A year ago, my colleague Gaurav Mehta and I discovered that the Nifty churns by over 50% every decade. This churn ratio is very high, compared to developed markets (where churn ratios are around 25%) and to other major Emerging Markets (churn ratios of around 35%).

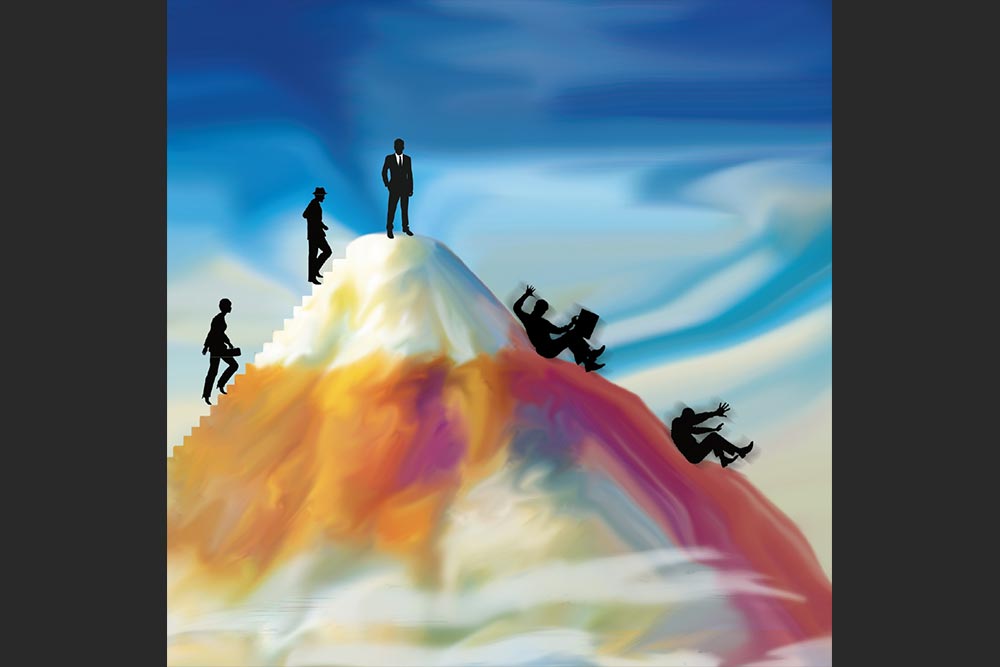

So why does the Indian market have such a high churn ratio? Consumed by this question, four month ago, we teamed up with the highly respected equity strategist, Anirudha Dutta, and launched an intensive research exercise. Our research has led us to realise that across all parts of the Indian market, great companies systematically slide towards mediocrity. We find that the average probability of a sector leader remaining a sector leader five years later is only 15%, implying that 85% of BSE500 companies slide towards mediocrity.

Why do successful firms slide with such regularity?

Promoters, in their own explanations for underperformance, tend to cite external factors (such as business cycle, Government interference, rising competitive intensity or the macro environment). However, such explanations are not always convincing because within the same sector (and hence subject to the same regulatory and competitive forces), while some firms are sliding, others are rising. Contrast, for example, the performance over the past five years of Infosys vs HCL Tech or Bajaj Auto vs TVS Motors. In our view, the slide is primarily due to poor strategic decision making.

Using a framework primarily based on the works of Jim Collins and William Thorndike, we can see that once companies achieved great success, they are often consumed by ‘hubris & arrogance’ — the bonuses, the awards, the press coverage, etc. tends to have a bearing on most management teams’ self-perception. Overconfident management teams then make poor strategic decisions which usually involve unbridled expansion and the misallocation of capital.

As a result, RoCE and RoE starts sliding and, gradually, financial stress builds up. As the share price loses its sheen, the company gets, to use Collins’ phrase, “stuck in rut”. Often cost discipline and/or product excellence erodes and prices are then raised. Profits, return multiples and valuation multiples start sliding. Company politics thrives. The leader of the company becomes increasingly autocratic and announces ‘recovery plans’ that are not based on accumulated experience.

