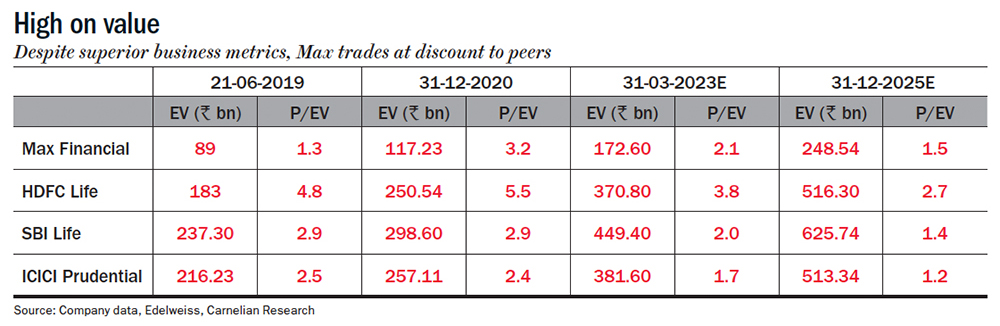

As the opportunity size increases, Max stands to expand its market share with the Axis deal, its large investment in building a proprietary agency-channel and its digital strategy. Its share will go up from the current 10.7% to 12% by 2025, causing Max’s embedded value (EV) to grow at 20% CAGR from Rs 118 billion to Rs 248 billion over the same period.

The approval of the Axis deal has resulted in significant unwinding of some discount, however the stock is still trading at 2.2x FY23’s EV and 1.5x FY25’s EV. This valuation is still a discount compared to the leader, considering Max Life has a good growth profile and business metrics (See: High on value). We believe the stock continues to offer a superior compounding opportunity and there seems to be a potential rerating in the horizon.

As we know, when earnings compound along with valuation re-rating, “magical” returns are generated.

Disclosure: We own stock in Carnelian PMS and AIF schemes.