Very few CEOs are as articulate about their journey and experience as Vishal Sikka. Within six weeks of his leaving German IT major SAP in April 2014, Sikka was steering Infosys in June 2014. Sikka wrote in his blog: “Transitions at large companies are in many ways similar to personal ones. Perhaps this is not surprising. Doug Engelbart had compared organisations to organisms. Companies, after all, are us. No more, and no less, than us, the people within them.”

But as the first non-promoter CEO, Sikka had to traverse a challenging stint at India’s second-largest IT services company. In August 2017, three years into the top job, Sikka called it quits after he drew flak from none other than founder NR Narayana Murthy for, among other things, drawing high compensation. In his parting note to Infosys employees, which he posted on his blog as well, Sikka wrote, “I deeply believe in creating value in an atmosphere of freedom, trust and empowerment… I need this for my own work as well.”

An industry consultant, on the condition of anonymity, points out that his exit was an eventuality, considering Sikka was a product guy and could not have run a services business. “You can’t make a service business into a product business. It doesn’t work… it is like asking a commercial bank to turn into an investment bank. Also, he didn’t fit into the culture created by the founders and that dissonance was only accentuated by his close coterie,” says the observer.

While Sikka has since gone on to build his own AI start-up, he did manage to leave his imprint. “What he brought to the table was the focus on increasing intellectual property (IP),” adds the industry observer.

Kumar Rakesh, analyst, BNP Paribas Securities India, agrees that Sikka brought in a very strong culture of re-skilling employees. “He started focusing on design thinking and initiated multiple training sessions both for his employees and for clients to get a better outcome for their problem.”

When Sikka took over, Infosys was clocking Rs. 533.19 billion in revenue, and by FY17, it had crossed Rs. 684.84 billion with an operating margin of 24.1%, beating some competitors for the first time in many years. Attrition was down from 23.4% in Q1FY15 to 15% in Q1FY18, the quarter he left. He was succeeded by Capgemini’s Salil Parekh, who joined in December 2017 and who has since come into his own. “Salil appears to be culturally different,” adds Rakesh. Concurring with his view, the industry observer believes the combination of Nandan Nilekani as the chairman and Parekh as the CEO has worked. “Nandan knows how Infosys runs and is good with strategy, while Parekh comes from a services background and understands the business well.” During Sikka’s tenure, R Seshasayee was chairman of the board.

Under Parekh, revenue has grown from Rs. 827 billion in FY19 to over Rs. 1 trillion in FY21. What’s impressive about the FY21 topline growth is that Infosys managed to beat industry leader TCS (See: Fast reboot). “We are seeing a massive uptick in our technology spends as enterprises try to build resilience and pivot to a post-COVID world,” said Pravin Rao, COO, Infosys, in an email to Outlook Business, adding they are seeing a “strong start” to this financial year. This performance comes after Infosys chose not to give revenue guidance for the fiscal in April 2020 when the pandemic broke out.

Under Parekh, revenue has grown from Rs. 827 billion in FY19 to over Rs. 1 trillion in FY21. What’s impressive about the FY21 topline growth is that Infosys managed to beat industry leader TCS (See: Fast reboot). “We are seeing a massive uptick in our technology spends as enterprises try to build resilience and pivot to a post-COVID world,” said Pravin Rao, COO, Infosys, in an email to Outlook Business, adding they are seeing a “strong start” to this financial year. This performance comes after Infosys chose not to give revenue guidance for the fiscal in April 2020 when the pandemic broke out.

Neerav Dalal, analyst, Kim Eng Securities, says while Infosys was strong in technology, it lacked sales firepower, till Sikka came in. “The sales engine started to build under Sikka, and now it is delivering in Salil Parekh’s time. Look at all companies which have had a CEO with a strong sales focus, even in mid-caps like L&T Infotech and Coforge. Infosys lacked the sales engine, but it has strengthened in the past four years,” says Dalal.

Unlike Infosys, TCS hasn’t seen top management change even as N Chandrasekaran moved on to head Tata Sons, ensuring uninterrupted business continuity. TCS always had an insider taking over the top job. “It has multiple leaders and there has never been any management issue there and very few leaders moved out because each leader is driving a business bigger than a mid-cap company. They drive business worth $500 million-600 million,” says the industry consultant. TCS seems to have managed the transition at the top better than Infosys.

The Bengaluru-headquartered IT company had another problem. It was first on digital but was weak on sales but that has been corrected now. The change also ensured that it did not lose out on digital transformation that has been sweeping across businesses in various sectors.

