During the Covid-19 pandemic, Raj Sahu registered Sysotel.ai, a yield management software company, in his hometown, Rourkela, in Odisha. He soon realised that if he wanted to make his start-up truly click, he needed to have a presence in a metro like Bangalore. “The reason is simple; all the big brands, the talent and the affiliated tech partners are here. Running a start-up from Rourkela would have been difficult, so we decided to shift base,” Sahu explains.

Urban centres like Bangalore, Mumbai, Delhi, Chennai and Gurgaon, also the top five cities in the Outlook Start-Ups Outperformers 2023, offer a blend of workforce, networking opportunities and a vibrant entrepreneurial culture. They have established themselves as innovation hubs with a track record of successful start-ups. These factors together act as a major pull for start-up founders looking for mentorship, access to capital and a supportive ecosystem.

Bangalore, Mumbai and Delhi/NCT take up the top three ranks in terms of funding and investment, followed by Gurgaon, Hyderabad and Chennai in that order. This category considers the number of incubators, the maximum funding activity as well as highest total annual revenue earned by growth stage start-ups.

In the category of knowledge edge, which considers details like number of registered businesses, availability of mentors, research and development institutes, growth stage start-ups and funding rounds, the top three cities take the lead.

Bangalore, Chennai and Delhi are the best performers in terms of human capital, which includes the presence of top-ranked educational institutes, employment in the growth stage start-up sector and enrolment and placement in vocational courses. Bangalore has 144 higher education institutes, of which 54 are graded A or above by the National Assessment and Accreditation Council, according to the Outlook ranking.

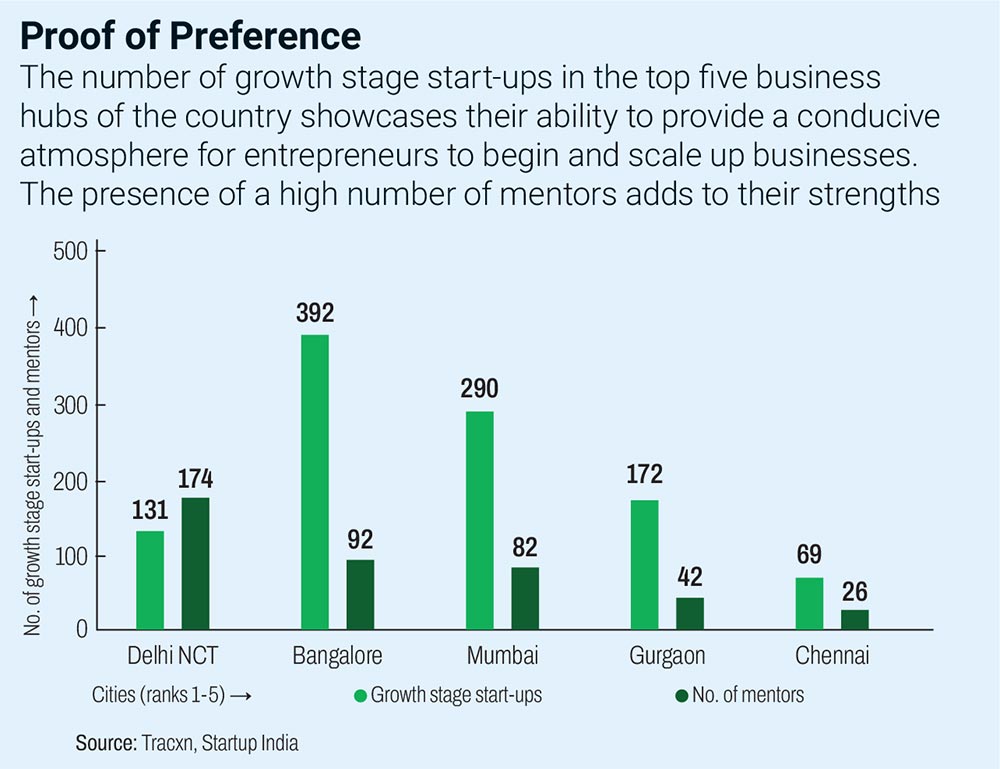

“Just remember, the decision does not boil down to the founder alone when it comes to setting up operations,” says Srikanth Tanikella, managing partner of Hyderabad-based Pavestone Capital. “They eventually need to find people and companies to support the start-up in creating the product or service. And the likeliest place to find the right talent is Bangalore, Hyderabad or Mumbai,” he adds. As per the ranking, Delhi NCT, Bangalore and Mumbai have the maximum number of start-up mentors—174, 92 and 82 respectively; Gurgaon has 42.

Winners Despite Challenges

The genesis of Bangalore’s identity as India’s start-up capital, says T.N. Hari, founder of The Artha School of Entrepreneurship, goes back to the 1900s when the Indian Institute of Science was set up in the city and the then king of Mysore, Krishnaraja Wodeyar IV, donated over 370 acres of land for establishment of this premier institution.

