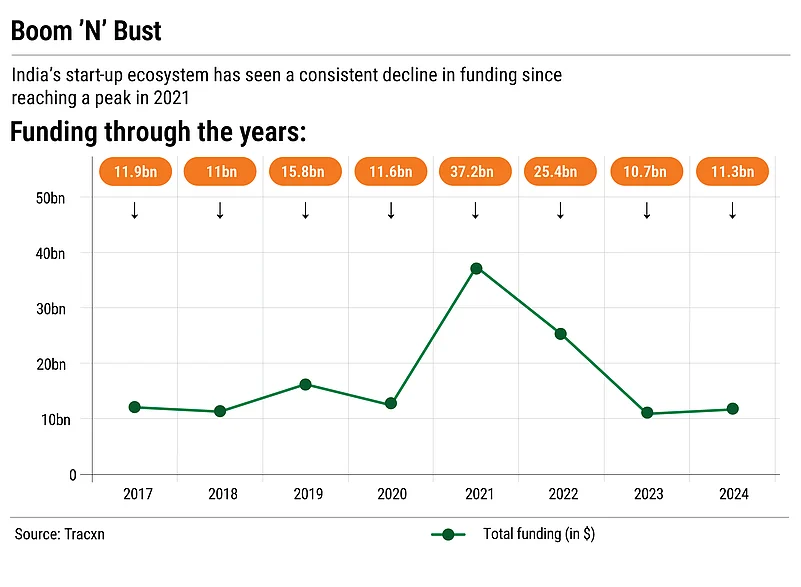

Up until three years ago, investors were gushing over India’s start-up ecosystem. New age firms were finding bold capital. Fledgling ideas were turning billion-dollar businesses. And then suddenly, the music stopped. The economy that emerged after the pandemic was no longer in the mood for big risks. The rapidity with which the economy was digitising lost steam and central banks tightened the supply of cheap money.

Daring investors who were willing to watch their cash burn in the hopes of conquering the world turned cautious. Valuations plunged. Star start-ups imploded. A long funding winter set in.

But now, the tide seems to be turning again. The year has begun with big funding announcements. Leading venture capital (VC) fund Accel said in January that it has raised $650mn to support growth-stage start-ups in India and Southeast Asia. Microsoft chief executive Satya Nadella announced that the company will invest $3bn in India, part of which will support start-ups. Central banks around the world have started slashing rates.

The future has once again started to look bright for businesses that are pegged to help India become a developed nation over the next two decades. Yet, it is unlikely that things will go back to how they were. “The lessons of the last correction will stay with investors,” says Nruthya Madappa, a partner at VC firm 3one4 Capital.

Leading VC firm Accel said it has raised $650mn to support growth-stage start-ups in India and Southeast Asia. Microsoft announced $3bn in investments

She believes that following the correction over the past couple of years, founders and investors will focus on building sustainable businesses that are healthy in the long term while balancing steep growth.

An analysis of growth-stage start-ups by Outlook Business reveals this change of focus, even as the results of the change appear mixed. While start-ups in a handful of segments have started doing well and seem on their way to becoming large, sustainable businesses, others are finding it hard to bear the pressures of competition.

State of Start-Ups

The analysis found that growth-stage start-ups in the direct-to-consumer (D2C) segment, fintech, enterprise tech, health tech and clean tech are the most attractive to investors. Moreover, two nascent segments—space tech and defence tech— have become ones to watch out for.

While ranking start-ups, the analysis focused on the funding India’s start-ups received in series A and series B rounds. The analysis also sought out how companies were performing within segments to determine the overall health of segments.

The method elicited some interesting trends. For example, it found that even though the D2C segment is doing well as a whole, only about 17.6% of companies in the segment are performing well on 10 critical parameters, including profitability, revenue, valuation, funding and quality of investors.

On the other hand, fintech has 38% of its constituent start-ups performing well. For health tech start-ups, that number was 33% whereas for clean tech it was 37%.

