With the Hindenburg report against the Adani Group set to turn one year old, the shares of the group may find themselves at the same level they were at before the massive sell-off. While Adani businesses have recovered to an extent from the hit to valuations, the battle for trust is not over yet. Does this explain why the feelings of institutional investors on the bourses do not match the exuberance of retail investors?

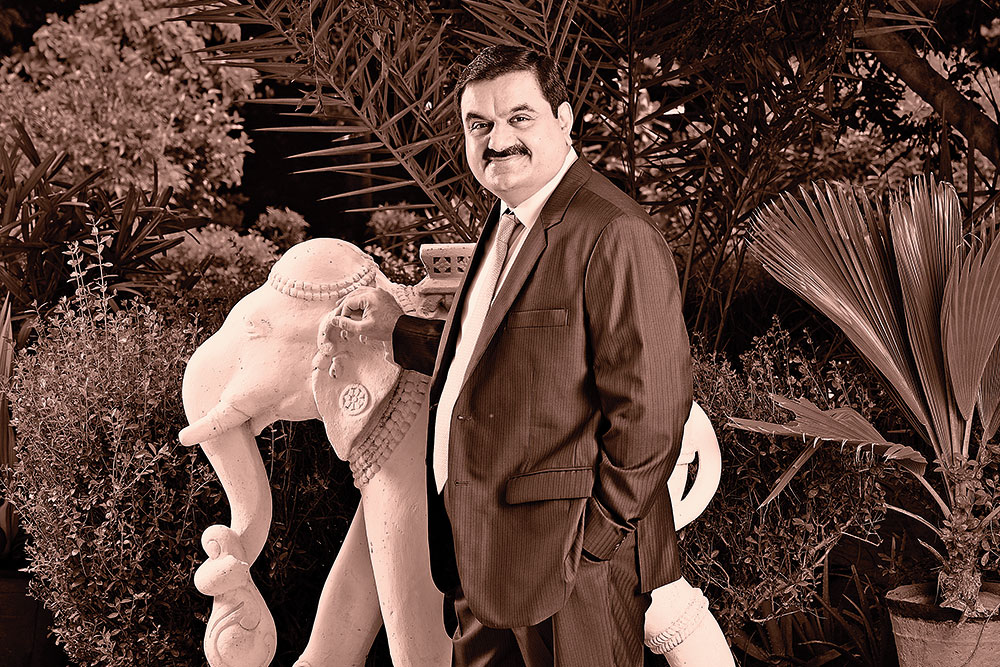

The timing of launching the country’s largest follow-on public offer (FPO) by the Adani Group in January 2023 could not have been better. The shares of the conglomerate’s flagship firm, Adani Enterprises, had just ended 2022 with over 120% returns. Speaking ahead of the launch of the FPO, chairperson Gautam Adani expressed confidence about the timing of the issue. “A time when we are at our strongest with most of our growth is still ahead of us...,” he asserted.

Just a day after the speech, calamity hit the group. New York-based short seller Hindenburg Research’s scathing report sparked a storm with allegations of market manipulation. Within days, billions of dollars were wiped off the conglomerate’s shares as investors rushed to exit. From Rs 3,436 on January 23, the stock of the group’s flagship firm crashed to Rs 1,586 in just 10 days.

The crisis forced the company to cancel its FPO and focus on damage control. Gautam Adani, who had reached the top of richest Indians’ list, found himself out of the top 25 within a matter of days. In the 35-year-old history of the group, this was the toughest challenge it had faced, which threatened to unravel an empire spread across the country.

Eleven months down the line, the storm has calmed. While several shares have still not crossed the levels reached before the Hindenburg report, the sentiment on the bourses has clearly changed. For a group which was making news for losing market capitalisation week after week earlier in the year, adding Rs 3.14 lakh crore in just one week in the last month of 2023 summed up Adani’s position.

A series of measures by the group following the Hindenburg storm, and no regulatory action, has helped the conglomerate recoup a vast share of its losses on the bourses.

Rush to Invest

Just days after the Hindenburg report, the Adani Group completed the $1.2 billion acquisition of Haifa port in Israel. The expansion spree did not slow in the current financial year, with the ports business taking over the Karaikal port in Puducherry for Rs 1,485 crore. On the renewables front, Adani Green set a 45GW target for 2030. Between March 2021 and December 2023, it raised $3 billion debt to build the world’s largest renewable energy park.

With no pause to its expansion plans, analysts believe there is not much scope of things going wrong from the fundamental point of view. To allay investors’ concern over the group’s finances, the promoters prepaid $2.02 billion of share-backed financing in March. In a statement to Reuters at the time, Adani Group had said that the balance sheets of each of its entity were very healthy. “We are confident in the continued ability of our portfolio to deliver superior returns to shareholders,” it added.

