Sun Pharmaceuticals needs no introduction: it’s the largest Indian pharma company, the 5th largest in the US, and the biggest Indian pharma company in emerging markets. It has 47 manufacturing sites, presence in 150 countries, and a portfolio of 2,000-plus products.

Sun Pharmaceuticals needs no introduction: it’s the largest Indian pharma company, the 5th largest in the US, and the biggest Indian pharma company in emerging markets. It has 47 manufacturing sites, presence in 150 countries, and a portfolio of 2,000-plus products.

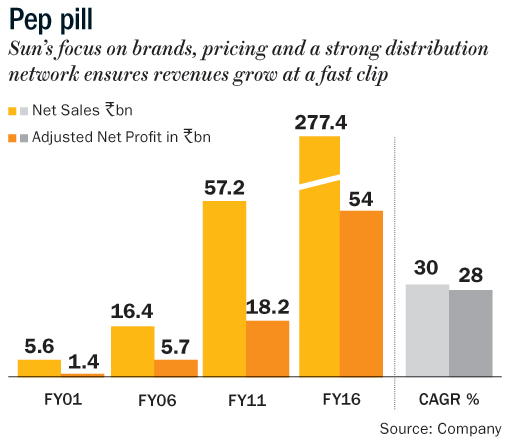

Among the most low-profile pharma bosses in India, Dilip Shanghvi founded Sun Pharma in 1983 with a two-man marketing team and a small manufacturing facility to make psychiatric drugs and capsules at Vapi, Gujarat. Since then it has been a story of small victories adding up to a big win. Known for his vision and business acumen, Shanghvi focused his attention and meagre resources on creating a portfolio of niche generic drugs which were not a priority for others because of their low revenue earning potential. In the 1980s and 1990s, when his bigger Indian rivals were taking on multinational drug makers in established categories with assistance from India’s new patents regime, Shanghvi focused on specialty and chronic therapies such as psychiatry, cardiovascular, neurology, oncology and dermatology. This strategy paid off handsomely as urbanisation and lifestyle diseases grew exponentially. Also, Sun Pharma was one of the first Indian companies to focus on brands, pricing and a strong sales and distribution network. Smart bold acquisitions and a unique ability to turn around companies made Sun an investor’s delight with its market cap going from $100 million in 1994 to over $34 billion by 2015.

What went wrong

The past three years have been a roller coaster for most blue-chip pharma companies, largely because of increased regulatory rigour enforced by the US FDA – but this is an industry-wide phenomenon. Sun, which completed the acquisition of Ranbaxy Laboratories in April 2015, has been consolidating the operations of the latter. The mega deal boosted the market capitalisation and revenues of Sun Pharma but also hit its bottom line. High legal expenses, Ranbaxy’s legacy FDA issues and high staff costs and one-time write-offs have impacted profitability. At the recently concluded conference call, the management has assured that synergies from the acquisition are gaining momentum and they are on track to achieve the $300 million target by FY18. The acquisition will soon start bearing fruits as is visible from the second quarter results.

Growth in the US market, which accounts for nearly half of the company’s revenue, moderated in FY16 owing to regulatory issues at its Halol plant, which is an important facility that contributes 12-15% of Sun’s US sales. The regulatory issues have taken longer than expected to resolve, causing near-term pressure on revenue and profitability. Sun recently disclosed that the FDA has re-inspected its Halol unit and issued Form 483 with nine observations. Given no repeat observations or any data integrity issues are highlighted, I believe a re-inspection is unlikely to be required. The observations are low to moderate in nature and are mostly related to documentation control. The Halol warning letter is likely to be resolved before June 2017 and this will be a big positive.

The US Department of Justice (DoJ) probe on price collusion is also putting pressure on the company’s stock price performance with investors wary of a negative outcome. Only in a scenario where collusion is proved in the setting of prices can companies be framed under anti-competitive legislations. This could be a multi-year process and clarity is unlikely to emerge in the near-term. Hence, it could remain an overhang on sector valuations but is unlikely to result in any significant downside in the near term.

It’s all in the valuations

There are a lot of factors that make Sun a compelling investment. It has the best-in-class franchise of 9,200-plus sales representatives covering 600,000 doctors and field-force productivity of Rs.7.8 million per medical representative (MR) against the industry average of Rs.5.2 million per MR.

The company has a strong track-record of turning around acquired assets (Taro Caraco) and has a well-diversified revenue stream with leadership in key therapeutic areas. It has strong ANDA pipeline across key therapeutic areas (567 fillings and 417 approved) and spends 8.3% of revenues on research and development. More importantly, Sun has a solid unfolding pipeline in specialty business which includes Elepsia, Bromsite, MK3222 – Tildrakizumab Infusmart, Xelpros, and Dexasite. This will drive its profitability with strong free cash flow generation, going forward.

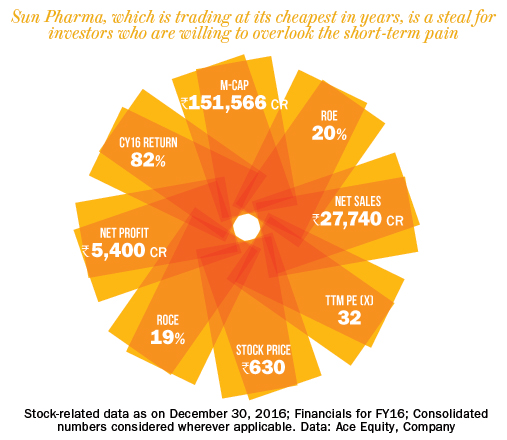

The stock is trading at a five-year low valuation and, perhaps, the lowest forward multiple in eight years. Sun, which enjoys return on capital employed in excess of 28% and return on equity of 20%-plus, is available at a forward multiple of 18 times estimated FY18 earnings and 15 times FY19 earnings.

Like the famous quote reads: “Our greatest glory is not in never falling, but in rising every time we fall,” I believe tough companies emerge stronger from adverse situations. Sun Pharma is a tough company that will weather the storm and come out better, stronger and, most importantly, profitable for investors who take some short-term pain for superior long term returns. A delay in the resolution of the Halol Plant and adverse findings in the US DoJ probe on price collusion remain the key risks but they are well worth taking given the significant long-term growth potential that the company offers.

The author has a position in the stock