On July 12, the Securities and Exchange Board of India (SEBI) surprised market watchers when it cut down the number of guidelines in a proposed environmental, social and governance (ESG) framework for the top 1,000 listed companies down to less than 50 for the purpose of third-party audits and assurances. Ever since it announced the earlier set of reporting guidelines, termed the Business Responsibility and Sustainability Report (BRSR), in 2019, which expected the top listed companies to make ESG disclosures on 800 counts, there were murmurs in the industry about the extra work this type of ESG compliance would entail.

Investors the world over are seeking to engage with companies that make elaborate ESG disclosures. In the wake of climate change and focus on social and governance aspects of business, investors and regulators prefer companies that are sustainable and responsible. This has made ESG reporting not just a business obligation but a legal requirement as well.

Sustainability reporting offers many advantages for businesses. It enhances prospects of attracting capital, as investors are interested in environmental and social issues. ESG reporting offers analysis on risk and opportunities in their investments, and, therefore, they actively seek such information.

Since the profile of the investor into Indian businesses is fast acquiring a global character, SEBI’s initial aggressive push on ESG disclosures was in tune with international developments. However, with BRSR Core, SEBI seems to have faced a reality check and concluded that even global regulatory frameworks require Indian solutions.

Declaring Goalposts

ESG reportage leads to an increase in the value of a business. This is how the narrative around a global ESG regime is being built. Emerging global research shows that companies that are ESG-focused perform better than their counterparts in the same industry. Apart from improving their business, it also helps businesses attract human capital and score high on reputation.

Dipankar Ghosh, partner and leader, sustainability and ESG, at BDO India, feels that the global ESG morality has moved out of the domain of the optional now. He says, “Understanding the ESG framework is not just necessary, it is also a duty. Business leaders must recognise the significance of environmental, social and governance factors and take them into account while making decisions. We can genuinely create a better future for the organisation, stakeholders and the planet by embracing sustainability, encouraging inclusion and keeping strict ethical standards [of corporate governance].”

SEBI responded to this understanding of the new business environment when it made filing of the BRSR compulsory for the top 1,000 listed companies from 2022–23. While announcing the standards, it stated, “The BRSR is intended towards having quantitative and standardised disclosures on ESG parameters to enable comparability across companies, sectors and time. Such disclosures will be helpful for investors to make better investment decisions. The BRSR shall also enable companies to engage more meaningfully with their stakeholders by encouraging them to look beyond financials and towards social and environmental impacts.”

With this grand statement of intent, SEBI set down nine principles of ESG disclosures under the BRSR. It said that businesses should (a) conduct and govern themselves with ethics, transparency and accountability; (b) provide goods and service that are safe and contribute to sustainability throughout their life cycle; (c) promote the well-being of all employees; (d) respect the interest of, and be responsive towards, all stakeholders, especially those who are disadvantaged, vulnerable and marginalised; (e) respect and promote human rights; (f) respect, protect and make efforts to restore the environment; (g) when engaged in influencing public and regulatory policy, do so in a responsible manner; (h) support inclusive growth and equitable development; and (i) engage with and provide value to their customers and consumers in a responsible manner.

In 2020, the Ministry of Corporate Affairs made recommendations on the BRSR structure. It proposed two BRSR formats: a comprehensive format and a lite version. This was done after a ministry committee noted that only the top 500 listed companies file business responsibility reports, and thus a level down of the BRSR, then termed BRSR Lite, would ease it out for the first-time filers of sustainability report.

Underprepared India Inc.

The Outlook ESG Bharat Survey, the Outlook Group’s exclusive survey on ESG adoption in the industry, found that only 33% of the surveyed business leaders thought their organisations were equipped to build a long-term strategy for ESG adoption. They cited confusion around a multiplicity of ESG compliance standards, among other issues, as an impediment for adoption even when they saw value in it.

