Chris Nolan’s much-awaited sequel, The Dark Knight Rises, is expected to hit theatres worldwide on July 20. Now, if you are a die-hard Dark Knight fan who can’t wait to see the sequel, go find some cocoa beans that have been scattered across India en route their way from Ghana. Find them all and you not only get to watch the film before anyone else, but also win a trip to Australia to visit Warner Brothers Movie World. If you haven’t guessed already, we are talking about the online bean hunt — Cadbury’s latest promo for its Bournville range of chocolates. While running brand contests is old hat, getting interactive via digital and social media is new.

Digital advertising works for brands targeting the youth, who spend more time on the net than flicking TV channels or reading newspapers. Clearly, digital media is getting its due in marketing budgets. Says Arnab Mitra, national director, digital, Starcom Mediavest Group, “Even if brands spend only 10% on average on digital media, 90% of their discussions centre on it.”

Not surprisingly, digital spend has increased from ₹1,623 crore in 2010 to ₹2,851 crore in 2012. According to the Internet and Mobile Association of India (IMAI), digital advertising, including mobile telephony, is set to touch ₹4,391 crore by March 2013. Digital spend accounts for 11% of a company’s overall ad spend and is growing by 25% every year. “Brands are increasing their digital outlays because youngsters feel it is a fuddy-duddy brand if it’s not on the web,” says Abhijit Avasthi, national creative director, O&M.

That could be the one reason why Vodafone, Cadbury, Coca-Cola and HUL are leveraging the digital medium. Vodafone made its presence felt with 3.2 million Facebook fans and its YouTube channel has drawn over 12 million viewers — thanks to the hugely popular Zoozoos. “Digital is an exciting and dynamic medium and brands need to experiment with the content they create,” says Anuradha Aggarwal, senior vice president, brand communication and insights, at Vodafone. She adds, “Once we knew the Zoozoos were generating a huge buzz online, we created our Facebook page and dedicated YouTube channel in a matter of days.” Today, the brand’s activities on the net range from those that provide pure entertainment to a Facebook webstore where customers can recharge pre-paid connections or download songs.

Thanks to the country’s growing Facebook population, brands today have made the social media their first digital preference. India is Facebook’s third-largest market with over 48 million users, behind the US (158 million) and Brazil (49 million). More than 85% of Gen Y is on Facebook and spends more than an hour every day trawling the net. Only some brands use Twitter for promotions and as a 24x7 customer service channel.

Buzzing all the time

But opening a Facebook page to fans is not the end-all of the game. Brands have to continuously engage with fans to keep the brand buzz alive. “Digital medium can help you micro-target, customise content and get instant feedback. So if you approach it like a traditional medium, you are wasting your time and money,” says Wasim Basir, director, integrated marketing communications, Coca-Cola India. Little wonder that Coke has the largest Facebook following with 42 million fans globally, of which 12% come from India. One of the ways Coke has managed to keep its brand buzzing on the internet is through Coke Studio in collaboration with MTV. In its first season, Coke Studio garnered over 600,000 fans on Facebook and 13 million mobile downloads, the bulk of which were paid for. With the second season of Coke Studio around the corner, plans are afoot to distribute content across platforms, including QR codes on bottles.

Concurring with Basir’s views is Chandramouli Venkatesan, director, snacking and strategy, Cadbury India. “We can’t run the same stuff [on the net] for three months like we do with commercials.” This Kraft Foods company has a strong digital presence as over five of its brands enjoy over 1 millions fans on Facebook (Cadbury 5-star alone has over 11.2 million fans). “Digital is a very high priority for us given that our products are targeted at the young and digital is their preferred medium,” says Venkatesan. The company releases all its TV commercials online 10 days before they go on air, so that their fans are privy to exclusive content. He adds, “It works in our favour since the tendency to share is more when you believe you have access to something exclusive.”

