Nvidia Shares Fall: Just less than a year ago, Nvidia was tagged as the 'Most important stock on earth.' With solid quarter earnings and share prices climbing to new highs, Wall Street seemed high on the hype created by AI and large language models (LLMs). This momentum continued for the better part of last year, with shares of the GPU-maker climbing by nearly 180%.

As OpenAI gained traction, Nvidia's shares zoomed and so did other US tech stocks. The tech-heavy index, NASDAQ touched an all-time-high and surged by around 35% last year.

Fast forward to now, the entry of DeepSeek, backed by Chinese hedge fund High-Flyer, has sent triggers across Wall Street. While competition in the AI space is always viewed as something positive, it was DeepSeek's low-cost structure that attracted investors who were earlier convinced that AI is an expensive play.

For perspective, OpenAI’s GPT-4 took $100 million in computing power, while DeepSeek only needed $5.6 million. This has forced Silicon Valley and tech investors around the world to rethink about their AI investments.

As for Nvidia, the steep decline in its shares has put investors on edge, sparking doubts around the company's ongoing dominance in AI hardware.

Too big to fail?

Despite the recent bloodbath in Nvidia's share price, analysts are viewing the trend as a minor blip. Bernstein stated in its report, "the models (DeepSeek V3 and R1) look fantastic but we don't think they are miracles...... the resulting Twitterverse panic over the weekend seems overblown."

The global investment firm pointed out the claim that DeepSeek built a model similar to OpenAI's GPT for just $5 million is misleading. While the startup did use efficient techniques to lower costs, the figure is based on simplified assumptions and doesn't account for all the expenses.

For instance, the oft-quoted "$5M" number was calculated by assuming a $2 per GPU hour rental price but this doesn't include other costs like research, experiments and overall architecture.

Besides this, many analysts are already viewing the recent dip as an opportunity. Bank of America's research analyst, Vivek Arya reportedly said that he “views the recent selloff as an enhanced buy opportunity” for Nvidia stock.

Even OpenAI's rival firm added to the investor confidence.

Aravind Srinivas, CEO of Perplexity recently replied to a post stating "There is no silver lining right now with Nvidia though," with contradictory opinion.

“I just bought some more Nvidia,” he said.

Jefferies' recent report pointed out that DeepSeek's entry could push the industry to focus more on ROI, instead of just mere computing power to improve models.

"DeepSeek could prompt investors to ask hard questions about these computing power investments. Therefore, US AI players' management could be under more pressure to justify further raising AI capex in 2026. The AI supply chain (ie, GPU, server ODMs, PCB, liquid cooling) is highly vulnerable to a de-rating," the report read.

The China Play might not be 'that' bad

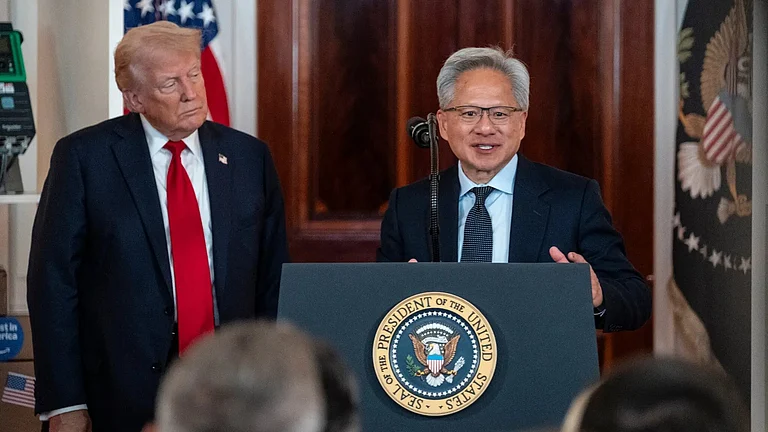

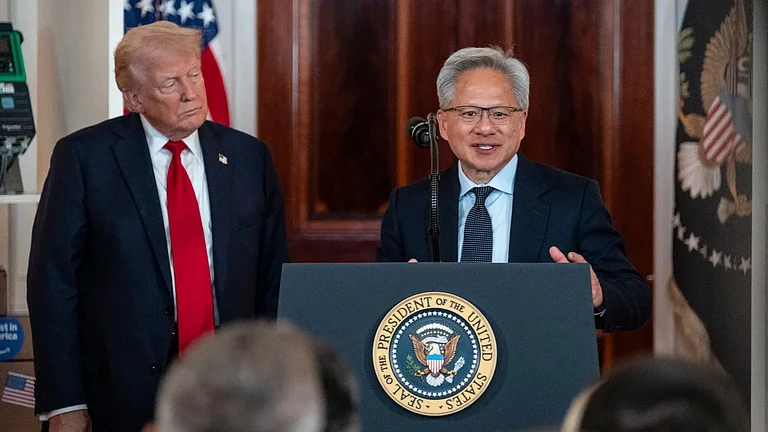

After Trump's planned restrictions and heavy tariffs on the Dragon nation, many expected US dominance to continue in the AI space. Undoubtedly, DeepSeek's entry has changed many perspectives in the AI sphere, where industry dynamics and investor narratives change faster than bottom-line numbers.

Some are even viewing this as a positive indicator, citing the Jevons Paradox, wherein demand for the technology actually increases when efficiency improves. So, even if computing costs go down, the demand for AI applications will likely rise, attracting more investments at the end of the day.

As for the tech stock, which has delivered a multibagger return of more than 400% in just a period of 3 years, the entry of another player doesn't seem to change the overall investment trajectory, as per analysts.

"Overall our own reaction is not to buy into the doomsday scenarios currently playing out in the Twitterverse. We continue to like the Al stories in our coverage, particularly Nvidia and Broadcom Inc. (both rated 'Outperform')," Jefferies said.

Now Trump’s entry might complicate things moving ahead, especially with the first round of tariffs already hitting Mexico, Canada and of course, China. More than the entry of new AI players in the market, it will be the outcome of trade wars and retaliatory moves that will impact investor sentiment.