The big change

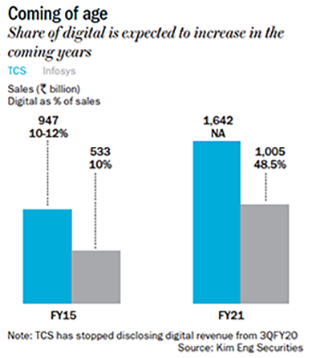

What has been remarkable about Infosys’ growth in FY21 is that digital business has inched closer — just 150 bps away from the 50% revenue threshold (See: Coming of age).

At a virtual meet last December, Nilekani said large companies are still on legacy systems and therefore, face a huge challenge of “crossing the software chasm”. Against this backdrop, he said three major trends would drive the digital business — cloud adoption, cybersecurity, and reskilling. At a recent analyst meet, the company outlined that over the next three years, a $500-billion opportunity will be available across enterprise cloud.

With its first cloud brand, Cobalt, Infosys is looking to make a mark in the migration and maintenance space by providing over 200 different types of solutions through a team of 35,000 associates. Parekh said at the virtual meet that the digital push has also come about by the reskilling of employees. “In the current scenario, the demand for digital is largely driven by cloud as well as data and analytics,” says Rao, adding that they also see opportunities in cybersecurity, IoT and automation. “As our clients recognise the permanence of certain changes that they adopted in the wake of the pandemic, they are increasing their investment in digital channels and self-service products and tools. Similarly, we also see pent up demand to restart delayed projects,” he says.

The consultant quoted earlier believes the runway for digital has just begun. “Today, Amazon is not just rattling retailers but, with its cloud technology, is also disrupting tech companies that sell boxes (proprietary legacy tech). Every company today has to go digital and build an intuitive interface with the latest tech. That will be a key business for the next two to three years.”

Rakesh believes, given the pandemic, clients have shown an increased urgency in terms of migrating their systems and this is where Infosys got its timing right. “Earlier, migration to cloud across industries used to take 10-18 months but the pandemic has accelerated this transition and clients are pushing IT services companies to get this done in six to eight weeks. With Cobalt, Infosys has given a readymade template that can be used across industries, be it travel, logistics, or energy. More importantly, it reduces the time and risk of migrating to cloud because these are tried and tested modules.”

The other shift that Infy has seen is the impact of nearshoring as the Trump administration tightened H-1B visa rules. Even as the current Biden administration eases the visa norms, the Bengaluru-based IT major, which has 259,619 employees, is looking to hire 26,000 people from campuses in India and overseas in the current fiscal. Rao had earlier said that while 24,000 will be in India, the rest will be recruited overseas. Of the 21,000 campus hires in FY21, 19,000 were from India and the rest overseas. Though Infosys has development centres across 46 countries, bulk of the work still gets done offshore. And that’s unlikely to change. “There are two primary trends that have accelerated during the pandemic,” says Rao, “First, there is continued relevance and growth of the offshore model that was witnessed last year in terms of delivery and as a result, the onsite mix has evolved. Second is the increasing growth of the hybrid model, our localisation strategy continues to be even more relevant in the emerging hybrid environment.”

The industry consultant’s view supports this: “Nearshoring in the US is much cheaper and cost-effective than sending people from India but at lower levels with up to five years of experience. The pandemic has shown that having large offices in the US is not a necessity. What do clients want? They want to get their work done at the lowest cost possible, and the pandemic has once again proved that you can have 10% employees onsite and 90% offshore.”

In a sense, the pandemic has significantly weakened the case against offshoring as the entire IT services industry has been working out of homes from remote locations. Any requirement for nearshoring could always be addressed through M&As.

Buying heft

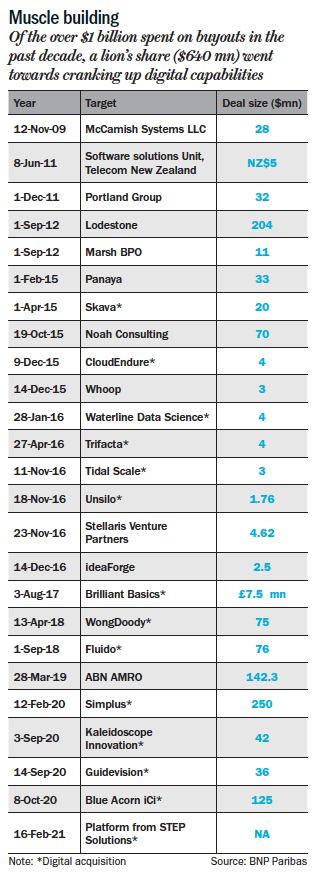

To bolster its digital capability, Infosys has been ramping up its M&A spend. Of the over $1 billion spent over the past decade since 2009 on buyouts, a chunk has gone towards digital (See: Muscle building).