SEBI seems to have sensed this feeling among business leaders and finally accepted the proposal of the Ministry of Corporate Affairs to adopt the lighter version of the BRSR; however, it has a twist. Named BRSR Core, the lighter version, it is seemingly a term that does not connote a dilution of the comprehensive provisions that SEBI introduced through the BRSR.

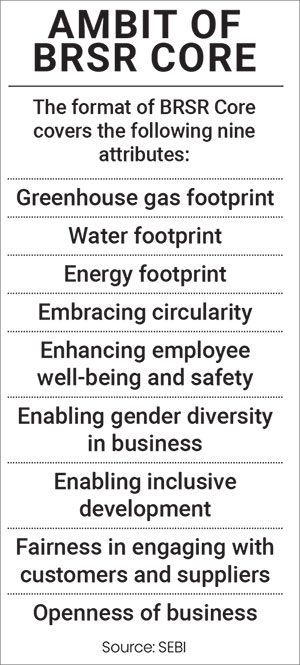

The BRSR Core, while reducing the number of reporting parameters to 46 from the earlier 800, focusses on assurance, the aspect of reporting that ensures accountability through a process of verification and includes an ESG layer not just on disclosures but on investing and rating as well. A SEBI consultation paper on the issue, titled Consultation Paper on ESG Disclosures, Ratings and Investing, states that to ensure “twin objectives” of enhancing “credibility” and “limiting the cost of compliance, BRSR Core has been developed for reasonable assurance which consists of select Key Performance Indicators (KPIs) under E, S and G attributes/areas that need to be reasonably assured.”

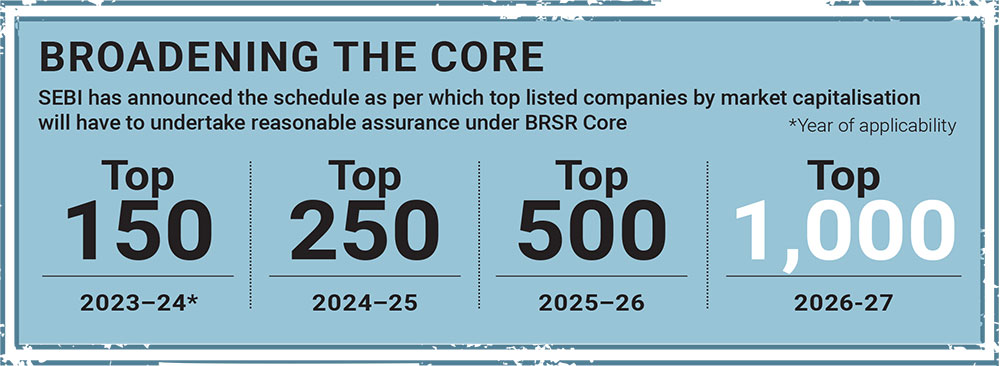

The assurance process involves parties other than the entities making ESG disclosures. Inderjeet Singh, partner at Deloitte India, says, “The BRSR Core essentially covers the most important set of indicators prescribed in the BRSR that should be considered for third-party reasonable assurance by the top 150 companies to begin with. These requirements will be extended to the complete set of 1,000 companies. It is also important to note that reasonable assurance requirements are far more stringent compared to limited assurance that has been introduced in Europe through Corporate Sustainability Reporting Directive in January 2023.”

SEBI defines the BRSR Core as a subset of the larger BRSR format. In fact, it has updated the BRSR format to include KPIs that are the area of focus in the BRSR Core. Bose K. Varghese, who heads the ESG practice at law firm Cyril Amarchand Mangaldas, wrote on Outlook Planet, “From a practitioner’s point of view, the BRSR Core is not a subset of the BRSR main format. It has KPIs that are not covered in the main BRSR format. SEBI has addressed this and included an updated reporting format as a part of the circular.”

SEBI’s approach gives the impression that it does not want to underplay its insistence on the larger BRSR format, which continues to be mandatory for the top 1,000 listed companies by market capitalisation, but it wants to introduce the concept of audit and third-party assurances in a graded manner, which puts an extra compliance burden on the companies.