A crucial moment in restoring investors’ trust came in the form of the daring $1.9 billion bet by Rajiv Jain-led GQG Partners on four Adani Group companies that helped the embattled group. Kranthi Bathini, director of equity strategy at WealthMills Securities, says that it was a turning point for the group on the bourses. “The investment from GQG Partners helped the group in allaying fears of investors. Its bet on the companies proved to be a hit,” he adds. Following the latest rally in the first week of December, the value of GQG Partners’ investment shot up to $7 billion. From a strategic point of view, the firm sold off its financial services arm to Bain Capital and doubled down on the presence across infrastructure and energy space. In his address to shareholders after the conclusion of financial year 2022–23, Gautam Adani said, “Your group will continue to consolidate what it has built while looking at expanding its horizons.”

However, in the case of Adani, it is rather the story of retail investors rushing to buy its stock, while mutual funds have stayed away and other institutional investors showed tepid exuberance.

Divided Sentiments

Ambareesh Baliga, an independent market research analyst, notes that fundamentally Adani group businesses are all in the right segments. “Most of its focus is on infrastructure and energy businesses. Given the momentum in the economy, it is bound to benefit from the push in these sectors,” he says. However, Baliga adds, the momentum in the stock is mostly coming from the rush of retail investors. “More than valuations, it is momentum which matters these days. It appears that institutional investors are much more cautious at the moment but, buoyed by the recent favourable reports surrounding Adani group, retail investors have bought their stocks big,” he says.

Data shows that between December 2022 and September 2023, retail investors raised stakes in all Adani Group stocks except Adani Power. However, at the same time, the shareholding of mutual funds and foreign institutional investors has seen a decline in many companies.

Bathini explains that the investors with high-risk appetite are the ones who are mostly looking to invest in stocks. “What makes Adani Group attractive is its highly valuable assets. While there have been concerns over its debt, we need to remember that those were taken to acquire new assets. In infrastructure business, firms have to take on more debt,” he says.

Following the concerns over its leverage, the group has repeatedly highlighted that its net debt to EBITDA ratio has constantly reduced in the last few years. From 3.8x in FY19, the net debt to EBITDA ratio came down to 2.5x in September 2023 for the trailing 12 months. Baliga says that he does not see debt repayment as a problem, but the concern is elsewhere. “While they will be able to manage their debt, valuation of some of the group stocks is a concern,” he says.

His concerns are shared by institutional investors like fund houses, which are keeping them away. “Funds usually stay away from stocks with high valuations. They have minimal exposure to most Adani stocks. Moreover, the free float is also less in some Adani stocks, which creates more volatility,” says Deepak Chhabbria, founder and chief executive officer of Axiom Financial Services Ltd.

Even before the Hindenburg report, the holding of mutual funds in the stocks of the company remained minimal. Adani Group’s chief financial officer Jugeshinder Singh said that a high capex, high growth business was bound to have a high price to earnings ratio (P/E), a significant factor for fund houses. “When the funds see, they just see P/E multiples. If something is above a certain P/E multiple, they will not invest. That is why the majority of them missed investing in Apple, Tesla and the likes. It is not just India-specific, it is a global phenomenon, where fund managers have missed all such stocks,” he told The Economic Times in an interview before the launch of FPO.

But the lack of enthusiasm from such investors has not held back the recovery of the Adani stocks. Buoyed by the market sentiment in both equity and debt markets, Adani Group has unveiled ambitious plans to raise more funds from issuances of bonds. Ahead of maturity of a tranche of its bonds next year, the improvement in sentiment could not have come at a better time.

What the Future Holds

Market regulator SEBI completed investigation in 22 out of 24 cases against the Adani Group. Though the final judgment of the Supreme Court in the case is due, it has already set the tone, noting that it cannot rely on media reports for the evidence of alleged wrongdoing by the Adani Group. Add to it the cheering the group’s stocks got on the bourses following the BJP’s victory in the recent state elections, and 2024 is unlikely to be anything like the previous year.

Bloomberg data showed the comeback of some of the dollar bonds issued by the group. It had reported earlier in the year that the bond prices had fallen 5% to 18% below the level they were at before the release of the Hindenburg report. However, the latest data showed that most of the bonds have recovered their prices. The price of a dollar bond of Adani Green Energy, which is set to expire next year, recovered by 24% between January 31 and November 30. A rise in price means a fall in bond yield, which makes it cheaper for the firm to borrow from the market.

The group had announced earlier in the year that nearly $2 billion worth of bonds are due to expire in 2024. To refinance these, it is reportedly planning new bond issues which are expected to find takers.

“They (Adani) are going for some pre-committed deals, which they usually do. They are known for having a soft commitment with their investors and not coming directly to the market. Their improved businesses are surely giving them confidence for these deals,” says a fixed income manager, requesting anonymity, on the fundraising plans of Adani.

Analysts say that the recent financing of Adani Port’s expansion by United States International Development Finance Corporation has helped reassure about the prospects of the group. But the group is still not completely out of the woods. The Delhi High Court asked the Central Bureau of Investigation and the Directorate of Revenue Intelligence to investigate the allegations of over-invoicing of coal imports by a few companies, including Adani Group.

While market watchers found it hard to see what could go right for the group following the Hindenburg storm in the beginning of 2023, not much appears to be going wrong for the 35-year-old group as it begins the new year.

The Hindenburg-Adani saga reaffirms that markets rally behind business logic and seldom go by allegations of market manipulation.