Infosys’ M&A strategy is based on a three-pronged approach — strengthening service line capability, deepening vertical capability, and expanding geographical footprint. For instance, in FY21, it strengthened its digital services’ capability with WongDoody, Brilliant Basics, Blue Acorn Accelerate, Simplus, Fluido (Salesforce) and GuideVision (ServiceNow). In an interaction with the media, Parekh mentioned, “the thinking for acquisitions is very focused on digital”. The company also added to its vertical expertise in financial services through a joint venture (JV) with Stater, while JVs with Compaz and HiPus gave it reach in Singapore and Japan.

Infosys’ M&A strategy is based on a three-pronged approach — strengthening service line capability, deepening vertical capability, and expanding geographical footprint. For instance, in FY21, it strengthened its digital services’ capability with WongDoody, Brilliant Basics, Blue Acorn Accelerate, Simplus, Fluido (Salesforce) and GuideVision (ServiceNow). In an interaction with the media, Parekh mentioned, “the thinking for acquisitions is very focused on digital”. The company also added to its vertical expertise in financial services through a joint venture (JV) with Stater, while JVs with Compaz and HiPus gave it reach in Singapore and Japan.

Software-as-a-service (SaaS) is another opportunity that Infosys is hot on. For instance, the company made three acquisitions covering the ecosystems of Salesforce, ServiceNow, and Adobe. “Our focus will remain on those types of acquisitions. We also have very good organic growth in those areas, but acquisitions give us incremental additional focus,” Parekh had said in that media interaction.

Rao says, “M&A remains a key element of our strategy. Our focus is in areas of cloud, IoT, cybersecurity, and data and analytics, among others. We evaluate fitment (of every acquisition target with the parent company) in terms of culture, integration, and value to the company.” In fact, integrating an acquired company into the parent is critical for the software giant.

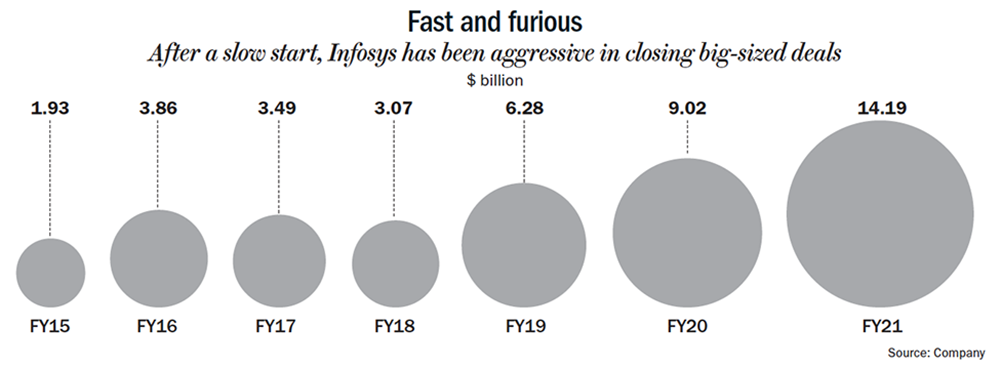

It’s not just M&As, Infy’s appetite for big-sized deals, too, have gone up.

In FY21, large deals, in terms of the total contract value or TCV, peaked at an all-time high of $14.19 billion with 66% being new orders. “In the past few years, we have renewed our focus on large deals, strengthened our dedicated large deals team, strengthened relationships with deal consultants and been much more proactive in taking and shaping solutions to our clients. Our digital capability has played a huge role in our success, as well,” says Rao, “In FY21, our large deal wins was more than 3x our large deals win in FY18, and the momentum continues in FY22 as well.”

In the COVID-ridden year, the two mega-deals that stood out were the $1.5 billion deal with Vanguard and the $3.2 billion deal with Daimler.

The contract from Vanguard, which is also an investor in Infosys, will cover the US investment firm’s recordkeeping business, software platforms, administration and associated processes. The multi-year deal with German automotive major Daimler is aimed at driving its hybrid cloud-powered innovation and IT infrastructure transformation across plants and regions, besides paving the way for consolidation of its data centres. “We need to think about infrastructure beyond the size of our company,” Jan Brecht, chief information officer, Daimler and Mercedes-Benz, was quoted as saying, “With Infosys, we found a partner to scale, to innovate and to speed up. Moreover, this is a strategic partnership for Daimler’s IT capabilities and Infosys’ automotive expertise.”