Then comes the sacking of the leader as the falling company now “grasps for solutions”. Often the new leader tries to fire silver bullets (for instance, a ‘transformative’ acquisition, a blockbuster product, a cultural revolution, etc). However, a new leader (ideally, someone from inside) who takes a long, hard look at the facts and then acts calmly to put in place a measured recovery strategy with sensible use of cash and capital at its centre, could be the saviour.

Finally, we reach the climactic stage in the decline of a great company. Usually, the firm is sold or fades into insignificance or, and this one happens rarely, shuts down completely. Occasionally, however, the company pulls back from the brink and under its new leader, it begins the long slow climb to recovery.

Case study: Tata Steel

In the years spanning FY01-05, Tata Steel generated more cumulative Ebitda (₹135 billion) than it had generated in totality over the previous 15 years. Tata Steel’s RoCE rose from 10% in FY2000 to 61% in FY05. With success came several awards.

In 2004, Tata Steel, received a special ’Leadership in Excellence‘ plaque from the Tata Group to mark the company’s progress up the ‘Quality Value’ ladder. At this stage, Tata Steel was regularly being feted by World Steel Dynamics as one of the most-efficient and low-cost global steel companies.

In October 2008, Tata Steel won the Deming Prize, the manufacturing equivalent of the Nobel Prize. In November 2008, at a special ceremony in Tokyo, Muthuraman, who would eventually be bestowed the Padma Bhushan by the President of India, received the Deming Prize.

In August 2004, Tata Steel announced the acquisition of NatSteel, a South Asian steel maker with ~2mt of steel capacity for ~SG$260 million. In December 2005, Tata Steel acquired Millennium Steel, Thailand, which has a 1.2mt steel-making capacity and 1.7mt long products rolling capacity.

And then came the mega acquisition — in 2006, Tata Steel bid for Corus. The total acquisition cost for Tata Steel was US$12 billion, which was funded through a combination of debt and equity. To put this acquisition into perspective, Tata Steel’s FY06 shareholders’ equity was just over US$2 billion. To date, this acquisition remains the largest by an Indian firm.

A year later Lehman went bust and the end of the liquidity-fuelled global growth cycle was especially harsh for European steel makers. Capacity utilisation in Europe fell and Tata Steel Europe reported an Ebitda loss in FY10 and in every single year post FY10. Senior management at Tata Steel Europe has seen multiple changes, with the managing director being changed thrice within a span of two years.

Even as the firm’s consolidated RoE declined from 32% in FY08 to -17% on FY10 and 7% in FY12, senior executives from Tata Steel India who were deputed to Europe also returned to India within a short span as differences of opinion within the firm rose. The parent company also went for multiple rounds of equity dilution between 2007 and 2011.

Tata Steel undertook several measures to re-structure its European operations. Simultaneously, Tata Steel went ahead with expansion plans in India to increase capacity from 5mt to 16mt. Over FY08-12, capacity at Jamshedpur increased from 5mt to 10mt. Furthermore, the company is continuing with a 6mt greenfield expansion at Kalinganagar (which has overshot its original budget by US$2 billion). Net debt levels for the company have remained elevated at ~₹50 thousand crore since FY08 (implying consolidated debt:equity of 1.6x at the end of FY13).

Tata Steel has posted a net loss of ₹7,000 crore in FY13. According to the April 2013 cover story in Forbes, Tata Steel is looking for a new European head. Tata Steel also looks likely to get a new managing director in the coming months. The current group chief financial officer, Koushik Chatterjee, is tipped to get the job. In effect, Tata Steel is about to enter the final stage of the corporate decline cycle.

Hence, our findings have significant implications for those who like investing in successful Indian companies. For starters, given how frequently great Indian companies fail, paying premium valuations for sector leaders (even as they are posting record results) is something every investor should think twice about doing. History says that such an investment strategy is highly unlikely to work.

These are the writer’s personal views

Just one email a week

Just one email a week