“In [the] consumer-tech business, we often see crowded categories such as beauty and personal care. Due to the competition to gain users, there is high cash burn,” says Madappa. She adds that fintech start-ups have a clearer business model, which helps gain investor trust. The success of the fintech segment has primarily been because of its ability to scale. A large number of fintech start-ups has swerved to the lending at a time when small-ticket loans are booming.

Twenty-five lakh people in the country had five or more loans by the end of June 2024, up over 17% from the year before, according to data from credit bureau CRIF High Mark. Many fintech start-ups have turned into non-banking financial companies (NBFCs) while others have tied up with established NBFCs to benefit from the boom.

Founders Find a Way

The funding winter that seems on the verge of an end has altered the way start-up founders run businesses. During the peak of the funding boom, a growth-at-all-costs mentality pervaded the Indian start-up ecosystem. Cash burn ensured fast growth, particularly in consumer-facing segments.

But the chickens had to come home to roost and firms had to answer if the cash burn could eventually lead to profitability. The Byju’s disaster characterised this approach.

As funds dried up, founders had to focus on building stronger business models. Initially, many of these start-ups were burning through money in a bid to acquire customers without regard for unit economics. They felt they had to price their products at a rate the price-sensitive Indian market would accept them.

This approach comes with pressures when brands want to offer high-quality products while ensuring pricing doesn’t discourage consumers, says Matt Chitharanjan, founder of D2C firm Blue Tokai Coffee Roasters.

To bear with the pricing pressures, founders have focused on branding so that consumers seek them out even when the market becomes crowded. Successful branding ensures consumers stay loyal to brands beyond pricing decisions or top-shelf positioning.

“By our brand pull, we can draw in customers to slightly off-prime locations, so we do not need to take the most expensive location in a micro market as we have found people are willing to go a little out of their way for a differentiated product. We are constantly looking for efficiency in areas including packaging, utilities and maintenance to improve the profitability of our stores,” says Chitharanjan.

Fintech start-ups have done better than others because they had to take a sustainable and measured view of their business from day one, according to Satyam Kumar, co-founder and chief executive of fintech firm LoanTap. “Given the delicate nature of dealing with capital, financial firms have to be careful with their business models,” he adds.

When Paytm was ordered by the Reserve Bank of India to stop onboarding customers to its payments bank, the entire ecosystem took note. And as one of the most prominent fintech majors suffered a stock price shock of over 50%, other founders realised that a lack of adequate governance could make their businesses suffer too.

Governance Matters

Proactive action by regulators has prompted start-ups to take governance matters more seriously. Moreover, as several big start-ups such as Zomato, Swiggy and Ola Electric started listing on the bourses—making their businesses transparent and open to scrutiny—smaller start-ups started putting in governance controls.

The journeys of the start-ups that have listed on the public markets have inspired early-stage start-ups too, says Madappa of 3one4 Capital. “As companies turn their sights on successful public listings, they are putting public-level governance and processes in place much sooner and with greater intentionality. It is clear that the focus on the highest levels of governance has increased across the ecosystem at at the earliest stages,” she adds.

The past couple of years has seen several start-ups being punished for not adhering to governance standards. When car services start-up Go Mechanic was accused of inflating numbers, investors punished the company. Byju’s is facing an enforcement directorate probe and insolvency proceedings.

These instances have had a bearing on the trustworthiness of the start-up ecosystem as a whole with governance matters coming to the front-and-centre of the conversation. Veteran start-up investor Sanjeev Bikhchandani says, “There is a greater emphasis on commercial prudence on the part of investors and therefore on the part of start-ups. Greater emphasis on the integrity of data. And greater emphasis on good governance. These three have become important. I think these will stay.”

If start-ups indeed take the lesson from the last boom-and-bust cycle, they will focus better on governance matters and try to build more sustainable business models. Conversations with players in the start-up ecosystem suggest that they are intent on becoming healthier. But will they lose focus once abundant capital returns?