The hunger for such big-sized contracts is evident in the TCV’s seven-fold rise since FY15 (See: Fast and furious). That’s a big change from the past. “Post the global financial crisis, TCS’ Chandra had gone aggressively behind big deals [up to $1 billion] as companies were still reeling under the impact and looking at outsourcing but Infy was happy chasing $300 million-400 million kind of deals,” says the industry observer. One aspect of such big deals is that it also involves taking over employees of clients. “While TCS was never averse to taking employees on board, Infosys was apprehensive about this because of the impact on margins,” says Dalal.

The hunger for such big-sized contracts is evident in the TCV’s seven-fold rise since FY15 (See: Fast and furious). That’s a big change from the past. “Post the global financial crisis, TCS’ Chandra had gone aggressively behind big deals [up to $1 billion] as companies were still reeling under the impact and looking at outsourcing but Infy was happy chasing $300 million-400 million kind of deals,” says the industry observer. One aspect of such big deals is that it also involves taking over employees of clients. “While TCS was never averse to taking employees on board, Infosys was apprehensive about this because of the impact on margins,” says Dalal.

The reticence was also compounded by the culture of extreme risk aversion that pervaded the company. “The problem was that the old risk management team within Infosys followed the old NRN model… they terrorised the senior management saying you can’t do this kind of deals. Salil is new to the game and the old risk management people are gone and Nandan is far more adventurous than NRN and is willing to take more risk,” adds the consultant.

That change in approach is showing. For instance, 1,300 Vanguard employees engaged in record-keeping, client administration, operations, and technology functions will transition to Infosys as part of the deal. They will be offered comparable positions in close proximity to Vanguard’s offices in Malvern, PA; Charlotte, NC; and Scottsdale, AZ. Transitioning employees will receive the same salary, comparable benefits for a period of 12 months, and incentives, says a company statement. But big deals mean that Infosys will have to contend with lower margins.

“From the 30s, margins have come down. So, clearly, they are fine with giving back benefits to the client by absorbing the cost of employees. That thinking changed when Sikka came in,” feels Dalal. But the consultant, quoted earlier, believes that’s the only way to grow: “Even if you grabbed a low-margin business (captive) over a period of two-three years, one can turn it around.”

But investors won’t be complaining about margins because the company has been using its cash flow to keep them happy.

Money spinner

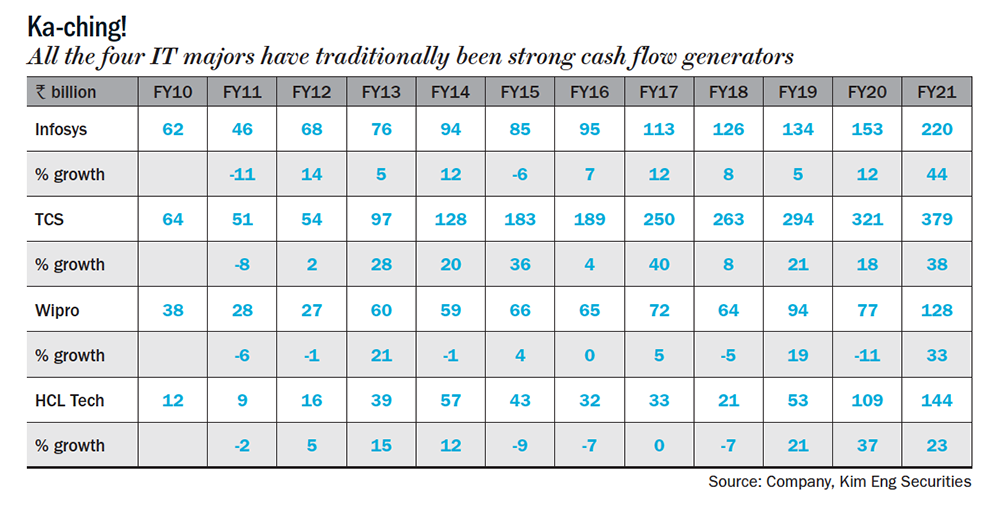

The big advantage that Indian IT services companies have been enjoying for the past decade is huge cash generation, irrespective of growth upheaval (See: Ka-ching!). In keeping with the management’s stated policy of returning 85% of free cash flow, cumulatively over a five-year period, Infosys has given back $10.4 billion over past four years (FY18-FY21), including dividends and buybacks.