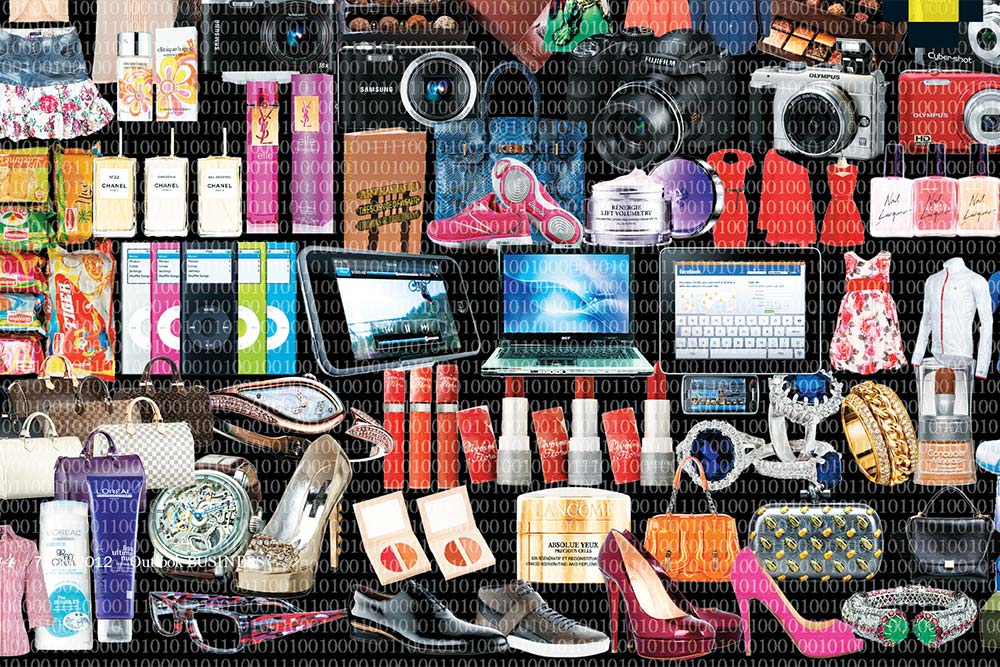

Apart from putting out good content, brands must ensure that it’s available on multiple platforms. “Today’s consumers are connected with digital devices all the time and getting their attention is a challenge,” says Unny Radhakrishnan, head, digital, South Asia, Maxus. Biraja Swain, vice-president, digital and emerging media, Omnicom Media Group agrees, “Viewing content on-the-go is a growing trend. Content now must be available on the most accessible device at the most convenient time.”

Quality content tops

Besides engaging consumers, digital marketing has a direct impact on sales, too. Take the case of autos. A Google study says one in every two car buyers spends 9-12 weeks before zeroing in on a car. Much of this research is on the internet with 50% of potential buyers changing their choice of brand after accessing information online. “Youngsters are increasingly influencing family purchases. So it is important to stay connected with them. After all, they are our future customers,” says Manohar Bhat, chief general manager, marketing, Maruti Suzuki. Maruti has around 2.61 million Facebook fans and a digital team that constantly engages with consumers for its major models.

Not just that. Auto firms are also opting for digital teaser campaigns before any new vehicle launch. Hyundai managed to do that with Eon in 2011. “During the launch, we had 400,000 visits to our campaign microsite and 20,000 enquiries before the actual event,” says Arvind Kumar Saxena, director, sales and marketing, Hyundai. “We understand the importance of online research and leverage that through digital marketing.”

For Bajaj, digital engagements helped the other way around — by keeping consumer interest alive in Pulsar even though there were no new variants launched for three years. The brand not only created a community of bikers through its website and Facebook, but also kept them engaged by posting do-it-yourself videos on bike maintenance and stunts, posting content from the MTV Stunt Mania series, which it sponsors, and its youth festival, Pulsar Mania, held in various cities. “After 2009, we launched the next-category Pulsar in 2012,” says Shyam Narayan, DGM, marketing, two-wheelers, Bajaj Auto. “You need product news to keep the excitement alive and in the absence of any product news, the digital medium helps a great deal in keeping the buzz around the brand alive.”

Mobile manufacturers, too, are going digital. According to Samsung, another Google study shows that 70% of people who research for mobile phones online, buy it offline. So, Samsung has been beefing up its digital spend considerably. “Our digital budget is 15% of our marketing budget for the mobile business,” says Ranjit Yadav, country head, Samsung Mobile & IT. It’s not just spending, Samsung uses it to simply increase brand awareness. “The trick is to create brand awareness through influencers who can amplify your message. Young people tend to be influencers for their peers in most categories,” says Santanu Bhattacharya, CEO, Salorix, whose technology helps brands identify influencers across social media platforms.

On the downside, if brands get it wrong in their communication, or their products don’t match expectations, the damage is much worse as social media is word-of-mouth on steroids. But it also doubles as an instant feedback channel for brands, not only ads and products, but to address customer preferences as well. Take the case of Kwality Walls, which wanted to launch a new Cornetto flavour — it had two flavours equally liked by consumers. But HUL wanted to launch only one flavour. “It was a difficult decision for us because both flavours were liked equally so we decided it was best that our consumers did the job for us,” says Sapan Sharma, category head, ice-creams, HUL. So, the company asked Kwality Walls’ 600,000 Facebook fans which flavour they would like and, within hours, HUL got its answer. Disc Fruity Yo was launched as its ‘innovation for the calendar year 2011’.

Not just click and flow

But the digital medium does come with its challenges, the biggest being that of reach. While internet users numbered 132 million in 2011, they made up for just 25% of the total number of TV viewers in the country. Moreover, much of the concentration of internet users is in the metros, so most brands have no choice but to target the same limited audience. Even e-commerce companies are pretty much old school these days when it comes to advertising as they earmark a bigger outlay for TV and print ads. “From a pure view of creating awareness, offline media still has the biggest reach,” says Ravi Vora, vice-president, marketing, Flipkart, which has 1.1 million fans on Facebook. “Since we are building awareness and trying to educate people to shop online, we are spending most of our money offline.” Thus, brands often use digital media to amplify the message that they are conveying to offline consumers.

Secondly, performance metrics in the digital medium still need to evolve, say marketers. “The kind of tracking mechanism available in the US and the UK is still not prevalent here,” says Flipkart’s Vora. Metrics need to move ahead from the current ‘cost per impressions’ or ‘cost per click’ mode.

But that’s not halting the juggernaut. According to a KPMG report, over 500 million people will have internet access by 2016 — that’s 70% of the total TV viewers by 2016 (see: The digital wave). Besides, with over 950 million mobile services subscribers and expected increase in internet-enabled smartphone penetration from 10 million in 2011 to 264 million by 2016, mobile advertising is set to take off as well. “We believe that in India, the first opportunity is in mobile and then in social media,” says Coke’s Basir. Mobile advertising, currently pegged at around ₹100 crore, is tipped to grow to ₹1,000 crore in five years.

There is no denying that brands are increasingly speaking the digital language today. “Young consumers are already thinking in 140 characters. Marketers also need to reword their brand proposition to 140 characters,” says Starcom’s Mitra. And that might be the bigger challenge for brands in an era where consumer preferences are becoming unpredictable.