“When IISc alumnus Satish Dhawan was offered ISRO’s chairmanship position after Vikram Sarabhai’s demise in 1972, one of his preconditions was that the space agency’s headquarters be located in Bangalore,” Hari says. “Similarly, Infosys moved its headquarters from Pune to Bangalore because most of its founders were Kannadigas,” he adds.

While some of these instances were happenstance, it nonetheless led to a domino effect. In 1985, Texas Instruments established its R&D centre in Bangalore and other tech majors like Intel and HP followed suit, though they also opened secondary offices in cities like Mumbai, Delhi, Gurgaon, Hyderabad and Chennai.

Bangalore’s continued prominence in the start-up ecosystem can be attributed to several factors, including its first-mover advantage, a culture of innovation, access to significant capital, a diverse talent pool, a strong focus on technology and global connectivity.

This is not to say that there is no downside. The estimated population of Delhi NCT in 2026 will be 2.25 crore, according to projections by the National Commission on Population under the Union Ministry of Health and Family Wefare. Bangalore and Mumbai are also expected to witness similar growth although there are no official estimates. As a result, these cities are facing the pressure of increasing burden on their resources and infrastructure. Bangalore is ranked fifth on the parameter for infrastructure and facilities, which covers public transport facilities and logistics networks. This is its worst performance across the categories considered for the city ranking.

Mumbai’s position as the country’s financial capital notwithstanding, the growing population—largely due to migration of people into the city—has led to immense pressure on the city’s public infrastructure, with overcrowding of public transportation, flooding of arterial roads every monsoon and traffic congestion.

However, these infrastructure challenges do not seem to have made a dent in the popularity of these cities among entrepreneurs.

A Strong Pull

Historically, numerous successful start-ups commenced their journeys in metro cities, leveraging the vibrant and supportive ecosystems and the availability of skilled professionals to propel their ventures. This pragmatic approach by early-stage founders aligns their operations with existing talent hubs, aiding in navigating initial challenges and fostering growth, says Anirudh A. Damani, managing partner at Artha Venture Fund.

According to the Economic Survey 2021–22, Delhi added more than 5,000 recognised start-ups between April 2019 and December 2021, while Bangalore added 4,514 start-ups during this period. The latter has 392 growth stage start-ups, the highest in the country, followed by Mumbai with 290, Gurgaon 172 and Delhi NCT/New Delhi 131. Chennai has 69, as per the Outlook ranking.

The Place Matters

In the early stages of a start-up venture, the surrounding ecosystem and accessibility to the right talent are crucial for growth. At this juncture, attracting talent to less urbanised areas is expensive and time-consuming, hence founders gravitate towards urban centres where the requisite talent already resides.

“When founders consider setting up operations in new cities, they focus on essential factors such as access to customers, talent and resources as critical to ensuring a market base. Evaluating the cost of talent helps manage finances effectively, at a time when every penny truly matters for the start-up,” says Vishnu Chundi, founder and CEO of AasaanWil.

The Ministry of Electronics and Information Technology (MeitY) launched the Startup Accelerators of MeitY for Product Innovation, Development and growth (SAMRIDH) programme in 2021 to provide seed funding and mentorship. Recently Rajeev Chandrasekhar, minister of State for Electronics and Information Technology, told the Lok Sabha that it sought to support 300 start-ups across India through existing and future accelerators.

“Founders keenly identify the unfair advantages specific cities offer, shaping their decision-making and leveraging unique opportunities for their start-up’s success,” Chundi says.

When founders set up operations in Tier II or III cities, they consider several critical factors, with availability of skilled talent pool predictably topping the charts. Next is assessing the market potential in the new location, studying local demand for their product or service. Infrastructure, including office spaces and transportation, plays a significant role in their decision-making, as does understanding local regulations and compliance requirements. Evaluating competition, assessing the cost of living and analysing networking opportunities are other key considerations. The decision is not solely financial. It is a delicate balance between cost-saving and ensuring that the chosen location can offer the necessary ecosystem to propel a venture from inception to a substantial growth stage.

Venkata Suman Cherukuri, chairman and MD of Hyderabad-based TRUSTlab Diagnostics, notes that founders also weigh factors like quality of life for employees and their families, access to funding and whether the city aligns with their long-term growth strategy.

In Favour of Traditional Hubs

Setting up operations in emerging start-up destinations might present some challenges related to investor and government stakeholder engagement. Many investors and government bodies are concentrated in larger cities like Bangalore or Mumbai. As a result, start-ups in emerging cities may need to invest more effort in building and maintaining these crucial relationships. Karthik Sankaran, CEO of start-up incubator Deshpande Startups, says that it is easy to meet and network with venture capitalists in metro cities. “However, VCs do invest in start-ups from non-metro cities if they have a good value proposition and customer traction,” he adds.

Tier II and III cities may be fine for expansion, but early-stage start-ups find established hubs like Bangalore, Mumbai, Delhi and others more suited to meet their needs. Challenges notwithstanding, the lure of the big cities continues to remain high.