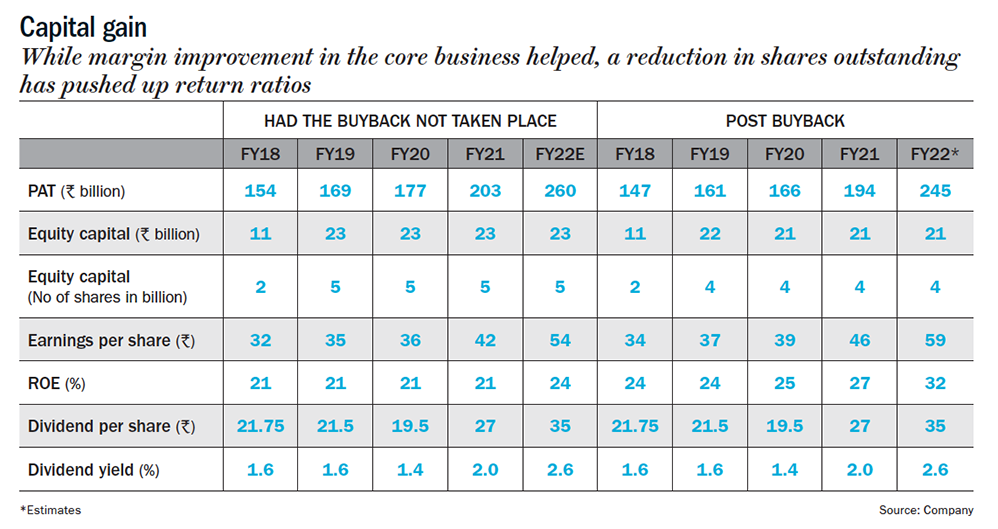

As part of the optimal capital allocation strategy, the company has been engaging in frequent buybacks. Including the recently announced buyback for Rs. 92 billion, Infosys has seen three buybacks since 2017. The two buybacks resulted in over 220 million shares being extinguished. Infosys seems to be taking a leaf from Accenture’s book, which has historically been buying back shares and in CY20, earmarked another $6.3 billion for the exercise.

Analysts, too, believe the capital reduction exercise makes sense. “If you are sitting on cash, your return ratios will look weak. Take the case of TCS, which has an ROE of 40%, while Infosys has an ROE of 20-25%. It is a win-win for everyone including shareholders and the company. When you are growing profitably and reduce capital, return ratios improve and so will the multiples,” points out Dalal. In fact, if one were to look at what would have happened had Infosys not engaged in buybacks, that claim does make sense (See: Capital gain). “While better margins, too, play a role, there is no denying that buyback has helped improve return ratios,” says Dalal.

On whether the company could better deploy its resources for acquisitions, Rakesh believes that the company generates enough cash flow to take care of that. “Typically, not just Infosys, but most of the Indian IT companies don’t go and buy revenue, they buy capabilities or access to some geographies, partly because they are growing themselves,” he explains. Dalal agrees, “The 15% that the company is left with is good enough to pursue M&As driven by the need to build capabilities. It’s only when you need to buy revenue, the ticket sizes get above a billion, else smaller M&As happen in the $500 million-600 million range, which the company’s cash flow can easily fund.”

Better times in store

For now, TCS continues to be the industry leader with a wide margin in terms of revenue. Its consolidated revenue was $22.2 billion in FY21 versus $13.56 billion for Infosys. There was an aspirational target that Infosys had aimed for during Sikka’s tenure of hitting the $20-billion mark by 2020. While the target seems a long distance away, analysts are now betting on Infy to lead industry growth over and above TCS. Deepak Jasani, head of research, HDFC Securities, says, “Today, the degree of separation in terms of digital is not vast. The key differentiator in a commoditised play is how quickly you can build a team, train and improve execution. It’s all about getting employees with higher skillsets.”

As for TCS, the industry consultant believes the company is making the same mistake that Infosys did in the past. “TCS has become a giant with 500,000 employees and a huge revenue base. To talk of 15% growth means $4 billion-5 billion a year and that’s tough. You can grow by acquisition in the first year but then what about the next? Four years before the pandemic, TCS fell into the same trap that Infy had fallen into, which is ‘we want high margin’. It’s now Infosys showing the way of how not to sacrifice growth for margins,” says the industry consultant.

While doing so, Parekh could eventually get Infosys to reach Sikka’s once-coveted topline of $20 billion.