The industry realises that ESG compliance is both necessary as well as cumbersome. Jitendra Sharma, managing director and CEO of Andhra Pradesh Medtech Zone Limited, the world’s largest medical technology cluster, says that the BRSR is both necessary and challenging but for the sake of advancement of sustainable business practices, both regionally and globally, its short-term weight needs to be ignored. He adds, “Economies will increasingly demand the ESG practice as a packaged compliance along with goods and services. Hence, while its adaptability may take a graded or phased approach, its necessity is beyond debate, and indeed desirable.”

Investor’s World

By choosing to focus on third-party audits of ESG disclosures, SEBI has put investors at the centre of the ESG debate. Since ranking and rating companies play a significant role in creating a conducive image for a company that can impact investments in it, SEBI’s move to create an accountability framework for rating agencies within the BRSR Core appears logical. Singh says that the BRSR Core confirms the seriousness of SEBI on how non-financial performance is also instrumental in long-term growth of companies. He says, “Technically, this should also greatly help the ranking and rating agencies, both active and passive, in recalibrating the outlook of Indian companies and their commitment towards stronger ESG performance. Not to forget that the BRSR Core disclosures will also help investors, be they institutional, treasury or funds, to make decisions on fresh investments as well as staying invested in a particular sector or company.”

SEBI adds in the paper that with the BRSR becoming compulsory and stakeholders, like investors and ESG rating providers, relying on the information disclosed, “assurance becomes key for enhancing credibility of disclosure and investor confidence”. Thus, this step in the new ESG regime became SEBI’s rationale for mandating third-party assurances. Under this provision, ESG rating providers will be required to take into account India and emerging market characteristics to come up with ESG rating systems within the BRSR Core framework.

Upasana Rao, partner at law firm Trilegal, says, “A regulatory framework has been introduced for ESG rating providers. They will be required to apply a minimum set of defined ESG parameters based on the BRSR Core indicators that are assured by third-party audits to ensure more credibility. The amended regulations [of the BRSR Core] require rating providers to disclose the rating rationale based on qualitative and quantitative factors, key drivers of ESG framework and the weight assigned.”

With the global discourse on ESG disclosures becoming dominant, SEBI wants to avert a greenwashing crisis in India as well. Since ESG compliance and disclosures, and now assurance as well, have a steep cost attached to them, observers have noticed a trend where companies fake environmental impact of their business practices. To deal with this problem and ensure transparency and inappropriate selling of green securities, SEBI has made it compulsory for the ESG-related schemes offered by asset management companies, notably mutual funds, to invest 65% of assets in listed companies that have embedded the BRSR Core.

Rao adds, “Mutual fund regulations have also been amended to introduce criteria and expand disclosure norms for ESG-labelled schemes with focus on mitigating risks of mis-selling and greenwashing. This includes third-party assurance and certification on compliance with the objective of the ESG scheme, enhanced disclosures on voting decisions on ESG disclosures, fund management commentary and case study, etc.”

It has taken sustainability reporting in India more than a decade to reach this stage today. The Ministry of Corporate Affairs stepped in the ESG terrain with the launch of the Voluntary Guidelines on Corporate Social Responsibility in 2009. Two years later, the ministry introduced a refurbished version of the 2009 guidelines and called them National Voluntary Guidelines on Social, Environmental and Economic Responsibilities of Business.

In 2012, SEBI announced the Business Responsibility Report for the top 100 listed companies by market capitalisation that became the precursor to the BRSR for the top 1,000 companies in 2019.

In 2022–23, in an attempt to bring its practices on par with global standards, SEBI engaged with the Financial Services Agency, Japan, for sharing knowledge on ESG-related matters, like ESG ratings, sustainable finance, disclosures, etc. While, through the BRSR Core, the market watchdog has increased pressure on listed companies and funds to become more responsible around ESG issues and reassure global investors, it has also given leeway to top listed companies to invest in the learning and assurance processes to be battle-ready in the global market.